Home

>

Other IRS Forms

> IRS Form 8832: How to Fill it Right

Home

>

Other IRS Forms

> IRS Form 8832: How to Fill it Right

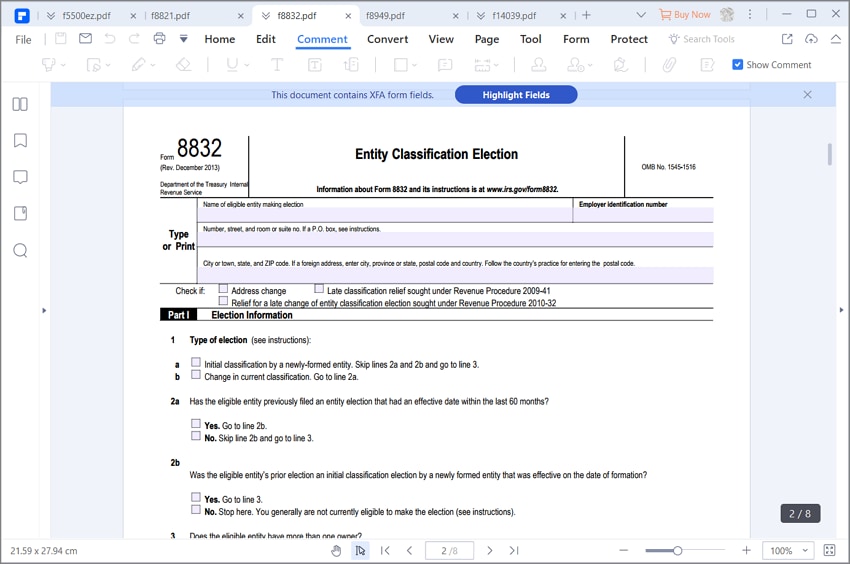

IRS Form 8832 is the Entity Classification Election form which is used by an eligible entity to elect how it would be classified for federal tax purposes as a corporation, a partnership or an entity disregarded as separate from its owner.

Your Best Solution to Fill out IRS Form 8832

There are different ways of filling PDF forms and one of such ways is filling it through the help of a software program electronically. Your best solution to fill out this form electronically is by using Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement.

It is straightforward, simple and easy to use. The PDFelement can in addition to writing on your PDF form, edit, merge and split, create PDF documents among so many other features. What you need to do is to download the form and open it on PDFelement. The form filler program of the PDFelement helps you to fill out the form successfully and faster.

Instructions for How to Complete IRS Form 8832

What do you do if you have an IRS Form 8832 to fill out? The following is a step by step guide for helping those in this situation.

Step 1: First of all, get the IRS Form 8832 from the government website which is the irs.gov website where all IRs forms are obtained. Open the form with PDFelement and use the program to start filling the form.

Step 2: On the top, type your name as the eligible entity making election, the employee identification number and your address. Your address should comprise street, city, town, state and zip code. Note that if you are using a foreign address, you must provide the exact information for the country. Under it, check the box applicable to your situation after reading the conditions.

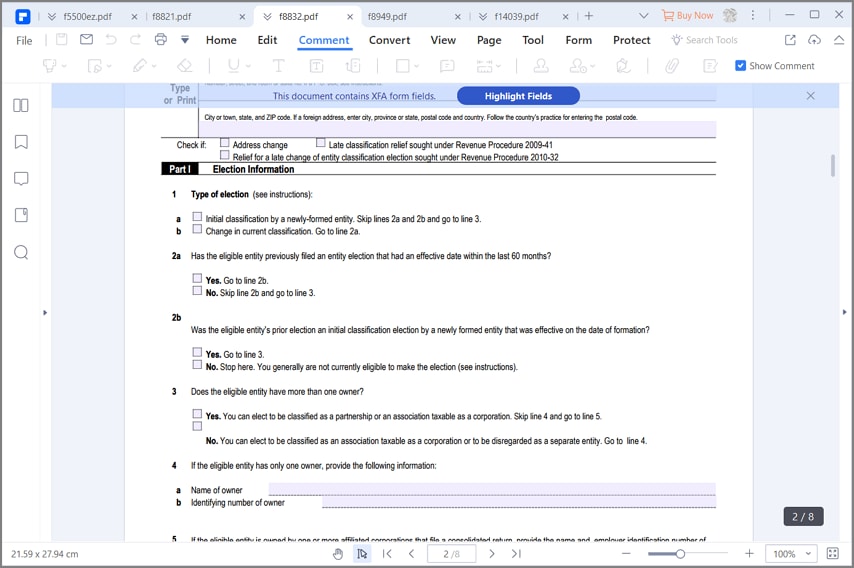

Step 3: Proceed to Part 1- Election Information. Check the type of election on line 1. Skip lines 2a and 2b and go to line 3 if the election is initial classification by a newly formed entity, if not go to lines 2a and 2b and check either the yes or no box. If yes, go to line 2b if not, ship line 2b and then go to line 3. However, line 2b asks if the eligible entity prior election an initial classification election by a newly formed entity that was effective on the date of the formation. Answer by checking either the yes or no box. Note that if you check yes, you should proceed to line 3 but if you check No, then stop, you are not eligible to make the election.

Step 4: On line 3, answer if the eligible entry has more than one owner. If yes, check the yes box and skip line 4 but if No, check the box and go to line 4. Remember that if you have checked NO, you can elect to be classified as an association taxable as a corporation or to be disregarded as a separate entity. On line 4, write the name of the owner and the identifying number of the owner if the eligible entity has only one owner. However, if the eligible entity is owned by one or more affiliated corporations that file a consolidated return, then provide the name of the parent corporation and their employer identification number.

Step 5: Go to the second page and continue Part I. See instructions on the type of entity and check the appropriate box from line 6a to 6f. Go to line 7 and provide the foreign country of organization if the eligible entity is created or organized in a foreign jurisdiction. Enter the date in which the election is to be effective on line 8. For line 9, you are expected to write the name and title of contact person the IRS may call for more information and the write down the person's contact telephone number on line 10.

Step 6: Read the consent statement and sign the signatures accordingly. If more than one person, then every member is expected to sign and date appropriately.

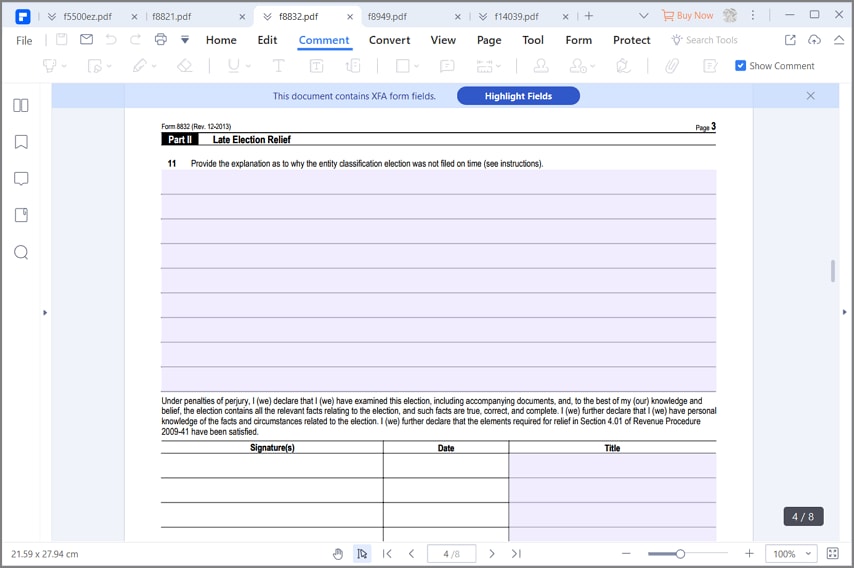

Step 7: Complete Part II-Late Election Relief. On line 11, you are expected to provide the explanation as to why the entity classification was not filed on time. There are enough spaces, provided for this, write the explanation very clearly. Then under the penalties of jury, declare that election is examined including the accompanied documents and they are true and correct. Do this by signing, entering the date and title below it. If other members are involved, they must also sign on the form on the spaces provided.

Tips and Warnings for IRS Form 8832

- You must be able to understand the default rules to fill this form properly. It is advisable to go through the existing entity default rule, domestic default rule and foreign default rule before filling this form in order to avoid misrepresentation of facts.

- The terms have been properly defined in the accompanying instructions on the form. You must read and understand the exact definitions from the IRS for terms like Association, Business Entity, and Corporation etc in order to follow the specific instructions from the IRS.

- You are liable for any incorrect information entered on this form. Be warned that you may be punished if found guilty of misleading the IRS. Ensure all information is true and correct.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor