Home

>

Fill IRS Forms 1040

> IRS Form 1040: How to Fill it Wisely

Home

>

Fill IRS Forms 1040

> IRS Form 1040: How to Fill it Wisely

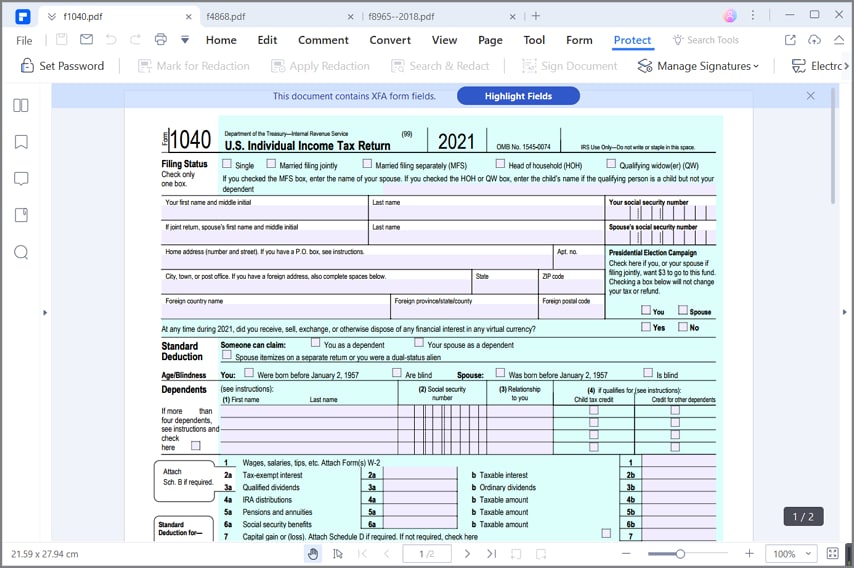

IRS Form 1040 is used to report financial information to the Internal Revenue Service of the United States. It helps in reporting income and calculating taxes that are to be paid to the federal government of the United States.

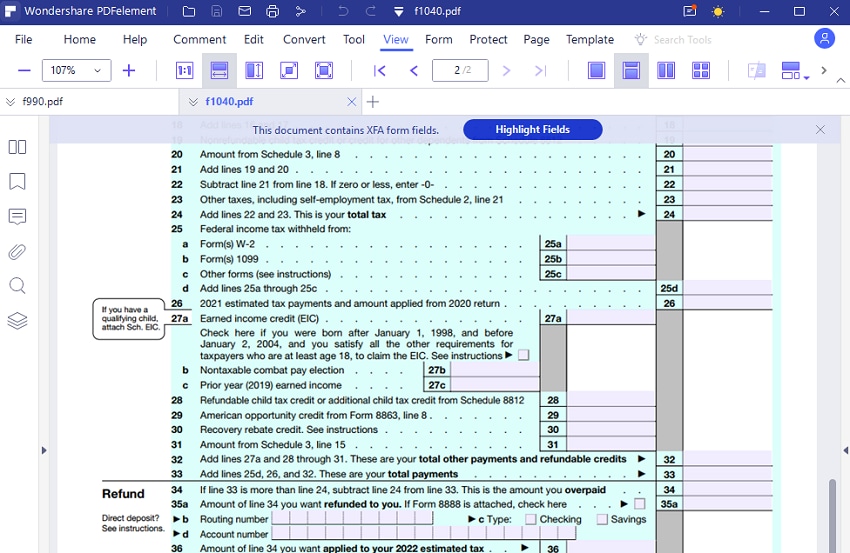

Your Best Solution to Fill out IRS Form 1040

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is a professional PDF editor that will allow you to fill official form wisely. You are able to add and edit form in PDF page quickly and easily with PDFelement.

It supports adding notes, new text, highlighting words or phrases or deleting it, drawing, and even adding links to web pages, all on the original PDF. At the same time, the software has a wonderful OCR integration, so you can process text scanned or saved in image format.

Instructions for How to Fill out IRS form 1040

Step 1: Making Preparations for Filling the IRS Form 1040.

The first step is to prepare before filling IRS Form 1040. The form can be downloaded from the IRS Website, visit any US Post Office from January to April or you can connect with a tax preparer for blank forms. Users are advised to go through the instructions depicted in Chart-A, usually on page 77 which contains the instructions for Form 1040A for the current income thresholds. The instructions may change depending on one's filing status and are annually changed. All information must be gathered before one starts filing out their taxes.

Step 2: Working with the Primary Details

The second step involves filling out primary taxpayer's complete name along with social security number which go in the above line.

The name must be full, and must be the same as in Social Security Administration and IRS Taxpayer Records. For couples filing jointly, there is no rule for any name to be on top, but the same name must go on top each year.

Singles don't need to fill out the second line. Street address must be chosen between PO Address and Street Address. PO Address can be used if the post office won't deliver mail at your home.

For those living in foreign country, information is to be filled in the 5th line of the box. For US citizens, 5th line is to be left blank.

At this point, users are supposed to decide if they want to tick the Presidential Election Campaign Box. If checked, $3 of your taxes would be allotted to a fund and distributed to presidential candidates who have agreed to limit their campaign spending and refused private donations. This does not affect your tax refund in any manner.

Step 3: Working through the Filing Status and Exemption Sections

The third step focuses on filling out the filing status and exemptions sections. Start with choosing your filing status. You should choose the one that gives you lowest tax liability.

If on December 31st, you are single or legally separated, not choosing any other household, mark 'single'. For those who are married and are filing the taxes on the same form as their spouses (even if one of you has an income), choose ‘married filing jointly'.

There is also an option of ‘married filing separately' for the couples filing their taxes on separate forms. For singles supporting other people in the household, choose ‘head of household'.

If the person is a child who doesn't happen to be your dependent for tax purposes, write the child's name besides the box.

Exemption boxes are to be checked for you and your spouse, if applicable, through lines 6a-d. For those who can be claimed on someone else's taxes, tick box 6a.

For those whose spouse can be claimed on someone else's taxes, tick box 6b. Mark the box 'spouse' only if marriage is according to the definition of the federal government. If your marriage is to the same sex, you state taxes could be filed jointly, but not your federal tax returns.

The right side of the Exemptions Section is to be completed then. You are merely required to add up your exemptions, your spouse's exemptions, your dependent's exemptions, and fill the sum in the lower right-hand corner.

Form 8332 comes with instructions for custodial parents who want to release their claim to allow noncustodial parent to claim the child or children of their taxes.

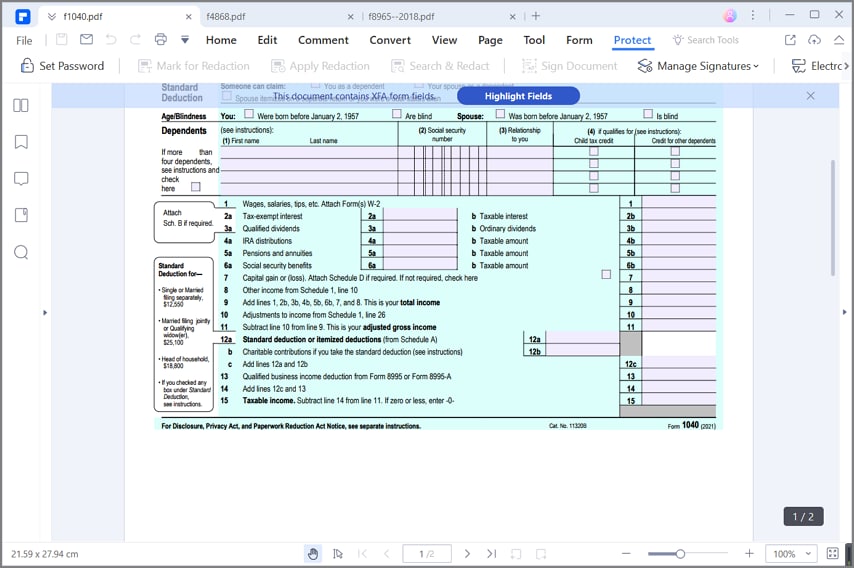

Step 4: Working with Income and Adjusted Gross Income

The fourth step involves completing the income and adjusted gross income sections. The income declared on your W-2 forms on line 7 is to be used. It has income from wages, salaries, tips, as well as other income added by your employer on a W-2. Almost all filers will need to insert info from at least one W-2, if not all. A copy of one's W-2s is required to be attached to the return.

Also fill throughout lines 8a-22. Most lines would be left blank. Don't be alarmed if most of the lines do not apply to you or your income. Remember, if you were one of those who did not get a form 1099, or any other federal form depicting that a certain type of income was transferred to you, it means you never had that income.

Wrap up the section by summing up all the amounts you entered in the income section. Line 22 would be used to fill the total, which is your gross income.

Adjustments to your taxable income would be entered in lines 23-35 which is the Adjusted Gross Income Section. It allows you to pay fewer taxes by striking off specific deductions from your taxable income. Check through lines 23-35 thoroughly and see if any apply to you. Some might require additional documentation, in the form of another IRS form. The result is to be added in line 36.

Subtract the income not being taxed from your income, that is the amount in line 36 from line 22, and you get your adjusted gross income.

Step 5: Working with Tax and Credits along with other Tax Sections

Step 5 involves wrapping up Tax and Credits along with other Tax Sections. Mark all the boxes that suit you in Line 39 and entering the total number of boxes marked in 39a.

The next step is to decide if you wish to itemize your deductions or opt for standard deduction while filing your status. In the box, left to line 40, most filers' standard deductions can be found. Amount in Line 39a is compared with standard deduction. Users should opt for a greater deduction.

Those itemizing their deductions must complete and attach Schedule A and enter the amount in Line 40. Else, choosing the margin that corresponds to your filing status in Line 40, subtract it from Line 38, and enter result in Line 41. Understand the formula for exemptions listed in Line 42, enter result in Line 42, calculate taxable income by subtracting Line 42 from Line 41 and fill the sum in Line 43. If you get a negative number, enter 0.

Look up on the tax tables (http://www.irs.gov/pub/irs-pdf/i1040tt.pdf) to arrive at your taxable income.

For taxable income < $100,000, and no special situation on pages 40 and 41, use tax table beginning on Page 75, else, follow instructions on page 40.(for income >$100,000 or if any special situations on pages 40 and 41 apply to your household).

If one is subject to AMT (Alternative Minimum Tax), they are to complete and attach Form 6251 and enter the result on Line 45, else, complete the worksheet on page 45 of the instructions.

For those who received Advance Premium Tax Credit, complete and attach form 8962 along with filling the amount of any excess premium credit received on Line 46.

Sum up Lines 44, 45, and 46 and you'll have the total tax which is to be entered in Line 47.

If you are applicable, fill out through lines 48-54 for the Credits Section.

Wrap it up by adding all the totals in Tax and Credit section. If you end up with a result less than 0, enter 0.

Go through the other taxes section for garnering additional information. Even though most of them won't apply to you, but it's always recommended to go through. Tax obligation is achieved by adding sum through lines 56-62. The sum is entered in Line 63.

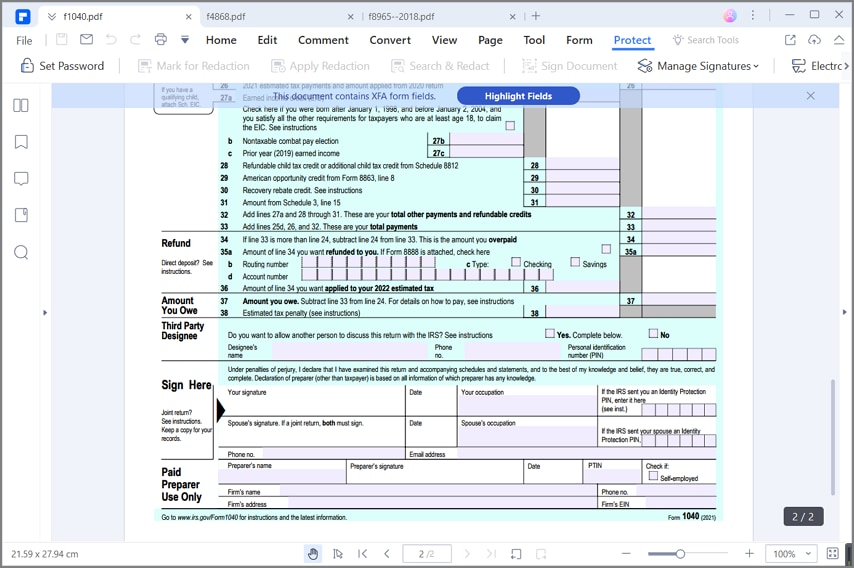

Step 6: Wrapping up IRS Form 1040

This section requires wrapping up the IRS Form 1040. Only one or two lines are normally filled in this section. Start by entering the complete amount of federal income tax withheld on all forms W-2 and 1009 in Line 64. After adding info in all pertinent lines, sum up lines 64, 65, 66a, and 67 through 73. Fill the result in Line 74.

If the result in Line 63 is more than the one in Line 74, this section is to be left blank as one is not applicable for any refund. However, if the result is greater in Line 74, the difference of Line 74 and 63 is filled as amount in Line 75.

If refund is to be split between different bank accounts or for purchasing US Saving Bonds, box in the shaded portion of Line 76a is to be market along with completion of Form 888. For deposition in a single bank account, complete lines 76b, c, and d. Routing number of the bank is in 76b, account number in 76d. If you wish for any part of Line 75 to be applied to succeeding year's tax obligation, enter the amount in Line 77.

The next step is calculating the additional taxes owned by you. If Line 74>Line 63, section is to be left blank, else the difference is added in Line 78. If Line 78 is at least $1,000 and more than 10% of the tax on your return or if you did not pay sufficient estimated tax at either of the quarterly due dates, it may generate a penalty. Use instructions starting from Page 74 to calculate it and enter it in Line 79. Amount can be paid through a personal check payable to US treasury. Methods can be chosen from IRS website.

Completing the third party designee is always important. It helps IRS to discuss your return with another party. Ticking ‘No' in this section if you don't want IRS to discuss it with anyone. You can divert questions and queries from IRS by ticking ‘Yes' in that section and writing that person's name along with other necessary information. A 5-digit number is also required for this person to identify themselves to the IRS.

Step 7: The Signature and Completion of IRS Form 1040

Signature constitutes an integral part of the form filling process. The information must be accurate and true to your knowledge. Criminal penalties are awarded for inaccurate information.

You and your spouse must sign their names as they appear at the top and as they are in the records of Social Security Administration and IRS Tax Database. Occupations and dates must be listed correctly.

If you are filling this form yourself, the paid preparer section must be left blank. A daytime telephone number should also be listed along with the code in the space allotted.

This completes the procedure of filing your tax return through IRS Form 1040. If these steps are followed correctly, you won't end up with any criminal penalties. If there is a need for additional assistance, one can visit the website of IRS.

Tips and Warnings for IRS Form 1040

- The name should be entered carefully, as in the records of Social Security Administration. Conflict in records can hinder the entire taxpaying process of an individual, leading to delays and penalties.

- Couples filing their statements together should be careful about the name that comes on top, as it must correspond to the signature. As long as the same pattern is being followed each year, it's acceptable.

- Marking the presidential election campaign box has no affect on your tax returns. The box shouldn't be mistaken for increase or decrease of tax return.

- Filing Status and Exemptions section should be dealt with carefully and instructions must be followed with precision for divorced couples.

- As an individual, you are requested to go through each and every section of the form, even if doesn't apply to you. This is in order to gain a deeper understanding of the taxation system.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor