Home

>

Other IRS Forms

> IRS Form 8802: How to Fill it Right

Home

>

Other IRS Forms

> IRS Form 8802: How to Fill it Right

There is a growing need to fill out PDF forms in recent times by software programs instead of manually filling and scanning them. Although there is some software capable of doing this task, PDFelement remains the best and most trusted for a complete solution to this growing need.

Download Fillable & Printable Form 8802 in PDF

Your Best Solution to Fill out IRS Form 8802

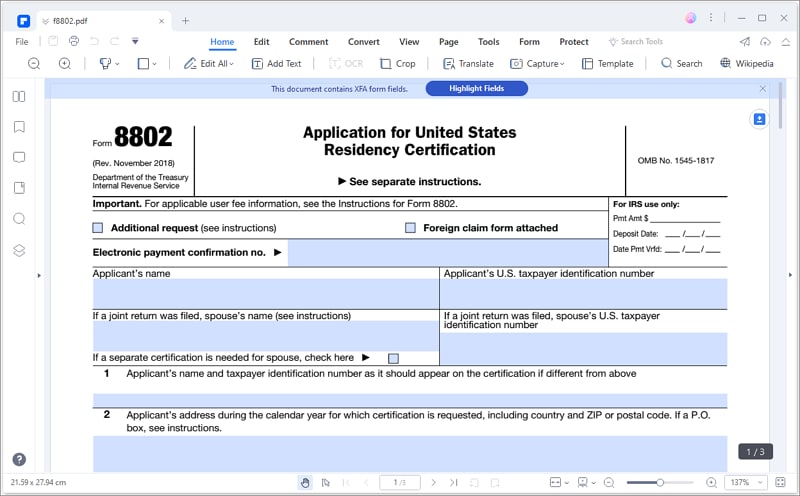

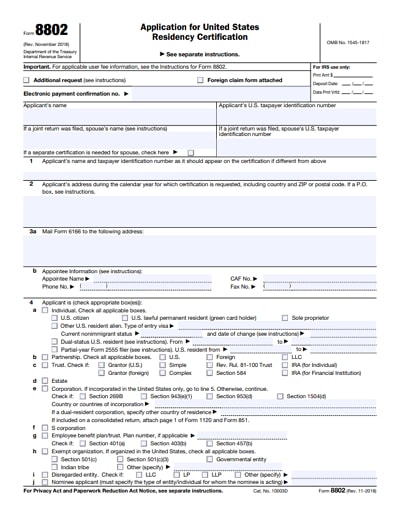

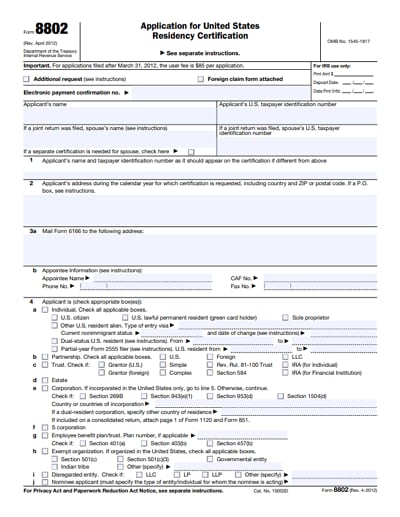

IRS Form 8802 is the Application for United States Residency Certification form. It is a simple 3-page form with a lot of checkboxes and writing spaces to write some valuable information. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is the perfect platform to fill out this form comfortably.

It is an all in one PDF solution capable of solving your entire PDF task like creating PDF documents, editing, merging, and splitting among others.

Instructions for How to Complete IRS Form 8802

Completing the IRS Form 8802 is easy with PDFelement form filler program. Just follow the step-by-step guide below.

Step 1: Download the IRS Form 8802. Open the form with PDFelement. Write your name, your U.S taxpayer identification number, and if a joint tax return was filed, write spouse name and spouse U.S taxpayer identification number. However, if a separate certification is needed for your spouse, then check the box in the column and proceed to line 1.

Step 2: On line 1, write your name and your taxpayer identification number as it should appear on the certification if it is different from the one you have written above. Your address during the calendar year for which certification is requested, including country, zip or postal code on line 2. But on line 3a, write the address in which the form 6166 is mailed to and on line 3b, write the appointee name, phone number, CAF number and Fax number.

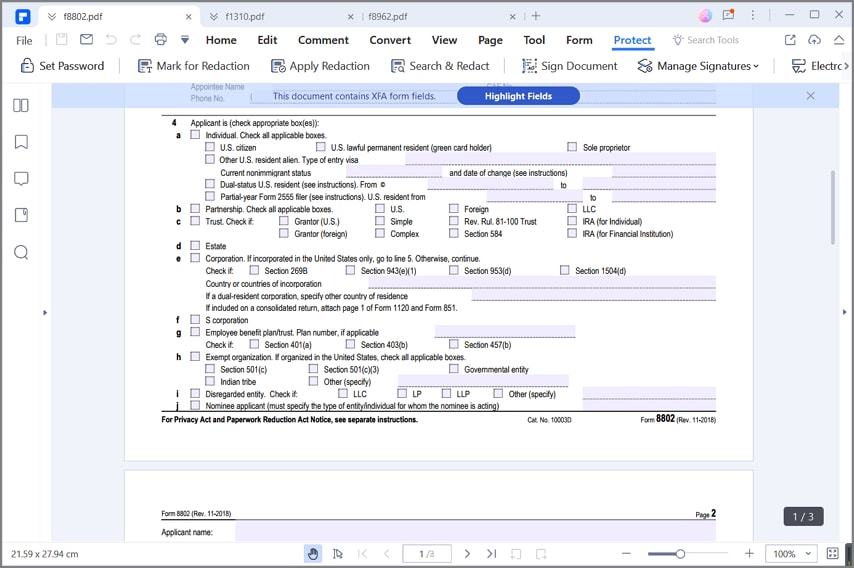

Step 3: Proceed to line 4 by checking the appropriate boxes. If you are applying as an individual, then check the appropriate boxes on line 4a. The options are U.S citizen, sole proprietor, immigration status among others. Check the one applicable to you. If you are running a partnership, check any of U.S, Foreign or LLC checkbox on line 4b.Line 4c is for trust and check the applicable boxes. For line 4d, check the estate box. Line 5e talks about Corporation and for example, if incorporated only in the United States, then you have to go, to line 5 else continue with line 4and fill out the appropriate check boxes from f to j.

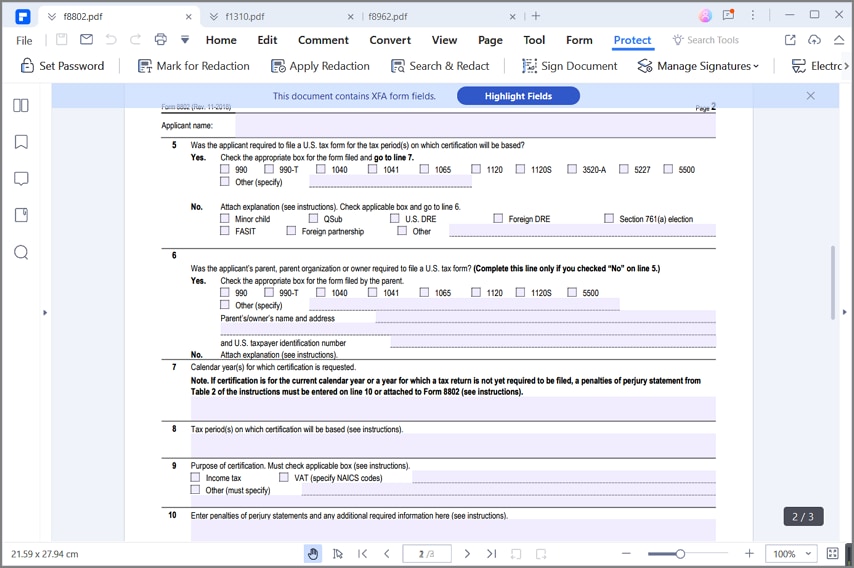

Step 4: Line 5 ask a question whether you are required to file a U.S tax on the tax period of which the certification will be based. You should either select yes or No. But note that if yes, check the appropriate box for the form filed and go to line 7. The forms if the answer is yes are forms 990, 990T, 1040, 1041, 1065, 1120, 1120S and others. If the option is not listed, check "other" and specify. However, if you select No, check the appropriate box and proceed to line 6. The options are Minor Child, QSub, Foreign DRE, FASIT, Foreign Partnership etc and if option is unavailable check 'Other' and specify it.

Step 5: On line 6, select either Yes or No if your parents, parent organization, or owner are required to file a U.S tax form and should be completed if you checked "No" on line 5. If yes, then check the appropriate box. The options are 990, 1040, 990-T, 1041, 1045, 1120, 1120S and 5500. If option is not available, then check the "Other" box and specify the form, write the owners name and address including the U.S tax identification number. However, if No, you are required to attach explanation. You can see further instructions.

Step 6: Enter the calendar year for which certification is requested on line 7, the tax period on which the certification will be based on line 8 and the purpose for certification on line 9. For line 9, you must check the applicable box. They are income tax, VAT and Others if the option is not listed. However, you must ensure you write does the purpose if you check "other" box.

Step 7: Enter the penalties or perjury statements and any other required information on Line 10. You can see further instructions for details.

Step 8: Go to the "Sign here" part and sign your signature as the applicant and write the date and phone number. Put down your name and title. If it is a joint application, write your spouse name and let her sign her signature and complete 11 and 12.

Tips and Warnings for IRS Form 8802

- The form contains worksheet for U.S residency certification Application. It has a list of all the countries in which certification is requested. You should enter the number of certifications needed in the column to the right of each country and enter the total number of certifications required on line 12.

- It is important to ensure that the application and the accompanying documents are true, correct, and complete to the best of your knowledge. You will be liable for any misrepresentation of facts in this form.

- PDFelement is safe to protect the privacy of your information filled using the platform.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor