Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form SS-4

Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form SS-4

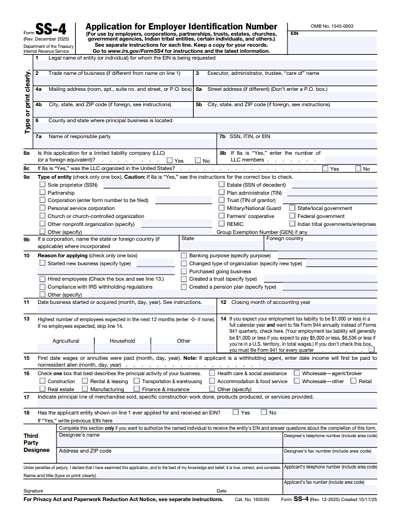

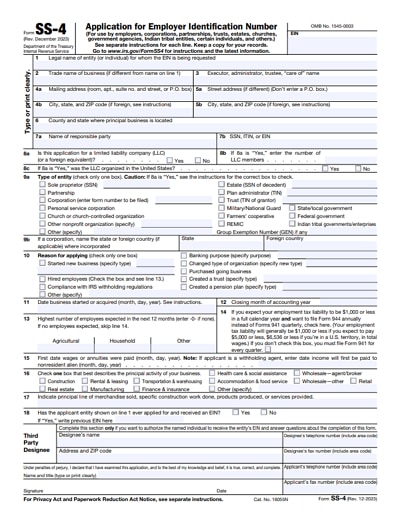

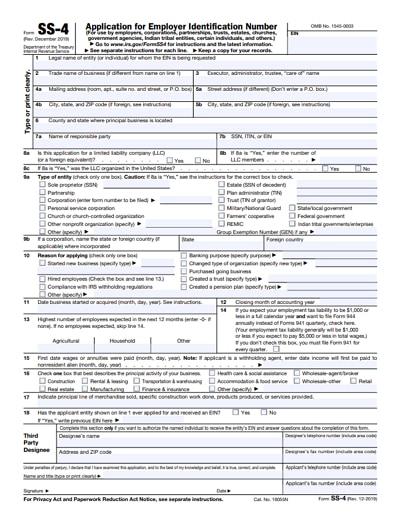

Just as Social Security Number is allotted to individuals, Employer Identification Number is 9 digit number allotted to Corporations in United States. It is used to Identify Businesses and employers. Corporations and businesses need it while identifying themselves on tax returns. Form SS-4 is used to apply for EIN number.

Download Fillable & Printable Form SS-4 in PDF

Your Best Tool to Fill in IRS Form SS-4

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is the all-in-one PDF editing tool which is featured with all the PDF functions that you would need, including editing text and images in PDF files, creating and converting as well as form editing and filling.

Filling IRS From SS-4 with PDFelement would be the better way to avoid misunderstanding or mistakes which happen a lot if the form is filled in by hand-writing. Of course, you must also care the detailed steps for how to fill in IRS Form SS-4. Check the next part, you will find all the details you need.

What Do you Do if you Have an IRS Form SS-4 to Complete

Step 1: Import the form in PDFelement for filling.

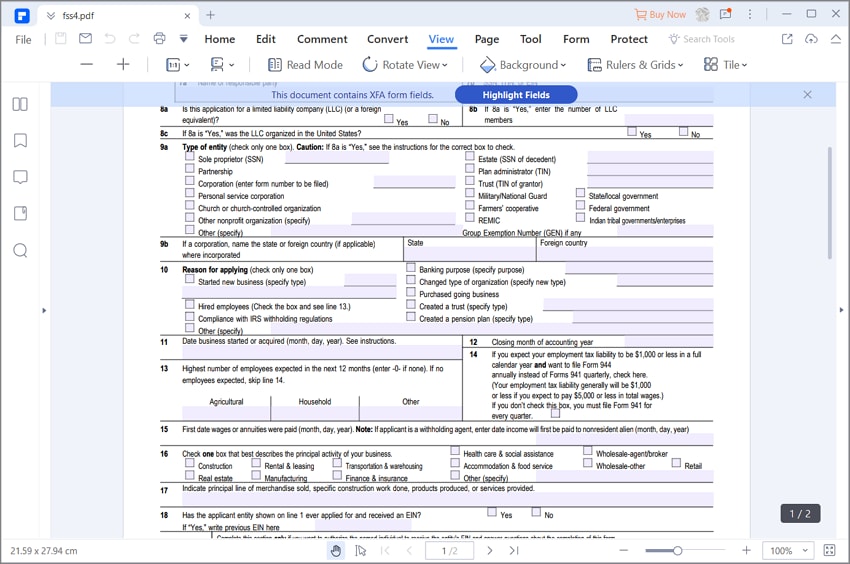

Form SS-4 is a fill –in form can be mailed or faxed to IRS after successfully completing. Open the Form SS-4 with PDFelement. You can choose to zoom in the form page view by scrolling the mouse if you wish to have a clear look for each line and box you are required to fill in.

Step 2: Fill in the Lines and Boxes as Directed as Below One by One.

For the Line 1, Write or type the legal name of the entity as mentioned in the charter, Social security card or any other legal document. An entry in this space is required. A legal citizen means, Individuals, Trusts, Partnerships, Corporations and Plan Administrators.

Line 2-3: Insert the trade name of your business. Write name of Trustee for Trusts, for estate enter its executor name. If a person has been designated to receive tax information of a legal entity, enter the person's name as the "Care of " Person. The format should be First Name, Middle Initial and Last name.

If you do not have an Employer Identification when a tax return is due, write "Applied for" and the date you applied for in the space shown for number in return performa.

Do not Enter Social Security Number as EIN on any of your returns. They cannot be used in place of each other.

EIN can also be applied for Online, through telephone, fax, or by mail depending on how quickly you need an EIN.

Lines 4a–b. Mailing address: A working mailing address is needed for correspondence with entity. If address is outside United States of America, then Mention city, province or state, postal code, and name of the country. You must not abbreviate any name. If correspondence is to be made with some person representing the organization, enter the address of executor, trustee or "care of" person.

Line 7-a,b: Those corporations and entities who have shares which are traded on public exchanges or who are registered with Securities and Exchange Commission, "Responsible Party" is

- Principal officer if business is a corporation.

- A general partner if a business is a partnership..

- The owner of the entity that is not regarded as segregated from its owner..

- Trustor if the organization is a trust.

A "responsible party" of an organization is a person who has a level of control over the funds of the company which enable the individual to control the direction and disposition of those funds and assets.

Lines 8a-c: A limited liability company, LLC may be treated as partnership or corporation or not separate from its owners for purposes of federal tax purposes. Which forms you should use and fill in exactly depends on the company classification and members. You can check the Form 8832 if you want check more information on entity classification.

If you write "Yes" in the line 8a, specify your LLC member number. Enter"1"on line 8b if the entity belongs solely to a couple who decides to treat the company as disregarded entity.

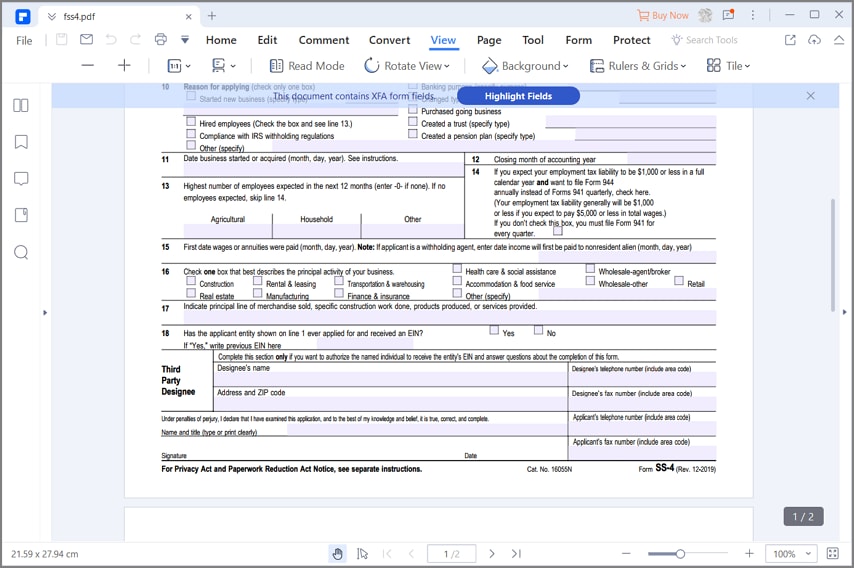

Line 9a-10: Select the box that you think has the exact description for your company type for line 9a. Choose the only reason for applying on line 10, "N/A" is not acceptable.

Line 11-18: Fill the exact the info which is required for line 11-14, and enter the first date you received wages or annuities, then select the box that give the most precise description to the principal activity of your business. Enter the major product or service your business provides or sells in line 17. Choose the right answer for line 18 according to your EIN status.

Step 3: Sign and Enter the Filling Date

Check all the lines and boxes again before you print the form. Sign and enter the filling date, mail the form by first-class mail to the IRS's EIN processing center. You can use EIN received on phone to immediately File Tax returns without waiting for printed response.

Warnings and Tips for IRS Form SS-4

- EIN should be used for business activities only. It is not an alternative to social security number.

- EIN number is offered for Free by IRS. Do not pay any kind of fee for it.

- File only form for EIN to avoid getting your request entangled in process. A sole proprietor only needs one EIN no matter how many businesses he operates.

- In case of change of address you do not need to file another Form SS-4. Just file Form 882 to report change to IRS.

- Federal taxes on business can be filed an paid electronically. Use electronic submission for quicker response.

- Applicants of EIN who are residing outside United States of America or its possessions cannot use online method to apply for EIN. Use telephone or some other method.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor