Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form 8606

Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form 8606

Taxpayers use Form 8606 in reporting different transactions relating to what the Internal Revenue Service or IRS known as "Individual Retirement Arrangements" and what most people just known as IRAs. These are accounts that offer tax incentives in saving and invest money for retirement.

Your Best Solution to Fill out IRS Form 8606

If you are looking for a PDF Form Filler to use on filling up your IRS form 8606, then the best software you can use is the Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. It is not only allows you to fill a form for printing, but it also comes with other useful features. These features include annotation, redaction, combining files, adding images, adding password, conversion, and others.

Key Features

- Shrink the PDF files with Optimize feature.

- Convert files from or to PDF documents without quality loss.

- Smart form filler to fill any official form.

- Password protect to secure your high-sensitive PDF documents.

Instructions for How to Complete IRS Form 8606

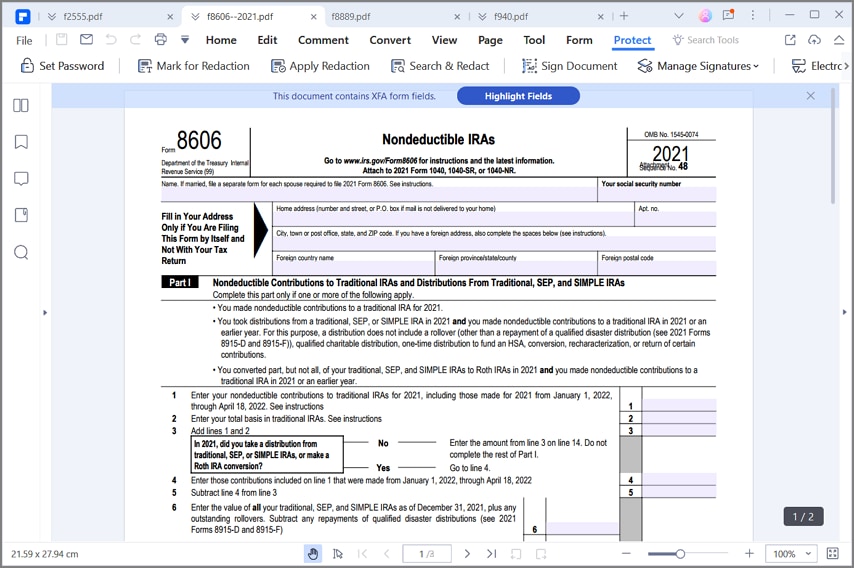

Step 1: Find a download the IRS form 8606 from IRS website and open the downloaded file on Wondershare PDFElement software.

Step 2: If you are using the IRA Deduction Worksheet in the Form 1040NR, 1040, or 1040A instructions, deduct line 12 of the worksheet from the smaller of line 10 or line 11 of the worksheet. Write the result on the line 1 of Form 8606. You can’t subtract the amount included on the line 1.

Step 3: In general, if it’s going to be your first year, filling out Form 8606, enter -0- on the line 2. Otherwise, you can use the Total Basis Chart, later, to find the amount to write on the line 2. However, you might have to enter an amount that is over -0- or increase or decrease the amount from the chart if the basis changed due to any reason.

Step 4: If you make contributions to traditional IRAs for 2015 in year 2015 and 2016 and you have both deductible and nondeductible contributions, you could choose to treat the contributions made in year 2015 first as nondeductible contributions and then as deductible contributions, or the other way around.

Step 5: On the line 6 you have to enter the total amount of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2015, in addition to any outstanding rollovers. A statement has to be sent to you by January 31, 2016, showing the value of each IRA on December 31, 2015. However, if you recharacterized any amounts initially converted, contributed, or rolled over from a capable plan in 2015, enter on the line 6 the total value, considering that all recharacterizations of those amounts, which include recharacterizations made after the date of December 31, 2015.

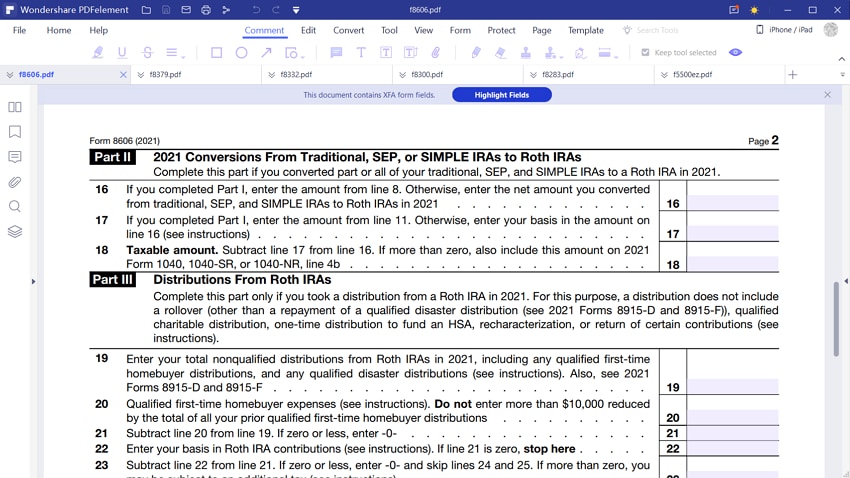

Step 6: If, in year 2015, you converted any amounts from traditional, SEP, or SIMPLE IRAs to a Roth IRA enter on the line 8 the net amount you converted. In order to compute that amount, you have to subtract from the total amount converted in 2015 any part that you recharacterized back to traditional, SEP or SIMPLE IRAs in year 2015 or 2016.

Step 7: If you had an eligible first-time homebuyer distribution from your Roth IRA and you made a contribution to a Roth IRA for any year from year 1998 up to 2010, write the amount of your capable expenses on line 20, but don't enter over $10,000.

Tips and Warnings for IRS Form 8606

- When and Where To File: File Form 8606 using your 2015 Form 1040A, 1040, or 1040NR by the due date, which include the extensions of your return. If you’re not necessary to file an income tax return but are necessary to file Form 8606, you may want to sign Form 8606 and send it to the Internal Revenue Service all at once and place you would otherwise file Form 1040, 1040A, or 1040NR. Make sure that you write your address on the page 1 of the form and you sign it and write the date on page 2 of the form.

- An eligible employer plan is able to keep a separate account or annuity under the plan to obtain voluntary employee contributions. If in year 2015 you had a believed IRA, use the rules for either a traditional IRA or a Roth IRA depending on which type it was. You may want to check out Pub. 590-A for more information.

- You don't need to file Form 8606 exclusively to report regular contributions to Roth IRAs.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor