Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form 4562

Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form 4562

If you have purchased property to use in the business, you are able to deduct a part of your costs by claiming a depreciation deduction and reporting it on IRS Form 4562. Once you purchase property to use in the business, the IRS does not allow you to claim the whole cost as a business deduction in the first year. But you are able to deduct a part of the costs every year by claiming a depreciation deduction and reporting it on IRS Form 4562, Depreciation and Amortization. The amount you are able to deduct on Form 4562 will depend on the IRS assessed useful life for every piece of property.

File Taxes Faster with PDFelement

Scan receipts and paper forms into searchable PDFs

Compress large PDFs for easy storing and sharing

Securely save and back up tax records as PDFs

Organize tax files by year and category

Merge related tax forms, statements, and receipts into one file to reduce clutter

Your Best Solution to Fill Out IRS Form 4562

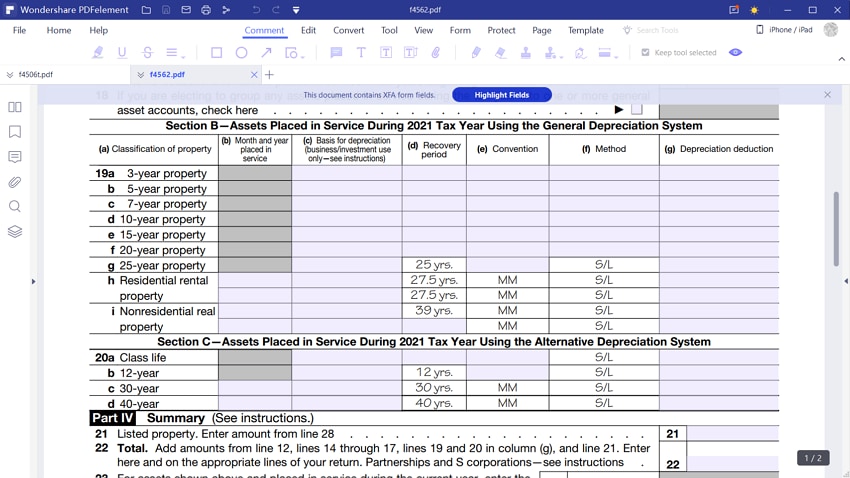

When filling out of Form 4562, you have to know that Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is your ultimate solution to all your PDF needs. Wondershare PDFelement is a very useful PDF tool you can get to fill out your form without breaking a bank.

Key Features

- Support working on Windows & Mac operating system.

- Light size and user-friendly interface.

- An all-in-one PDF solution to meet all your needs for dealing with PDF files.

- Support digital signature to authorize your official documents.

Instructions for How to Complete IRS Form 4562

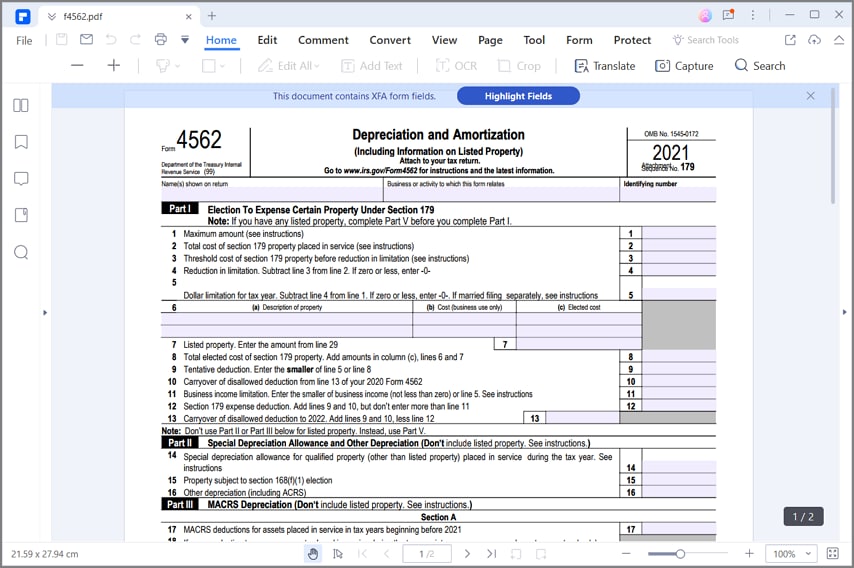

Step 1: Download a copy of the IRS form 4562 from the IRS official website.

This form is also available at public libraries, but this depends on the state. Contact your local library for more information. Import the downloaded file on PDFelement and start filling out the form.

Step 2: Read and follow the directions for every section, by recording the value as directed on the form 4562

Keep copies of all paperwork to support the claim once it is filed, should it need to be appraised by the IRS whenever. The time you need to prepare the form is roughly 4 hours and 55 minutes, with another 4 hours and 16 minutes needed to inform yourself on the form and your suitability to obtain the deduction.

Step 3: Follow the steps as below to fill out IRS Form 4562

Part I – The first part deals with the Section 179 property expenses. Section 179 property should have been bought and used throughout the tax year. For property that's used for business and personal purposes, the fraction of time the possessions is utilized in the business defines the price basis wherein the devaluation is calculated.

Part II - In this part, you will enter what is known as bonus depreciation, the "Special Depreciation Allowance." Bonus depreciation that goes with the Section 179 deduction is totaled after the deduction of the Section 179 expense, and is allowed after purchasing new property throughout the first year of use. The calculation should be derived from 50% of the remaining foundation of the amount after the deduction of Section 179 cost.

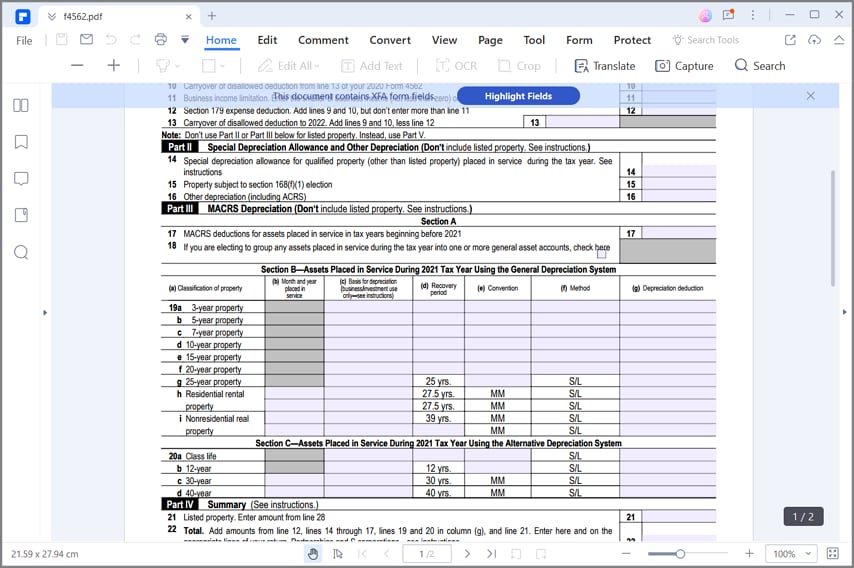

Part III - This part reports the devaluation on property put into service throughout the present tax year. So in part III, you have to enter the Modified Accelerated Cost Recovery System or "MACRS" with suitable MACRS recovery period for every particular property, or the suitable Alternative Depreciation System, or "ADS" calculations.

Part IV - The summary of entries from the first three parts are included in Part IV, this concludes the first pages of the Form 4562.

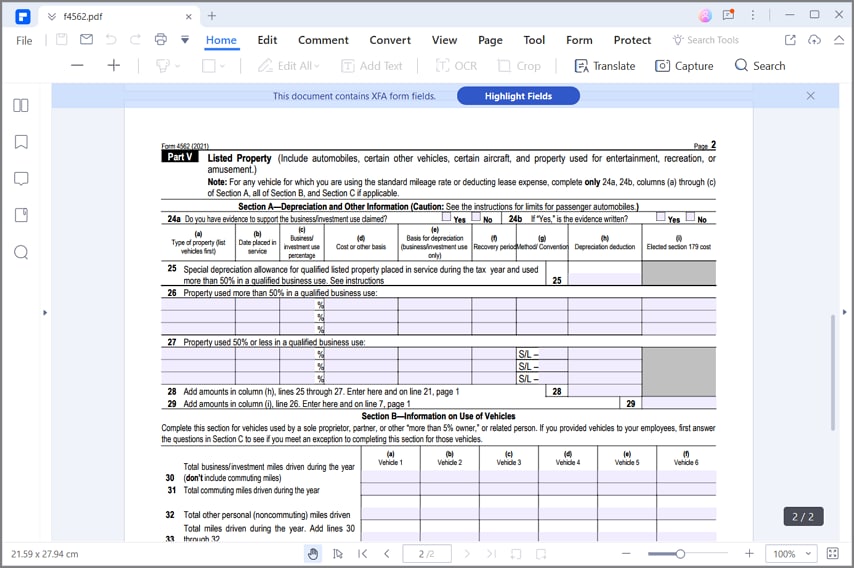

Part V - This section has three parts which deals with "Listed Property." The listed property includes vehicles that weigh not more than 6,000 lbs. For the vehicles that included in property, there are particular restrictions on the depreciation deduction, expense, and bonus depreciation. The information is necessary regardless of the date of you have purchased the vehicle. Except if the owned property is used entirely at business site, entertainment equipment and computers should also be listed on the property.

Part VI - What reported in the Part VI of the form is the amortizable expenses. Amortizable expenses include costs of starting up a business, expenses of the lease acquisition, research costs, bond payments, copyrights, goodwill, and all intangible properties.

Tips and Warnings for IRS form 4562

- Call an IRS representative through phone at 800-829-1040 to help answer any questions about the form, if there are parts on the form that confuses you.

- The instructions for filling out any form for the IRS are really specific, and every form doesn't apply to everyone. You must read all IRS documents carefully before filing it.

- If you did not acquire any assets and are merely belittling the cost of assets acquired in prior years, you might not be required to complete this form depending on the type of business you have.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor