Home

>

Other IRS Forms

> IRS Form 9465: Instructions for How to Fill it Correctly 2026

Home

>

Other IRS Forms

> IRS Form 9465: Instructions for How to Fill it Correctly 2026

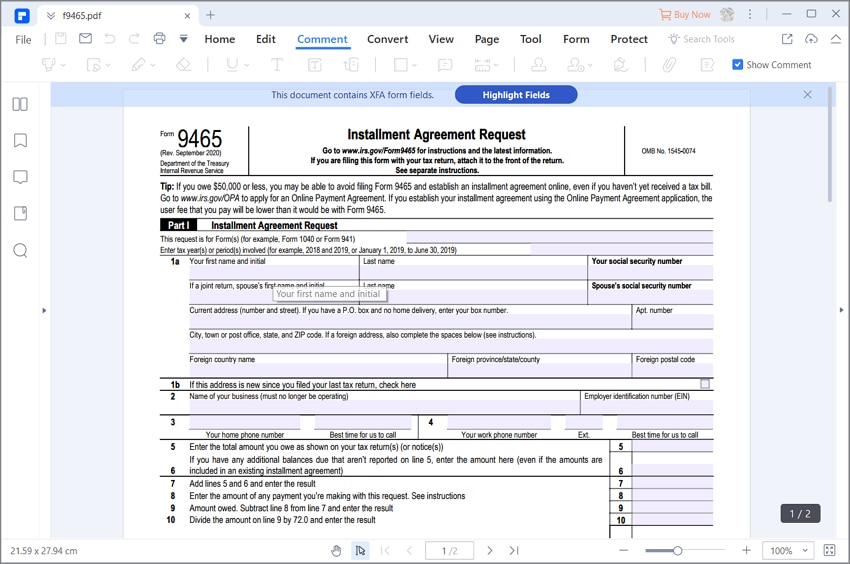

IRS Form 9465 is made for those people who are not able to pay their taxes in a single installment. They will request through this form so that they can submit their taxes in monthly installments.

Your Best Solution to Fill in IRS Form 9465

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement can be your best solution to complete the IRS Form 9565 as you can zoom in the whole form and fill each box or line correctly by following filling instructions.

The form 9465 is a two page form consist of two parts: namely part I and part II. It is advisable to read the instruction as below properly before filling out the form.

Filling Instructions for IRS Form 9465

Step 1: Download PDFelement. Launch the program and open IRS Form 9465 with it.

Step 2: Show the names and SSN'S (social security numbers) for returning a joint tax in the similar order as they are shown on line 1a on tax return.

Step 3: On Line 2, write down (EIN) employer identification number and the name of your business which must no longer be running.

Step 4: On the notice in line 7, write the total amount which is indebted by you on tax return.

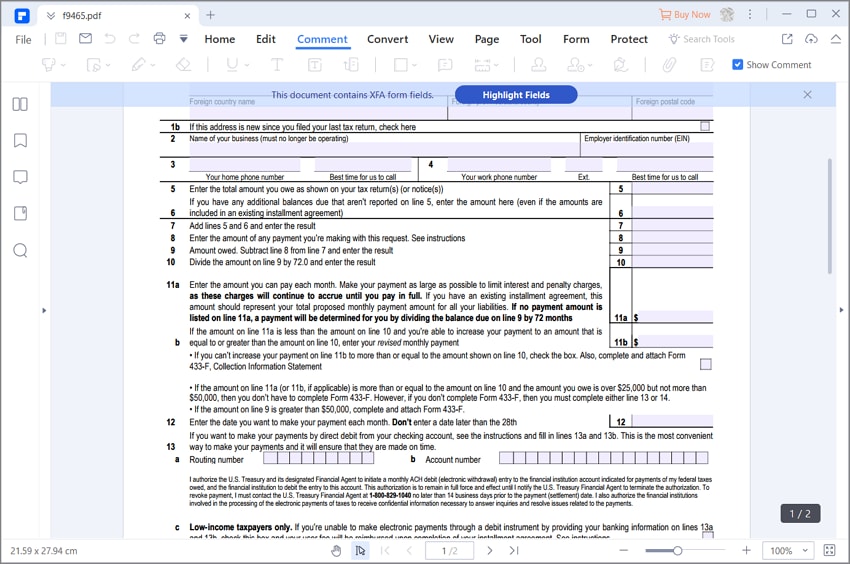

Step 5: Try to pay the tax as much as you can pay in order to lessen the penalty and the interest rate. You should make the payment with your return if you are filling this form 9465 with your tax return.

A fee which comes along with the installment plan can easily be paid by money order, cheque, credit card or any other method of payment which is convenient for you. Following are the details of fee for setting up a plan according to the mode of payment.

|

Payment method

|

Applicable fee

|

|---|---|

| Check, money order, or credit card | $120 |

| Direct debit | $52 |

| Payroll deduction installment agreement | $120 |

1. For further details on the method of how to pay tax, kindly see the instructions of your tax return, or you can find irs contact numbers to get assisstance.

2. Once you submit each payment you will receive a notice by IRS informing you about the amount paid and the amount left to be paid by you.

Step 6: If the amount to be paid is more than $50,00 then you can file a complete form 433-F along with this form. Form 433-F can be obtained from our IRS website.

Step 7: Where to file:Attach the forms 9465 to the front side of tax return and then send it to address given in the tax return booklet.

Tips and Warnings for IRS Form 9465

- Form 9465 can be used in the following situations:

a. If you have Indebted income tax

b. If you are or might be the one who is responsible for a trust fund recovery penalty

c. If you indebted to employment taxes (for example as it is shown on forms 941, 943 and 940) which are related to a single property owner's business which is no longer running now.

- It is often advised not to take advantage from form 9465 if:

a. You are able enough to pay the full amount of tax in 120 days.

b. You are interested in requesting an online payment agreement.

c. Your business is still running and that owes unemployment and employment taxes.

d. Your installment agreement will be cancelled if you'll fail to provide incomplete information to IRS if they request you for a financial update.

- Paying your installment by direct debit will guarantee that you made your payments in time and you will not be in default list of this agreement.

- The direct debit will not be approved from your checking account until and unless you sign the form 9465. Your spouse must also sign it in case f joint return

- You can not file form 9464 electronically if you opt to make payments by the method of payroll deduction.

- Installment agreements must be in accordance with the criteria set by the IRS installment agreement. The maximum time allowed is 72 months according to this agreement.

- Considering some special kind of circumstances, the allotted time can be extended as well. As installment agreements comes along with some price so you should think considering those alternatives which are cheap like getting loan from a bank or using the money available on your credit card.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor