Home

>

Other IRS Forms

> IRS form W-2: Instructions for How to Complete It

Home

>

Other IRS Forms

> IRS form W-2: Instructions for How to Complete It

Wage and Tax Statement Form or Form W-2 must be filed by every employer who pays wages including the non-cash payments of $600 or more from which Social security, or Medicare Tax was withheld, for the work done by an employee.

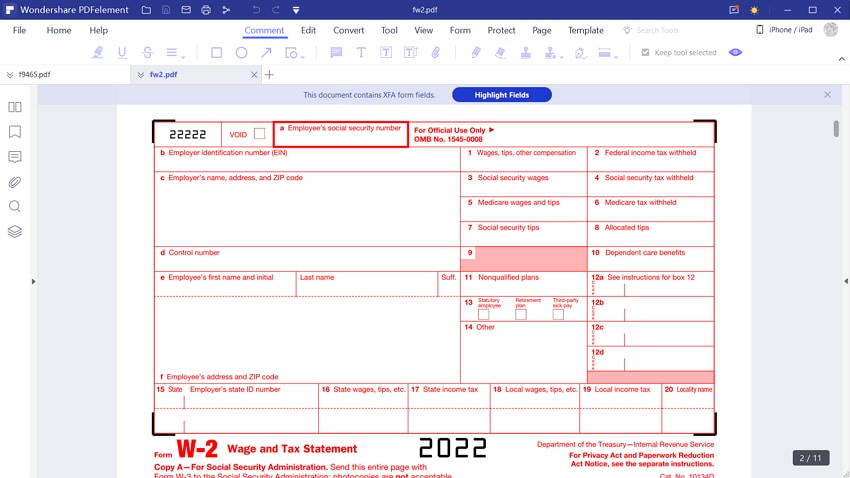

Your Best Solution to Fill in IRS Form W-2

In order to save time and avoid mistake, choosing a smart form filing tool is critical. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is capable of facilitating the form filling process with its agile functions.

PDFelement has multiple useful functions such as form editing, creating and digital signature. Plus, it is an all-in-one PDF editor which makes the effort on PDF documents simple and fast.

Instructions for How to Fill in IRS Form W-2

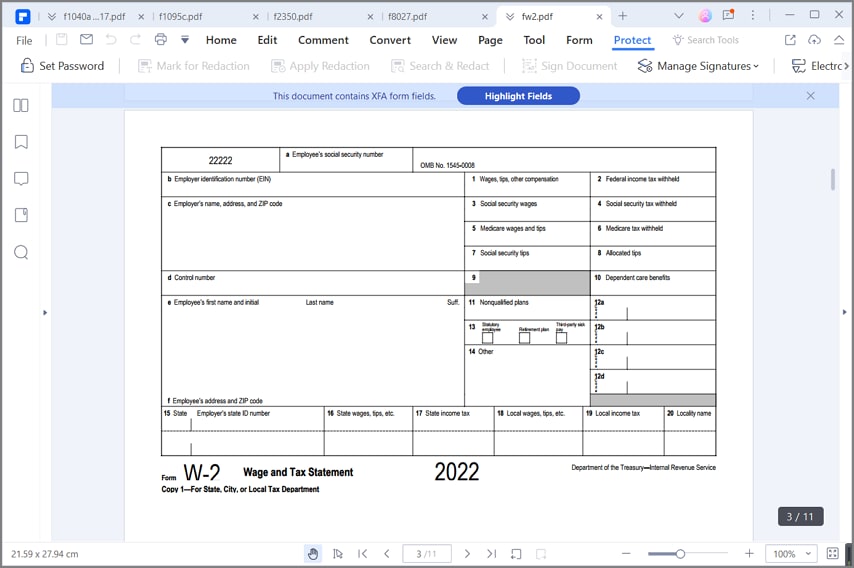

Form W-2 has several parts. Make sure that all writing is legible. Send Copy A to SSA; Copy 1, if required, to your local, city or state tax department; and copy B, C and 2 to your employee. Keep Copy D and a Copy of From W-3 with your records for 4 years.

Step 1: Launch PDFelement. Drag and drop the PDF form in this program to activate form filling process.

Step 2: Enter all the information on form W-2 using black ink in 12 point courier font. Copy A is read by machine and therefore must be typed clearly with no corrections made and no entry must exceed box size. Data completed by hand, in script or italic fonts or with other colors cannot be read by machines.

Step 3: Make all dollar entries on Copy A without the dollar sign and comma but with decimal point.

Step 4: If a box does not apply to you, leave it blank.

Step 5: Whole copy A of the form W-2 with Form W-3 to the SSA even if one of the Form on W-2 is blank or void.

Do not staple form W-2 to W-3 or together.

Step 7: File Forms alphabetically by last names or numerically by employees' SSN.

Step 8: Voiding a form: If you made an error on Form W-2 and you are voiding it to complete a new form, check this box. Do not Show any amounts shown on “Void” forms in total you enter W-3.

Step 9: Undeliverable form W-2: If you could not deliver employees copies of W-2 after you tried, keep those copies for 4 years. If undelivered form W-2 can be sent to IRS electronically till the April 15th of fourth year after issue, you need to not to keep undeliverable employee copies. Do not send undeliverable copies to social security administration.

More Tips and Warnings for IRS Form W-2

- When to File: While filing, Form W-3 must be submitted along with copy A of form W-2 before February 19, 2016. For E filing the due date is extended to March-31, 2016. For Each late W-2, a Penalty is levied.

- Form W-3: If you are required to file Form W-2 you must also file W-3 to transmit copy A of form W-2. Keep a copy of form W-3 with you and Copy D of the form W-2 for your record for 4 years. Use correct W-3 form for the given year if you are filing electronically. Filing paper Forms W-2 and W-3: File Copy A of Form W-2 with Form W-3 at the following address.

- Unless notified, any reference to Medicare tax includes additional Medicare tax.

- Using a reporting agent or third-party payroll services does not release employer of the duty to ensure that Forms W-2 are e furnished to employees and forms W-2 and W-3 are filed with SSA on time.

- No kind of payments and money should be sent along with Form W-2 and W-3 submitted to SSA. This includes cash, checks, money orders, or any other forms of payment.

- Employers must use an employer identification number (EIN) (00-0000000) while Employees must use a social security number (SSN) (000-00-0000) while filling this.

- When you list a number, separate the nine digits properly to show the kind of number. IRS individual tax payer identification number (ITIN) must not be accepted from employee in lieu of SSN for employee identification for reporting on form W-2.

a. Social Security Administration

b. Data Operations Center

c. Wilkes-Barre, PA 18769-0001

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor