Home

>

Other IRS Forms

> IRS Form 8027: Work it Right the First Time

Home

>

Other IRS Forms

> IRS Form 8027: Work it Right the First Time

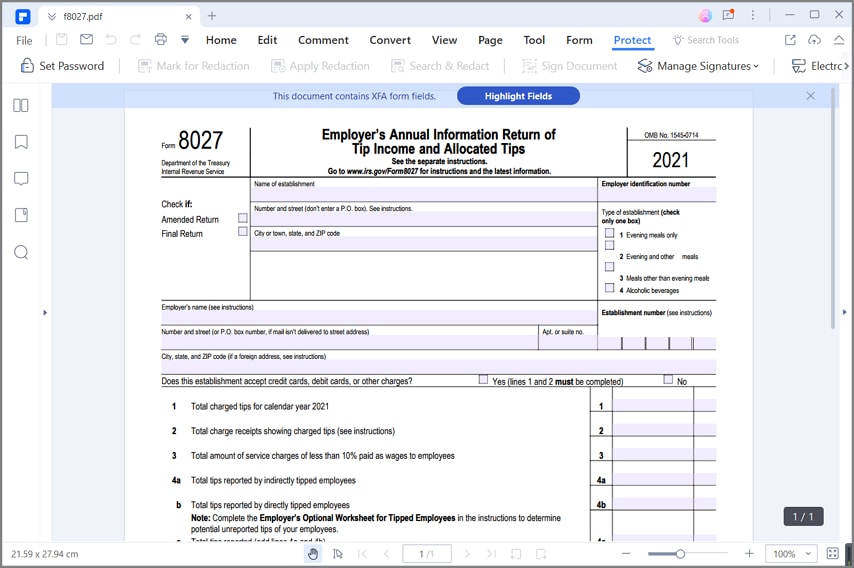

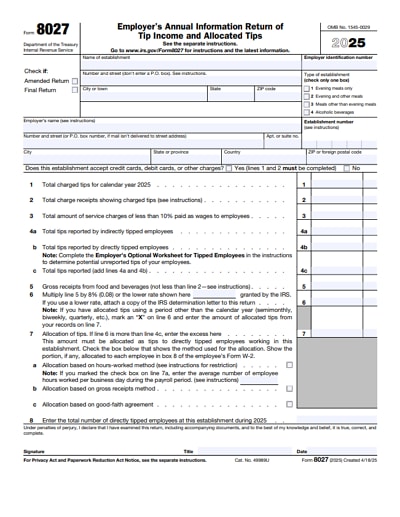

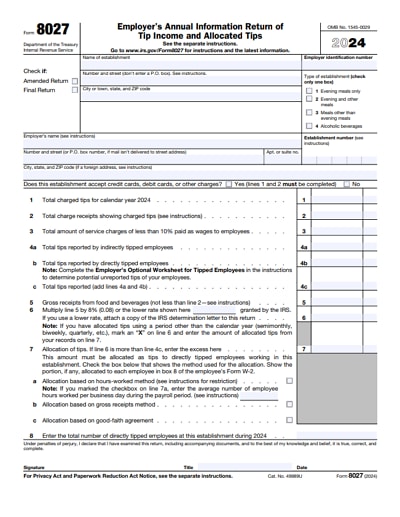

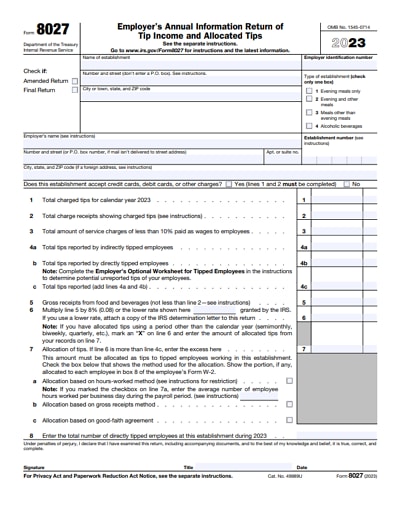

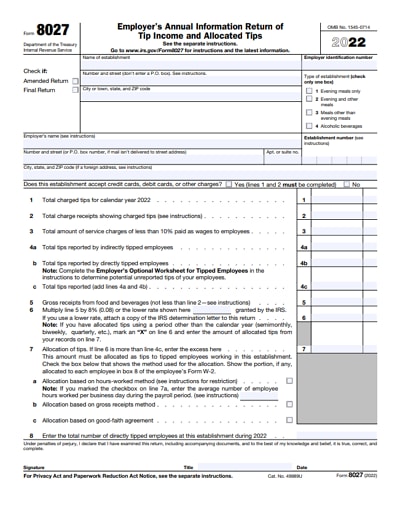

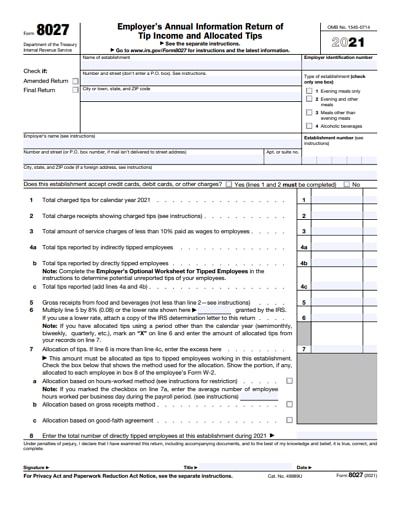

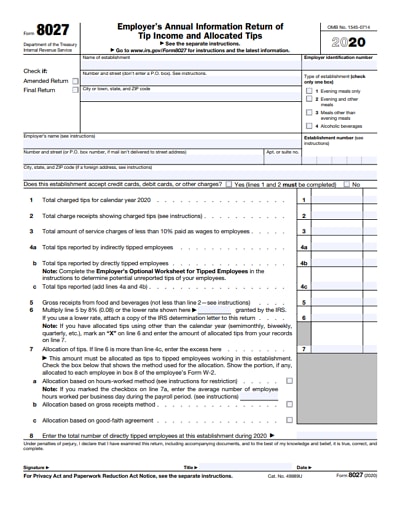

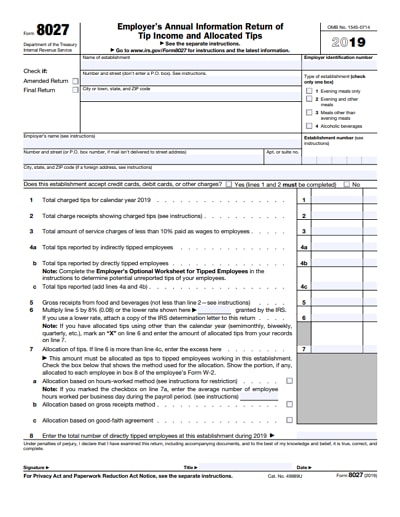

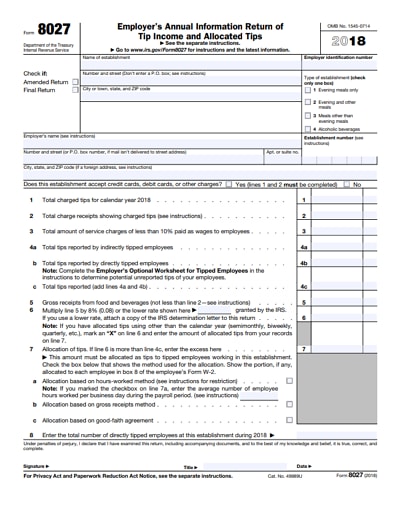

If you are an employer who operates a large food or beverage establishment, then you must file IRS Form 8027 which is the "Employer's Annual Information Return of Tip Income and Allocated Tips" to the Internal Revenue Service the receipt and tips from your establishment.

Download Fillable & Printable Form 8027 in PDF

Your Best Solution to Fill out IRS Form 8027

IRS forms are widely used for information sharing in government circles. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is the most tested and trusted form filler that is capable of filling out your IRS Form 8027 and any other PDF forms.

Apart from offering you a superb form filling service, PDFelement is an all in one PDF editing program which can be used in creating, editing and converting PDF documents. It supports digital signature and offer security to your document by offering password protection.

The benefits of using PDFelement are huge. It is available in Mac and Windows version with a multi lingual support in top languages. PDFelement is certainly the best all round tool you require for any PDF task and obviously the best solution to fill out your IRS Form 8027.

Instructions for How to Complete IRS Form 8027

To complete this form successfully, use the step by step instructions below:

Step 1: You can obtain the IRS Form 8027 by downloading a soft copy at the official website of the Internal Revenue Service, Department of Treasury. Open the downloaded copy using PDFelement and start filling out the form using the program.

Step 2: There are two boxes at the top left side of the form labeled Amended return and final return. You are to check any of the boxes that is applicable to you. Write the name of establishment, the employer identification number and the address of the establishment. But note that your address must be written in such a way that it shows the number, street, city, town, state and zip code. There are four types of establishment as captured in the form. They are evening meals, evening and other meals, meals other than evening meals and Alcoholic beverages all represented by a box at the top right corner of the form. Check the appropriate box that represents your establishment.

Step 3: Then write the employers name as shown of Form 941, the address and the establishment number. Ensure the address contains the number, street, suit, city, state, zip code. If it is foreign address, see further instructions. Then answer if the establishment accepts debit cards, credit cards or other charges by checking either yes or no box.

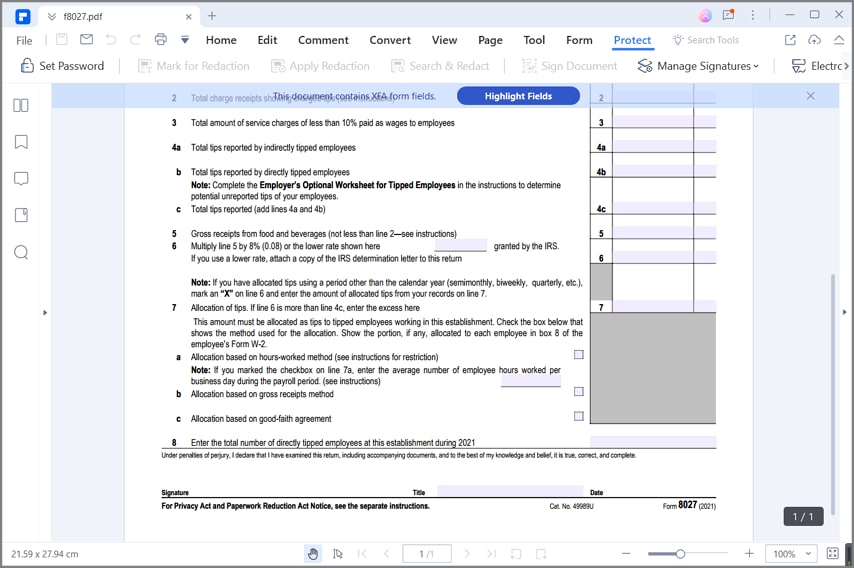

Step 4: Enter the total charged tips for the calendar year and the total charged receipt showing charged tips on lies 1 and 2. Then enter the total amount of service charges less than 10% paid as wages to employee on line 3.

Step 5: Go to line 4 and enter the total tips reported by indirectly tipped employees on line 4a. However, the total tips reported by directly tipped employees should be entered on line 4b and add lines 4a and 4b to get the total tips. Record the amount in line 4c.

Step 6: Enter gross receipt form food and beverages and multiply line 5 by 8% and enter the amount on lines 5 and 6 respectively. But note that if you have allocated tips other than using the calendar year, then mark “X” on line 6 and enter the amount of allocated tips from your records on line 7.

Step 7: Check for allocation of tips. If the amount of tips shown on line 6 is greater than the amount of tips reported by your employees on line 4c, you must then allocate the excess to those employees. Then enter the excess on line 7 and check any of the boxes on line 7a, 7b and 7c to show the method which you may allocate tips. The methods are the allocation based on hours worked method, allocation based on gross receipt method and allocation based on good faith agreement as captured on lines 7a, 7b and 7c.

Step 8: You are expected to enter the total number of directly tipped employees who worked at the establishment during the year. This will be the cumulative total of all directly tipped employees who worked at the establishment at any time during the year.

Step 9: Complete the form by signing your name and including your title. Enter the date you signed the form and also enter the daytime telephone number including your area code so that you can be reached by the Internal Revenue Service if needed.

Tips and Warnings for IRS Form 8027

- It is advisable to voluntarily complete the optional worksheet as a means to determine if your employees are reporting all of their tips to you. Note that unreported tip income may lead to additional employer liability for social security tax and Medicare tax. However, this worksheet is just for the employer’s use; do not send it to the IRS.

- If you need help because it appears that not all tips are being reported to you, you can take advantage of the IRS service called Tip Rate Determination and Education Program. You can get further information on this by sending a mail to TIP.program@irs.gov.

- The law provides penalties if you do not file IRS Form 8027 on time except you can provide a reasonable cause of the delay.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor