Home

>

Other IRS Forms

> The Instructions to Fill out IRS Form 8840

Home

>

Other IRS Forms

> The Instructions to Fill out IRS Form 8840

For Canadians, taking a winter holiday in the U.S as a legal non-permanent resident may be subject to the U.S. income tax if you exceed a specified period within one year. The number of days is calculated on the IRS form 8840. By overstaying in the US, you will be considered as a US resident and you will have to file tax returns. Therefore, you need to avoid at all cost to being considered as US resident by meeting The Substantial Presence Test, The Closer Connection Exemption and avoid counting on The Canada - U.S. Tax Treaty.

Now, if you meet the closer connection exemption or qualify for Substantial Presence Test you will need to file form 8840. To file this form easily you will need a PDF form filler as you will be shown on this article.

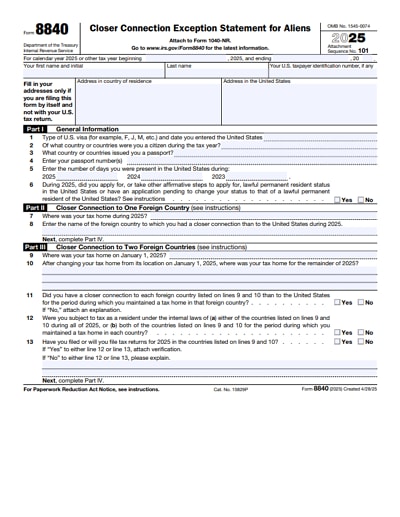

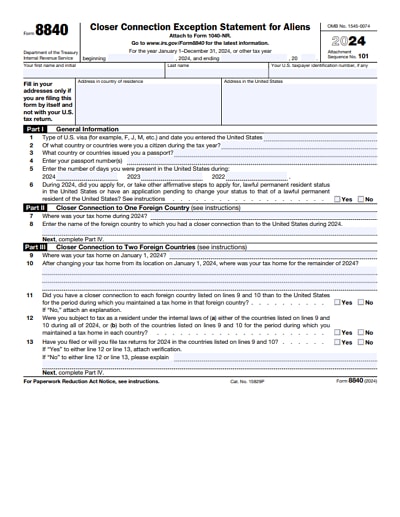

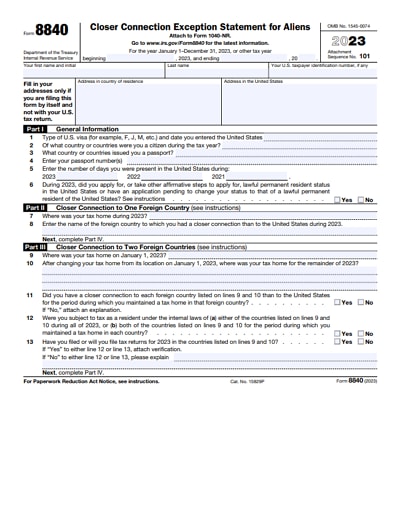

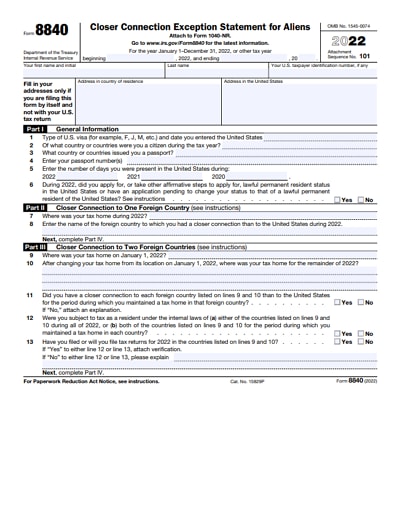

Download Fillable & Printable Form 8840 in PDF

The Best Solution to Fill out IRS Form 8840

Filing IRS 8840 requires an accurate a form filler like Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. Due to its smart interface, you are guaranteed of flawless filing within the shortest time possible you would wish to fill the file. You will be able to enter texts to the form fields of desired font and style. If you are required to authorize a digital signature then you can easily add your digital signature with this software. Other than, this tool allows you to create PDF forms, make scanned PDF forms editable, share the PDF files to emails and cloud storage.

Furthermore, you can also create PDF files from existing files, merge PDF files and convert them to formats like Excel, Word, HTML, Plain texts among others. Now, let us see how to use it file IRS form 8840.

Instructions for How to Fill IRS Form 8840

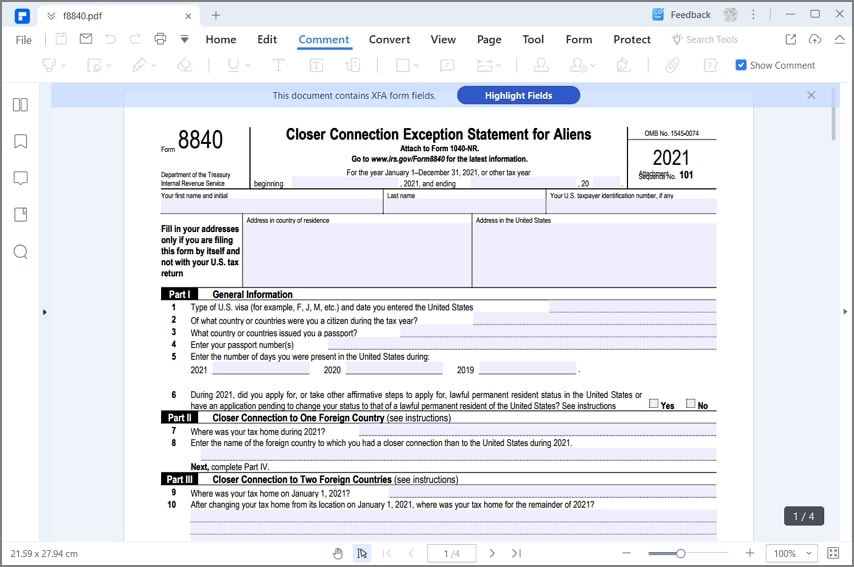

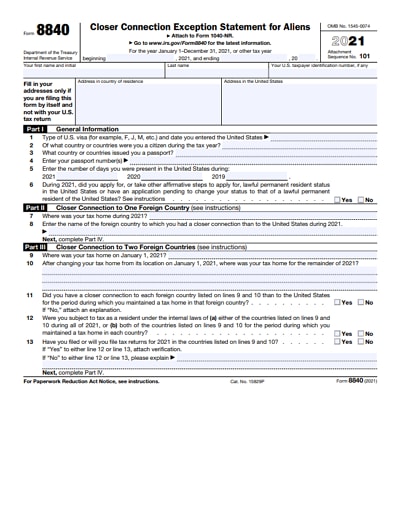

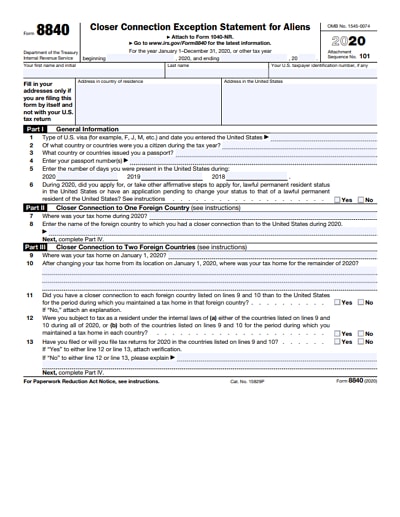

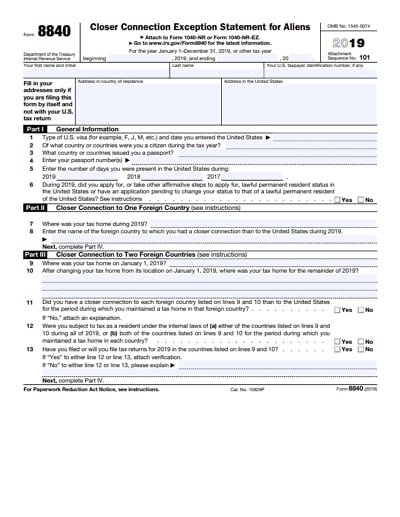

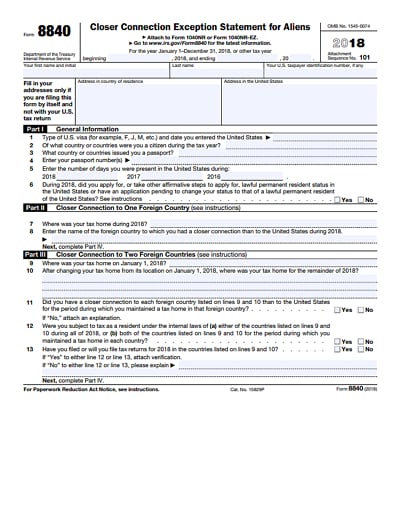

Unlike other IRS forms, form 8840 is simple and lesser complicated to file. However, since you are new to it, you should expect guidance on how to fill it. It includes four parts with an additional section of references as per the U.S. Internal Revenue Code. To proceed to fill, you can download IRS form 8840 here.

Step 1: Launch PDFelement and click "Open File" to add form 8840 from your computer.

Step 2: Fill the tax period, your identification names and the U.S. taxpayer identification number. In case you are filing the form alone, you'll be required to enter your physical addresses in your residence country and the U.S. simultaneously.

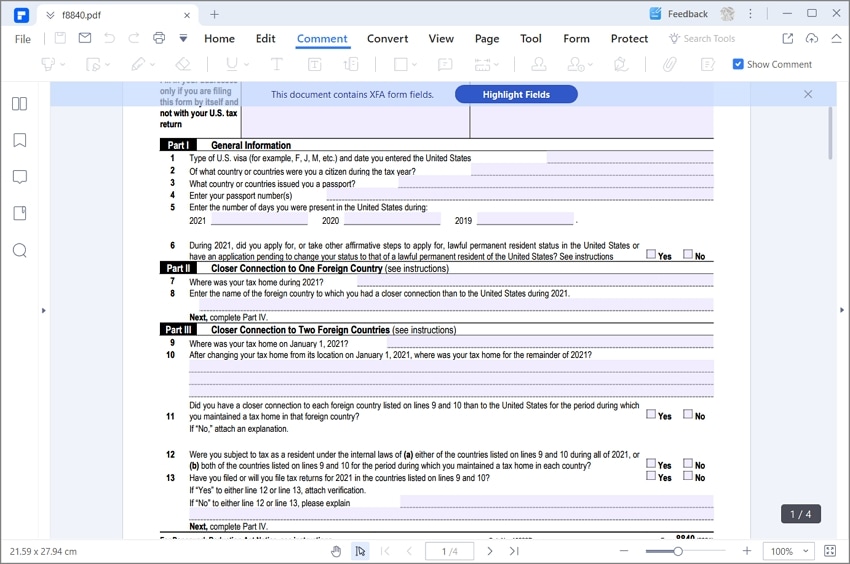

Step 3: Part 1, General Information, gives the basic information on the U.S. visa type and the country you are entitled to income tax payment. Additionally, you have to state any pending application in case you wish to change to permanent resident status.

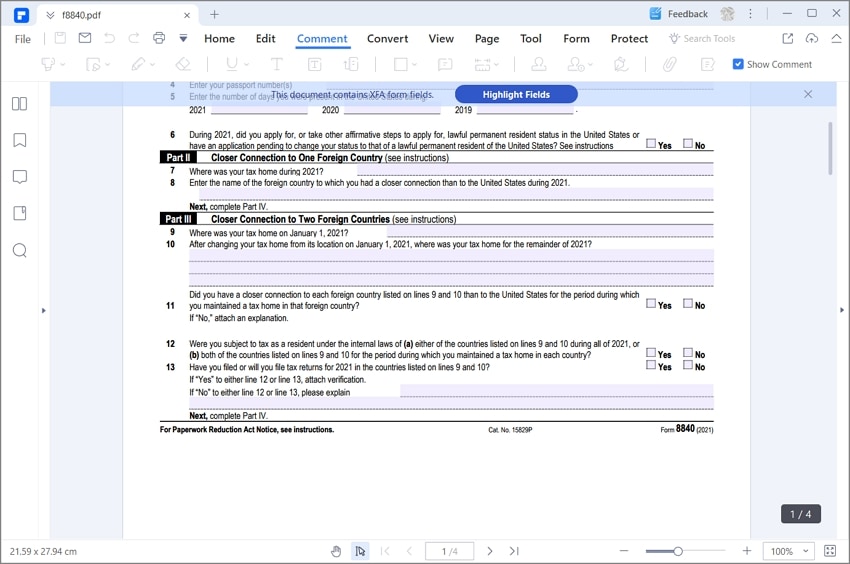

Step 4: Part 2 and 3 involves any close connection to one or two foreign countries that you may be entitled to income tax payment. It will be in consideration to your previous places of tax in the preceding years. Depending on your foreign countries close connections, you'll fill either part 2 or 3 and then proceed to part 4.

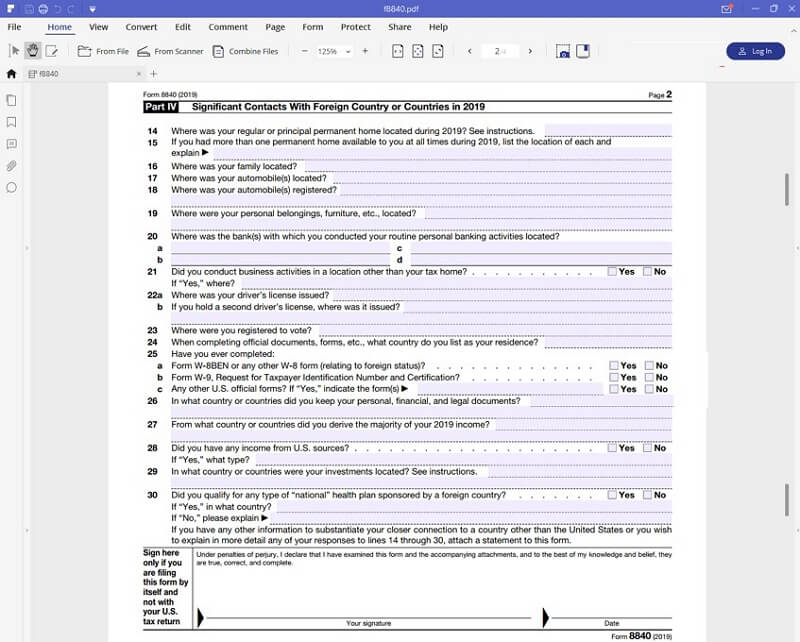

Step 5: Finally, you have to give relevant contacts to a foreign country or countries listed under part 4. Here, you list your country or countries of residence, family location, location of your personal belongings and business activities.

Equally important is the information regarding the filing of Form W-8BEN relating to foreign status; Form W-9, relating to Request for Taxpayer Identification Number and Certification or any other U.S. official forms.

Complete by declaring any income generated from U.S. sources, investments in other countries and health plan sponsored by a foreign country.

In case there is more information to add to substantiate your connection to another country or more explanation in detail, you are advised to attach a statement to the form.

Confirming the authenticity of the information given, you are required to sign on the space provided and the corresponding date of the document filling.

Tips and Warnings for IRS Form 8840

Considering that rules change over time, there are tips and warnings you ought to be wary about when filling the IRS form 8840. However, prior notice is made through broadcast or on the IRS website. An example is that form 8840 for snowbirds 2018 got reviewed to effect changes on the form 8840 2019 henceforth concerning passed suggestions from the users.

- IRS form 8840 or any other U.S. form you may need is available at IRS.gov.

- In case your presence in the United States is about a medical condition or far from a foreign government-related issue, you must file the form 8843.

- In case you spend over four months in a year in the U.S., it's recommended you file form 8840 before June 15th in that year. Actually, with 182 days not exceeded, you are eligible to file the 8840 Form. This applies to persons travelling for tourism purposes especially the Canadian Snowbirds, who are limited to 182 days within 12 months.

- Eventually, you have to avoid the late filing penalty since you will not be allowed to claim a close connection to a foreign country. Instead, you will be treated as a U.S. resident. However, an exception comes in when you can prove having taken action to comply with the set requirements.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor