Home

>

Other IRS Forms

> How to Fill IRS Form 1099-R 2026

Home

>

Other IRS Forms

> How to Fill IRS Form 1099-R 2026

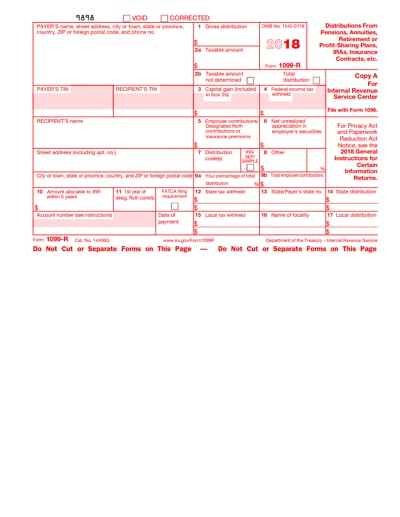

What is a 1099-R form and what to do if you get one? This is one of the most popular question o the internet. To begin with, the 1099-R form is an Internal Revenue Service (IRS) form used to report the distribution of $10 or more from retirement benefits such as pensions, charitable gift annuities, or other retirement plans.

The 1099 R tax form is available on IRS official website as well as the Instructions for Forms 1099-R. It is from IRS website you can download or print the form fill it. So how do you fill the 1099-R form offline? Well, this article guides you on how to fill it using a PDF form filler.

Download Fillable & Printable Form 1099-R in PDF

The Best Solution to Fill 1099-R Form

Looking at 1099 R Tax form, it has different form fields and you will need a form filler that can enable you to fill all the fields for you. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is the best form of filler that is suitable to fill 1099 r Form 2022. It allows you to fill interactive forms by adding texts, deleting texts, copy texts and images and add links where possible. Also, you can create PDF forms and share them via email, Dropbox or Google Drive.

This PDF form filler is built with a PDF merger that allows you combine and several PDF files and convert them to PDF format or other editable formats like Word, Excel, PPT, HTML, EPUB among others. It also comes in handy when you want to protects PDF files with passwords, redact them or add digital signatures to forms or PDFs.

Without further ado, let us look at how you can fill form 1099 R 2022.

How to Fill IRS Form 1099 R Step-by-Step

Now, follow this guide and see how to fill the 1099 R form 2022 easily using PDFelement once you have installed it on your computer.

Step 1: Go to IRS website and download the 1099 R tax form and then open it with the program. On launching the program, click on "Open File" and the program will enable you to browse the files. Select the downloaded 1099 R tax form and open it with the program. Alternatively, you can drag and drop the file to the program window and it will be uploaded.

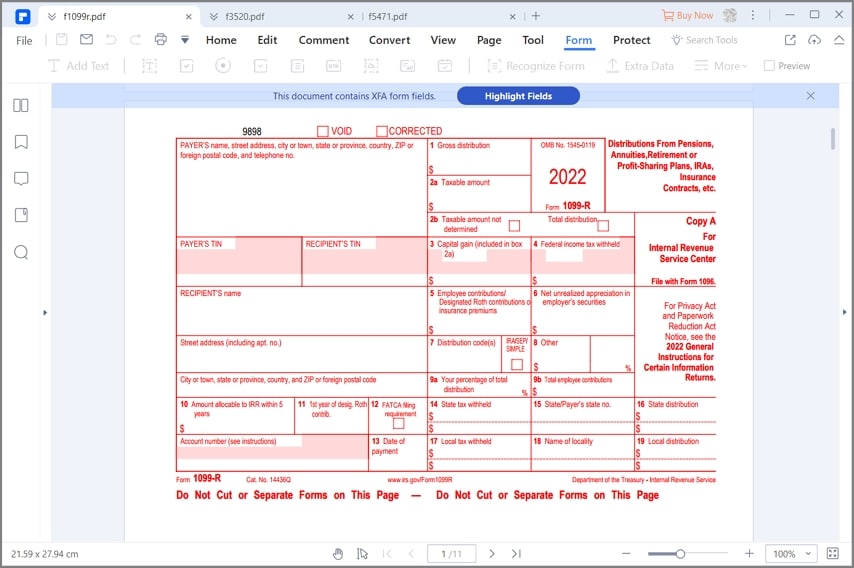

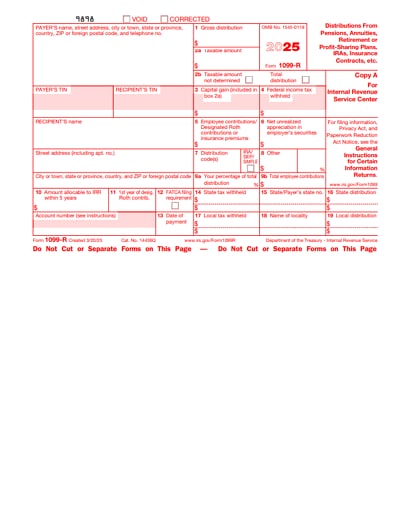

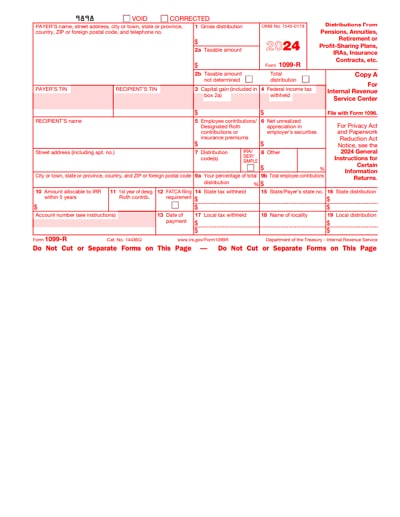

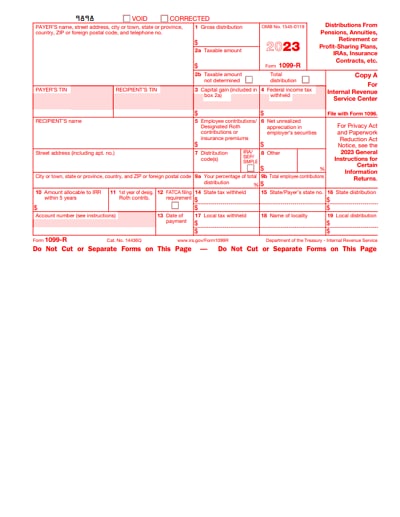

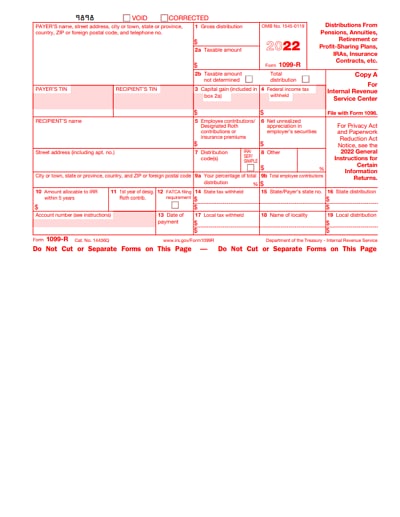

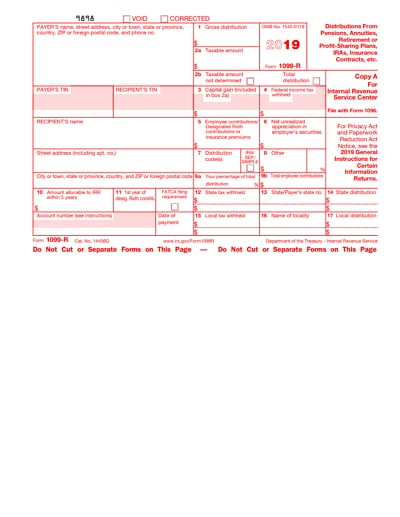

Step 2: When it opens you will see some instructions on the first page. Now pay attention to the details provided. Copy A is marked in red and according to the instructions you do not to file it because it is for informational purposes. Therefore, skip it.

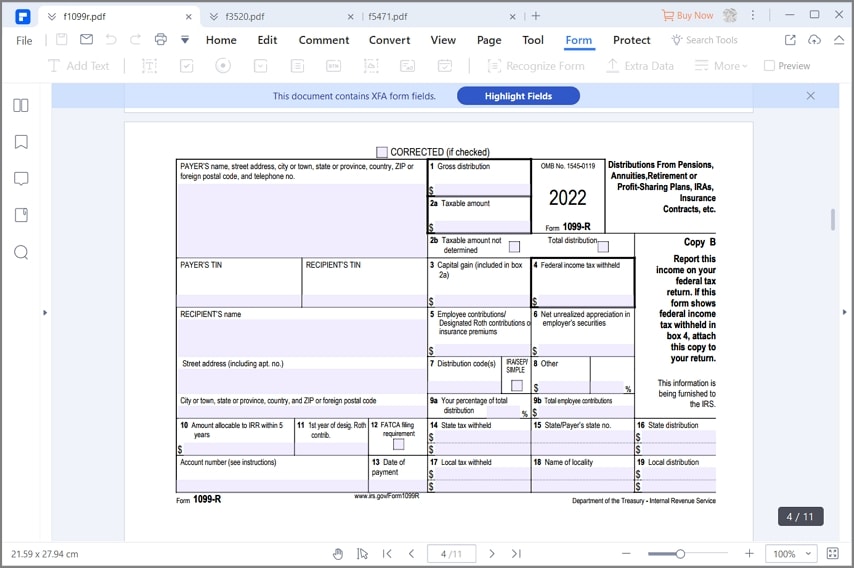

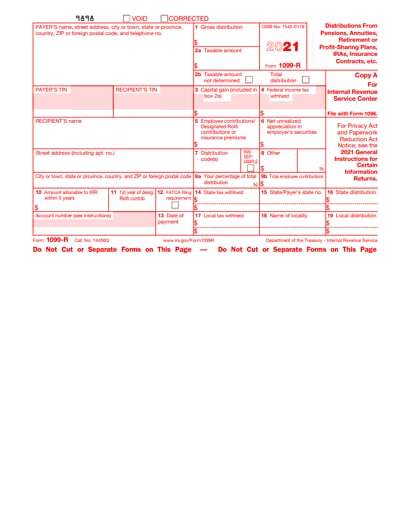

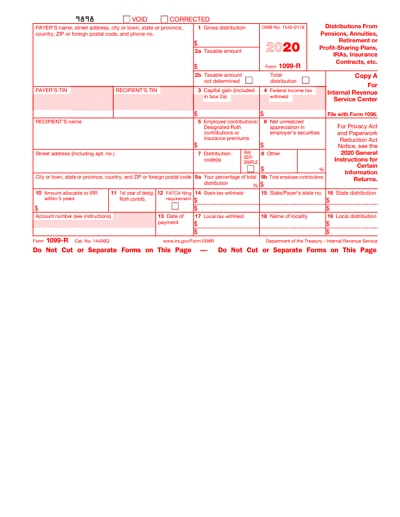

Step 3: Next is Copy B. Copy states that, you need to file this income on your federal tax return. If box 4 show that the federal income tax is withheld then you need to attach this copy on your return. The fields need to you fill recipients identifying information, Payers information, distribution amount and employee distribution among others.

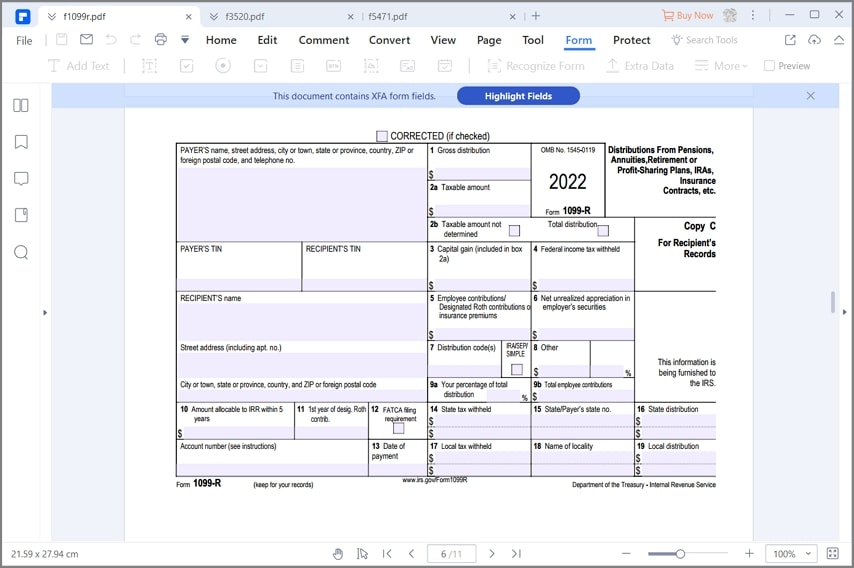

Step 4: After that scroll to part C for the recipient's records. Again, the boxes to be field requires Payers details, recipients' details, distributions and employee contributions filled. You can read the instructions for the recipient at the bottom of the copy to know to calculate and fill the form correctly.

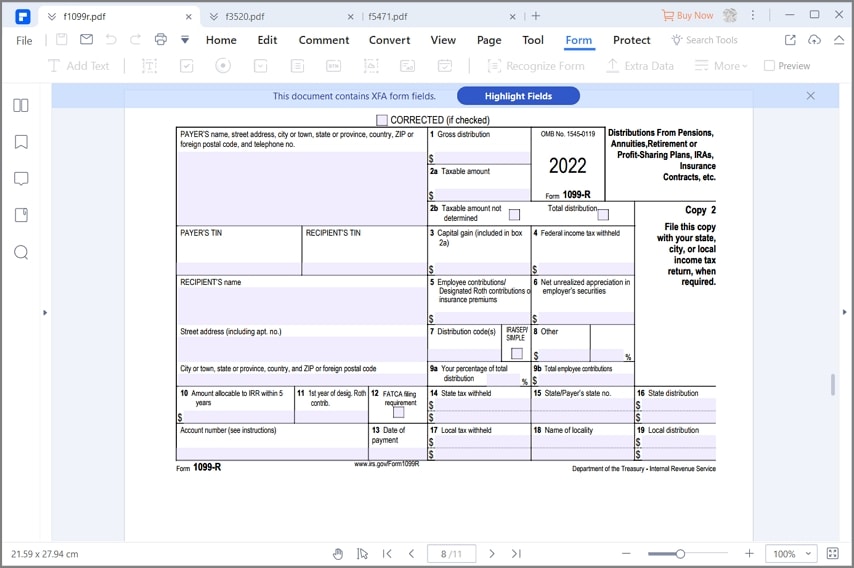

Step 5: Next is filling out copy 2. This part needs to be filed with your state city or local income tax upon request. The fields are the same as those of copy B and C and the recipient's instructions are available at the bottom of Copy 2.

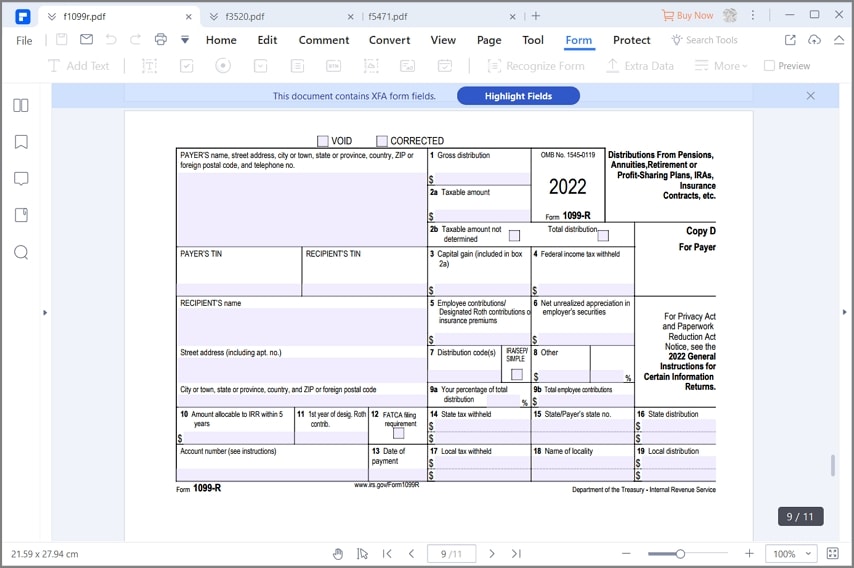

Step 6: The last part of IRS 1099-R is Copy D which is for the Payer. Here you are requested to use 2023 General instructions for certain information returns and the 2023 Instructions for Forms 1099-R and 5498. All this information you can find on the IRS website instructions form.

Step 7: After filling all the required sections fully, you can then save your form. Click on "File" at the top left, click on "Save As" and then choose the path the save form 1099-R and save it. From there you can submit it.

Tips and Warnings for IRS Form 1099-R

To correctly fill the form 1099-R here is what you should take note.

- Before you file 1099 r form 2023, always go through the instructions so that you can fill the form correctly.

- Check the due dates of the form at the end of the document under the restrictions so that you can be left out.

- You are required to file Copy A of form 1099-R with the IRS by March 1, 2023, However, if you filing it electronically, the deadline is March 31, 2023.

- Since filing the form may sound or look complex you can seek help from IRS experts to help your fil the form.

- Too easily for the form use PDFelement.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor