Home

>

Other IRS Forms

> How to Fill IRS Form 3520

Home

>

Other IRS Forms

> How to Fill IRS Form 3520

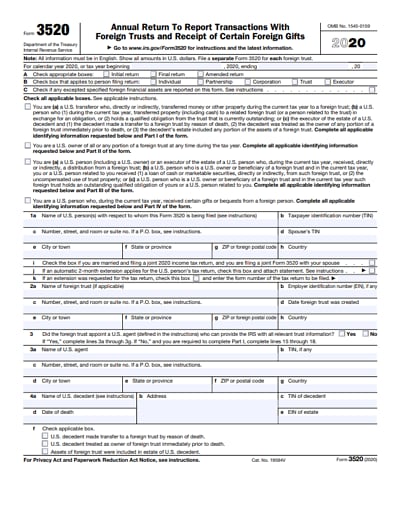

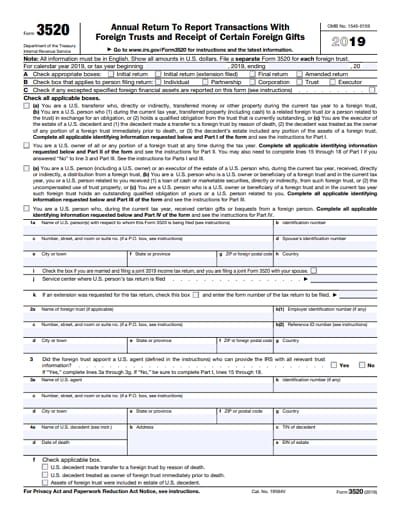

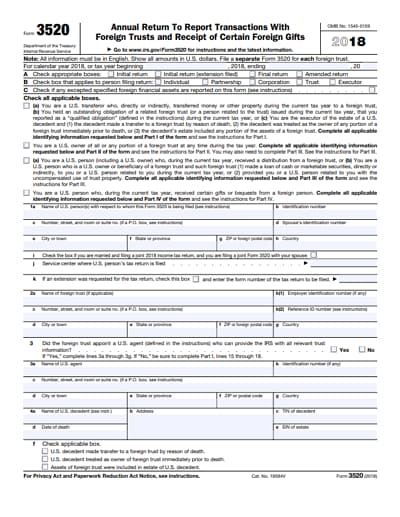

Who should file IRS form 3520? According to Internal Revenue Service portal, form 3520 should be filed by a U.S. person including executors of estates of U.S. decedents to report certain transactions with foreign trusts, ownership of foreign trusts and receipt of certain large gifts or bequests from certain foreign persons. The form is readily available on the IRS website. You will also find form 3520 instructions that you must read before you start filling out the form. In this article, we recommend the best IRS 3520 filler and show how to use it.

Download Fillable & Printable Form 3520 in PDF

The Best Form Filler for Filling Form 3520

A recommended PDF form filler that allows you to fill interactive forms easily is Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. This PDF tool enables you to add texts, edit texts, add images and links and also add digital signatures. If you are to share the document and there is sensitive information that you do not display then this tool allows you to redact that information.

Moreover, this tool comes in handy when you want to edit or fill scanned PDF forms or documents thanks to its OCR technology. Besides, you can also create PDF forms, convert PDFs, merge PDFs and share the files via email, Dropbox and Google Drive.

Furthermore, this PDF former has an intuitive interface with great customer support. Also, it is a cross-platform that can be installed on a Mac or Windows platform. Now let us dive to the next section and see how you use it to fill lines of IRS form 3520.

Instructions on How to Fill IRS Form 3520

As stated earlier ensure you go through form 3520 instructions before you start filing the parts of form 3520.

Step 1: You need to have the IRS form 3520 on your computer hence you need to download it. Here is the direct download link for form 3520 from IRS website.

Step 2: Next is to download the PDFelement to your computer, set it up and then launch it.

Step 3: After that, you can now open the IRS form 3520 with PDFelement. Navigate the bottom of the screen and click on "Open File" and you will be able to search for the form. Upon getting it to click on the file and open it.

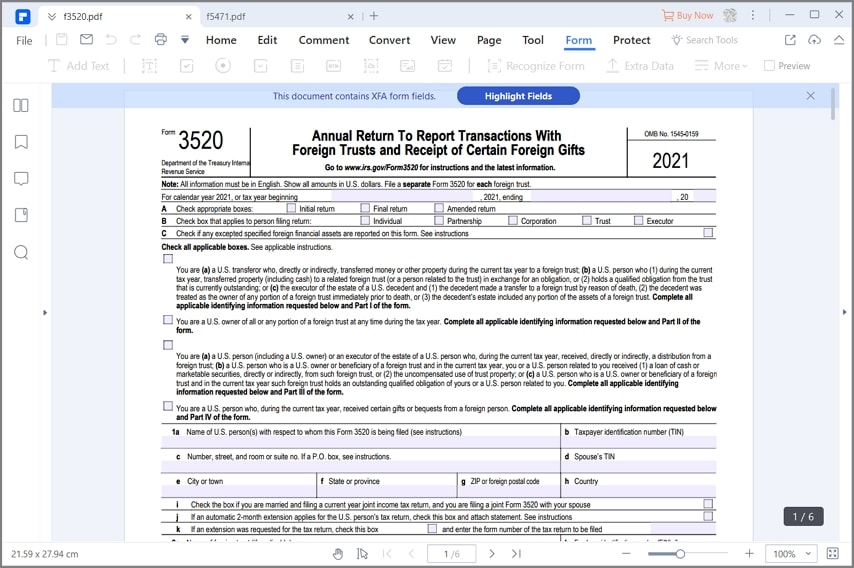

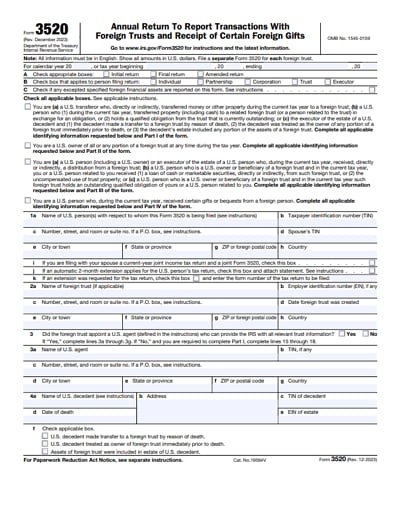

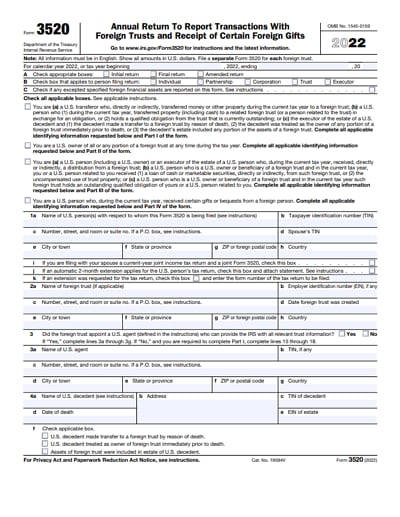

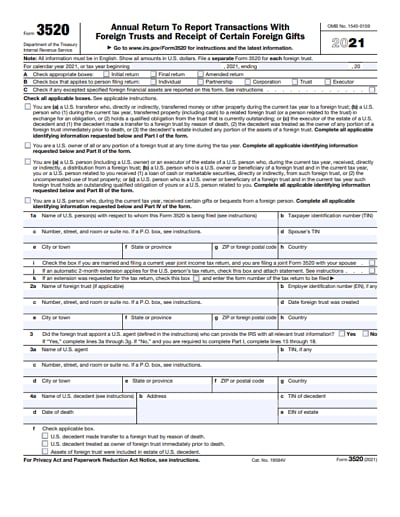

Step 4: Now, you can start filling out for 3520. First, you need to indicate the tax year, then you need to fill out the returns that are the initial and the final return. Then indicate if you are fling for yourself, partnership, corporation trust or executor. Next, you need to go through the lines after that and fill out the boxes correctly. Below that, you will be required to fill out identifying information.

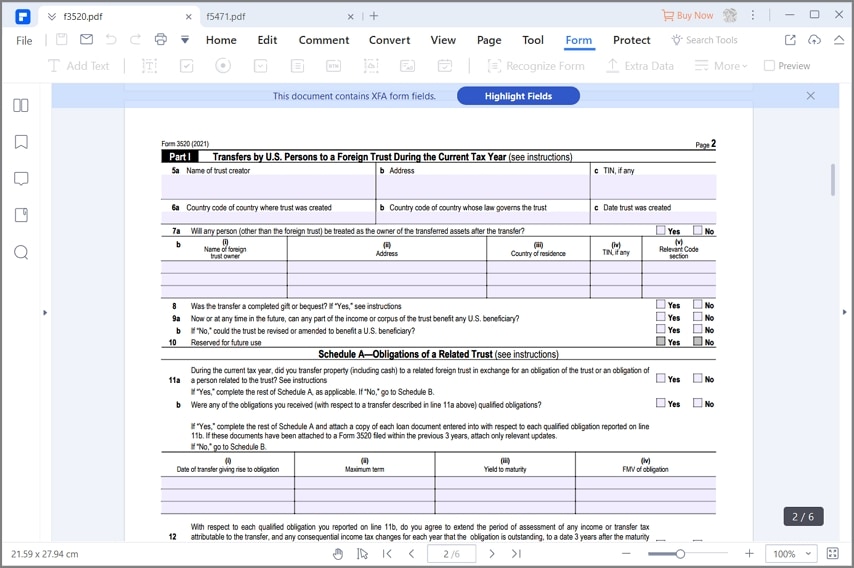

Step 5: When you have ticked the boxes correctly, you need to fill our part I on transfers by U.S persons to a foreign trust during the current tax year. Fill out the identifying information and the relevant sections on part I. You are greatly advised to check form 3520 instructions so that you can know the sections to fill.

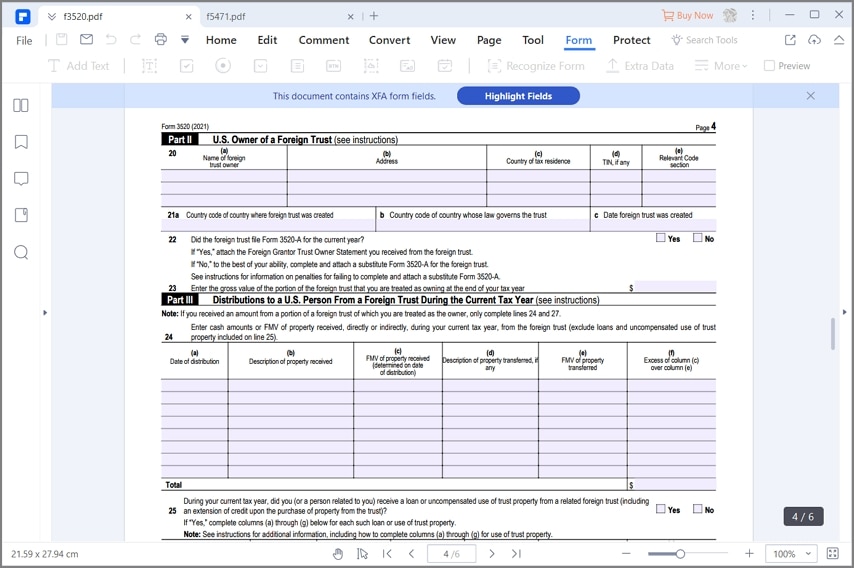

Step 6: After filling out part 1, you need to fill part II. Here, if you receive distributions from the foreign trust, you may have to complete lines 15 through 18 of Part I if you answered "No" to line 3, and Part III as stated on the instructions form. You must provide the name of the foreign trust owner, their address, country tax, ID number and relevant code.

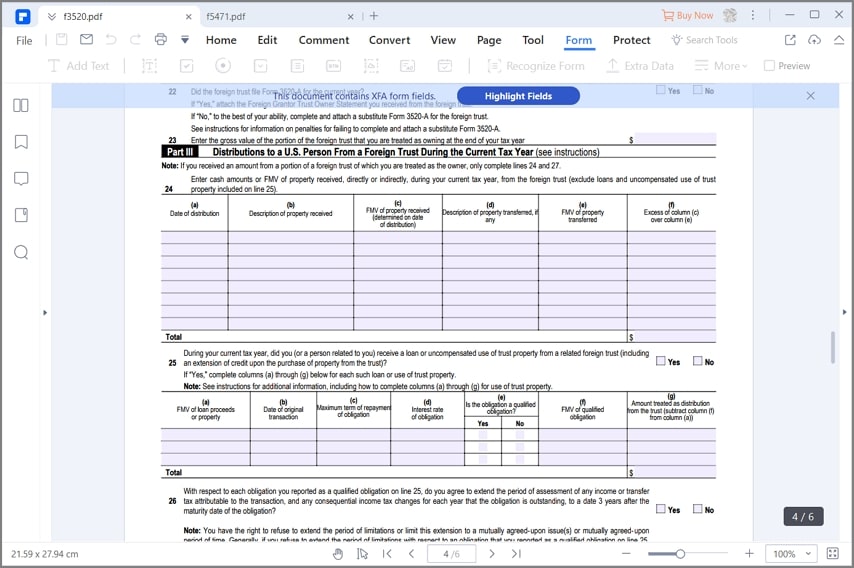

Step 7: Part three on distributions to a US person from foreign trust during the current year tax is quite lengthy. The form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24 and 27 of this part. Also note that it has schedule A, B and C and you can always refer to the instructions to know how to fill them.

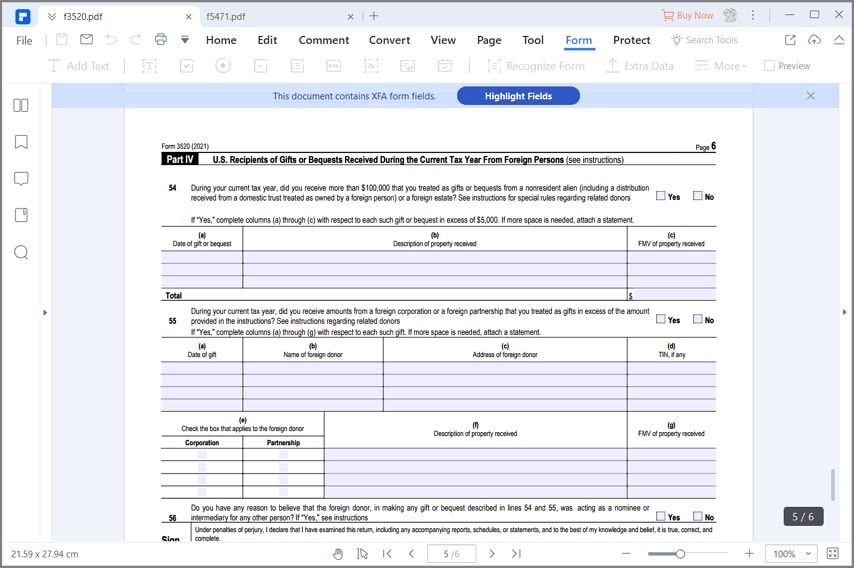

Step 8: The last part of form 3520 on Recipients gifts or bequests received during the current Tax year from foreign persons. If you received any gifts or bequest you need to file them here. Note that the medical payments that you received do not count as gifts so do not include them here.

Step 9: After filling the relevant parts, you can save the file. Click on "File" then "Save As" option and select the destination on your computer.

Tips and Warnings for IRS Form 3520

As you fill form 3520 here is what you need to take note.

- All information that you provide must be written in the English language.

- For all the amounts that you indicate, they must be in U.S. dollars.

- You are advised to file a separate Form 3520 for each foreign trust.

- If you do not fill IRS form 3520 on time or correctly, you risk being penalized $10,000.

- If you fail to report gifts you received you also risk getting penalties.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor