Home

>

Other IRS Forms

> How to Fill out IRS Form 4852

Home

>

Other IRS Forms

> How to Fill out IRS Form 4852

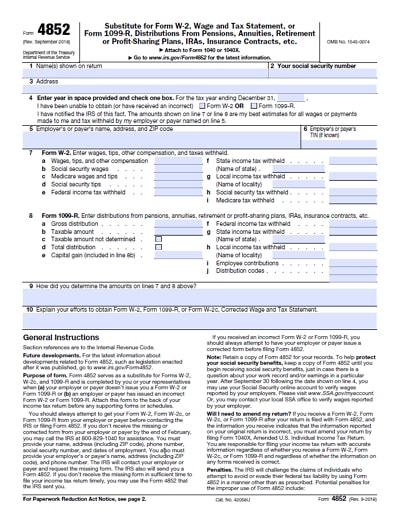

How do I file a substitute W-2 using Form 4852? You need to file IRS form 4852 if your employer fails to send your form W-2, a US wage and tax statement used to report wages paid to employees and the taxes withheld from them.

We will show you how to easily fill out the 4852 form line by line. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is a smart, AI-powered PDF editor that can simplify your tax filing process.

File Taxes Faster with PDFelement

Scan receipts and paper forms into searchable PDFs

Compress large PDFs for easy storing and sharing

Securely save and back up tax records as PDFs

Organize tax files by year and category

Merge related tax forms, statements, and receipts into one file to reduce clutter

Download Printable, Fillable IRS Form 4852 in PDF

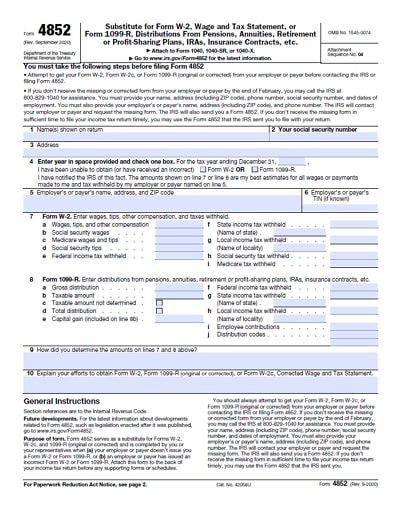

What Is IRS Form 4852?

Form 4852 is an IRS-approved substitute document that allows taxpayers to report income and withholding information when an employer or payer fails to issue a required Form W-2 or Form 1099-R, or issues a form that is materially incorrect.

The IRS requires employers and payers to furnish Forms W-2 and 1099-R by January 31, but in some cases, taxpayers do not receive them or receive forms with incorrect wage, distribution, or withholding amounts. Form 4852 allows the taxpayer to estimate and report the correct amounts based on available records.

You should use Form 4852 only if:

- You did not receive a Form W-2 or 1099-R by the filing deadline, and

- You made reasonable efforts to obtain the correct form from the employer or payer, and

- You need to file your tax return without further delay.

Form 4852 should not be used if you simply disagree with the tax withheld or want to change correct amounts.

Difference between Form 4852 and Forms W-2 or 1099-R

Form W-2 is issued by an employer and reports wages, tips, and tax withholding.

Form 1099-R is issued by a payer and reports distributions from pensions, annuities, IRAs, or retirement plans.

Form 4852 is completed by the taxpayer and serves as a substitute only when the original form is missing or incorrect. Unlike a W-2 or 1099-R, Form 4852 relies on taxpayer estimates and explanations, not employer-certified figures.

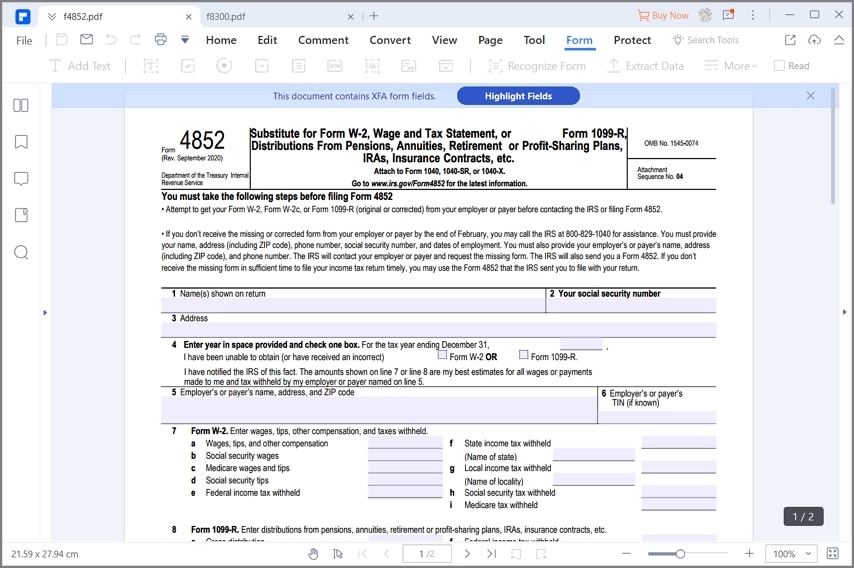

How to Complete Form 4852 (Step-by-Step)

Use Form 4852 only if you did not receive a Form W-2 or Form 1099-R, or if the form you received is incorrect and you cannot obtain a corrected version in time to file your tax return.

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is a PDF software utility that is built with an intuitive PDF form filler. It allows you to edit texts, links, and images. You can also organize pages, annotate PDFs, or merge PDF files if you are to attach any other IRS form, not to mention that you can also create PDF forms.

Enter Your Personal Information

On Lines 1 through 3, enter your name, Social Security number, and current mailing address. This information should match exactly what you will enter on your Form 1040 to ensure the IRS can properly associate Form 4852 with your tax return.

Enter Tax Year

On Line 4, enter the tax year for which the Form W-2 or Form 1099-R was missing or incorrect. This is usually the calendar year you are filing for.

Fill out Employer or Payer Information

On Line 5, enter the name and address of your employer or the payer that should have issued the Form W-2 or Form 1099-R.

On Line 6, enter the employer’s or payer’s taxpayer identification number (TIN), if known. If you had the same employer or payer in a prior year, you may use the EIN shown on last year’s Form W-2 or 1099-R. If you do not know the EIN but know another identifying number, such as a Social Security number, you may enter that instead.

Provide Wages and Withholding (Substitute for Form W-2)

Complete Line 7 only if you are replacing a Form W-2. If any information on a W-2 you received is correct, enter that correct information here. If you do not have a complete or accurate W-2, use your final pay stub or payroll records.

You need to enter information such as your gross pay, federal income tax withheld, Social Security and Medicare taxes withheld, and state income tax information. Enter only amounts you can reasonably support with records.

Provide Retirement Distributions (Substitute for Form 1099-R)

Complete Line 8 only if you are replacing a Form 1099-R. Use statements from your retirement plan or payer to provide information such as the total distribution received, the taxable amount, federal/state income tax withheld, employee after-tax contributions recovered tax-free, etc. This information can be approximated if an exact figure cannot be computed.

Explain How You Determined the Amounts

On Line 9, explain how you calculated the amounts on Line 7 or Line 8. For example, state whether you used pay stubs, bank records, or retirement statements.

Explain Attempts to Obtain the Correct Form

On Line 10, explain the steps you took to obtain the missing or corrected Form W-2, Form 1099-R, or Form W-2c, such as contacting the employer or payer.

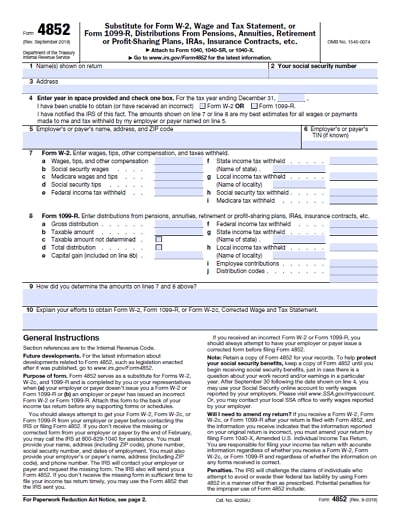

Tips and Warnings for IRS Form 4852

In this section, we will tell you a few tips and warning in regards to IRS form 4852. Here are a few but important.

- Always try to get your Form W-2, Form W-2c, or Form 1099-R from your employer or payer before contacting the IRS or filing Form 4852. This also applies when your employer provides incorrect information on form W-2 Form W-2c, or Form 1099-R.

- Always make a copy of Form 4852 for your records.

- There are penalties for misusing the IRS form 4852 or when you provide wrong information.

- You should always go through the IRS instructions for form 4852 before filling it.

How to File Form 4852

In most cases, Form 4852 cannot be filed electronically and must be submitted as part of a paper-filed federal tax return. The IRS generally requires mailing returns that include Form 4852 because the form relies on taxpayer estimates and explanations that are not fully supported by the standard e-file system.

Paper filing Form 4852

If you are filing by paper:

Complete Form 4852, your Form 1040 and any required schedules using the income and withholding amounts from Form 4852.

Attach Form 4852 to your paper Form 1040 in place of the missing or incorrect Form W-2 or Form 1099-R.

Sign and date your return and mail the complete return to the appropriate IRS address listed in the Form 1040 instructions.

Do not attach pay stubs, correspondence, or supporting documents unless the IRS specifically requests them.

Electronic filing Form 4852

Although the IRS e-file system generally does not accept returns containing Form 4852, some professional tax software platforms, such as Thomson Reuters or TaxSlayer Pro, may allow electronic filing in limited circumstances. These options are generally not available to most individual taxpayers using consumer software.

TurboTax, H&R Block Online, and similar consumer tax software do not allow e-filing of returns that include Form 4852. While these platforms can help you prepare the form, the final return usually must be printed and mailed to the IRS.

Frequently Asked Questions About Form 4852

Can I e-file with Form 4852?

No. You cannot e-file a federal tax return that includes Form 4852, so you’ll need to print a hard copy of your return and mail it to the IRS, with Form 4852 attached.

What happens if my estimates are wrong?

If your estimates differ from amounts later reported by the employer or payer, the IRS may adjust your return, request additional documentation, or issue a notice. In some cases, you may need to file an amended return using Form 1040-X.

Will filing Form 4852 delay my refund?

It may. Returns that include Form 4852 are more likely to be reviewed because the IRS must verify the reported income and withholding against third-party filings.

What if I later receive a W-2 or 1099-R?

If you receive the correct form after filing and it differs from your estimates, you should file Form 1040-X to amend your return and correct the income and withholding amounts.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor