Home

>

Other IRS Forms

> IRS Form 990-EZ: Read the Filling Instructions 2026

Home

>

Other IRS Forms

> IRS Form 990-EZ: Read the Filling Instructions 2026

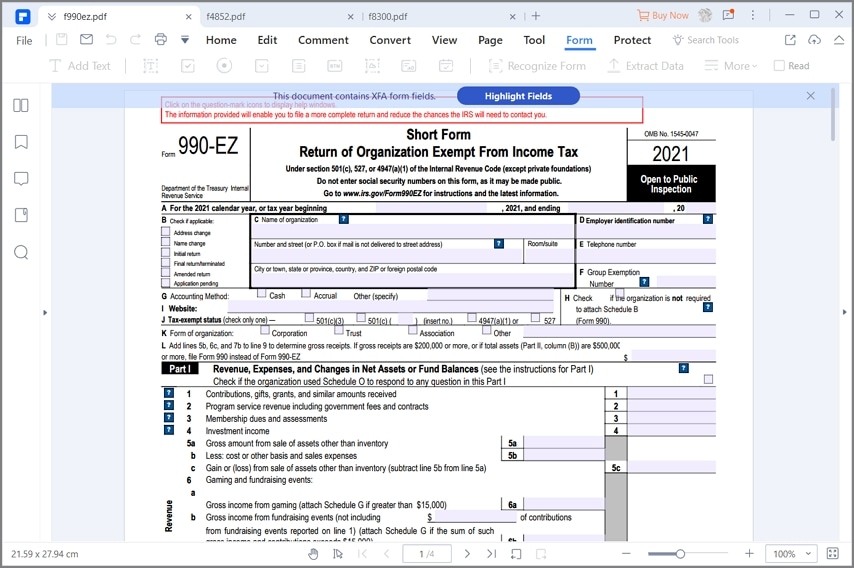

IRS Form 990-EZ is recorded and regulated by the Internal Revenue Service of the United States of America. This form can help an organization to get tax exemptions if it is submitted correctly and completely.

Your Best Solution to Fill out IRS Form 990-EZ

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement can be your convenient choice when comes to fill out an official form like IRS Form 990-EZ, as it helps avoid mistakes and facilitate the filling process. It is the finest program to execute any PDF-related operations with perfection.

IRS Form 990-EZ is titled 'Return of Organization Exempt from Income Tax'; these forms are recorded and regulated by the Internal Revenue Service of the United States of America. And form filling is only one of its basic functions, it can also be used to extract, create and edit PDF files. It shows high performance in both Mac and Windows operating systems.

Instructions for How to Complete IRS Form 990-EZ

The following steps given below will guide on how to complete the IRS Form 990-EZ

Step 1: Simply download this form from the IRS website. And open it in PDFelement after you have downloaded the form.

Step 2: At the top of the form, enter the details of the organization by filling in the Name of the organization and the Employer identification number. There also other blank fields where you must enter the details like the Address and Telephone number. One Part I, which is titled as Revenue, Expenses, and Changes in Net Assets or Fund Balances, enter the details of all revenues from line 1 to line 8. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8 to get the total revenue on line 9. From line 10 to line 16, enter the value of all expenses. Add line 10 through 16, to get the total expenses on line 17. Enter the details on net assets from line 18 to 20, add line 18 through 20 and enter the amount on line 21.

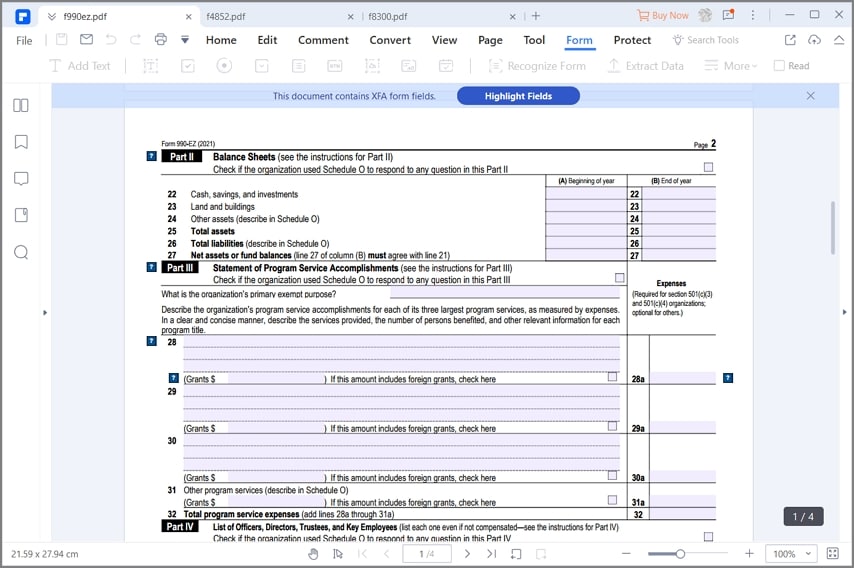

Step 3: Part II is titled Balance sheets. On line 22, enter the amount of beginning and ending balance of Cash, savings, and investments. For line 23, enter the value of the beginning and ending balance of Land and buildings. Enter the amount beginning and ending balance of other assets on line 24. On line 25, enter the beginning and ending balance of total liabilities. Enter the beginning and ending balance of Net assets or fund balances on line 27.

Step 4: Part III is titled Statement of Program Service Accomplishments. From line 31 you have to describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses by entering them on line 28 to 31. On line 32, add lines 28a through 31a to get the Total program service expenses.

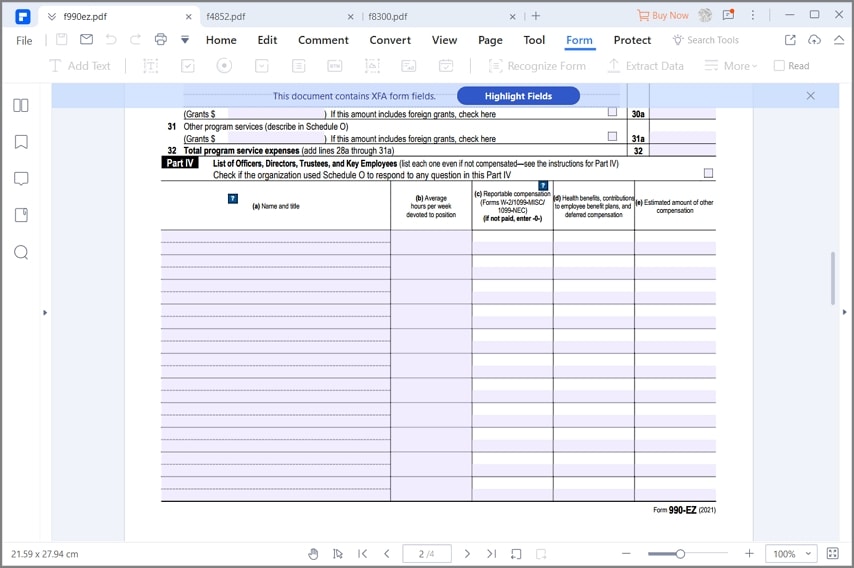

Step 5: Part IV is titled List of Officers, Directors, Trustees, and Key Employees. Filling up this part is easy if you have all the details available, here you have to enter the details of all the employees even if they are not compensated.

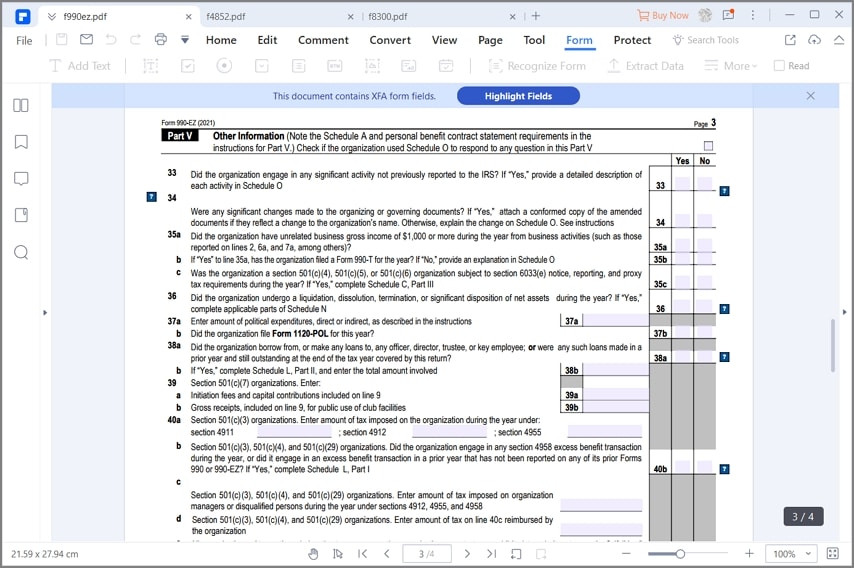

Step 6: Part V is titled 'Other Information'. In this part, you have to answer several questions as 'Yes' or 'No'. Enter the answers appropriately as yes or no. Filling up this part is easy but it requires a lot of attention and time to answer them correctly and completely.

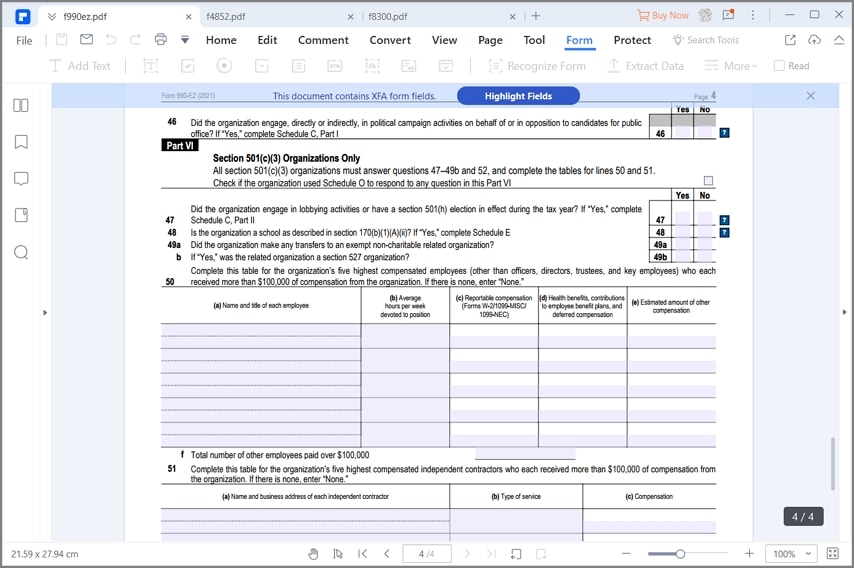

Step 7: Part VI is titled "Section 501(c) (3) organizations only". Also in this part, you have to answer several questions and fill them up in the tables given in this section. The special instructions must be followed in order to complete this section.

From line 47 to 49, enter the answer as 'Yes' on 'No' which is applicable to your situation. On line 50, there is a table; here you have to enter the details of the five highest compensated employees. On line 51, you have to enter the details of the five highest compensated independent contractors who received money more than $100,000 from the organization. For line 52, provide the correct answer whether the organization completed schedule A as 'Yes' or 'No'. At the end of the form, you must provide your signature and date to declare that all the details provided are true, correct and complete. This is how you complete an IRS Form 990-EZ using PDFelement.

Tips and Warnings for IRS Form 990-EZ

- Do not enter the social security numbers on this form as it may be made public. The first part, Part I, must be filled after you check if the organization has used Schedule O to answer any question on this part.

- Before entering the amount on line 27 of column B, you check whether it agrees with line 21. Make sure you have all the relevant information related to Schedule O, in order to complete the form filling process successfully.

- Use a professional PDF tool like PDFelement in order to avoid the hassle of entering and calculating manually by writing on forms. This will surely reduce your effort and time to complete the form successfully and most of the time it is recommended by professionals.

- Avoid making errors, since the result of this form will be reflected in many other related forms. You can get reduced form tax payments and avoiding penalties by submitting an error free IRS Form 990-EZ

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor