Home

>

Other IRS Forms

> IRS Form 941: Find Instructions Here to Fill it Right

Home

>

Other IRS Forms

> IRS Form 941: Find Instructions Here to Fill it Right

The Federal Tax Law has made it compulsory for employers to withhold a few taxes for the pay of their employees. For employees receiving an excess of $200,000 a year, there is an additional deduction of Medicare Tax. This information is reported to the Internal Revenue Service through IRS Form 941. Further, we shall discuss the different sections of IRS Form 941 and how one must go about the filling process.

Your Best Solution To Fill IRS Form 941

You can fill out IRS Form 941 by hand-writing. But with so many numbers to figure out, filling them in the form by hand can be shaky as any mistake would ruin your effort for the whole form. And that's why turning to Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is necessary for filling the form on our desktop fast and simple.

PDFelement can serve as your form filler when you deal with the official forms as IRS Form 941. No worry for those tiny mistakes to waste your time on paper-forms as you can modify numbers anytime before filing the form.

It's compatible with both Mac and Windows, supporting sharing files from Dropbox and Evernote so you can easily transfer those files from different computers.

General Instructions for Filling out IRS Form 941

Launch the form filler- PDFelement. Activate the filling process by opening IRS Form 941 with this program. Read the instructions as below before you work on the form.

For an easy understanding, we shall categorize the filling instructions according to the different lines in the form.

The IRS Form 941 can be categorized into 5 different sections which are exclusive of a payment voucher section and general business information section. Please note that not every part requires your attention, but going through each of them is a good habit to get into. Currently, the amount withheld from the employees is credited to them in payment of their tax liabilities.

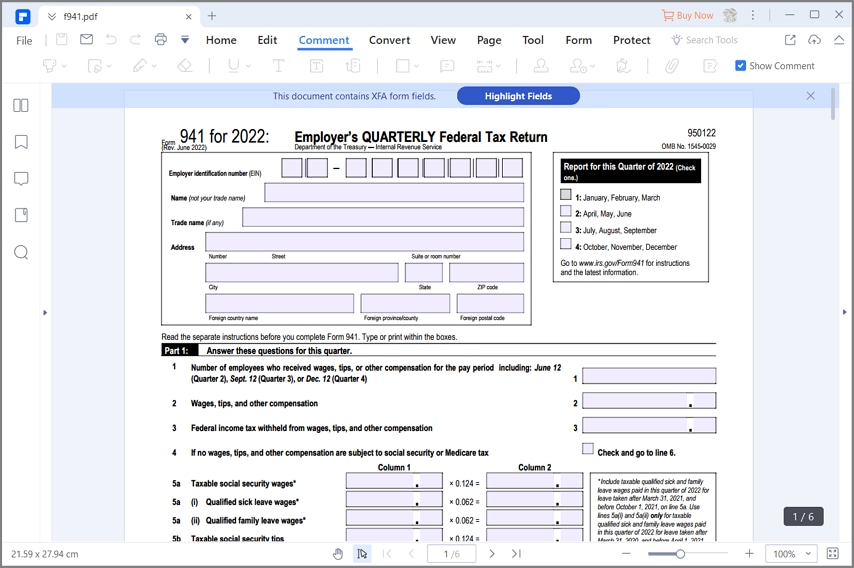

To begin with, business information is entered at the very top of the form. This contains the 'Employer Identification Number' (EIN), Business name, trade name (the name with which you have registered your organization or venture), and the address. Alongside, there is a box to choose the quarter for which you are filing the return.

Detailed Guide for Each Line

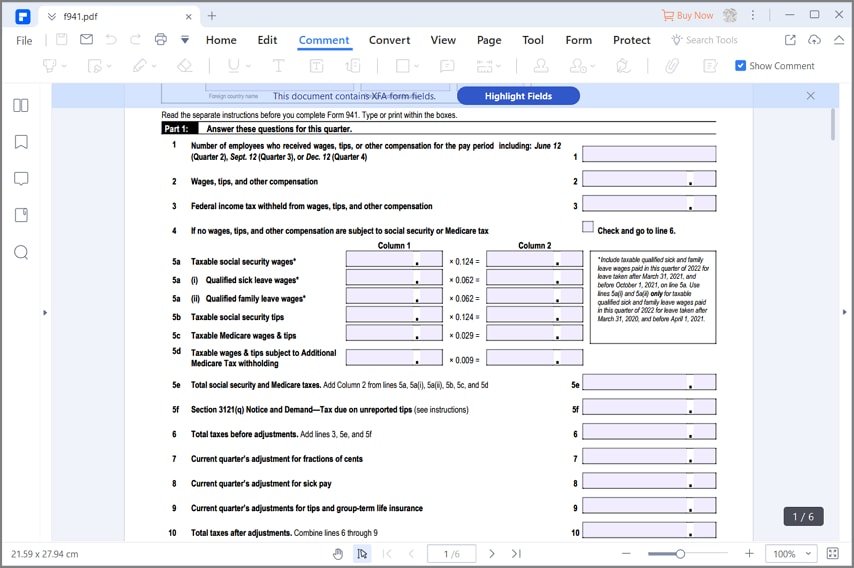

Step 1: It contains the number of employees that were at the receiving end of compensation in the quarter you are filing the return for.

Step 2: This contains the total tips, compensation, and wages that were paid by you to your employees. Supplemental wages are also added here.

Step 3: Enter the cumulative amount of tax you have withheld from the paycheck of your employees.

Step 4: Check the box and leave the lines 5a-5f blank if no compensation is subject to Social Security taxes or Medicare.

Step 5: Use this line to deduct the total amount that is required for Medicare and Social Security. A part of these taxes comes from you, the employer, much unlike the federal income tax. Therefore, you aren't supposed to withhold the total amount from your employees. The lines are explained below.

5a: Column 1 contains the total wages that are subject to social security wages. This is the same as in Line 2. This is then multiplied by the Social Security tax, and the answer is entered in Column 2.

5b: Enter the total tips that are subject to social security wages. Relevant for those who have their organizations doing tips. Others can ignore.

5c: Wages and tips subject to Medicare Tax are entered in Column 1. The number should equal the information entered in Line 2 and Line 51. It is then multiplied by the Medicare Tax and the answer is entered into Column 2.

5d: Relevant for those organizations which have tips.

5e: Cumulative sum of Column 2 numbers for 5a, 5b, 5c, and 5d.

5f: For the ones who are unaware of what their employees received in tips, there is an option to underpay on your obligation. Also, an employer doesn't owe taxes until the IRS informs based on the information received from the employee. Relevant only for those ventures which are tip ventures.

Step 6: Enter the sum of Lines 3, 5e, and 5f. This depicts the amount of taxes owned, but before adjustments.

Step 7: This helps you report any cent discrepancies, which might arise due to fractional pennies. You can enter the difference in Line 7. For instance, if you have paid $4993.15 instead of the informed amount of $4993.19, you enter -0.4 in Line 7.

Step 8: For the ones who have a 3rd party sick pay payer, might be an insurance company for instance, the amount is subject to taxes. Calculate the payment that was and enter it there.

Step 9: The section is in relevance with 5f if there is an existing uncollected share of Medicare taxes and social security on tips for employees. Also applicable if there is uncollected employee share of taxes which came from group-term life insurance premiums through previous employees.

Step 10: Deals with total taxes after adjustments. Taking adjustments for Lines 7-9, take Line 6, and use Line 10 to enter the answer.

Step 11: The amount that was paid throughout the quarter is entered here. The next sections can be referred for the money that is due to the government.

Step12: For the ones who have a 3rd party sick pay payer, might be an insurance company for instance, the amount is subject to taxes. Calculate the payment that was and enter it there.

Step 13: If the amount in Line 11 is in excess of the one in Line 10, or if one ends up paying more than they were supposed to, then enter the amount here. You can either receive a refund on the amount paid or apply to it to return for next quarter.

Tips and Warnings for IRS Form 941

- Before pursuing with the filling process, an employer must make sure of their payment date which depends upon numerous factors (listed above).

- Match the amount you have filled for the 4 quarters along with the information provided in W-2 and W-3 forms by your employees.

- The adjustments to the total amount before and after calculating the taxes should be done carefully to avoid any penalties.

- For the ones who are unsure of what tips their employees have received, should consult the above listed sections and not simply skip the section.

- Employer Identification Number should be entered correctly, along with other business details.

- The payment cycle, in some cases, might be very short, and hence care must be taken to ensure proper documentation.

Make sure there is no underpaid amount as that can lead to a penalty.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor