Home

>

Other IRS Forms

> IRS Form 14039: How to Fill it Easily

Home

>

Other IRS Forms

> IRS Form 14039: How to Fill it Easily

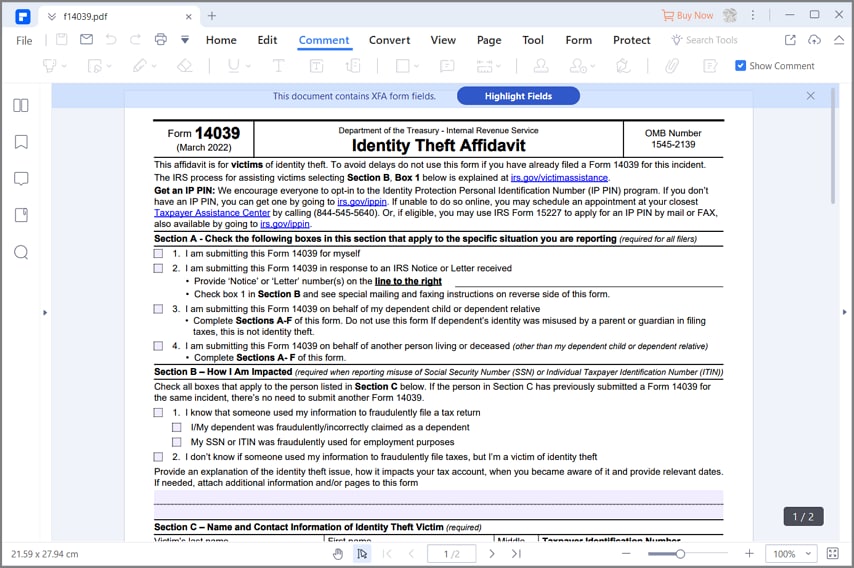

IRS Form 14039 is a PDF form which can be filled electronically using form filler software. There are few you can use but the most recommended is PDFelement that is the best tool available for this task.

Your Best Solution to Fill out IRS Form 14039

IRS Form 14039 is Identity Theft Affidavit Form which is completed and submitted by any individual who is the actual or potential victim of an identity theft that will like the IRS to mark their account to identify questionable activity. This form can be filled with Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement program. It enables you to create, split and merge PDF documents fast and easy.

To fill your IRS Form 14039, what you need to do is to open the form in PDFelement and use the program to fill it. It is fast, simple and easy and can be done by anyone who knows how to use a mouse. It is highly rated software and certainly the best solution to fill your IRS Form 14039 electronically.

Instructions for How to Complete IRS Form 14039

Filling this form is easy and can be done very fast using the PDFelement. However, the following step by step guide on how complete this form.

Step 1: First of all, you can get this form from the department of treasury or you can just download it online including the instructions soft copies. Open the form in PDFelement before you fill it.

Step 2: You must have to tick any of the checkboxes option to what applies to your situation. Tick the first checkbox if you are submitting the Form in response to the mailed notice or letter from the IRS or tick the second checkbox if you are completing this form on behalf of another person such as a deceased spouse or relative.

Step 3: Complete Section A- Reason for filling the form. Check one of the two boxes in this section. Check number 1 if you are a victim of identity theft and it is affecting your task record and check number 2 if you have experienced some events involving your personal information that may at some future time affect your federal tax record. In each of them provide a short explanation of the issues in their respective spaces.

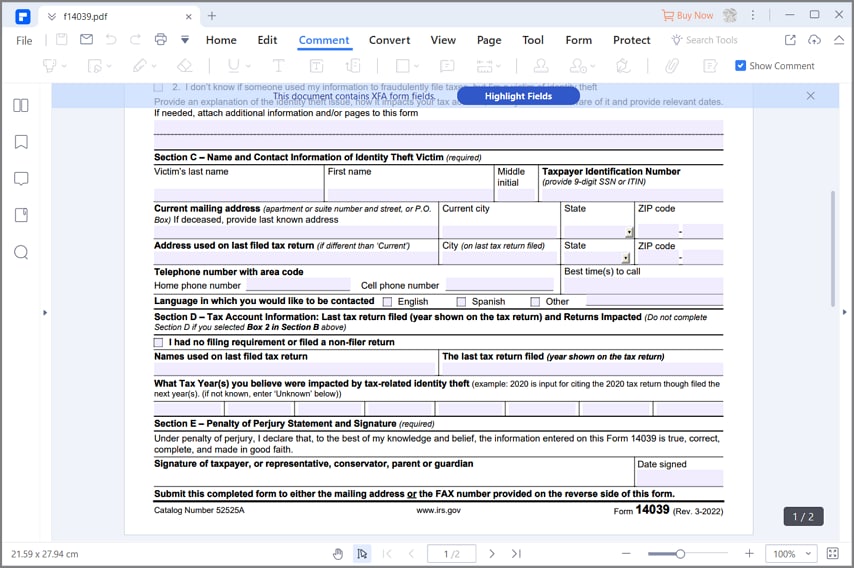

Step 4: Fill out Section B- Tax payer information and this is required for all filers. Write your Taxpayer last name, first name and middle initial. Fill in the last four digits of the taxpayer's social security number or the complete individual taxpayer identification number. Write your tax payer current mailing address, your city, state and zip code. You will see a column for the affected tax year, fill in the year if you checked box 1 in section A. Enter the last tax return filed year. There is a space for the address of your last tax return filed. Write "same as above" if it is the same as current address, else write the new one. Do the same thing for the city, state and zip code for the last tax return filed.

Step 5: Complete Section C- Telephone and Contact Information which is required for all filers. Write your telephone number and check any of the options, home, work or cell. Write the best time to call and check any of the contact language you prefer English, Spanish or others.

Step 6: Complete Section D which is Required Documentation section. You are required to submit this form with at least a document to verify your identity. The documents are the passport, Drivers license, social security card and other valid federal or state issued identity card. Check any of the boxes of the document you are submitting.

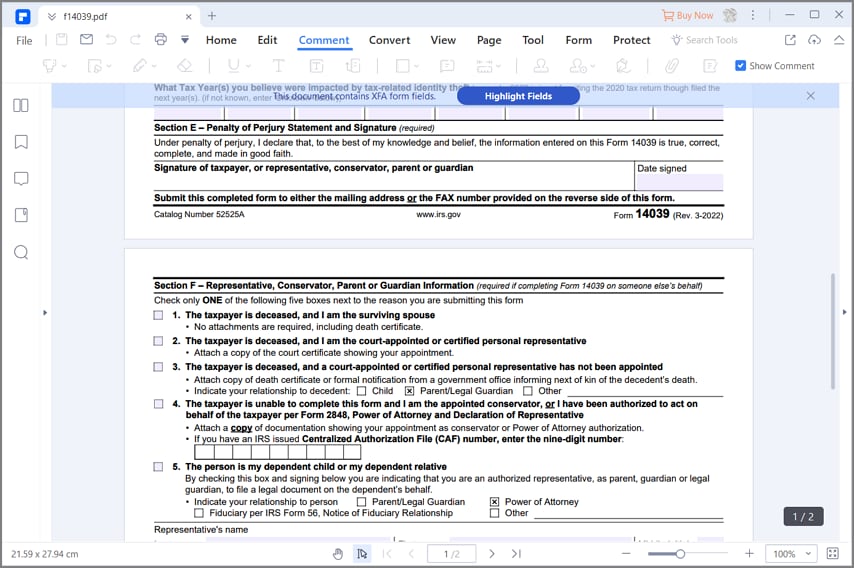

Step 7: Complete Section E only if you are filling the form on someone else behalf. Read the reasons given on this section and check only one of the boxes that correspond to the reason for filing. Thereafter, write the representative's name, current mailing address and city, state and zip code on the columns provided.

Step 8: All filers are required to fill Section F, Penalty of Perjury statement and signature. Read the statement very well and sign your signature and the date.

IRS Form 14039 Instructions

- You must ensure you submit this form in clear and legible copies with the required documentations. However, note that mailing and faxing the form will result in processing delay.

- It is very important to ensure that all statements and figures filled in this form is accurate and complete. You will be liable for any false statements and figures arising for filling of this form. Please note that by signing on section F, Penalty of Perjury statement and signature, you have committed to facing a penalty should the information you provide is found to be incorrect, untrue or incomplete. Please be guided accordingly.

- You can fill this form if you have a non federal tax related identity theft such as obtaining credit through the misuse of your personal identity information or ins such situations such as lost, stolen purse or a wallet. But note that you have to describe the event of concern which must include the date of the incident.

- Note that if you are submitting the IRS Form 14039 on behalf of another person, the documentation to be submitted should be for that person. If possible, you can enlarge the photocopies of the documents so that it appears clearly visible.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor