Home

>

Other IRS Forms

> IRS Form 843: Fill it Right the First Time

Home

>

Other IRS Forms

> IRS Form 843: Fill it Right the First Time

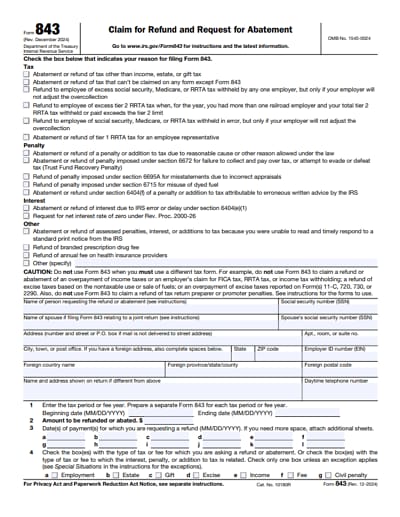

The IRS Form 843 is titled as Claim for Refund and Request for Abatement dispatched by the Department of the Treasury, Internal Revenue Service of United States of America. This article will offer you assistance with understanding all the viewpoints of the IRS Form 843.

File Taxes Faster with PDFelement

Scan receipts and paper forms into searchable PDFs

Compress large PDFs for easy storing and sharing

Securely save and back up tax records as PDFs

Organize tax files by year and category

Merge related tax forms, statements, and receipts into one file to reduce clutter

Download Fillable & Printable Form 843 in PDF

Your Best Solution to Fill out IRS Form 843

You can effectively fill up an IRS form if you precisely know how to use PDF form filling programs. To fill up the IRS 843 you can without a doubt utilize Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement which has all the features required for PDF form filling.

PDFelement is full of features packed on the PDF software with all the functions to alter, fill and make PDF documents. You have no stress in regards to the type of operating system and it is usable in both Mac and Windows platforms.

Simply, download the IRIS Form 843, open it on PDFelement and now you can fill up the PDF form reliably and efficiently. The following steps given below can guide you to show how to complete the IRS form 843.

Instructions for How to Complete IRS Form 843

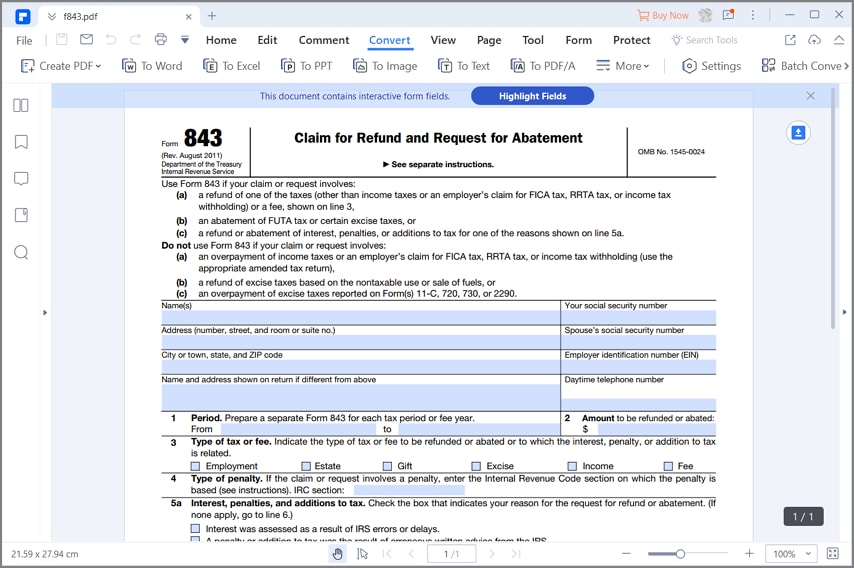

Step 1: You can get the IRS form 843 from the official website of Department of the Treasury, Internal Revenue Service.

Step 2: Download the form and open it on PDFelement to start the form filling process.

Step 3: On the top of the page write the name and social security number. Then write the address and spouses social security number. Write the address and Employer identification number (EIN). Just below it write the name and address if you have a different situation from above. Beside it enter the telephone number.

Step 4: Start filling the numbered items or lines. For item 1, enter the beginning and ending date of the tax period. For item 2, enter the amount you want to be refunded. On tem 3, check on the appropriate option that applies to you. Here you have to indicate the type of tax or fee to be refunded or abated or to which the interest, penalty, or addition to tax is related. The options are Employment, Estate, Gift, Excise and Income Fee. For item 4, enter the Internal Revenue Code section on which the penalty is based, if the claim or request involves a penalty. You can find the code on the Notice of Assessment you received from the IRS.

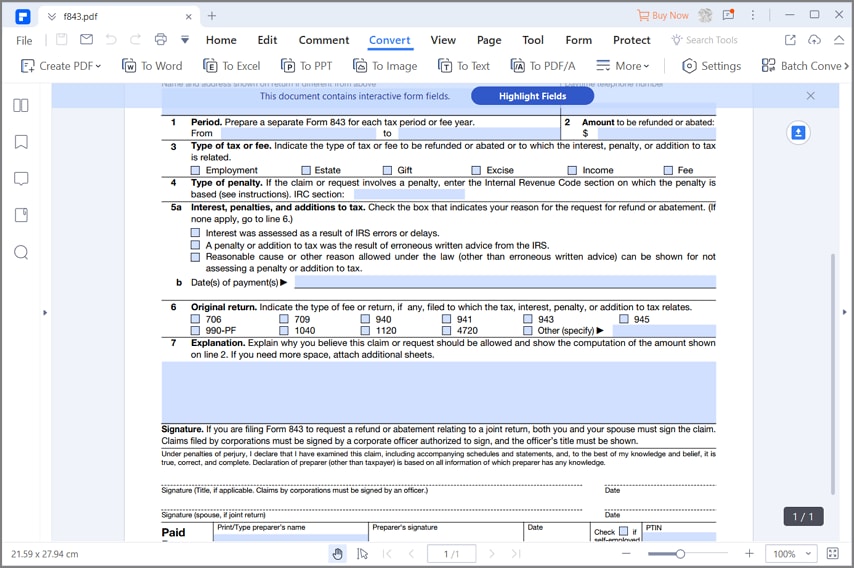

Step 5: Proceed to item 5 of the form. The item 5 has two subsections as 5 and 5b. On 5a, check the box that best applies to you for the request for refund or abatement. The options asks if, Interest was assessed as a result of IRS errors or delays, a penalty or addition to tax was the result of erroneous written advice from the IRS and reasonable cause or other reason allowed under the law that can be shown for not assessing a fine or addition to tax.

On item 5b, enter the date of payment or payments. For item 6, you have to indicate the type of fee or return, if you have filed to which the tax, interest, penalty or addition to the tax relates. The options are 706, 709, 940, 941, 943, 945, 990-PF, 1040 , 1120, 4720, and other. You must specify the other option if it is not available in this form. On item 7, you have to provide an explanation why the claim or request should be allowed. Also you have to explain the amount entered on item 2, by showing the calculations.

Step 6: On the next part of the form the applicants of this form must verify all the information provided with his/her signature. The signature must be accompanied with a date which can be entered on the blank field beside the signature field. The details of the preparer and his firm must be mentioned on the on the end of the page.

Tips and Warnings for IRS Form 843

- On item 7, you must include the tax periods for which you overpaid and underpaid your tax liability. You do not require a separate Form 843 for each separate taxable period involved in the request and when you paid the tax if underpayment is no longer outstanding.

- The request of abatement can be done within the period allowed for collection or addition to tax. It can also be done if you paid the penalty within the period allowed for claiming a credit or refund for penalty or addition to tax.

- You can file a claim for a credit or refund within 3 years from the date you filed your original return. You can also claim it within 2 years from the date you paid tax. You must select whichever is later.

- Make sure the data you are providing are true, correct and complete. The information about your tax duties will be verified by the Internal Revenue Service. If any tax related form is found with false information can be a trouble for the claimer of abatement.

- Completing this form on PDFelement platform is completely easy and safe. You do not have to worry about your personal information being exposed. Your confidentiality is guaranteed on the platform.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor