Home

>

Other IRS Forms

> IRS Form 433-A: How to Fill it Right

Home

>

Other IRS Forms

> IRS Form 433-A: How to Fill it Right

You can effectively fill out the IRS Form 433-A if you can use PDF form filling software programs. There are PDF form filler software programs available in the market place. However, this article will look at how to rightly fill the 433-A form while utilizing the most effective form filler program, Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement.

Download Printable, Fillable IRS Form 433-A in PDF

Your Best Solution to Fill out IRS Form 433-A

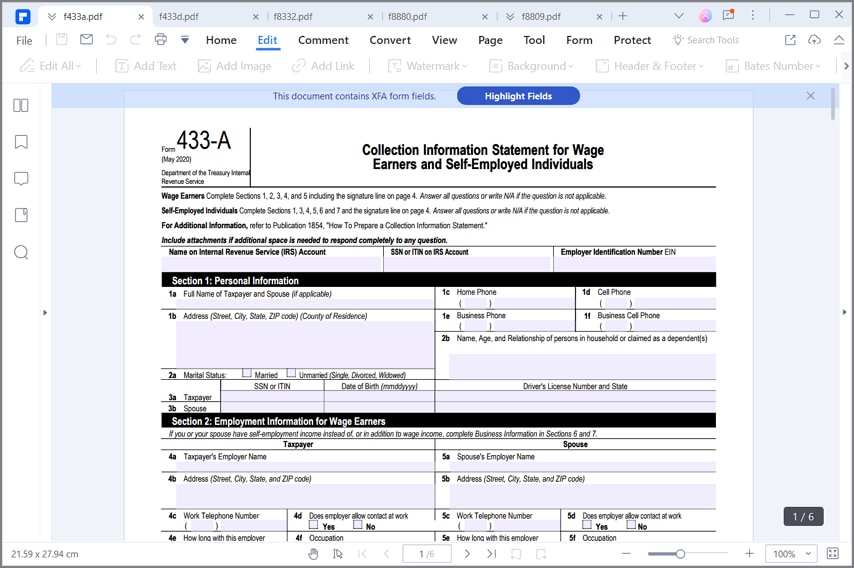

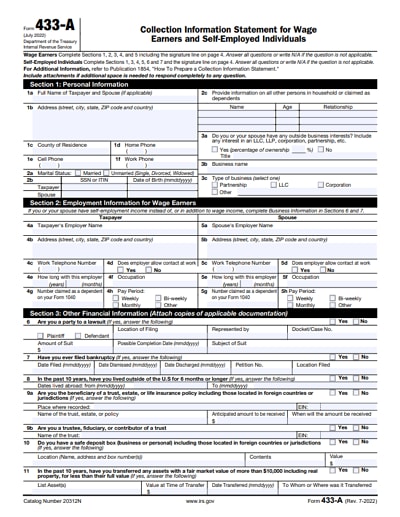

IRS Form 433-A is titled as Collection of Information Statement for Wage Earners and Self Employed Individuals is a form dispatched by the Department of the Treasury, Internal Revenue Service of United States of America to collect information for wage earners and self employed.

To fill up the IRS 433-A, you can utilize the highly rated PDFelement which has all the features required for PDF form filling. It has the capability of writing on the PDF form, checking boxes in PDF as well as selecting radio buttons in PDF forms.

This PDF editor is full of features packed on the software with all the functions to alter, fill and make PDF documents. Simply, download the IRIS Form 433-A, open it on PDFelement and now you can fill up the PDF form reliably and efficiently.

Instructions for How to Complete IRS Form 433-A

What will you do if you have IRS Form 433-A to fill out? The answer is simple. Open the form on PDFelement platform and use the program to fill it. The following steps will offer a guide in filling the form.

Step 1: The best way to fill out this form using the PDFelement is to download the form and its instructions from the official government website.

Step 2: Open the form on PDFelement to start the form filling process.

Step 3: Write your name as it appears on the Internal Revenue Service account, your social security number or IRS account, and employee identification number.

Step 4: Fill section 1-Personal Information. On line 1a, write your full names and that of your spouse if applicable. Then write your address, home phone, cell phone, business phone, business cell phone from 1b all through 1f. Check the marital status box on 2a and write the name, age and relationship of dependents on the space provided on line 2b. On line 3a and 3b, enter the social security number, date of birth and driver license number and state for yourself and spouse accordingly.

Step 5: Proceed to section 2-Employment Information for Wage Earners. You are to write your employers name, the full address of the organization, the work telephone number, how long you have spent with this employer and your occupation etc all completed from lines 4a to 4h. Replicate the information for your spouse by filling line 5a through line 5h.

Step 6: Fill out section 3- Other Financial Information. If you are a party to a lawsuit, check yes on line 6 and answer the question that follows. Answer the question on line 7 if you have ever filed for bankruptcy else check no and proceed to line 8 which asks how long you have lived in the U.S. If you check the yes box, then answer the question that follows else go to line 9a and 9b and answer the questions if you check yes on the boxes. Write the location, name, address and box number if you have a safe deposit box and have checked yes box on line 10. Also write the content and value in dollars. Then complete the section by answering the questions on line 11 or proceed to section 4 if you checked the No box.

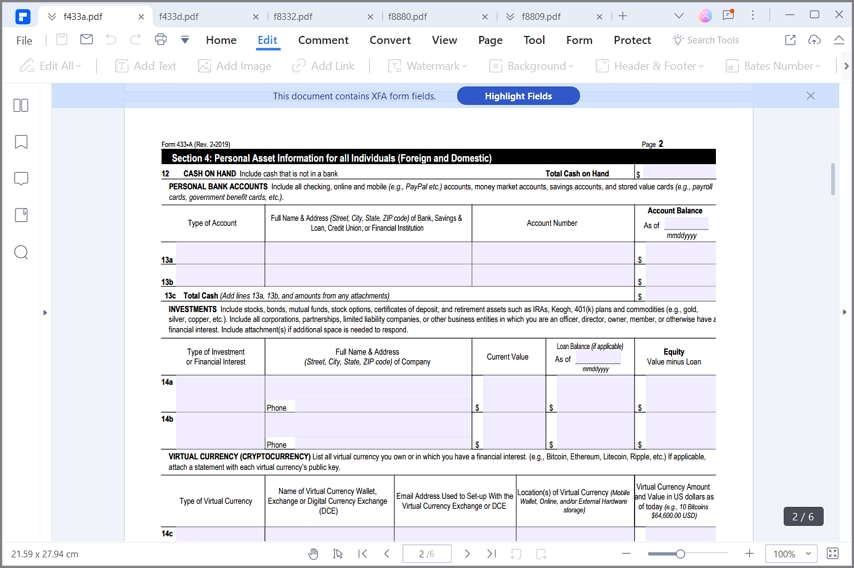

Step 7: Complete section 4- Personal Asset Information for All Individuals. It comprises of cash on hand, personal bank accounts, investment, available credit, life insurance, real property, personal vehicles leased and purchased and personal assets. Enter the total cash on hand on line 12 and the total cash for bank account on line 13d. Enter total equity on 14d, total available credit on 15c. Note that you are to complete blocks 16b through 16f for each policy if you own or have any life insurance policies with cash value. Therefore, on 16g, enter the total available cash by subtracting the amount on line 16f from 16e and including amounts from any other attachment. Get the total equity on each part and record it on 17c,18c and 19c for the real estate, personal vehicles leased and purchased and personal assets respectively.

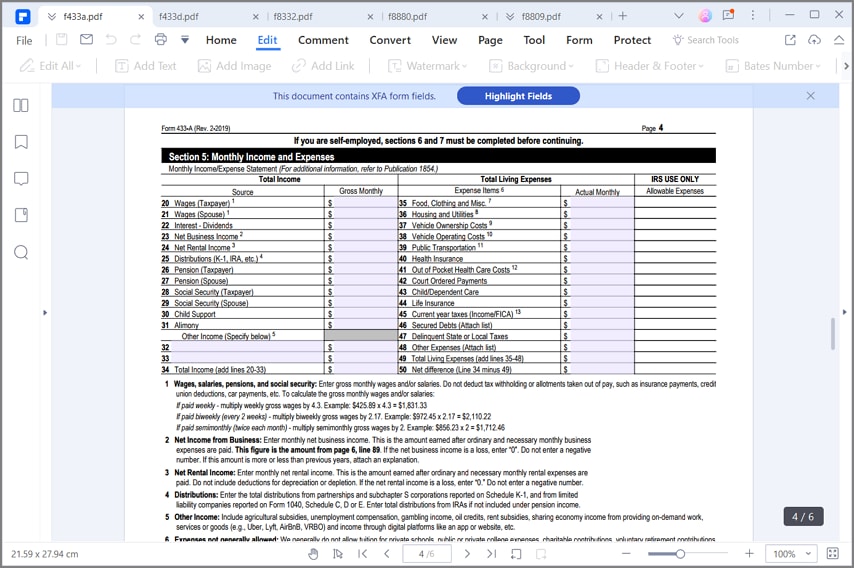

Step 8: Proceed to section 5 which captures the monthly income and expenses. Write the gross monthly amount for total income from line 20 to 33 and add it up on line 34. Also enter your actual monthly amount for total living expenses from line 35 to 48 and add it up on line 49. Write the net difference that is line 34 minus line 39.

Step 9: Proceed to section 6 and 7 if you are self employed. Complete the business information section and fill out the sole proprietorship information section. Note that lines 67 through 87 must reconcile with business profit and loss statement.

Tips and Warnings for IRS Form 433-A

- It is important to ensure that all the figures provided in this form is correct. The IRS will hold you responsible for any misleading information or misrepresentation of facts found in the form. Double check your figures.

- When providing information on investment, ensure you take into consideration bonds, mutual funds, stocks, retirement assets, limited liability companies and any other business entities you have financial interest on. The current value of those investments must be stated in clear terms.

- Filling this form with Wondershare PDFelement program is entirely safe. The privacy of your information is guaranteed.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor