Home

>

Other IRS Forms

> Filling Instructions for IRS Form 1096

Home

>

Other IRS Forms

> Filling Instructions for IRS Form 1096

PDF form has become a regular procedure regarding the submission of any information on government sites. The IRS form-filling process is not at all difficult, if you know about the best PDF form filler called Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. This write up will guide you in completing an IRS Form 1096 by using this program.

File Taxes Faster with PDFelement

Scan receipts and paper forms into searchable PDFs

Compress large PDFs for easy storing and sharing

Securely save and back up tax records as PDFs

Organize tax files by year and category

Merge related tax forms, statements, and receipts into one file to reduce clutter

Download Printable, Fillable IRS Form 1096 in PDF

Your Best Solution to Fill out IRS Form 1096

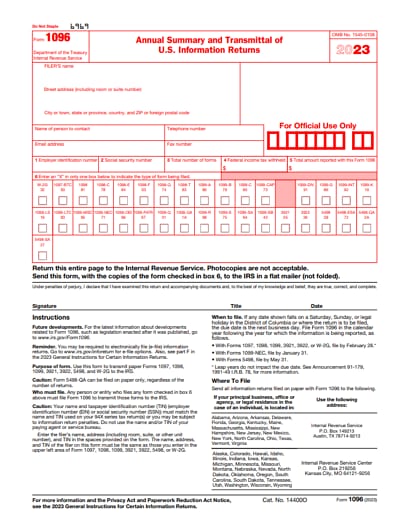

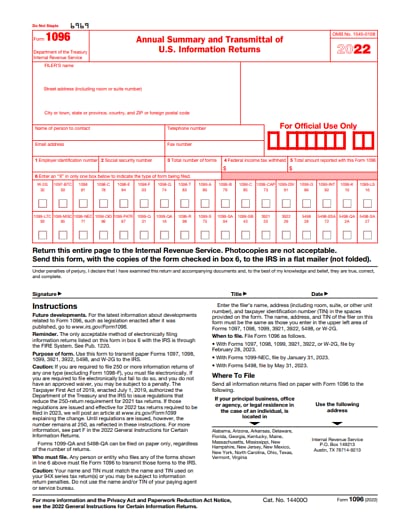

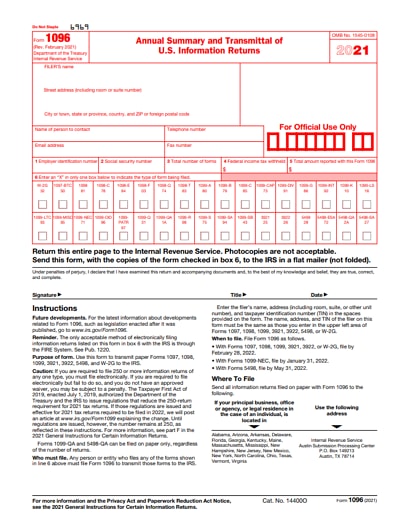

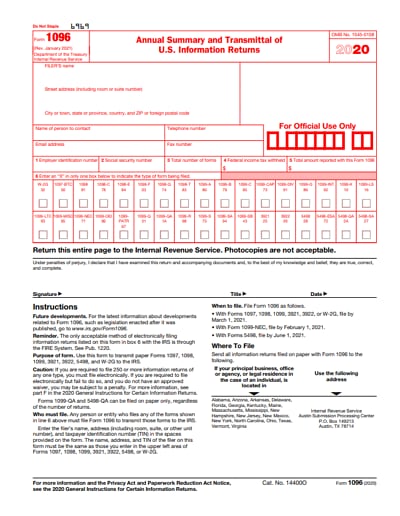

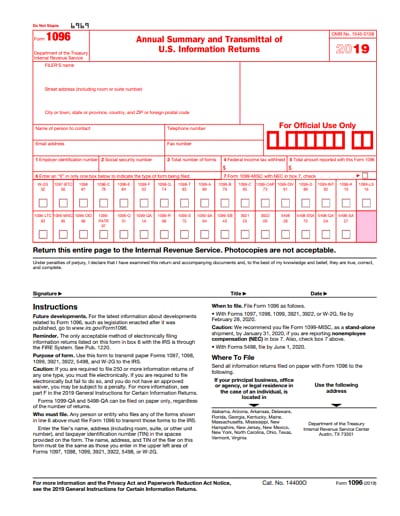

IRS Form 1096 is titled as Annual Summary and Transmittal of U.S. Information Returns it is circulated and regulated by the Internal Revenue Service of the United States of America. You can effortlessly fill up IRS Form 1096 using Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement, which is the most recommended tool by any advanced-level user.

It shows seamless performance in both Mac and Windows operating systems. Functions like form filling are the most basic function of this program which is actually intended to do much more professional operations. Editing, creating, and separation of PDF files can be done using PDFelement. You just have to download the IRS Form 1096 and PDFelement can assist you at its best to complete it.

Instructions for How to Complete IRS Form 1096

The following steps given below will guide you on how to complete the IRS Form 1096.

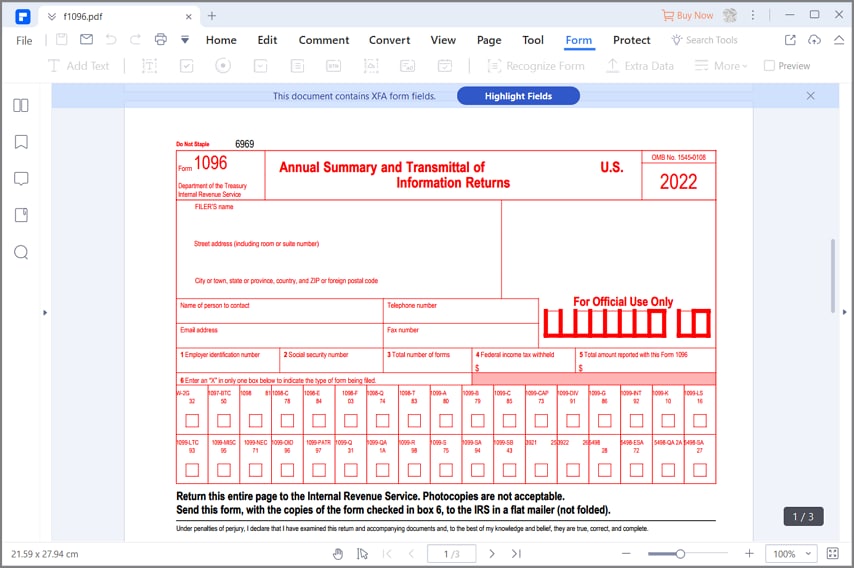

Step 1: You can get the IRS Form 1096 from the official website of the Department of the Treasury, Internal Revenue Service or you can simply search for IRS Form 1096 in any search engine. Open it with PDFelement and read the following instructions before filling it.

Step 2: First of all you must know that this form is provided only for informational purposes on the IRS official website. You will see that this form appears in red, similar to the official IRS form. The original form can be detected by machine whereas the form you find on the official website cannot be detected by machines.

Step 3: You must not print and file Form 1096 which has been downloaded from IRS website. A penalty will be imposed for filing with the IRS Form 1096 that cannot be detected by machines. To order official IRS information returns, which include a machine-readable Form 1096 for filing with the IRS you must order the form from its website devoted to order forms. On visiting the IRS website you must click on Employer and Information Returns, and the IRS services will mail you the form you request with their instructions.

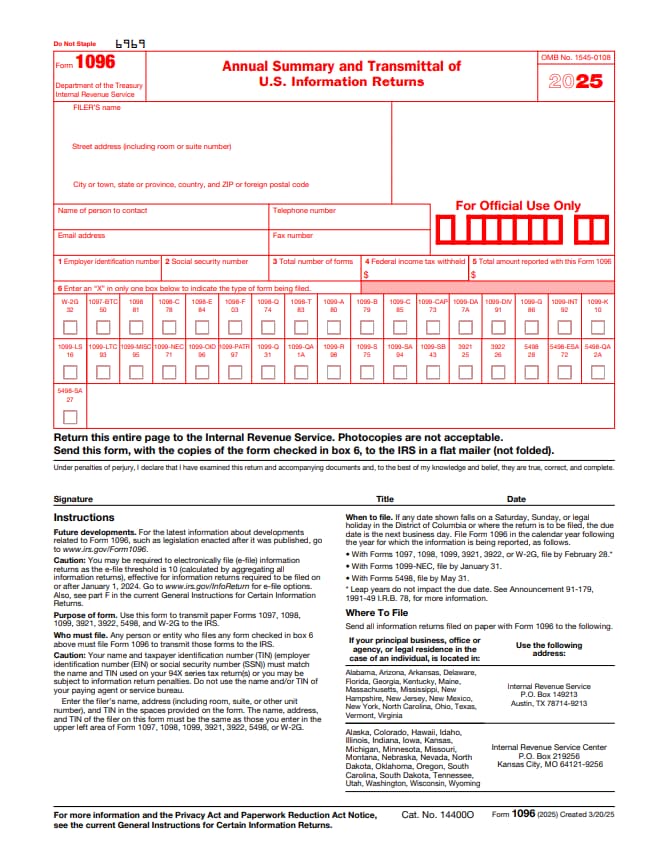

Step 5: Write your name in the first field. On the next field write the address; you can also include the room or suite number. Enter the details of the city or town, state or province, country, and zip or foreign postal code on the next blank field. On the right side there is a box, keep it blank since it is only for official use.

Step 6: On the following line, enter the name of the person to contact. Also, enter his telephone number, email address, and fax number. In the next par,t the fields are numbered. Enter the Employer Identification Number on field 1. The social security number must be entered on field 2. Enter the number of forms taken on field 3. For field 4, enter the amount of Federal income tax withheld. Enter the Total amount reported with this Form 1096 in field 5.

Step 7: Field 6 asks to ‘Enter an "X" in only one box below to indicate the type of form being filed'. The choices of forms given are Form W-2G, Form 1097-BTC, Form 1098, Form 1098-C, Form 1098-E, Form 1098-Q, Form 1099-B, Form 1099-C, Form 1099-CAP, Form 1099-DIV, Form 1099-INT, Form 1099-K, Form 1099-LTC, Form 1099-MISC, Form 1099-OID, Form 1099-PATR, Form 1099-Q, Form 1099-QA, Form 1099-R, Form 1099-S, Form 1099-SA, Form 3921, Form 3922, Form 5498, Form 5498-ESA, Form 5498-QA and Form 5498-SA. Enter X in the box that indicates the form you filed. You can check the box on field 7, if you filed Form 1099-MISC with NEC.

Step 8: On the last part of the form, you have to provide signature, title and date to verify that all the information provided are true, correct, and complete. This is how you fill up an IRS Form 1096 using a PDF application like PDFelement.

Tips and Warnings for IRS Form 1096

- Make sure that if you are about to file 250 or more returns of any one type, you must file electronically. If you are required to fill the form electronically but fail to do so, your waiver will not be approved, and you might also be fined for this.

- The IRS insists on preserving the forms for at least four years, since the information of the previous year is carried out in the next year and so on. Remember to group the forms by form number and attach it with each group with a separate Form 1096.

- If your citizenship or primary place of business is outside the United States, then you must file with the Department of the Treasury, Internal Revenue Service Center. Look for more information on this topic on the official website of the Internal Revenue Service.

- The most important tip will be to use a professional tool to fill out the IRS Forms using a professional tool like PDFelement, since the filling process is very crucial for every individual. Try to make the most out of these forms because it will help you get benefits and avoid penalties.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor