Home

>

Other IRS Forms

> IRS Form 1095-C: The Best Way to Fill it Out

Home

>

Other IRS Forms

> IRS Form 1095-C: The Best Way to Fill it Out

These days, many people get confused on how best to fill PDF forms as electronic methods becomes preferable to manual methods leading to software programs playing a role in filling PDF forms. A way of doing this is by using Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement as we shall see in this article.

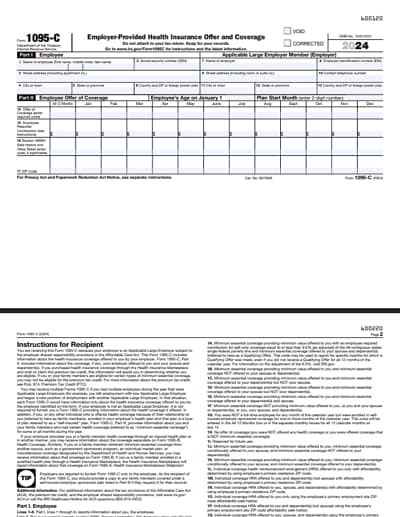

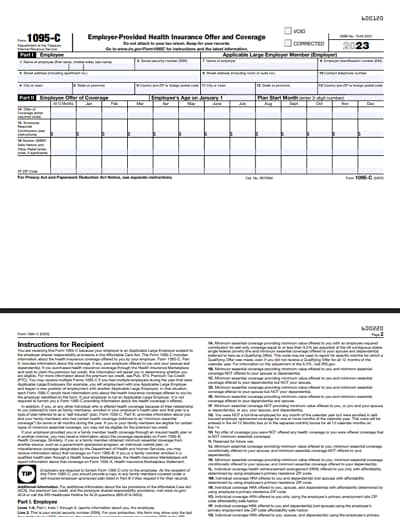

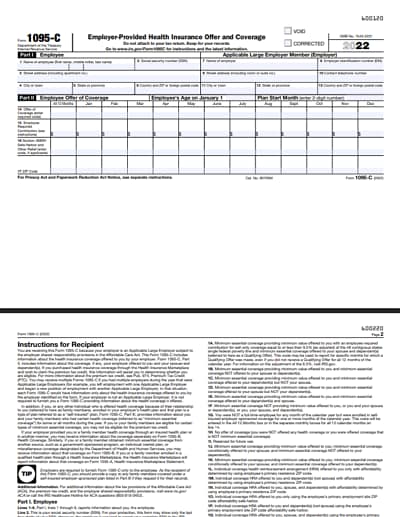

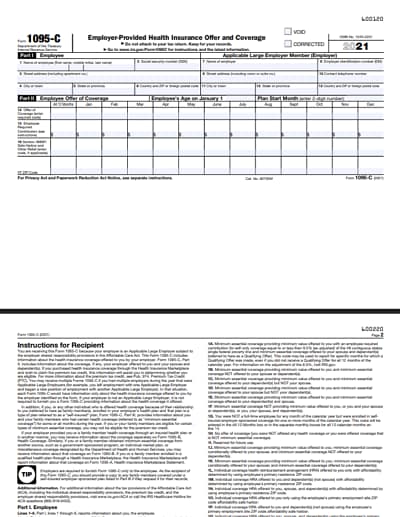

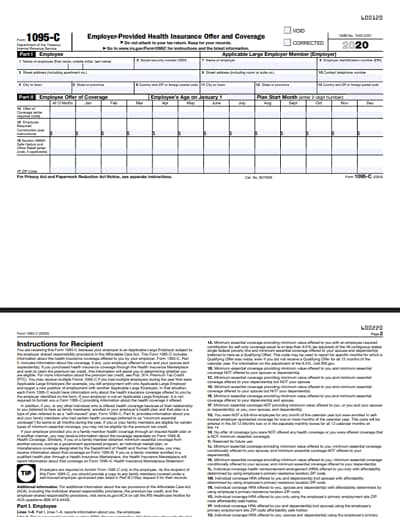

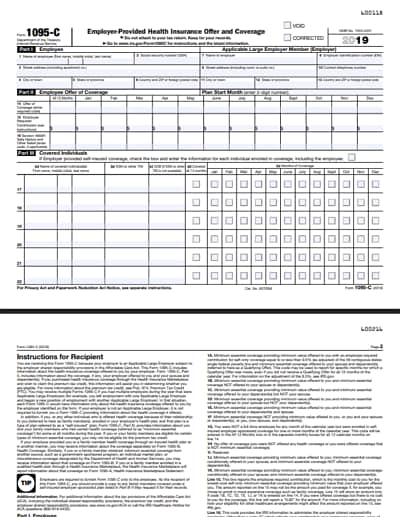

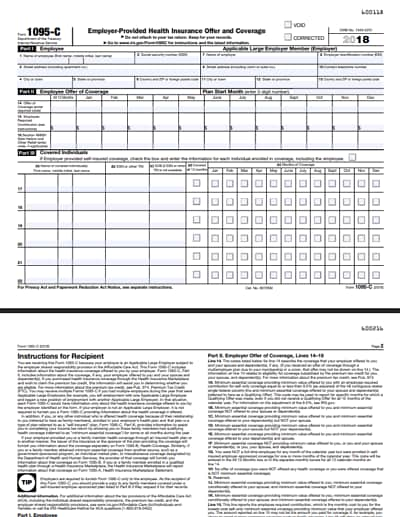

Download Fillable & Printable Form 1095-C in PDF

Your Best Solution to Fill out IRS Form 1095-C

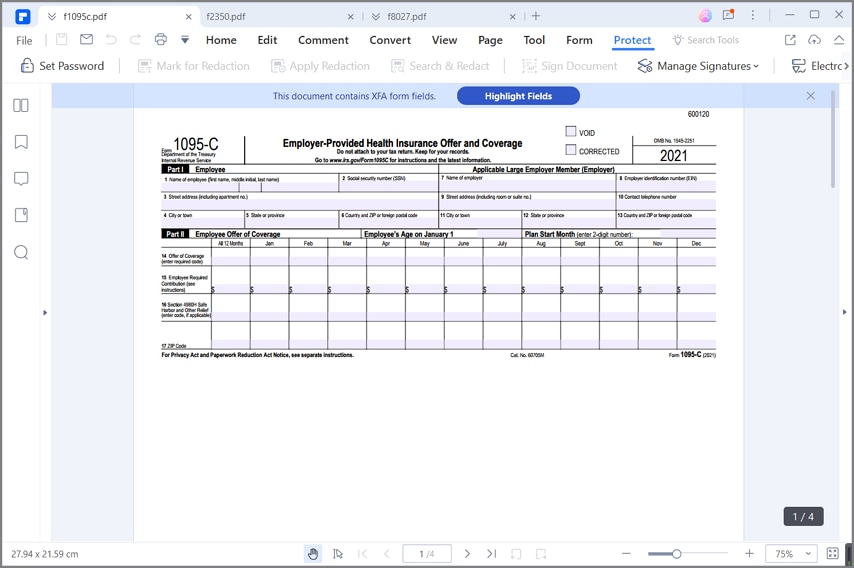

IRS Form 1095-C is a form filed to the Internal Revenue Service by taxpayers for Employer Provided Health Insurance Offer and Coverage. However, the question is how to ensure that this form is filled correctly?

In filling this form, it is important to note that the best solution is PDFelement filler program. This program allows you to fill out the form easily and very fast. You can check boxes, radio buttons and type on your Form 1095-C without problems.

This is particularly very useful as the form 1095-C contains a lot of checkboxes. It is in fact not complicated as it looks. All you need is to open your IRS Form 1095 on the PDFelement platform and use the program to fill it out. Also, you can do so many other tasks in your PDF like editing, conversion, and digital signings using this program.

Instructions for How to Complete IRS Form 1095-C

The follow guide provides an insight on how you can complete the IRS form 1095-C using the PDFelement program.

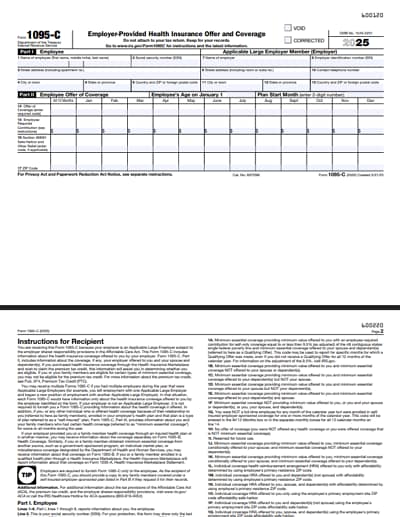

Step 1: Go to the Internal Revenue Service Website and download a copy of the IRS Form 1095-C with the filling instructions. Open it with PDFelement and start filling it out using the program.

Step 2: Begin filling Part I-Employee. If you are filling as an employee, write your name as the employee, social security number, street address which must include the apartment number, city, state, town and country zip code. Note, if it is a foreign country then enter a foreign postal code. Proceed to the top right side of the form which is line 7 to 13, the Applicable Large Employer Member and supply information about the employer. Write the name of the employer, the employer identification number, the address which must include the street, city, state or province, the contact telephone number and the zip code or foreign postal code if it is a foreign address.

Step 3: Proceed to the Part II-Employee Offer and Coverage. First enter 2 digit number as the plan start month. There is a table divided into 13 parts with the first part being the "All 12 months" and others running from January to December. On line 14, enter the required code for the offer of coverage. You do this by checking any of the boxes from "All 12 months" to December, whichever is applicable. On line 15, enter the amount of the employee share of the lowest cost premium for all the months by writing the figure after the $ sign. But note that the amount you reported on line 15 may not be the amount you paid for coverage like in cases where you choose to enroll in more expensive coverage such as family coverage. Enter the code if section 498OH is applicable on line 16. Note that the code provides the IRS shared information to administer the employer shared responsibility provisions.

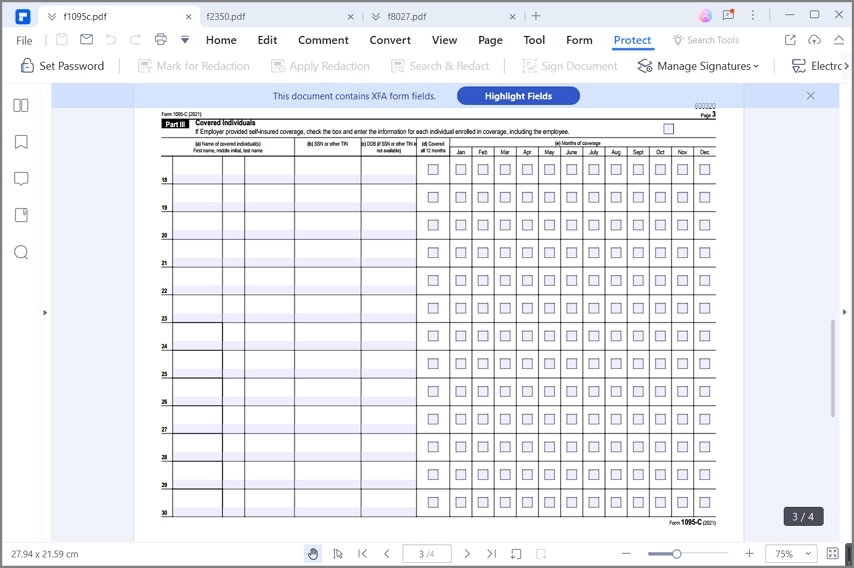

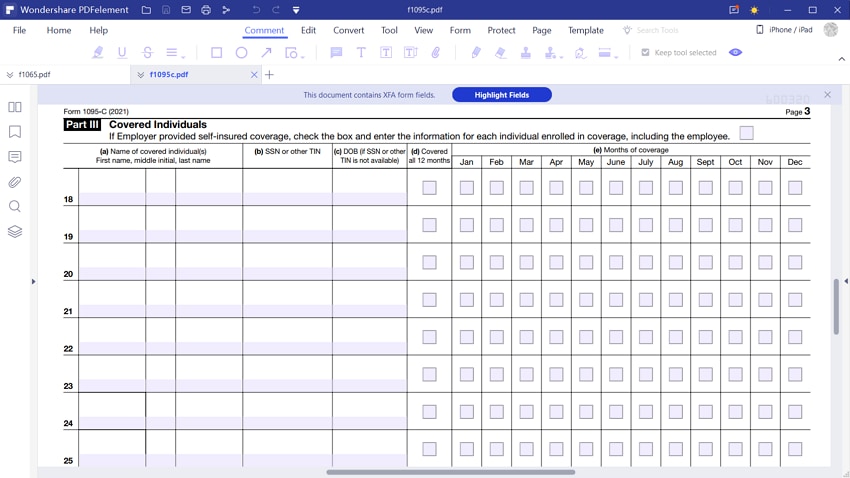

Step 4: Complete Part III which is covered individuals. If employer provided self insured coverage, check the box and enter the information for each covered individual. On line 17 to 22, you are expected to write the name of the covered individuals, the social security number and the date of birth if the social security number is not available. Next is the "Covered all 12 months" and Months of coverage which rolls from January to December. Check the appropriate boxes for each of the covered individual listed on lines 17 to 22.

Step 5: Continue with the Part III continuation sheets and enter the name of the covered individual from lines 23 to 34. Enter the social security number and the date of birth if the social security number is not available and check the boxes depending on the month of coverage of each of the individuals captured on line 23 to 34.

Tips and Warnings for IRS Form 1095-C

- It is important to note that column D will be checked if the individual is covered for at least one day in every month of the year. But for individuals which are covered in some months and not all months, it is expected that you check column e and select the number of months which this individual are covered. However, if there are more than 6 covered individuals, use the continuation sheet on part III.

- Note that if you do not provide your social security number and social security numbers of the covered individual to the plan administrator, it is possible that the IRS may have difficulty in matching the form 10995-C to determine that you in addition to the other covered individuals have complied with the individual shared responsibility position. However, for any other covered individual other than the ones listed on part I of this form, then you can provide a taxpayer identification number instead of the social security number.

- Part III will provide you with information to assist you in completing your income tax return by showing you had qualifying health coverage for some or all months during the year.

- You can use PDFelement to check the boxes in this form when filling it out. It is simple and easy to do.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor