Home

>

Other IRS Forms

> IRS Form 8822: The Best Way to Fill it 2026

Home

>

Other IRS Forms

> IRS Form 8822: The Best Way to Fill it 2026

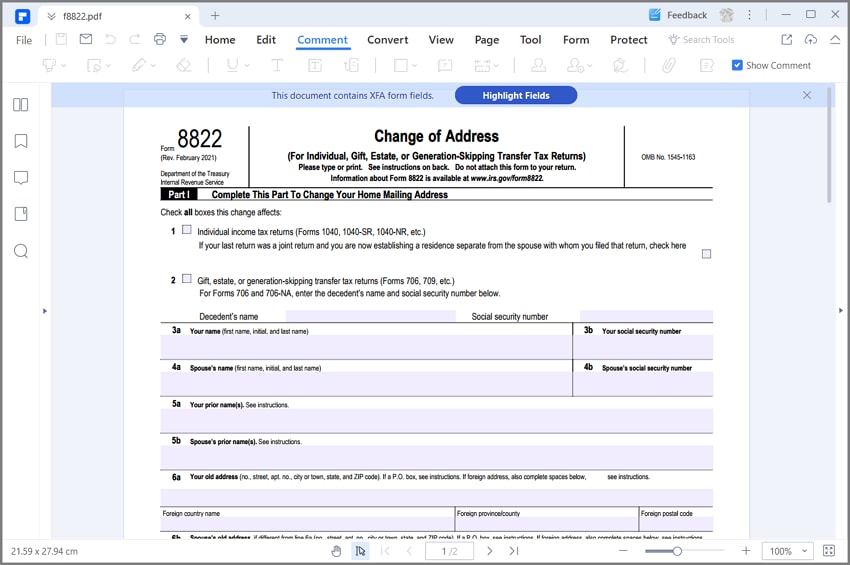

The IRS Form 8822 is a form issued by the Department of Treasury, Internal Revenue Service of the United States of America. The purpose of it is to notify the service if you have changed your home mailing address.

Your Best Solution to Fill out IRS Form 8822

Getting this form filled correctly is important and your best solution to do this is by using Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement program to open and fill it.

It does not require you to print it out before filling it out. Beside filling of forms, PDFelement has the capability of doing other PDF tasks like splitting, merging and converting documents to PDF and vice versa. You can watermark, sign PDF files and do much more with this program.

Instructions for How to Complete IRS Form 8822

Do you have an IRS Form 8822 to fill out? Relax! Filling this form is easy with the Wondershare PDFelement. All you need do is to open it on the platform and use the program to fill it out. However, in feeling it, the step by step instructions apply.

Step 1: Simply download the IRS Form 8822 online and open on the PDFelement to start the filling process.

Step 2: Fill out the first part, Part I to change your home mailing address. There are checkboxes in line 1 and 2. In line 1, you are expected to check the box if the change of address affects the individual income task returns- Forms 1040,1040A,1040EZ,1040NR etc. However, if your last return was a joint return and you are now establishing a separate residence with your spouse with whom your last return was filed, then check the box at the extreme right. For line 2 checkbox, check only if the change in address affect the Gifts, Estate or generations skipping any transfer tax returns like Form 706 and 709.In this case, enter the decedent’s name and the social security number on the spaces provided accordingly.

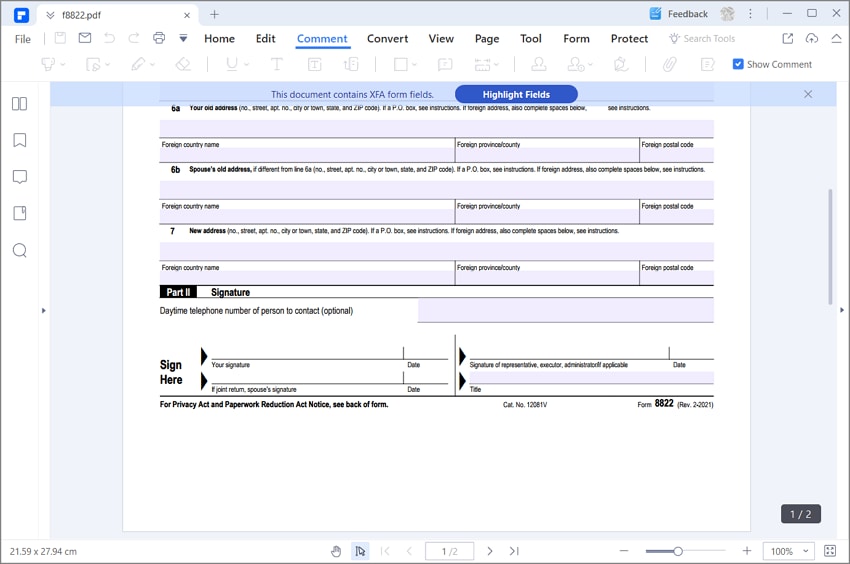

Step 3: On line 3a and 3b, enter your first name, and your social security number. Also write your spouse first name, initials and last name with your spouse social security number. Enter your prior name and your spouse prior name in column 5a and 5b. In column 6a, you are expected to write your old address. Write your street name, apartment number, city or town, your state and your zip code. However, note that if it is a foreign address, you have to write the foreign country name, foreign province county and the foreign postal code in the column provided for it as seen in the form. Repeat the same thing on line 6b but if different from 6a then write the street name, apartment number, city, state and zip code of your spouse. Also, if foreign address, complete the spaces below for foreign country name, foreign province and foreign postal code for your spouse.

Step 4: Part II is the signature part. First enter the daytime telephone number of person to contact although it is optional. There is a space for signature, sign your signature and write down the date. However, if joint return your spouse should sign in the space provided and write the date. Complete the form by capturing the signature of the representatives, executor, and administrator if applicable. Then write the date and title in the spaces provided accordingly.

Tips and Warnings for IRS Form 8822

- Listing nontraditional addresses is not ideal when filling 8822 as there are additional rules to follow if you want to use a post office box or foreign address. Note that the rule states that you can use a post office for your mail address only if the U.S Postal service does not offer mail delivery to your home address.

- For anyone using a foreign address, it is important that you use the format that is currently used in the country. If you want your tax related mails going to a third party like your attorney, you can enter a “care of” or “in care of” before the attorneys name and mailing address.

- It is important to note that any failure to update your mailing address with the Internal Revenue Service could become an issue if some time sensitive material is sent your last address.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor