Home

>

Other IRS Forms

> IRS Form 5558: A Guide to Fill it the Right Way

Home

>

Other IRS Forms

> IRS Form 5558: A Guide to Fill it the Right Way

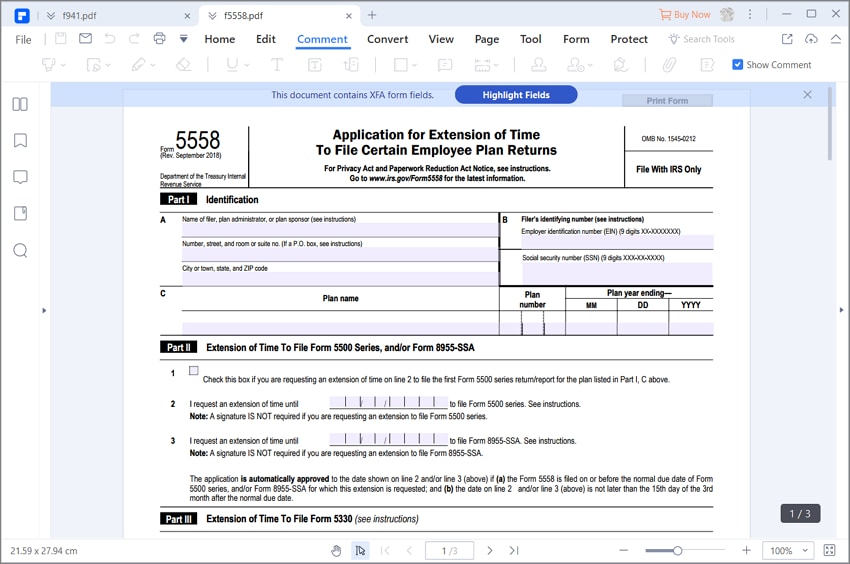

You can use the IRS Form 5558(Application for Extension of Time to File certain Employee Plan Returns) to apply for a one time extension of time to file the Form 5500 series. You can find further information about the Form 5558 and its instruction at the irs.gov website.

Your Best Solution to Fill out IRS Form 5558

Filling out the IRS Form 5558 is simple and easy when you use Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement for the task. It has a superb form filling capabilities that makes filling PDF forms straightforward and fast.

This application can write on your PDF forms, check boxes and select radio buttons if they are available on the PDF form making it the best solution to fill out the IRS Form 5558. In fact, it is an all in one PDF solution tool that is capable of solving any problem in PDF files and the good thing is that it is affordable.

Apart from its unique form filling features, PDFelement possess other top notch features like creating new PDF, modifying PDF, splitting and merging PDF, applying digital signature on your PDF forms to make them authentic and a lots more. The good thing is that it supports both Mac and Windows platform making it readily available with barrier to anyone who intends to use it.

Instructions for How to Complete IRS Form 5558

If you want to file an extension of time and you have an IRS Form 5558 to fill, then the following step by step guide will be of help.

Step 1: The first thing is to get the IRS Form 5558. It can be obtained by downloading a copy from the website of the Internal Revenue Service. Once this is done, open it on PDFelement and begin the filling process using the program.

Step 2: Start with Part I-Identification. This part has line A, B and C. The name of filer, plan administrator or plan sponsor should be written on Column A followed by the address which must include the number, street, city, town, state and zip code. On column B, enter filer’s employer’s identification number and the social security number with the plan name, plan number and plan year ending on column C.

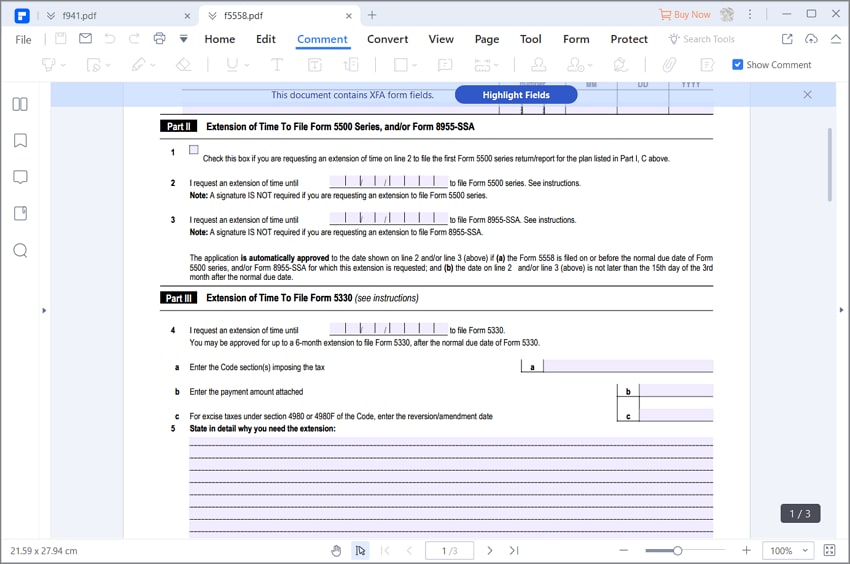

Step 3: Go over to Part II-Extension of Time to File Form 5500 Series, and/or Form 8955-SSA.There are three lines on this part which is the lines 1, 2 and 3. If you are requesting the extension of time on line 2 to file the first form 5500 series return/report for the plan listed in part 1cabove, then check the box on line 1. The due date for which you are requesting to file Form 5500, Form 5500-SF and Form 5500-EZ should be entered on line 2. Note that this date should not be later than the 15th day of the third month after the normal due date of the report/return. But on line 3, you are required to enter the due date for which you are requested to file Form 8955-SSA and the date should not be later than 15thday of the third month after the normal due date of the return.

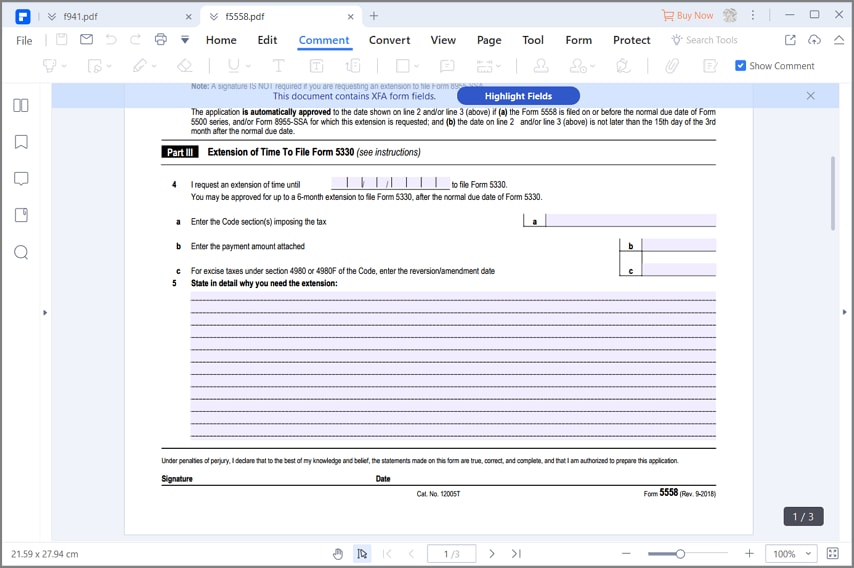

Step 4: Proceed to Part III-Extension of Time to File Form 5330. The requested due date should be entered on line 4. However, note that should your application be granted, you will be granted an extension of up to 6 months after the due date on Form 5330. On line 4a, show the sections for the excise tax for which an extension is requested while you enter the amount of tax estimated on line 4b. Where an amendment/reversion is made for excise taxes under section 4980 or 4980f, enter the amendment date on line 4c.

Step 5: You need to explain to the IRS of the circumstances leading to your request for an extension if you must get an approval. This will be done on line 5. You are expected to clearly describe these circumstances. It is important to note that consideration will be given to any circumstances that prevent you for any reason beyond your control to file your return by the due date. Complete the filling process by putting down your signature and date.

Tips and Warnings for IRS Form 5558

- It is important to note that if the employer does not have an employer identification number, the employer must apply for one. Note that it can also be done online by clicking the online EIN application link on the internal revenue service website. The employer identification number will be issued immediately once the application information is validated.

- Note that if an extension of time to file Form 5330 is granted and it is later found that the information on this form is false and misleading, then the extension will become null and void and a late filing penalty which you are trying to avoid by filling this form will be charged. Therefore, it is important to ensure all information on this form is correct to avoid this kind of situation.

- When filing IRS Form 5558, it may be signed by an employer, a plan sponsor, an attorney or qualified public accounted qualified to practice before IRS or a plan administrator.

- Use the most recent version of the IRS Form 5558 when filing an application of extension of time in order to avoid processing delays. You can check the most recent version at irs.gov website.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor