Home

>

Tax Refund Tips

> How to File Non-Resident Tax Return

Home

>

Tax Refund Tips

> How to File Non-Resident Tax Return

Someone maybe wondering if you need to file a non-resident tax return, don't worry, this article will give you a specific instruction on how to file non-resident tax returns.

- Part 1: Everything about Filing Non-Resident Tax Return

- Part 2: A Good Tax Form Filler You Shouldn't Miss

Everything about Filing Non-Resident Tax Return

1. Who Needs to File a Non-Resident Tax Return?

If you're a non-resident alien in the US working or doing business, you are to file tax return if your personal exemption (4,000 dollars in 2015) is lesser than source income in the U.S. 'Filing a return' is a means sending it to the IRS, either electronically or through a mail.

Even if you're an employee who works for wages, you're considered as one who is engaged in business. If you're a scholar or student visiting the U.S on an M, J, Q or F visa, and are classed as a non-resident primarily for tax purposes in U.S, you're required to file Federal income tax return every year if you've got an income that is subject to the United States income tax.

2. Which Forms to File

Listed below are all the publications and forms you will need:

- Forms 8843

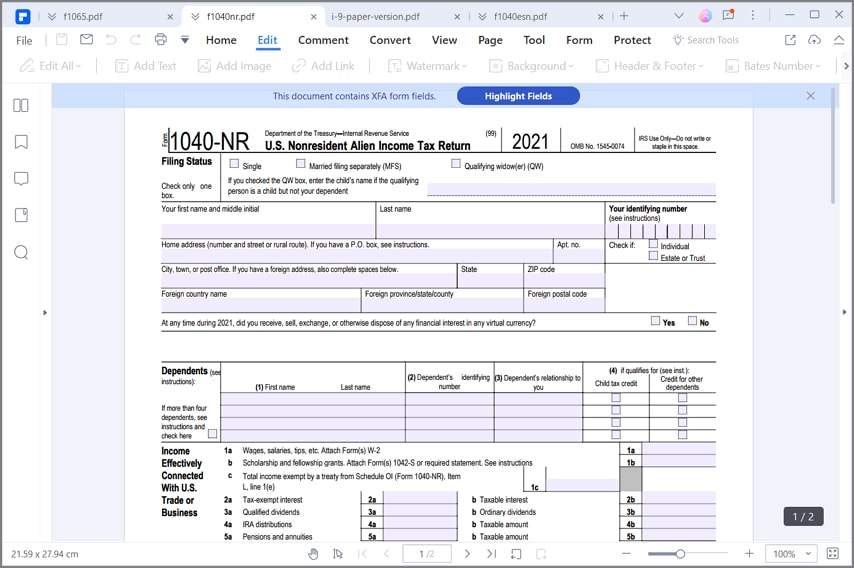

- Form 1040NR-EZ with instructions or Form 1040NR with instructions

- Publication 901

- Publication 519

- Publication 597 (if you're from Canada)

- Form 843 (for social security tax improperly withheld)

Reading through the 1st page of the Form 1040NR-EZ instructions will enable you to know if the shorter form can be used. Otherwise, Form 1040NR can be used.

3. When and Where to File?

If you do receive wages that are subject to the United States tax withholding, the filing of your tax return will be due on 15th April of the next year. If all through the year you didn't get taxable wages, the filing of your tax return will be due on June 15th of the next year. Your Form 1040NR-EZ or Form 1040NR (Form 8843 inclusive) must be forwarded to the Department of Treasury, Internal Revenue Service, Austin TX 73301. For more details, you can check IRS Publication 519.

4. What Aliens do Before Leaving?

The first thing that needs to be done is determining whether you're a dual status, non-resident, or a resident alien for tax purposes. The titles are not related to your immigration status. You may be considered as a US resident for tax purposes, even though you're not a citizen of US. This step is essential as it determines whether to file, whether you're eligible for benefits of treaty.

A Good Tax Form Filler

After determining that you're a dual status or non-resident alien, every information that you'll need to file your dual status or non-resident return is contained in 2 IRS booklets and Form 1040-NR instructions. The Internal Revenue Service booklets are Publication 901 (US Tax Treaties) and Publication 519 (US Tax Guide for Alien).

All these materials can be obtained from the IRS website at Publications and Forms. You can print and view publications and tax forms with the use of PDF file format. The best tax tool to fill your tax forms is Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. This is because though it is cheaper than Adobe, it's still got every quality feature that Adobe has. With just a click, you can fill out your tax forms as well as sign your signatures online on your tax forms very easily.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor