Home

>

Tax Refund Tips

> How to Print Tax Forms

Home

>

Tax Refund Tips

> How to Print Tax Forms

Payment of taxes is an important duty of any citizen and must be paid as at when due. Paying of taxes is not restricted to the United States alone, almost all countries of the world require that their citizens pay some income tax to the government. In order to pay taxes in the United States of America, citizens will be required to fill tax forms. It is important to print tax forms. This article tells you why you need print tax forms and the types of printable tax forms.

Part 1. Introductions to Tax Forms

It is important to note that income tax form is a legal and official documents tax payers must fill out when they pay their taxes. There are a lot of tax forms and they are all serve different purposes in the tax system. However, it is important to note that you may be required to fill out more than one tax form especially in a situation where your finances are complex. This means that if you have a kind of complicated financial status, you may be required to fill out more tax forms when compared with someone with a straightforward financial status. This is not a problem as the tax forms and the criteria for filling it out is very clear.

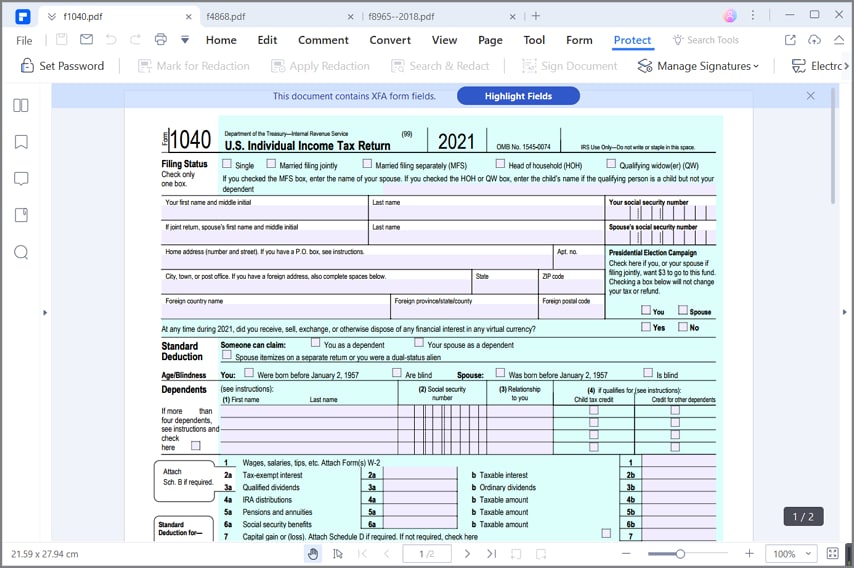

The common tax forms a lot of people fill include the IRS Form 1040, 1040A, and 1040EZ.These tax forms are the ones taxpayers need in order to properly report as well as pay their income tax at the federal level. However, it is also important to understand that there are also state and city tax forms used at the state level of paying taxes but in most cases, they are always modeled after the federal tax forms.

Part 2. Why You Need to Print Tax Forms

There are a lot of reasons why it is important to print tax forms even if you are filling it online

To Understand the Tax Form

Note that filing taxes is a serious issue and must be done with due diligence. For this reason, it is expected that tax payers study and understand the tax form to the fullest in order to avoid making mistakes when filling their taxes. There are many tax forms and in some cases, tax payers maybe required to fill out more than one tax form. Therefore, having an understanding of the tax form is the first thing that would ensure that the forms are properly filled out.

One way to get a full grasp of what is required is to print tax forms and study them properly. It is important to note that there are IRS printable forms that tax payers can print out and study properly before filling out the main tax form. These printable tax forms gives an idea and clarity especially for new tax filers about what is required and they can ask questions on any area that is confusing to them. So you need to print tax forms if necessary.

To Get the Instructions

Printing tax forms will also help tax payers read and understand the instructions. For instance, individual tax forms come with tax instructions that can be printed alongside the tax forms. These instructions help tax payers differentiate different requirements for their taxes and if in confusion, it will clarify the grey areas. With this, tax filings become easier and mistakes are avoided.

To Save Time

Initially, the IRS mails the tax forms into the taxpayers email to fill out and return but this seems not to be happening again. It is possible to print tax forms and fill it out without having to wait for IRS to send it to your email. There are printable tax forms for any type of tax and printing them directly without having to wait for IRS saves you a whole lot of time

For Reference

Another major reason why it may be good to print tax form is that it can be used for reference when needed. It is absolutely possible for tax payers to go back to these forms and check information when needed.

Part 3. List of Printable Tax Forms

There are a lot of printable tax forms that taxpayers can print out for their own use. These printable tax forms also comes with line by line instructions that are available for printing. This instructions are helpful for tax payers as it provides the needed information required for an effective tax form filing. The following are some of these tax forms.

- Form 1040- Individual Tax Return

- Form W-4- Employee's Withholding Certificate

- Form 1040-X- Amend/Fix Return

- Form 941- Employer's Quarterly Federal Tax Return

- Form 2848- Apply for Power of Attorney

- Form W-9- Request for Taxpayer Identification Number (TIN) and Certification

- Form W-2- Employers engaged in a trade or business who pay compensation

- Form W-7- Apply for an ITIN

- Form 4506-T- Request for Transcript of Tax Return

- Form 9465- Installment Agreement Request

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor