Home

>

Tax Refund Tips

> Check the List of Best Tax Software 2026

Home

>

Tax Refund Tips

> Check the List of Best Tax Software 2026

Submitting the tax return is an obligation for any citizen. There are various tax software and online tools available for filling any tax-related form. It becomes very difficult to make a choice of which software to use that totally applies to your financial situation. This article will compare some of the best taxes software by providing their key features, merits, and demerits in the tax software list.

If you have problems filling out PDF tax forms, you'll need a professional PDF editor. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is a complete PDF editor that is able to handle all PDF forms problems. It can fill out PDF forms, print out forms, sign PDF files, edit text, combine or split pages, redact sensitive information, and more. It can your real helper in processing PDF files. Free download this PDF editor to have a try.

Part 1: Best 8 Tax Software You Can't Miss

There is a whole lot of tax software in the market. However, only the best tax software partner with the IRS to bring free tax preparation to taxpayers each year. Here are the tax software you can trust.

1. H&R Block

H&R Block provides the best value to the customers who can create a correct tax return at an affordable price. All the tax forms are available to all types of filers but if you pay an added fee you can get additional guidance and instructions. The tax software includes step-by-step guidance within the program as well as free tax advice with one of its personal consultants.

Pros:

- The user interface is well designed.

- This tax software program is easy to use.

- It has an added feature of mobile applications.

Cons:

- The price is affordable but the added price of the customer service is very high.

2. TurboTax

The rating of tax software is its ability to offer intuitive simplicity and this is what the TurboTax is known for. The TurboTax is one of the best tax software that offers streamlined tax preparation and also boasts an easy-to-use interface. One benefit it offers to its teeming users is that it offers step-by-step instructions that are easy to understand that are very useful to first-time filers to prepare their taxes with relative ease.

The TurboTax software will prompt you with the key questions when you are in the process of filing your taxes to help capture any changes that could affect your taxes. In addition, there is real time live audit risk detection and you also have the opportunity to get free live advice from the experts to help clear some minor or major issues you do not understand. TurboTax now possess new feature like SmartLock where users can get their live tax prep questions using one-way video technology.

Pros:

- Provide free version.

- Intuitive interface for you to quickly find specific tax filing forms.

- Automatcially fill out fields of your forms if you upload W-2 to the software.

Cons:

- More expensive than its competitor.

3. eSmart Tax

The eSmart tax is owned by Liberty tax and has been waxing strong from year to year. It is one of the best free tax preparatory software available with the potential of generating good savings for you during tax return filing. The free eSmart version can help you e-file your tax return for free as well as other products. The eSmart tax software also does well in providing adequate customer support for users through live chats.

One very good feature of using eSmart tax is that it is possible to import your previous year's tax return from other tax preparation providers like H&R Block and TurboTax and the good thing is that it is free. With this, you can easily look at previous tax returns even if you did not use the eSmart tax software in those years and make a comparison with your present situation if necessary.

Pros:

- Many tax resources are accessible from the software.

- Good expense deduction capability.

Cons:

- No app version for you to fill tax from your mobile phone.

4. TaxAct Free Federal Edition

This is one of the best free best tax software for taxpayers although it does not match the advancements on offer at H&R Block and TurboTax. However, TaxAct covers all basic requirements for successful tax filing. It does well in customer service by offering tax guides, free email support, and other resources to make things easier for users and help them file their taxes without complications.

Pros:

- Its paid version is cheaper than its competitors.

- Its free version is not limited to first-time filers or simple returns.

Cons:

- The TaxAct free version only applies to federal returns.

5. TaxSlayer

TaxSlayer it offers step-by-step instructions and easy-to-use guides which is particularly useful for tax newbies. In terms of customer service, the TaxAct offers phone and free email support to users. TaxSlayer free edition like its counterparts supports the basic tax forms like 1040, 1040A, and also the 1040EZ tax returns. However, the only disadvantage of this software is that it lacks audit detection or assistance which could be very important in a fiscal year.

Pros:

- A budget option with a a free plan that covers education credits and the student-loan interest deduction.

- Offer a federal tax return file to active-duty military for free

Cons:

- A more complicated interface compared to its competitor.

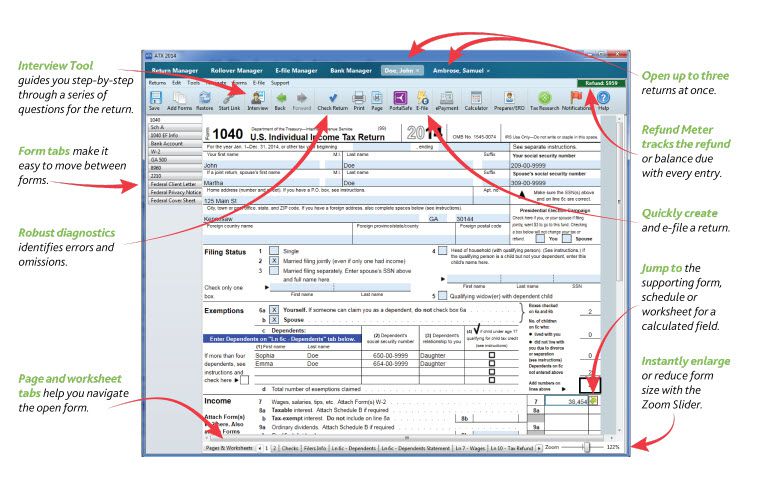

6. ATX

The ATX is a tax software that delivers continuous product enhancements to deal with the changing tax laws. It provides access to self-help tools that are available 24 hours to provide online Solution, particularly during the busiest time of year which makes it one of the best taxes software.

Pros:

- The ATX tax software has an online tax research service included in many pricing options.

- It has a simple forms-based interface and input screen.

- It also has strong suite integration points.

Cons:

- The tools for revision are incomplete.

- There is no solution for remote access.

7. Drake

Drake software is one of the best taxes software solutions intended for quick data entry and returns processing. This e-filing system includes built-in free modules like write-up, payroll and training services. The price of this software is $300 for 15 returns with only tax functions are provided with this package. The online support provided by this software may include some charges for providing some suggestions to the users.

Pros:

- It has integration with GruntWorx for automatic tax filing.

- The product offering includes all functions.

- Comprehensive pricing model

- It has multiple platforms to avail of desktop and online help.

Cons:

- The review options are limited to reviewing firm tax returns.

8. ProSeries Tax

ProSeries Tax is the tax software solution developed by intuit. It is designed as an affordable tax software solution to assist tax practitioners with processing returns quickly. ProSeries Professional is intended for accounting practices which focus on high volume and a wide variety of returns, while ProSeries Basic is designed for beginners for completing simple tax returns.

Pros:

- You can directly scan data and import it with additional charges.

- The software has a simple user interface directly allowing to enter information.

- It has been built for integration with QuickBooks and TurboTax.

Cons:

- The tools available for review are minimum.

- The option of remote access is not very user-friendly.

Part 2: Tips to Choose Right Tax Software that Suit You Most

- Before you start selecting the tax software you must ensure what your needs are and how much can you afford to pay. These services sometimes include some added cost or hidden cost when you ask for assistance.

- Go through each of the tax software in a detailed manner to ensure that you understand their functions, features, and the limit which they can offer. For example, not all tax software offers audit risk detection features as a free feature.

- Choose tax software that has the capability of finding missing deductions and information and can flag items with the potential to trigger an IRS audit.

- When choosing tax software, it is advisable to choose one that makes it possible to import data from your employer.

- It is important to have software that has the ability to file both your federal and state taxes. It makes things easier and saves you some extra cost.

- It is important that any tax software you choose must be the one that is updateable and which also include recent tax law and updates.

- Remember to look for a guarantee for the accuracy of the software and it can keep the data you provide confidentially.. This software has made it fast and easier to submit the tax return faster than the traditional method of writing in hand and making manual calculations.

- Make sure to include your tax filing software price in the tax return which might help to reduce your tax to some extent. Some of the online tax software have these options integrated and make deductions automatically.

- You can try filing out your tax return for free if you are willing to use the software to judge its capability and customer support. If you are confused you can review the products in this article to confirm which software meets your requirements.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor