Home

>

Tax Refund Tips

> Top 8 Tax Refund Calculators 2026

Home

>

Tax Refund Tips

> Top 8 Tax Refund Calculators 2026

Tax day 2023 in the United States of America is Tuesday, April 18. This is a day most Americans send in their tax forms as well as money to the Internal Revenue Service with the hope that they may get a refund. You can use a tax refund calculator to figure out how much you will likely get back. We will look at the top tax refund calculator 2023 that will help you figure this out easily.

After you have done the calculation, you can start filling out your tax form. E-filing tax means you have to work with different PDF files. If at some point, you need a PDF tool to fill PDF forms, print PDF, combine/split pages, edit text, images and more in PDF, convert files to or from PDF, you can always count on Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement, which is a full-featured PDF editor software that can edit, convert, annotate, fill and sign PDF.

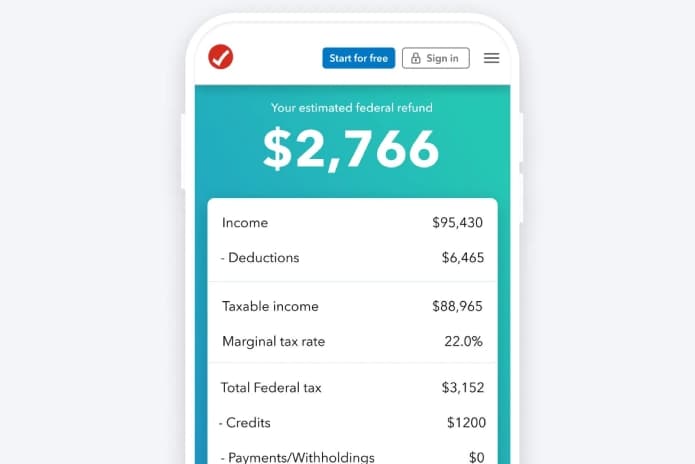

1. TurboTax Refund Calculator

When you talk about taxes, then there are not many other names you will call before TurboTax. It has been one of the most popular names in taxes for a long time and with the advantage of having a free calculator. Its TaxCaster tax calculator can be accessed online or be downloaded as an app from the Google Play Store or iOS App Store.

Estimating your tax returns with TurboTax is not complex. All that is required is to supply some basic information, and the TurboTax online calculator calculates and gives you the estimate. This is a great tax calculator tool because it even allows you to include other sources of income besides your primary source as well as put into consideration, retirement, education, and charitable donations when doing a final estimate.

Pros:

- One of the few tax calculators with an available mobile app.

- You can download the app for Apple on the App Store or for Android on the Google Play Store.

- It is free and easy to use as you do not need much guidance.

Cons:

- The interface is not well designed.

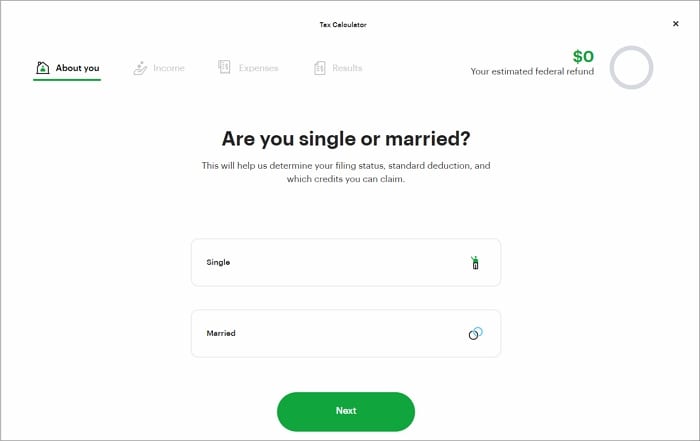

2. H&R Block Tax Estimator

The H&R Block Tax Estimator is one of the biggest names in Tax calculation services. The H&R Block has been in existence since 1955, helping a whole lot of Americans with their taxes, although they started off with offering high-interest loans based on an estimated tax refund.

What you need to do is to visit their website and use their tax refund calculator. It allows any user to use its free calculator to calculate the amount the Internal Revenue Service will refund you or how much you owe the Government. Whatever the case, H&R Block will utilize the basic information you provide about your income and expenses to help you calculate the status of your tax refund. It is very simple and easy to use. You do not need any advanced knowledge to use it. All you need is to log on to the website and enter your details. You will get the required result.

Pros:

- Simple and easy-to-use tax calculation tool.

- The level of accuracy is high.

Cons:

- Does not have apps like TurboTax.

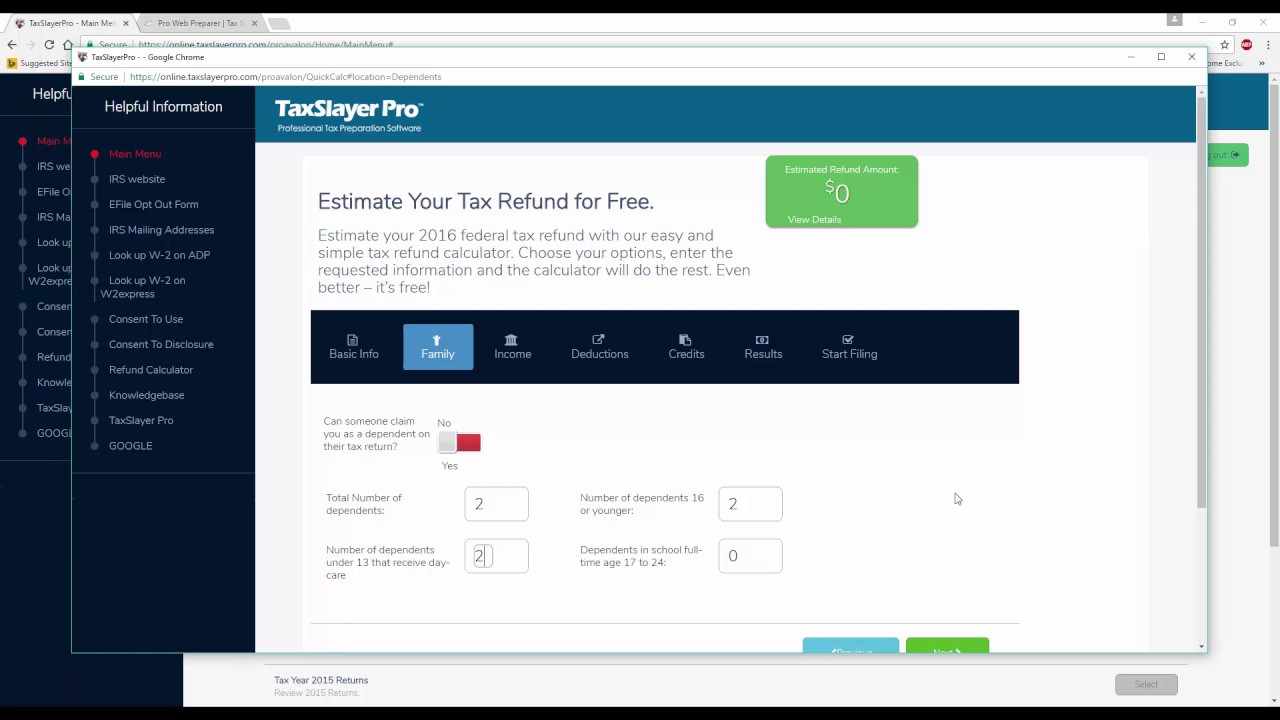

3. TaxSlayer Tax Refund Calculator

The TaxSlayer tax return calculator can be accessed when you go online. You can use it to estimate your task refund very easily with just a few steps. It will require you to enter certain basic information like your age, marital status, filing status, and a whole lot of questions bothering on your eligibility. After providing the basic information, it will require you to also provide information on family, income, deductions, and credits. The essence of this information is to enable TaxSlayer to compute your tax refund correctly. When the calculations are complete, you can see the estimation at the top right of the online page, and you can print it afterward. It is simple and easy to use. You do not require any sophisticated computer knowledge to use it. All you need to do is to supply the necessary information and click the buttons.

Pros:

- Simple and straightforward tax calculator.

- Apps are available on Android and iOS devices.

Cons:

- It is only for estimation purposes only.

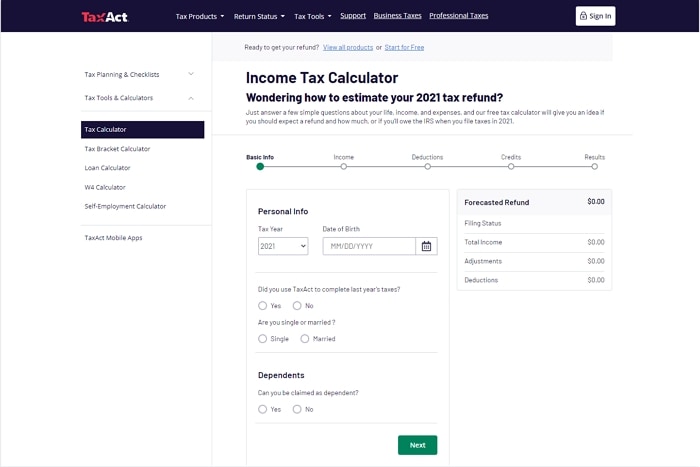

4. TaxAct Tax Calculator

The TaxAct TaxCalculator is a simple and easy-to-use online tax calculator which will help you calculate how much tax refund you are expected to get or how much you will owe. When using this tool, you will have the option of factoring in income, deductions, tax credits which could include education and energy savings in order to get a final estimate. TaxAct also factors in some personal information to determine your calculation. For example, you will have to tell the program if you are single, married, head of household, or a qualifying widow, etc.

Pros:

- Very simple application and easy to understand and use.

- It will quickly and accurately estimate your tax refund or what you may owe.

- It is free to use.

Cons:

- Accessibility of the website is always a problem, the server seems not to be reliable.

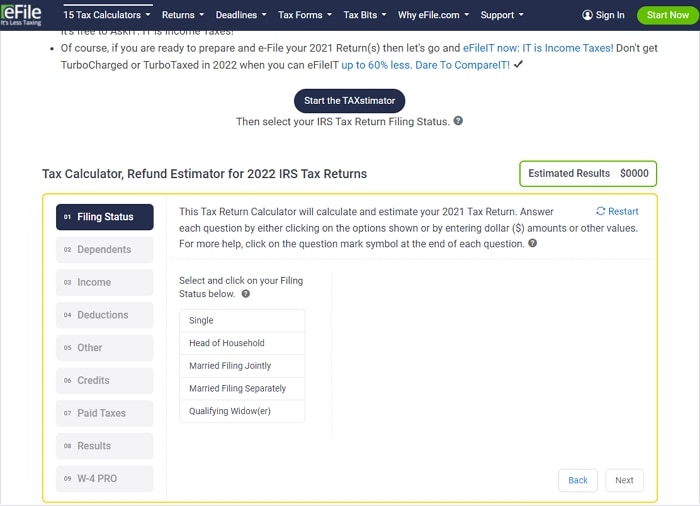

5. eFile Tax Refund Estimator

This tax refund estimator is an easy-to-use tax preparation calculator tool that can automatically calculate state and federal taxes for you to prepare for your 2021 IRS and state income taxes . Anybody can simply access the tax calculator online at their website and start using it with hassles. It is a free calculator and doesn't require you to register and create your username before you can calculate your tax refund. The tax estimator is well-designed and will allow you to enter income information while including exemptions and hourly rates. With this tool, you are just a few clicks away from knowing how much refund you can get or how much you owe in taxes.

Pros:

- Well-designed and easy-to-use tax refund calculator.

- Enables users to do other taxes other than for tax calculations.

Cons:

- You will have to register before using the tax refund calculator.

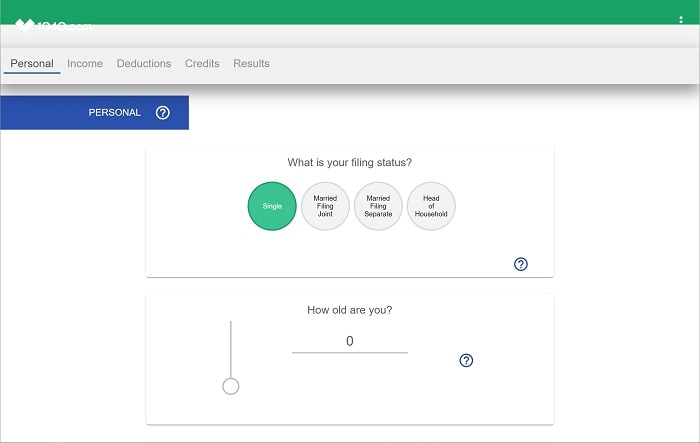

6. 1040 Quick Tax Refund Calculator

The tax estimator is an online tax calculator which can help you quickly determine how much you have a tax refund in just a few more steps. Compared to the other tax refund calculators, the tax calculator is simple and well-designed and provides you with a stress-free filing experience.

Pros:

- This is one of the top tax refund calculators because it is much more simple than many other tax refund calculators.

- It is reliable, simple, and easy to use. All your calculations are almost accurate.

Cons:

- This tax calculator can only estimate your tax liability or refund. It can't be used for federal income tax returns others.

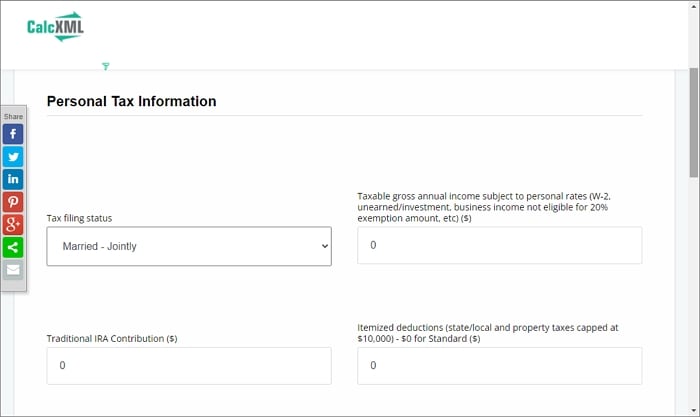

7. Calcxml Online Calculator

If you have withheld enough tax in the past year and will like to determine whether you still owe the Internal revenue Service or you are qualified for a tax refund, then use Calcxml as your tax return calculator. The Calcxml online tax calculator is simple and easy to use. You will be expected to supply your income and task information like the tax filing status, gross annual income, number of dependent children, number of personnel exemptions, among others. When the information is supplied, all you need is to click on the submit button, and your tax return estimate will be calculated and shown.

Pros:

- It is simple and easy to use.

- It includes trust in the tax filing status.

Cons:

- The website is not well designed as the interface looks disorganized.

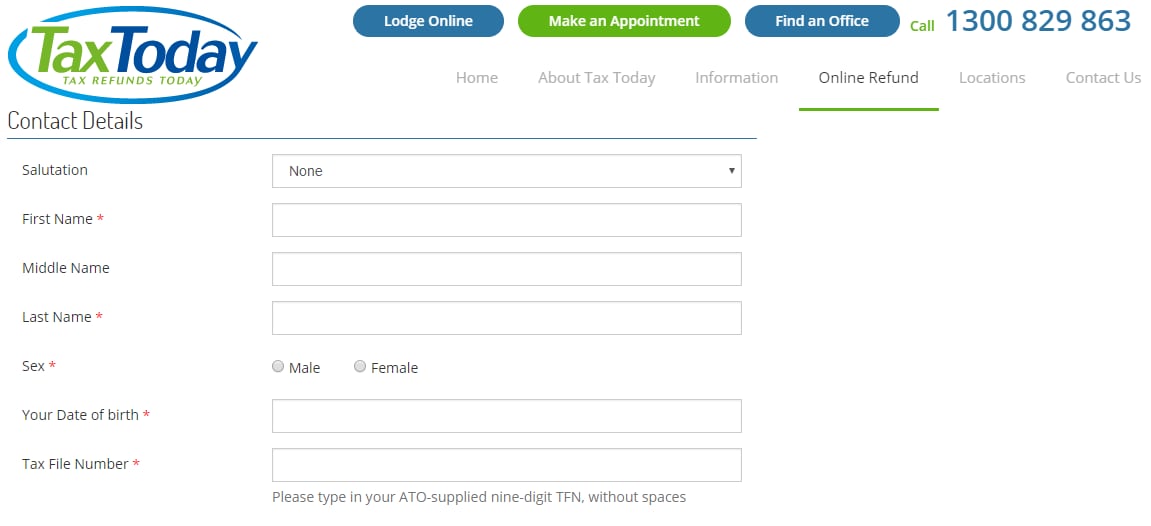

8. TaxToday Online Calculator

TaxToday is an income tax calculator that will help you estimate how big your refund will be or how much you owe the government. It is an up-to-date free tax refund calculator which applies to the last financial year that has ended. That means you can be able to file for your current tax return that is due. However, it is important to note that TaxToday calculations are just an estimate like some other online tax refund calculators but have some high level of accuracy because it calculates the same way as the ATO works out your refund. TaxToday tax calculator will request some information like the gross employment income, fringe benefits, and others.

Pros:

- Although it is just an estimate, the calculations are close to exact.

- Easy and simple to use.

Cons:

- Not widely used by people.

Warnings for Using Online Tax Calculating Service

- It is important to understand that these free tax calculators are just estimates. The amount of refund you get or the amount of money you owe may vary depending on the variety of different factors when you complete your tax return.

- Note that to find the total gross income and withholding amounts can be found when you add up the amount in your pay stub.

- You can use more than one tax calculator to verify your refund or the amount you owe. However, ensure that you supply the same information to each of these tax return estimators.

The tax refund calculators listed above have simplified tax calculations, making it easy for anybody to know his or her tax status in just a matter of a few clicks. Whether you get a refund or owe the government, you can use any calculator listed above to verify.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor