Home

>

Tax Refund Tips

> K-1 Tax Form: Fill it with the Best PDF Form Filler

Home

>

Tax Refund Tips

> K-1 Tax Form: Fill it with the Best PDF Form Filler

The K-1 tax form is a PDF document that can be filled electronically as a partner or beneficiary. Although, there are many form fillers available, the most recommended is Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement which is the easiest, safest for this task as we are going to see below

Your Best Solution to Fill out the K-1 Tax form

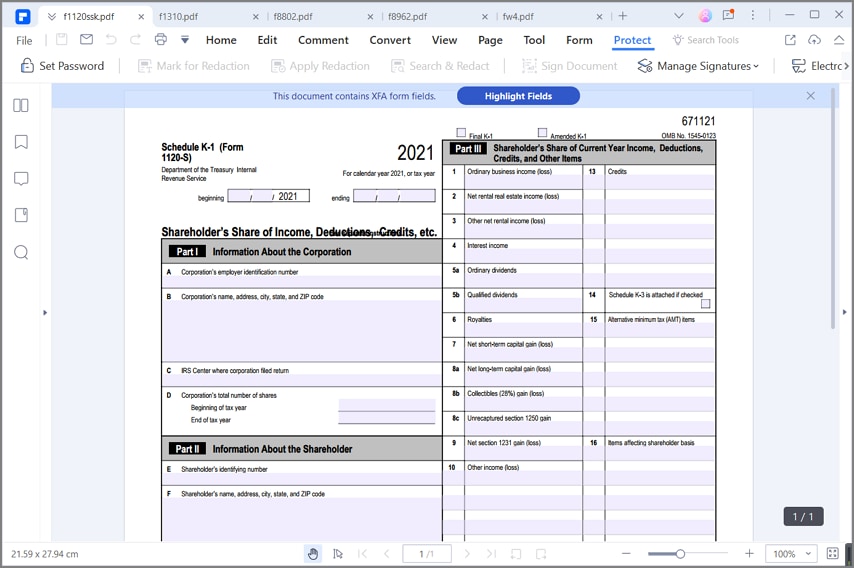

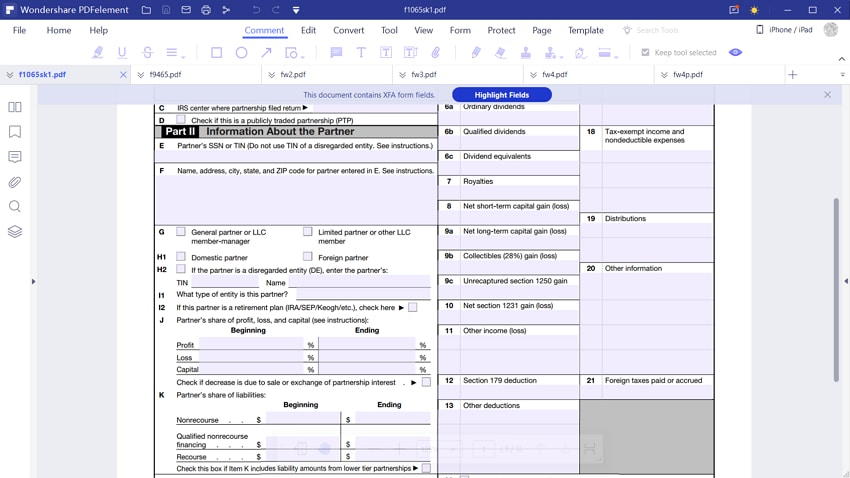

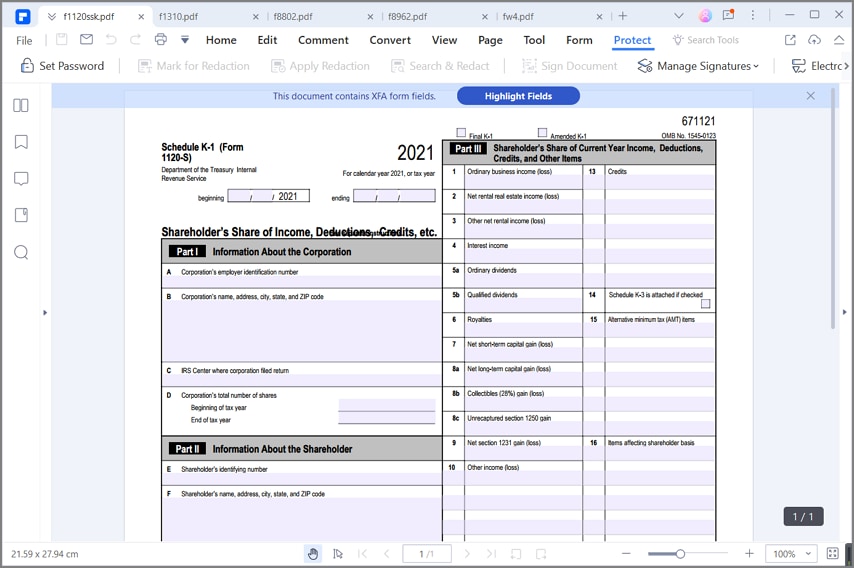

A K-1 tax form is a form issued by the Department of Treasury, Internal Revenue Service of the United States of America. It is used to record the information regarding the share of income, deductions, and credits for a beneficiary, partners, and shareholders.

To fill out your K-1 tax form, all you need to do is to open your tax form in PDFelement and fill it in using the software. It offers you the best platform where you can fill your tax form easily and efficiently. Apart from that, you can create, edit and sign off PDF forms using the program.

You can tick checkboxes, radio buttons, etc on your PDF using the program. PDFelement is supported by all the operating systems like Windows and Mac and it is easy to install and use. You have the option of saving your completed PDF file to your chosen destination, a rare feature when compared to other known form fillers.

Instructions on How to Complete the K-1 Tax Form

Filling the K-1 tax form is easy. However, it is important to follow instructions in order to fill them out correctly and accurately. All you need to do is to follow this easy step-by-step guide below.

Step 1: The easiest way to obtain the form is to download it online together with the instructions for filling it out. Open the form with PDFelement after you download it.

Step 2: Enter the beginning and ending date for the tax year.

Step 3: Fill in Part I which is the information about the estate or trust. In column A, write the identification number of the estate or trust employer. Write the name of the estate or trust name in Column B. Write the fiduciary name, address, city, state, and zip code in Column C. There are two checkboxes D and E. Check D if Form 1041-T was filed and enter the date in which it was filed and also check E if it is the final form 1041 for the estate or trust.

Step 4: Fill in Part II which is the information about the beneficiary. In column F, write the beneficiary Identification number. In Column G, write the beneficiary name, address, city, and zip code. Tick the appropriate checkbox on H for either a domestic beneficiary or a foreign beneficiary.

Step 5: Before starting Part III of the form, tick one of the checkboxes on top. It could be either final K-1 or amended K-1. Choose the appropriate one.

Step 6: Complete Part III which is the Beneficiary share of current year income, deductions, credits, and other items. In column 1, you are expected to write the interest income. The ordinary dividend and qualified dividend are written in Columns 2a and 2b. Write the net short capital; gain on Column 3, the net long capital gain on column 4a, the 28% rate gain on column 4b, and the unrecaptured section 1250 gain. Other portfolio and nonbusiness income, net rental real estate income, other rental income, should be written in columns 5,6,7, and 8. Fill in the directly apportioned deductions on column 9 and Estate tax deduction on column 10. Put your final year deductions on Column 11, alternative tax minimum tax adjustment on column 12, and credit and credit recapture on column 13. There is a space to add other information in column 14, use it and add any other necessary information.

Step 7: Crosscheck your information again and ensure that they are accurate and correct.

Tips and Warning for K-1 tax Form

- The form lists some codes used on the K-1 Tax form and provides summarized reporting information. Ensure you identify and follow the instructions for detailed information.

- As a beneficiary, it is important to note that you must report items shown on your K-1 tax form the same way the estate or trust treated the items on its return.

- In cases where you believe that the fiduciary has made an error on your scheduled tax form, you are expected to notify the fiduciary and request for an amended or corrected scheduled K-1 Tax form. On no account should you change any item on your copy. It is important to be sure that the fiduciary sends a copy of the amended K-1 tax form to the IRS. However, if you cannot reach an agreement with the fiduciary on the inconsistencies, you must proceed to file form 8082.

- This is a very important document of the Internal Revenue Service. You must ensure that all information filled on the form is correct without any form of ambiguity. It is important to note that you are responsible for the authenticity of the information should it be found wrong or incorrect.

- Filling your K-1 Tax form with PDFelement is safe and easy. It is just about opening the K-1 Tax form in the PDFelement platform and using the program to fill the form. You do not have to worry about printing out for manual form filling.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor