Home

>

Tax Refund Tips

> Check If You Need to File a Tax Return

Home

>

Tax Refund Tips

> Check If You Need to File a Tax Return

Does everyone need to file an income tax return? No, although the majority of people that are income earners have to file a tax return. To check if you need to lodge a tax return or receive a tax refund, you need to know your filing status, the total amount of income you made during the year and tax withheld, and others.

- Part 1: The Tool to Check If You Need to File a Tax Return

- Part 2: Key Standards for Filing a Tax Return

- Part 3: The Best Tax Form Filling Tool

Self-Assessment Tool For Tax Filing

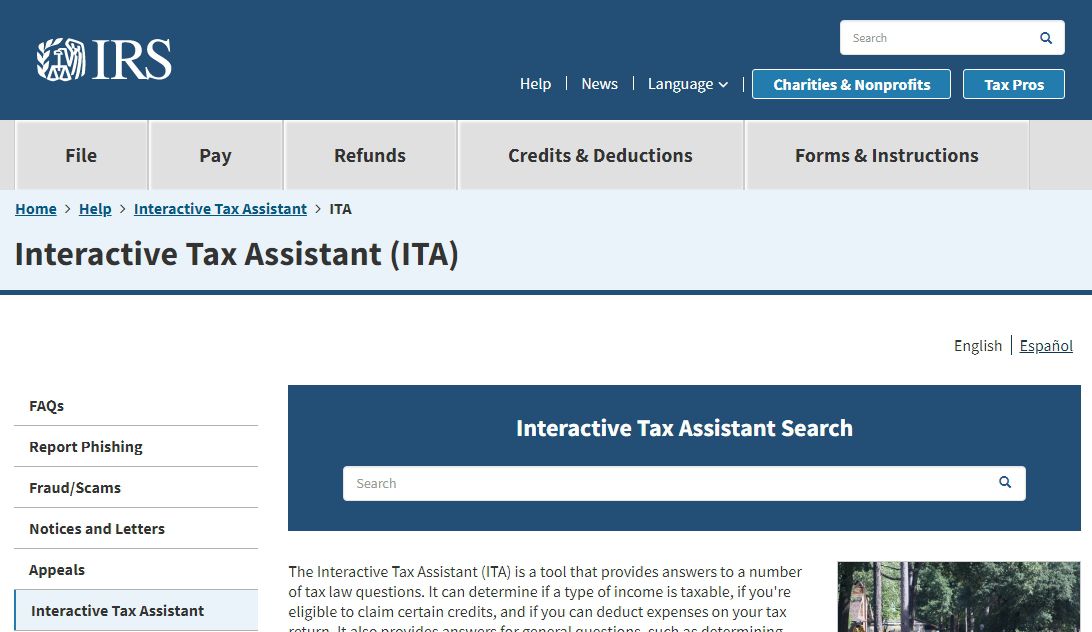

To check if you need to file a tax return, you should use the Interactive Tax Assistant, ITA. It is a self-assessment tool that helps you understand any tax issues that you are confused about or need further information on. ITA can help you get answers to questions such as the following:

- Am I eligible to receive certain credits?

- What type of income is taxable?

- Can I deduct expenses on an income tax return?

That is not all. The tool also offers general information on your filing status, if you are required to file a federal tax return, among others.

Key Standards for Filing a Tax Return

In addition to the afore-mentioned factors which will determine if you need to file a federal tax return, your marital status and age are also among the key standards. It is essential that you confirm your exemption status from filing to prevent a situation where you will fail to submit a return to the Internal Revenue Service, IRS.

Mostly, you are required to file an income tax return if any of these conditions are valid:

- Your home was sold during the tax year.

- You earned more than $400 (four hundred USD) from self-employment.

- You earned a gross income of more than $10,000 (ten thousand USD) as a single filer, or more than $20,000 (twenty thousand USD) for the case of (joint) filing as a married couple.

- Owing Social Security and Medicare taxes on any unreported tips to your employer, or on wages from which your employer did not withhold these taxes.

- Owing taxes as a result of your retirement account whether from excess contributions/distributions.

The Best Tax Form Filling Tool

Looking for a perfect alternative to Adobe Acrobat for filling tax forms? The solution lies in this app: Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. It is a tool with a range of features that make it easier, faster and smarter for you to fill PDF forms. With this software, you can design fillable PDF forms, export form data into Microsoft Excel, export data documents that have been scanned in portable document format and even create personal templates.

To determine if you need to file an income tax return, you have to know your filing status, marital status, gross income earned during the year, tax withheld, and so on. To get answers to any tax law questions you may have, you can utilize the Interactive tax Assistant, a self-assessment tool for checking the need for filing.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor