Home

>

Tax Refund Tips

> 4 Methods to File Your Income Tax Return

Home

>

Tax Refund Tips

> 4 Methods to File Your Income Tax Return

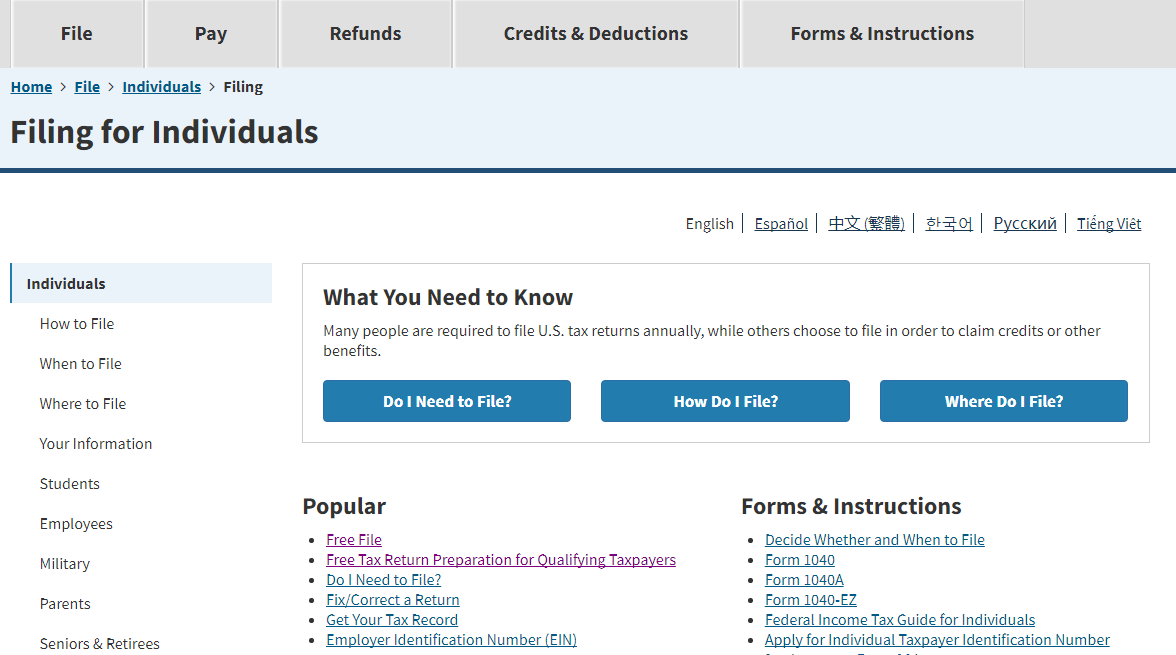

Filing taxes can be overwhelming to a lot of people but this need not to be so since there are several methods that can be used to file taxes. Whatever the method adopted, you still need to be adequately prepared which include gathering all the required documents and information. This article looks at 4 basic methods of filing income tax to the IRS.

Part 1. 10 Steps to File Your Tax

Filing an income tax return is necessary if you meet certain criteria for example, if your income is below an amount. It is important to note that taxes are paid through withholding from paychecks, payment made each year as you file your taxes as well as estimated tax payments. Therefore, if you are due for a tax refund, it then means that you must have to file a tax return to get a refund on income tax withheld or to claim a refundable tax credit. There are steps required to file a tax return as seen below:

Step 1. Confirm if you need to file a tax

The first step to take when it comes to filing a tax return is to Confirm if you need to file a tax. In most cases, you need to file a return if your gross income is over $10,000 as a single filer or over $20,000 as a couple filer, you earned over $400 from self-employed, you sold your home furing the tax year, or you owe taxes because of a retirement account, or you owe Social Security and Medicare taxes that were not reported to your employer.

Step 2. Gather Documents

Then you need to gather all the necessary documents like paper works and tax forms. This means that you must have known and obtained the necessary IRS form that you need to file. Some of these necessary documents include income statements and the W-2 form. In some cases, a proof of health insurance coverage may also be needed to file your income tax return. Other documents considered as supporting documents should also be obtained and this include things like interest statements, earning statements as well as evidence of charity donations like receipts. All necessary documents should be gathered and well organized in order to avoid mistakes and confusion when filing your taxes.

Step 3. Know your Status

You should know your filing status and this should be correct. To figure out your correct status, you have to factor in your household contribution to the cost of running the home as well as your marital status. Confirm you're filing as married or single.

Step 4. Check to Know if You Qualify For Free Tax Return Preparation

It is important to note that the IRS offer some tax return preparation help to some certain categories of people. Therefore, it is important to find out if you are among those group of people qualified for this service from IRS. For example, the elderly, people with disabilities, military service members, low income individuals and persons with limited ability in English are qualified for this free tax return preparation from IRS.

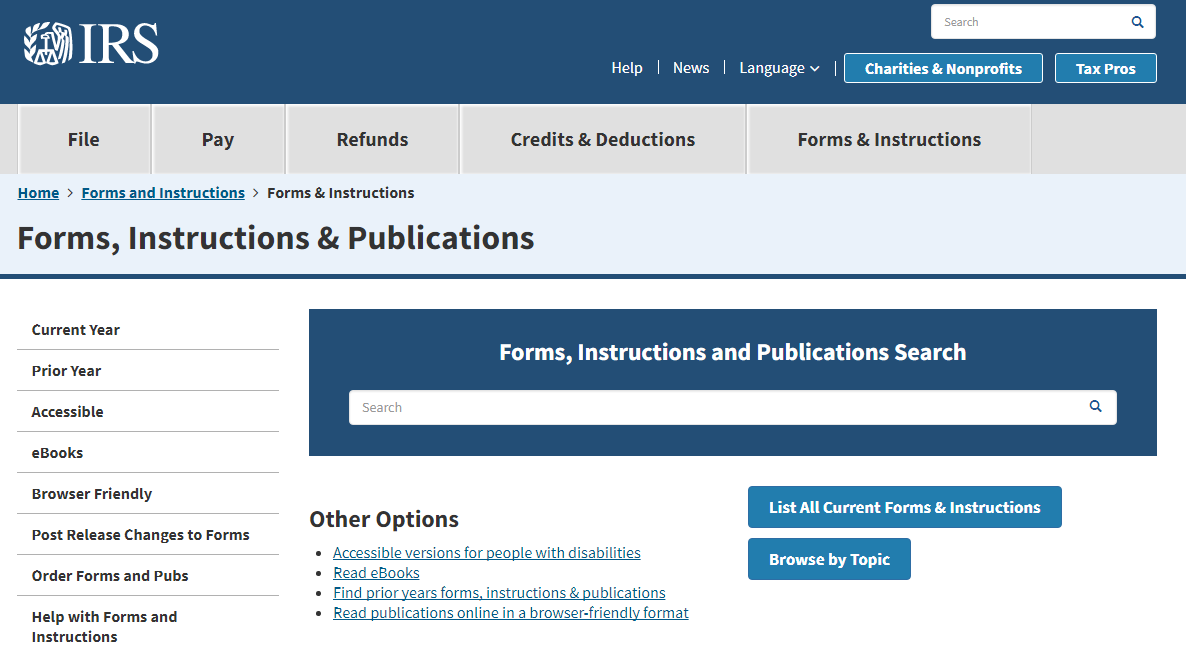

Step 5. Choose the Right Tax Form

There are several tax forms that can be used to file your taxes but it will all depend on the category of tax you are filing. It is important to choose the best tax form to file your taxes especially if you are filing it offline. However, you may not need to bother about getting the correct form if you are using the e-file option because the file you need will be determined by the system

Step 6. Figure Your Taxes and Credits

At this point, it is required that you figure out all your income from all sources like interest earned from investment accounts, salaries and pension accounts and see if you are due for credit and deductions like child care expenses and education.

Step 7. Claim Dependents and Exemptions

One very important step when filing out tax return is in the area of claiming dependents and exemptions. Not everyone is qualified to claim dependents and exemptions and that is why it is important to fully understand the rules guiding this to avoid mistakes. Claiming dependents involves claiming for a qualifying relative of child while exemptions would involve the deduction from taxable income of you and dependents

Step 8. Check to See if You are to Pay Quarterly Estimated Taxes

It is important to always find out if you are to pay taxes on certain incomes especially those are not really subjected to withholding. For instance, some of the income that can be classified in this category include dividends obtained, interests or self-employment. Tax payers are expected to determine this to ensure that they file their taxes correctly.

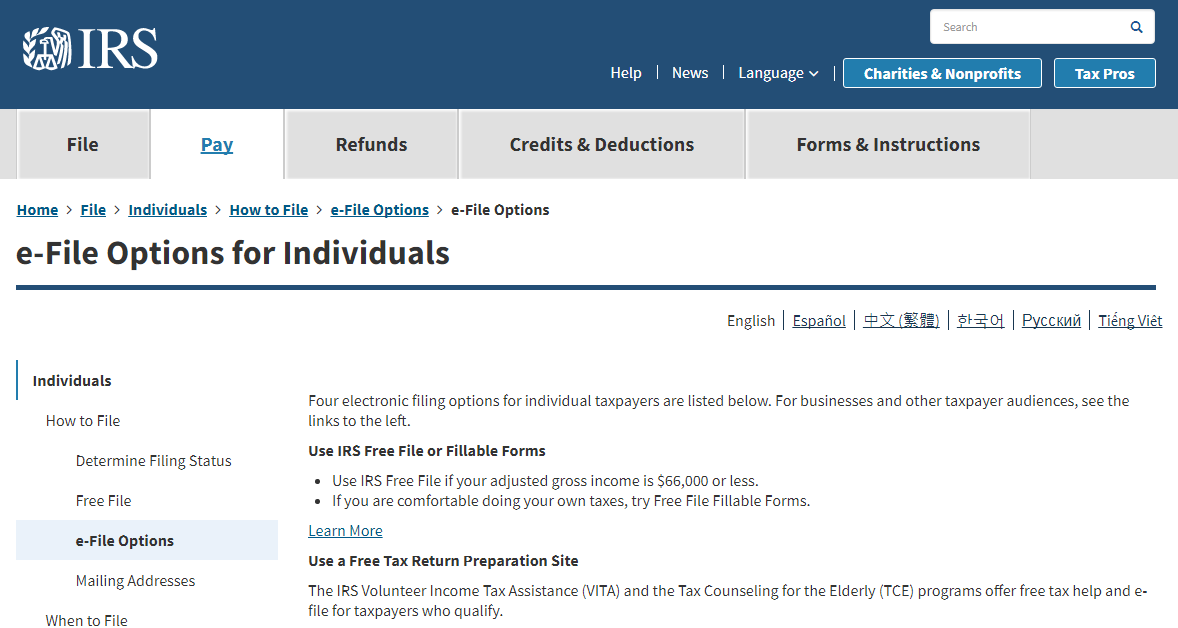

Step 9. Choose an Option to File Your Taxes

Tax payers can file their taxes using different methods and this would be decided by the tax payers themselves. The options available for filing taxes include filing online(by e-filing), using the paper tax form return(by Mail) or using the services of tax professionals or ask for help from the Volunteer Income Tax Assistance(VITA) and Tax Counseling for the Elderly (TCE) programs.

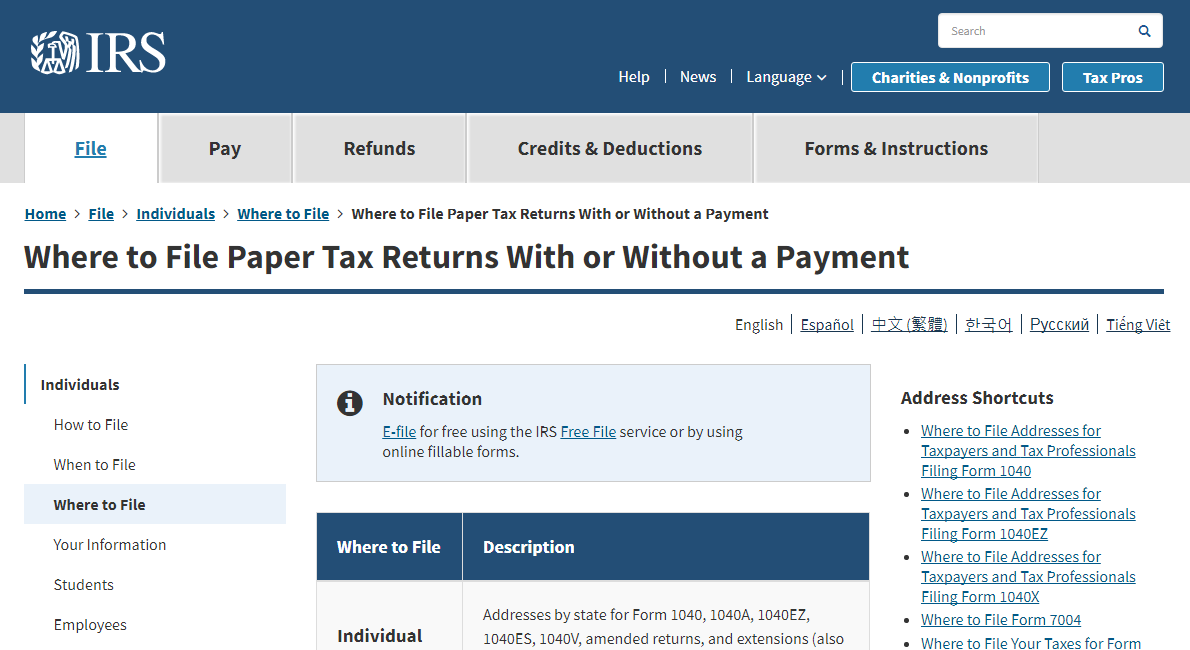

However, tax payers are not compelled to use any particular method rather they are encouraged to use the method that best suit them. This means that you need to check your needs and your situation to decide on which of these options to use. If you are using a paper method, ensure that you mail your paper return to the right address and if you are using a tax professional, ensure you choose appropriately.

Step 10. Contact IRS If Needed

If there is any need to get clarification on issues bordering on filing your taxes, do not hesitate to contact the IRS. You can call to get answers to your questions. However, note that you may require to wait for a long time in order to speak to a representative.

The deadline for filing tax return for this year's tax season is April 17, 2018 and tax payers should always keep this in mind. What this means is that you have to prepare and make sure it is done before the deadline to avoid penalties.

Part 2. 4 Methods to File Income Tax Return

1. Paper Filing

This is one of the oldest method of filing taxes. It involves the use of paper and pen in filling out printed tax forms and then mailing to the IRS. One thing about paper filing is that it may increase the risk of costly errors. When compared to e-filing, paper filing produces about 20% error rate as against 1% for e-filing. This is why IRS encourages the use of e-filing. In this case, you are to review your tax returns yourself, make calculations and check for missing information. However, paper filing requires that the tax payer mails their completed forms to the IRS through a certified mail.

2. E-Filing

E-filing is regarded as one of the best methods for filing taxes. In fact, using the e-filing method is one of the fastest way to get your due tax refund.It is not complicated if you know exactly what to do. What is required in e-filing is that you are expected to file your documents over the internet before the deadline. In e-filing, you are expected to type your information online and this include your banking information.

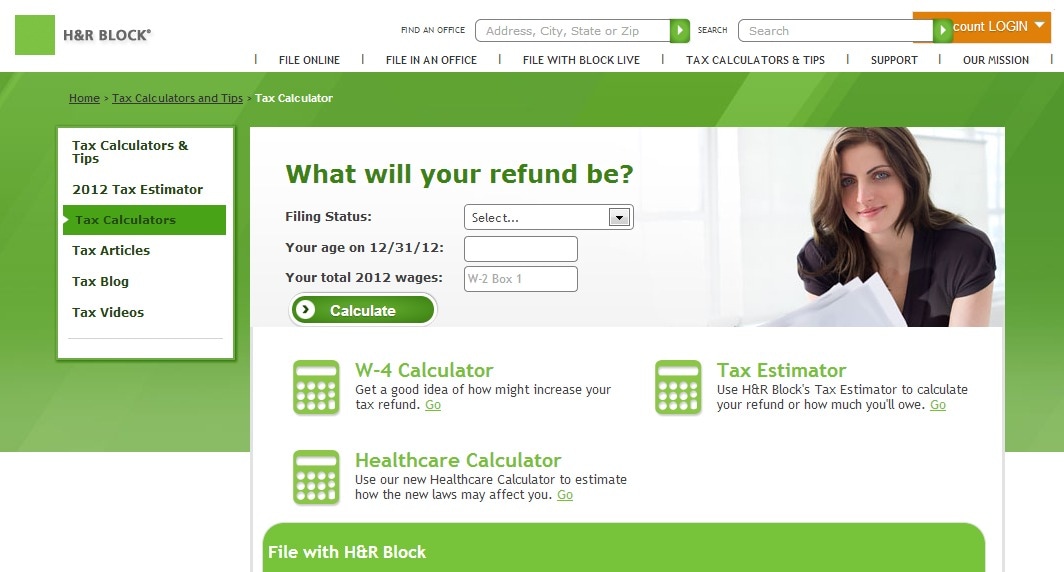

3. Tax Preparation Software

Another good way to file your tax return is by using tax preparation software. It is possible to get an affordable and IRS approved tax preparation software to help out in your tax situations. This software make a lot of sense especially where you have a complicated tax situation. There are reputable tax preparation software that you may consider and they include TaxSlayer, TaxAct, H&R Block and TurboTax. If you think that your tax situation may be complicated, it is best to use the tax preparation software to prepare your taxes.

4. Tax Professional

You have the option of hiring a tax professional to prepare your taxes. These professionals are armed with the knowledge and experience to help you out in a complicated tax situations. He/she may tax accountant or other professionals. However, the most important thing is to ensure that you choose a qualified and licensed tax professional to help in filing your taxes. Any professional you choose should be able to handle your taxes properly.

Part 3. Fill Your Tax Forms with PDFelement Form Filler

If you choose online filing, then you will need to fill out the tax forms which are PDF forms. It is important to note that PDF forms can only be filled with a special tool. Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement form filler is a special tool designed for filling out PDF forms including your IRS tax forms electronically. It gives you all the capabilities you need with all the editing and signing options. You can always save your online tax forms for printing or future reference.

The methods listed above can be used for filing your tax return. However, the choice of the method you want to use will depend on your own personal situation or how complicated your tax is. It is entirely your choice to use any method as IRS does not mandate tax payers to use a particular method.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor