IRS Form 4506-T: Filling it Made Easy by PDFelement

2024-05-22 13:36:15 • Filed to: Other IRS Forms • Proven solutions

IRS Form 4506-T is an important PDF form which can be filled electronically using form filler software. There are only a few you can use but the most recommended tool is Wondershare PDFelement - PDF Editor. It is the finest and the best solution to filling up a PDF form which has become a crucial part in our daily life.

Your Best Solution to Fill out IRS Form 4506-T

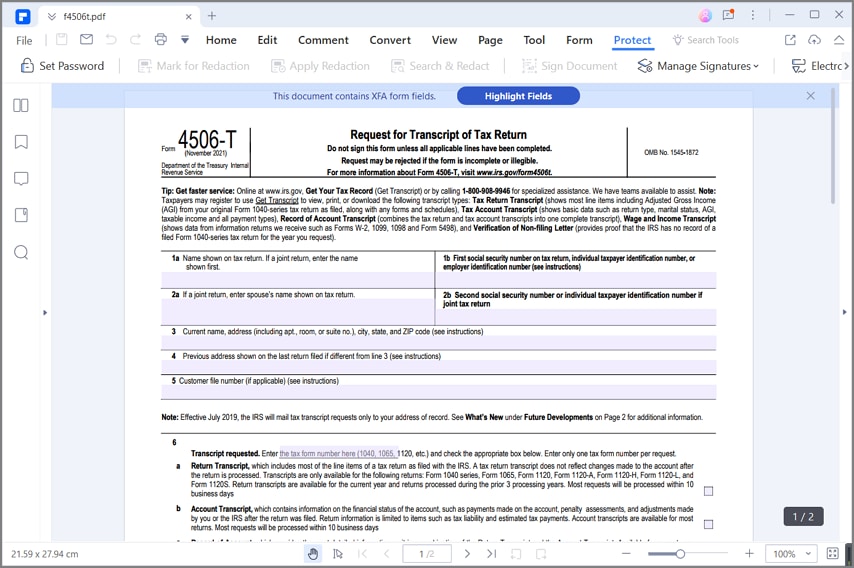

You can use IRS Form 4506-T to avail a transcript of tax return. IRS Form 4506-T is 'Request for Transcript of Tax Return' the circulation and amendment of these forms is regulated by the Internal Revenue Service of United States of America.

This form can be completed utilizing the finest PDF tool named PDFelement. It allows you to create, split and, merge PDF documents rapidly and easily. This program in addition to form filling allows you to alter the text, apply digital signature and watermark to a PDF file.

You just need to download the IRS Form 4506-T from the official website of Internal Revenue Services and open the form in PDFelement and start filling it. PDFelement is quick, straightforward and easy and can be used by any beginner level user.

Instructions for How to Complete IRS Form 4506-T

The following steps given below will assist you on how to complete the IRS Form 4506-T.

Step 1: You can download the IRS Form 4506-T the official website of Department of the Treasury, Internal Revenue Service or just search for it on any search engine. Open the IRS Form 4506-T in PDFelement.

Step 2: Start filing from line 1a, by entering the name shown on tax return, if it is a jointly filed then you must enter the name shown first. On line 1b, enter the first social security number on tax return. If it is joint return, enter spouse's name shown on tax return on line 2a. Enter the Second social security number on tax return on line 2b. On line 3, enter the Current name, address, city, state, and ZIP code. On line 4, enter the previous address shown on the last return filed if, it is different from line 3. Enter the details like name, address, and telephone number, if tax information is to be mailed to a third party on line 5.

Step 3: Enter the transcript number requested on line 6. You must remember that you should enter only one tax form number per request. You can easily check the boxes from 6a, 6b and 6c which are is titled as Return transcript, Account Transcript, and Record of account. The transcript talked about on line 6a includes most of the line items of a tax return as filed with the IRS. On line 6b, the transcript requested contains details on the financial status of the account, such as payments done by the account, penalty assessments, and adjustments made by you or the IRS after the return was filed. The transcript mentioned on line 6c provides the most detailed information as it is the combination of the Return Transcript and the Account Transcript which can only be available for current year and 3 prior tax years.

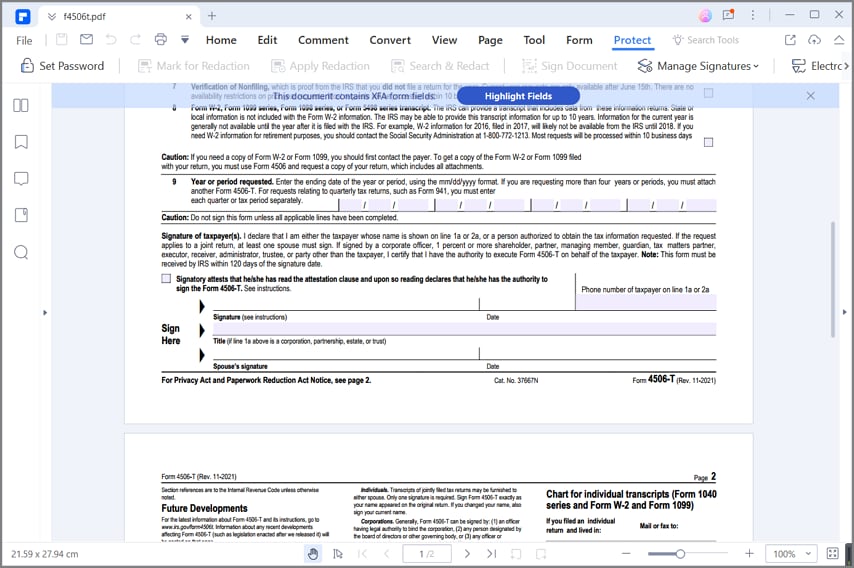

Step 4: You can select Verification of Non-filing, which is proof from the IRS that you did not file a return for the year on line 7. On line 8, you can select Form W-2, Form 1099 series, Form 1098 series, or Form 5498 series transcript if needed. You can also select Year or period requested, by filling in the date and year of the tax periods by checking on line 9.

Step 5: At the end of the form you must provide signature date and other necessary details to declare that all the information provided are true correct and complete. This is how you fill-up the IRS Form 4506-T by using a professional PDF form filling tool named PDFelement.

Tips and Warnings for IRS Form 4506-T

- If you are willing to mail the tax transcript to a third party, make sure that you have filled in lines 6 through 9 before signing at the end of the form. You can limit the third party's authority to disclose your transcript information by specifying these limitations in your written agreement with the third party for ensuring your information remains confidential.

- In any case if you need a copy of Form W-2 or Form 1099, first of all you must contact the payer. In order to get a copy of the Form W-2 or Form 1099 filed with your return, you should utilize IRS Form 4506-T and request a copy of your return, which includes all attachments related to the form.

- The transcripts of jointly filed tax returns may be provided to either spouse if there are more than one. But only one signature is required. You must Sign Form 4506-T just as your name appeared on the real return. For any reason if there is a change in your name you must also sign with your current name.

- Make sure the figures you are providing are true, correct and complete. The information about your requirements will be confirmed by the Internal Revenue Service. If any information related to IRS Form 4506-T form has false information you can be penalized.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Margarete Cotty

chief Editor