IRS Form W-3: How to Fill it With the Best Form Filler

2024-05-22 13:36:15 • Filed to: Other IRS Forms • Proven solutions

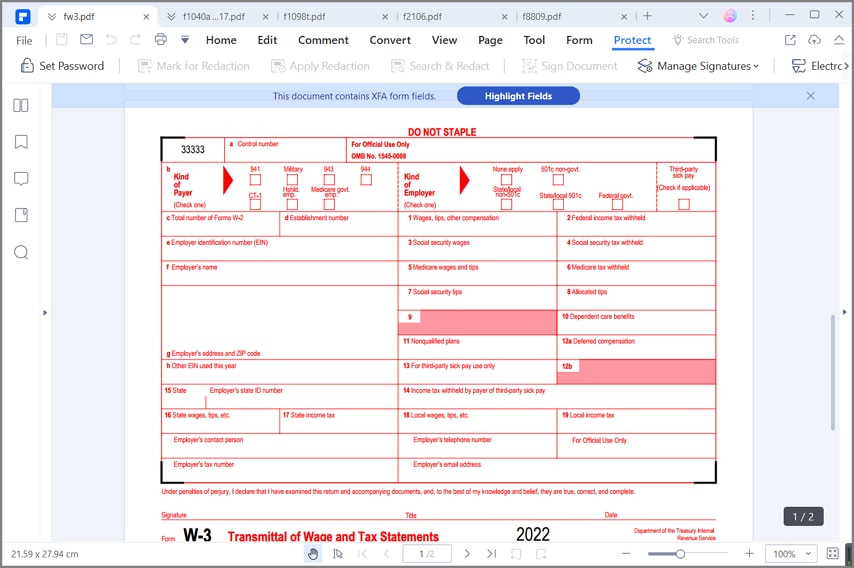

IRS Form W-3 is titled as Transmittal of Wage and Tax Statements which is submitted if and only if the copy A of form W-2, wage and tax statement is being filed.

Your Best Solution to Fill out IRS Form W-3

You can easily fill up IRS Form W-3 using Wondershare PDFelement - PDF Editor, which is a preferred tool by any advanced level user. It supports the most used operating systems like Windows and Mac OS. It has all the essential features required in a complete and all-round PDF tool.

PDFelement can edit, create and also separate PDF files. The form filling is just a basic function of this program which is actually intended to do much more professional tasks. You just have to download the IRS Form W-3 and start filling it straight away using PDFelement.

Instructions for How to Complete IRS Form W-3

The following steps given below will guide on how to complete the IRS form W-3

Step 1: You can get the IRS form W-3 from the official website of Department of the Treasury, Internal Revenue Service or you can simply search for IRS form W-3 in Google. Open it using PDFelement after installation is completed.

Step 2: It is written "Do not staple" at the top of the form you must not staple unless said to before filing IRS Form W-3. On the top of the IRS form W-3 fill up the first blank field by writing the control number, which is indicated as 'a'. The form has two columns one named as 'Kind of payer' and the other named as 'Kind of employer'.

Under 'Kind of payer', on field 'b', you have to select the appropriate option that applies to you. On field 'c', write the number of W-2 forms you have filed. For field, 'd' and 'e' enter the establishment number and employer identification number (EIN) respectively. Enter the employers name and address on field 'f' and 'g' respectively. The other used EIN number for this year must me entered on field 'h'.

Step 3: Now move to the right column under 'Kind of employer'. Here the lines are numbered, on line 1; enter the amount of Wages, Tips and other Compensations. For line 2, enter the amount of Federal income tax withheld. Enter your Social security wages on line 3. On the next line, line 4, enter your Social security wages withheld. The amount of Medical wages and tips must be entered on line 5. On line 6, enter the amount of Medical tax withheld. For line 7, enter the appropriate amount of Social security tips. On line 8, enter the amount for allocated tips.

Line 9, must be filled carefully by following the instructions on the other forms like Form W-2. On line 10, enter the amount of dependent care benefits appropriately. On line 11 and 12a, enter the amount of Non-qualified plans and deferred compensation respectively. Like line 9, line 12b also smut be filled by reading the instructions properly if it applies to you. For line 13, enter the amount appropriately for third-party sick pay use only. On the next line, line 14, enter the amount of Income tax withheld by payer of third-party sick pay correctly.

Step 4: On line 15, which is under the Kind of payer section, enter the name of state and Employer's state ID number. Enter the amount of State wages, tips, etc. appropriately on line 16. For line 17, enter the exact amount of State income tax and on line 18, enter the amount of Local wages, tips, etc. On the last line, line 19, enter the Local income tax.

Step 5: After you have finished entering all the amounts to be submitted, enter you're the personal details if you are an employer. The first detail you need to fill up is the Employer's contact person and Employer's telephone number. Employer's fax number and Employers email address must me entered below the form. At the bottom of the page, the individual must provide signature and date to assure all the details are correct, true and complete. This is how you fill up and IRS form by entering all the details using Wondershare PDFelement.

Tips and Warnings for IRS Form W-3

- You must not file IRS Form W-3 alone, it must be submitted with all the forms which comply with IRS standards and readable by machines.

- Make sure you don't just fill up the form by making a photocopy of it. You must use the IRS W-3 only if one IRS Form W-3 is being submitted.

- Make sure not to use the blank field reserved for official use, all your hard work will become useless. The forms must be filed by completing all the required information, otherwise there is a high chance that your submission will be rejected

- The IRS insists to preserve the forms for at least four years, since the information of the previous year is carried out in the next year and so on.

- The most important tip will be to use a professional tool to fill up the IRS Forms using a professional tool like Wondershare PDFelement, since the filling process is very crucial for every individual.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Margarete Cotty

chief Editor