It is the time of the year when everyone has to file their taxes. Suppose you have hired nonemployees to do services for your business. Or, you paid an individual or an entity some miscellaneous fees like rent or healthcare payments. You have to send them a Form 1099. So, how to send a 1099 Form to someone?

This article will answer that and many other related questions. For example, we'll briefly discuss how Wondershare PDFelement has become one of the best tools for 1099 Form management. It offers the two features you want: a secure Share feature, and an Encrypt feature.

In this article

Part 1. How To Send a 1099 Form to Someone?

First, we should ask, "Who should receive a Form 1099?" More than that, you need to determine if you really need to send one. You should only do so if you own a business and you paid other entities $600 or more within the tax year. These entities must not be under your company; in other words, they must be nonemployees.

Please remember that there are different types of Form 1099. There is Form 1099-MISC, Form 1099-NEC, and Form 1099-K. Most people do not have to worry about the last one. So, let us discuss Forms 1099 NEC and 1099 MISC.

When Do You Need To Send Someone a Form 1099 MISC?

You need to send someone Form 1099 MISC if you made payments that are not for nonemployee compensation. This includes rent for space and equipment, healthcare payments, services of attorneys, royalties, and awards. Furthermore, you need to send a Form 1099 MISC if you make direct sales of $5,000 or more of consumer products to a buyer for resale. But the sale must happen anywhere other than a permanent retail establishment.

When Do You Need To Send Someone a Form 1099 NEC?

You need to send someone a Form 1099 NEC if they are not your employees, but you paid them $600 or more within the tax year. Who could those people be? They could be construction workers, handymen, freelancers, consultants, and more.

How To Send Form 1099 to an Independent Contractor?

If you have to send a Form 1099 to someone, here's your guide to sending someone the form. Like with sending Form 1099 to the IRS, there are two methods. You can send them a printed copy through mail or electronically through an e-file service.

If you choose to send a printed copy, simply send it to your mail. If you followed standard procedures, you should have a W-9 form that tells you their address and contact number.

On the other hand, it should be automatic if you have used an e-file service. But let us say that they did not receive the Form 1099 you issued and have sent you a request. They want you tto resend the copy. You can send it through email. But remember to prioritize security. Here's a way to do it:

- Choose a trustworthy email service provider.

- Encrypt the Form 1099 and send it to your recipient.

- In a follow-up email, send them the password for unlocking the file.

Part 2. Wondershare PDFelement: A Reliable Tool for Sending Someone a Form 1099

Wondershare PDFelement allows you to share PDFs securely. That said, this tool is one of the best for sending someone a Form 1099. On top of that, you can use it to view your submitted 1099 Forms and even print them.

Here is a guide on how to send a Form 1099 to someone using Wondershare PDFelement.

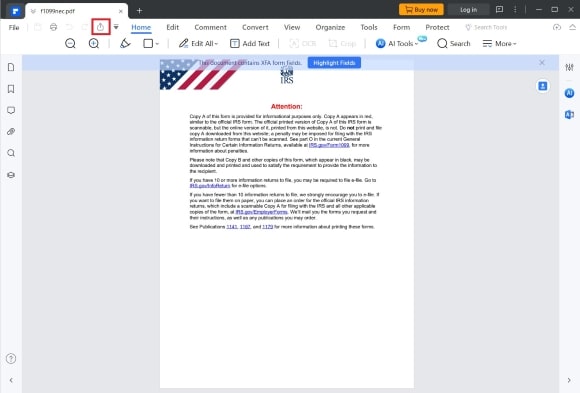

- Open the Form 1099 you need to send using Wondershare PDFelement.

- Click the Share button on the top left of the screen.

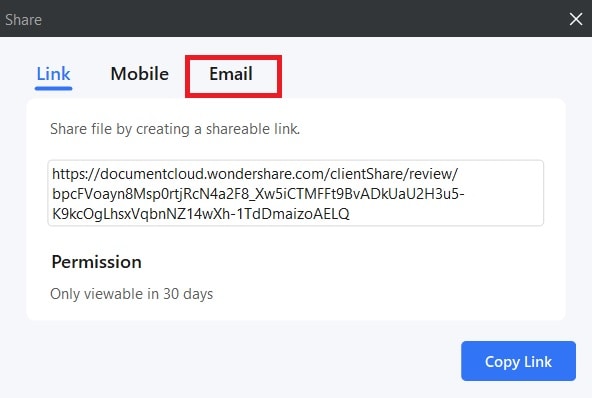

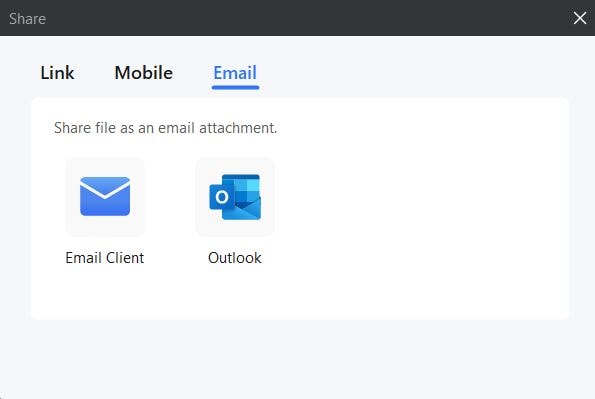

- Click Email.

- Select between Email Client and Outlook.

- Send your email.

Bonus: How To Password-Protect Form 1099 Before Sending It

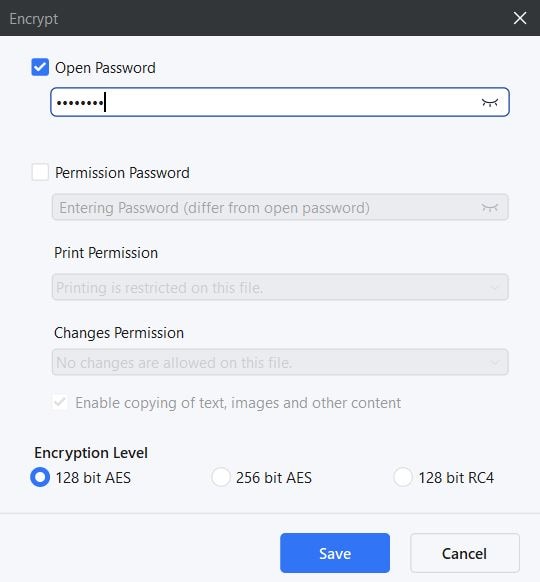

We mentioned that, for security measures, it is good practice to lock a Form 1099 before sending it. You'd be happy to hear that Wondershare PDFelement also has an Encrypt feature that lets you set passwords.

Here is how to use this tool:

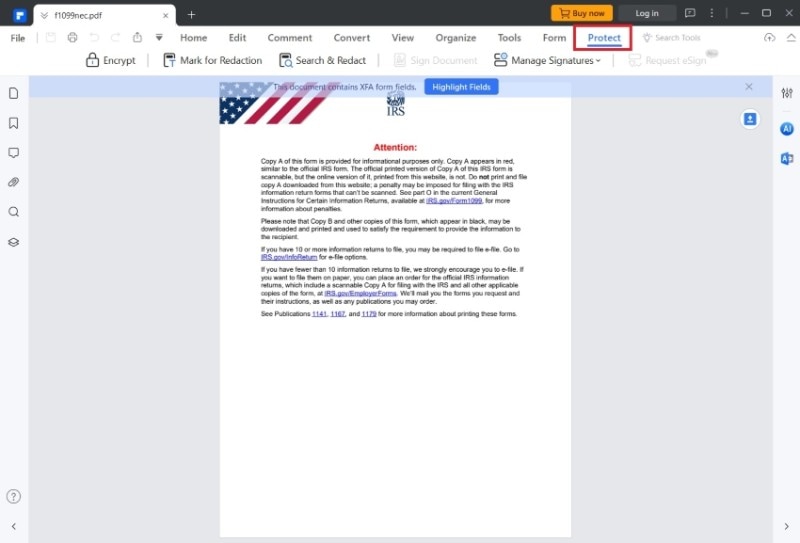

- Open the Form 1099 that you need to send with Wondershare PDFelement.

- Go to the Protect tab.

- Click Encrypt.

- Check Open Password and enter a password.

- Click Save.

Part 3. How To Send Form 1099 to the IRS?

While we are here, let us also discuss how to send a Form 1099 to the IRS.

For sending printed copies through US mail, please note that the address to send 109 changes depending on your location. So always check their website to get the correct IRS address to send 1099 forms.

For filing digitally, you really do not need to know the address. As long as you are using an IRS-approved e-filing service, the Form 1099 you submitted will reach them.

Conclusion

It is important to send your contractors that you paid $600 or more a copy of Form 1099. It's as important as filing them to the IRS. Just to refresh, "How to send a 1099 Form." If using snail mail, check their address on the W-9 form. If you filed electronically, it should be automatic.

In some instances, when e-filing, your payee may not receive the copy that you sent. Thankfully, you can do it manually. You can use a secure tool like Wondershare PDFelement to send them a copy through email. It is a must to use a secure tool like this because 1099 Forms are sensitive documents. Besides its Share feature, Wondershare PDFelement also offers an Encrypt feature. Use this to password-protect your Form 1099 before sending it through email.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure