PDFelement-Powerful and Simple PDF Editor

Get started with the easiest way to manage PDFs with PDFelement!

If you're a student, you're probably in the thick of paying for expenses, so your money management skills are vital. Fortunately, there are ways to manage your money, so you don't waste it on frivolous things. Student finance apps help you keep your finances in check.

With the right budgeting app for students, you can track spending and savings and control your finances at all levels, even on the go. Keep reading and eliminate your financial stress with these budgeting apps for students.

Making the Right Choice: A Comparison of Student Finance Apps

Invest in your financial future with these seven student money-saving apps. Check out this table below for a glimpse of each app-supported operating system, price rates, rating, and use cases.

Mint |

Wally |

Wallet: Budget Expense Tracker |

Moneybox |

Money manager & expenses |

MyMone |

Goodbudget |

|

| Best for | Students with multiple finance accounts | Students with shared finance accounts in different currencies | Students who prefer a combination of manual and automated money management app | Students who want to save and invest simultaneously | Students who understand visual charts better as part of managing finances | Students with minimal financial movement. | Students who like organized financial reports. |

| Basic Access Pricing | Available | Available | Available | Available | Available | Available | Available |

| Premium Access Pricing | Mint Premium 4.99 USD monthly | Wally Premium for Life for 74.99 USD | Wallet Premium starts at 5.39 USD, billed monthly. | N/A | N/A | MyMoney Pro is a separate app for 85 PHP or around 1.56 USD | Goodbudget Plus starts at 8 USD per month |

| Supported Operating System |

· Web browser · Android · Windows · macOS · iOS 13.0 or later |

· macOS 11.0 or later · iOS 11.0 or later |

· Web browser · Android · macOS 11.0 or later iOS 14.0 or later |

· Android · iOS 13.0 or later |

· Android · macOS 11.0 or later · iOS 11.0 or later |

Android |

· Web browser · Android · iOS 13.0 or later |

| Rating on Google Play | 4.3 out of 5 stars | N/A | 4.6 out of 5 stars | 4.4 out of 5 stars | 4.8 out of 5 stars | 4.8 out of 5 stars | 4.3 out of 5 stars |

| Rating on Apple App Store | 4.8 out of 5 stars | 3.9 out of 5 stars | 4.6 out of 5 stars | 4.8 out of 5 stars | 4.9 out of 5 stars | N/A | 4.7 out of 5 stars |

Our Top 7 Student Budgeting Apps

A student finance app can be tricky to pick. These best student budgeting apps will help you stay on top of your finances.

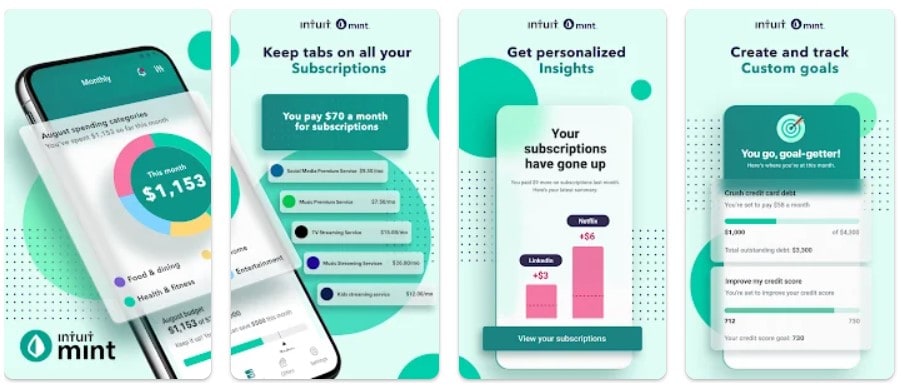

Mint

Mint is a free budgeting app for students that provides you with your net worth, budget, and credit score for each of your accounts in one app.

Pricing

Here are the price rates to access the Mint app.

- Mint is accessible for free.

- Mint Premium costs 4.99 USD monthly only for iOS users.

Pros

A minimalist user interface makes it easier to navigate around the app.

All your financial reports are in one place: income, debt, savings, and investments.

Notifies you whenever your subscriptions grow or bills are due, like student loans.

Automatically categorizes your transactions.

Presents tailored insights on your budgets and net worth spending to suggest savings possibilities.

Cons

Mint Ad-free subscriptions are no longer available to users. Ad-free will be enabled solely for existing Ad-Free clients.

Mint Premium offers you extra features like better data visualization. But right now, only iOS users get this feature.

Rating

Check these ratings to see the number of users trusting Mint on different devices.

- 3 out of 5 stars with over 204,000 reviews on Google Play.

- 8 out of 5 stars with over 764,900 ratings on the Apple App Store.

Review

With Mint, you can track expenses, save more money, pay student loans, and check your credit score for free from one place. Despite in-app advertisements, this app is one of the best student budgeting apps because its intuitive user interface prevents ambiguity.

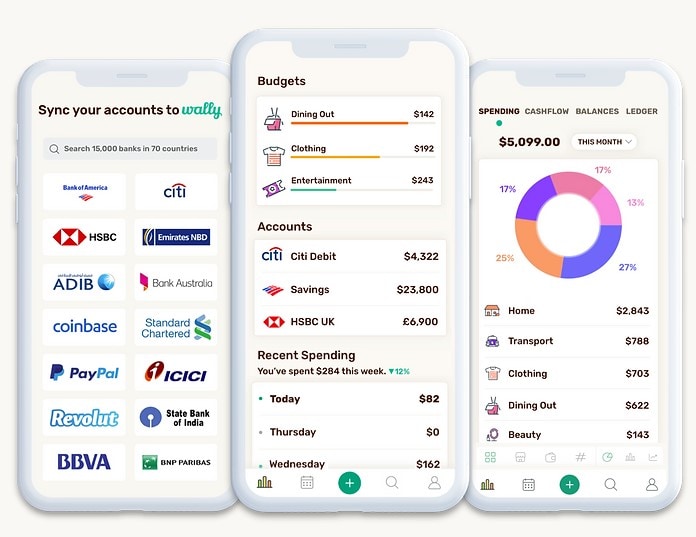

Wally

Wally is a centralized student finance app that keeps track of shared finances with family and colleagues better than ever.

Pricing

Here is what it costs to use Wally basic or premium.

- Basic features are available to users for free.

- Get Wally Premium for Life for 74.99 USD to experience features such as joint accounts, currency conversions, and unlimited insights.

Pros

You can maintain a custom budget for daily expenses like food, entertainment, and the house.

Keeps you loop with account balance updates and auto-categorized transactions.

Offers scan and upload invoices, receipts, and warranties to always have them with you.

Deals with 200 plus currencies to make it simple to keep track of and convert all your overseas transactions. It gives you a breakdown of your spending by currency.

Cons

Limited access to Wally since it is only available for Apple devices.

Users who prefer may not like the colorful interface of Wally since it uses different colors per category of your budget.

Rating

3.9 out of 5 stars with over 1,600 ratings on the Apple App Store.

Review

Among the best student money-saving apps, Wally lets you do more practical and realistic budgeting. You can digitally store your receipts and other paper trails of your expenses in the app. It is also a good budget application for students who want to collaborate with other users and learn from their money management skills.

Wallet: Budget Expense Tracker

One of the best all-in-one money budgeting apps for students, Wallet: Budget Expense Tracker helps students achieve their savings goals.

Pricing

These prices get you access to Wallet: Budget Expense Tracker by BudgetBakers.

- Access to basic features is free.

- Wallet Premium starts at 5.39 USD, billed monthly.

Pros

You control the decision-making process with it. Also, as it learns from you, it delivers just what you need.

BudgetBakers never sells consumer information to third parties.

You can add as many banking statements as you want in any currency.

Easily monitor your total cash flow patterns and create projections while regularly doing it.

Cons

Goal progress can't be automatically updated because it has limited categories and subcategories.

Budgeting is only manually possible in the free version, which takes a lot of time.

Rating

- 6 out of 5 stars with over 270,000 reviews on Google Play.

- 6 out of 5 stars with over 3,700 ratings on the Apple App Store.

Review

Students willing to pay extra for more features like advanced reports and charts, unlimited bank account syncs, and multi-user collaboration will love Wallet app. Nevertheless, if you only need to perform the basics, it may still make it one of the best student budgeting apps.

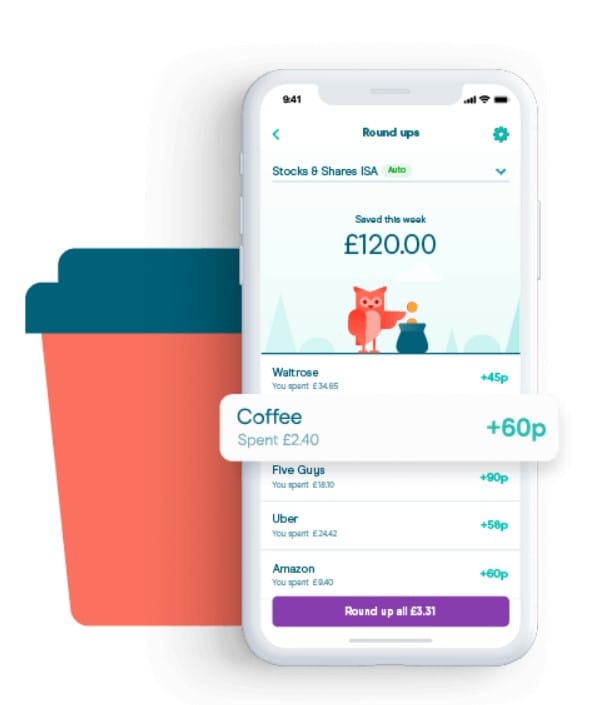

Moneybox

Moneybox is not only one of the best budgeting apps for students since you may quickly create a savings or investment account from the convenience of your smartphone.

Pricing

Moneybox price rates are here for beginners.

- You only need one pound to start making one-time deposits.

- The minimum payment for recurring weekly subscriptions is 2 pounds every week.

Pros

The Moneybox Stocks & Shares ISA lets you buy US equities and funds.

Alternatively, until you are ready to invest it, you can add money as Available Cash and earn 3% AER (variable).

With a linked payment method, the app rounds up every purchase to the next pound, and the extra charge goes to your brokerage account.

Cons

Moneybox is presently only accessible in the UK, which means it isn't available to US citizens (including dual citizens) or anyone paying US taxes; thus, if you moved to the States, your Moneybox account would have to be deactivated.

Rating

- 4 out of 5 stars with over 12,700 reviews on Google Play.

- 8 out of 5 stars with over 37,500 ratings on the Apple App Store.

Review

When it comes to the investment of money, micro-investments stand out for their clear financial benefits and low risk. You need a budget student app that helps you invest on a budget without putting too much liability on you. Moneybox encourages students to invest while building their habits of saving. Despite its limitations, it gives you an intuitive interface, automated data, and security.

Money Manager & Expenses

Money Manager and Expenses tracker, budget, and wallet may help you obtain control over your finances with personalized designs.

Pricing

Users can use Money Manager & Expenses for free with ads.

Pros

Automatically calculates your outstanding balance and produces a visual representation of your financial behavior.

Customize or use pre-made templates for expenditures like groceries and electricity bills, for example, or make your categories.

Recognizes several currencies and displays currency rates instantaneously, making it convenient to use while traveling overseas.

Allows you to set reminders for recurring fees such as credit repayments.

Cons

Cash flow doesn't come with a detailed or advanced report.

No bank account integration, so you can't link your different debit or credit accounts.

Rating

- 8 out of 5 stars with over 239,000 reviews on Google Play.

- 9 out of 5 stars with over 944 ratings on the Apple App Store.

Review

The Money Manager and Expenses tracker has a simple user interface suitable for students who are visual learners. And if you are one, you need a budget student application such as Money Manager & Expenses that allows you to assign your preferred colors and icons for your expenses and income. Although it lacks investing or predicting features, it can support multiple currencies and lets you download your accounts in Excel.

MyMoney

MyMoney is an easy-to-use, configurable spending organizer accessible offline.

Pricing

Here are the prices to access MyMoney.

- MyMoney app is open for free.

- Additional features are accessible on MyMoney Pro for 85 Php or around 1.56 USD, which is a separate app, not a subscription.

Pros

The free plan supports multiple currencies like USD, AUD, and Bitcoin.

Allows backup and restore files as a single backup file.

The free version offers a pie chart for reports like expense overviews, income overviews, and account analysis.

Cons

Features like more icons, input in widgets, and passcode protection only come with the upgraded plan.

It lacks advanced features like money-saving tips.

Rating

4.8 out of 5 stars with over 11,600 reviews on Google Play.

Review

Managing your money on the go is vital. MyMoney allows you to track your daily expenses, stay within your budget, and make smarter choices that save you money. Despite not having recurring payment tracking, it is easy to navigate within the app, just like other student money-saving apps. This application suits students with minimal cash flow changes.

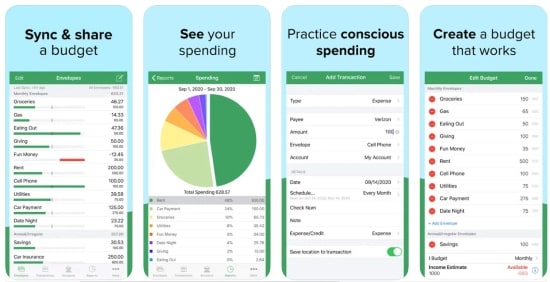

Goodbudget

The envelope budget approach is the foundation of the home budget software Goodbudget.

Pricing

The following are the prices for using Goodbudget as a free or premium user.

- Access to basic features is free.

- Goodbudget Plus includes unlimited regular envelopes, unlimited accounts, and email support for 8 USD per month.

Pros

It is easy to schedule expenses, transfers, and income.

Offers to track credit card bills and loans you are trying to settle.

Get cash flow reports and graphs like spending per envelope, debt progress, and budget allocation.

Enables importing your banking activities to create new records from the uploaded file or match it from your existing data.

Cons

Consider Goodbudget's disadvantages before using it instead of other student money-saving apps.

Limited to manual log-in or import of your bank transactions, it doesn't yet allow automatic or real-time syncing of your bank accounts.

Restricted customer support access if you have questions, although you can check community support.

No available tips or advice on how to better handle your finances.

Rating

- 3 out of 5 stars with over 19,200 reviews on Google Play.

- 7 out of 5 stars with over 12,700 ratings on the Apple App Store.

Review

Although Goodbuget has less functionality, the free edition enables you to try the app's most useful functions without paying any money. It can create financial reports based on your needs, including budget allocation, in contrast to other student budgeting apps.

Since this software utilizes an envelope system, it also works well for students who wish to be more organized with their money transactions. Due to its availability across various devices, Goodbudget may be accessed by students from any location.

How to Make Use of Budgeting Apps for Students?

The best student budgeting apps aid with money management, not encourage you to spend more. Before you commit any money, use applications that provide a free trial. To plan your next move before you spend money, you can use a budget student app offering money management advice or projections.

You can prevent late payments by setting up due dates or low-balance alerts. Stick to the budget you've established for yourself. Additionally, even if a budgeting tool is appropriate for your requirements, it could not work for you unless you confront your bad financial habits.

How to Create a Budget While in College to Save Money?

Your net income is a crucial component of your budget since it establishes the ceiling on how much you may spend. Next, group your spending, such as food, student loans, and rent. Decide how much you want to save each month, and then alter your spending by giving up or reducing habits you can no longer afford. Put money away for future investments as well if you earn additional money.

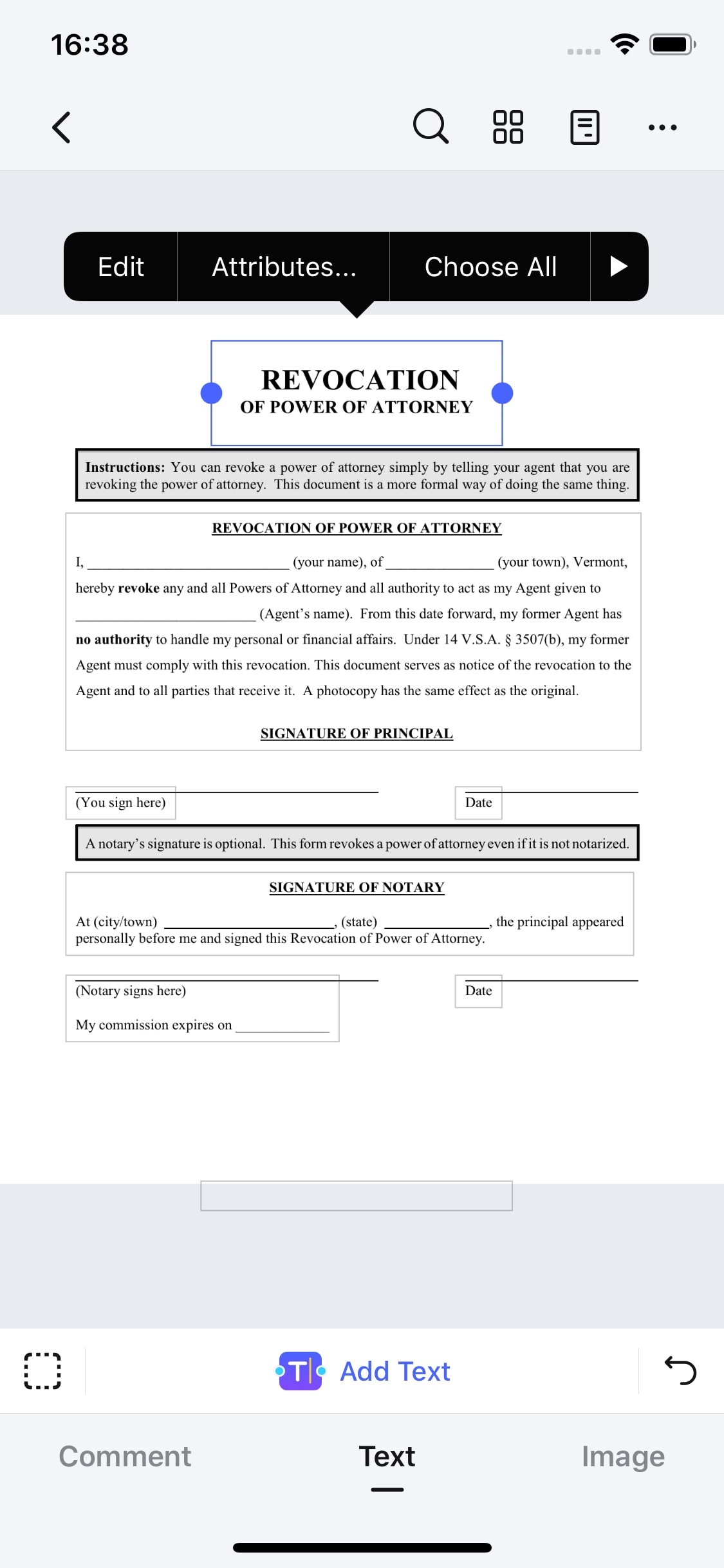

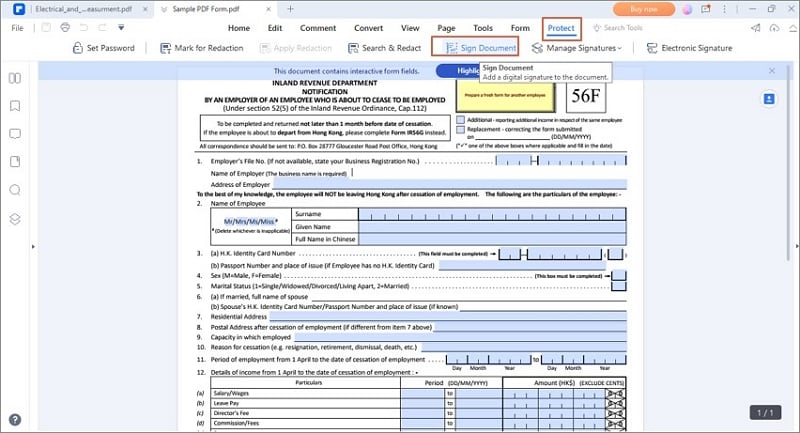

All-in-one PDF Solution for Students – PDFelement

You may edit, annotate, sign, and present documents with PDFelement, which increases the effectiveness of your classwork and home assignments.

Pricing

Prices for using PDFelement as a basic or premium user.

- Basic features are available for free.

- For Androidusers, the PDFelement is free.

- For iOS users, $6.99 is needed to unlock the Editor, Converter, and Scanner feature, $9,99 for the quarterly subscription, or a one-time fee of $39.99 for perpetual usage.

System Requirements

PDFelement works on desktops and smartphones with the following OS.

- Windows 11 and below

- Android 5.0(Lollipop) and above

- macOS 10.14 to macOS 13 (Apple M1, M2 Compatible)

- iOS 13.0 and above

Best Features Offered for Students

Check out these benefits of using PDFelement and see how you can save your budget for your educational needs.

- Allows editing of PDF files on multiple devices like smartphones to add images and edit texts anywhere.

- Offers an intuitive user interface that students can easily understand and navigate.

- Lesson plans, tables, and lists may be simply edited, combined, and created by both teachers and students. They may also readily send them to others.

- PDFelement Cloud offers security, effective distribution, and faultless collaboration to simplify your process.

Bottom line

There are multiple ways to pay for university courses: government funding or loans, income from a job, or banked savings. The seven apps in our roundup should help you track spending, follow your budget, or invest while building up savings.

Managing student finances isn't a one-size-fits-all thing. You need a budget student app complementing your spending and saving habits. All of them are free and easy to use, so try them out and see which one's right for you. While at it, consider downloading PDF editing tools like PDFelement to help you edit online resources at affordable pricing models.

Home

Home

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure