PDFelement-Powerful and Simple PDF Editor

Get started with the easiest way to manage PDFs with PDFelement!

You would need to submit a bank statement in many scenarios. You should be very careful when doing so. Why? Because this document contains so much sensitive information. And for specific use cases, some of this information is not relevant. In these cases, submitting a redacted bank statement is the right approach.

What is it, how to make one, and which information should you block? In this article, we will discuss all of these.

Part 1. Why Would You Need to Redact a Bank Statement?

Bank statements contain sensitive information. That includes your personal details, such as your name, address, and bank account number. Likewise, it contains your bank details and more.

The thing is that you may find yourself in situations when you need to submit a bank statement. However, most of these use cases don't require you to provide some of the sensitive information found in the bank statement. That said, it is highly recommended that you hide these pieces of information.

Situations of redacting a bank statement:

Here are some scenarios when redacting a bank statement is advised:

1. Applying for a Loan

Picture this: you are applying for a loan or other forms of financial assistance. They would ask you for a bank statement. You can redact your account number and any personal information not required by the loan provider.

2. Going Through a Divorce

When going through a divorce, you may need to provide a financial document for the discovery process. Of course, a bank statement is an easy choice. The thing is that some pieces of information in a bank statement are irrelevant here. You can redact your account number or the names of other account holders.

3. Applying for a Job

Employers would require you to submit documents to see if they can trust you. Some may ask you to provide a copy of a bank statement. It helps them verify your identity and may also enable them to confirm your eligibility for the job you're applying for.

4. Proof of Address

You can also use a bank statement as a proof of address. Some notable use cases are when you're applying for immigration or a visa. In these situations, the required information includes your name and address. You can redact things like your account number or bank details.

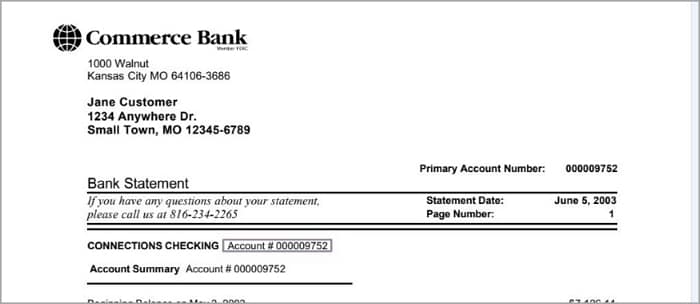

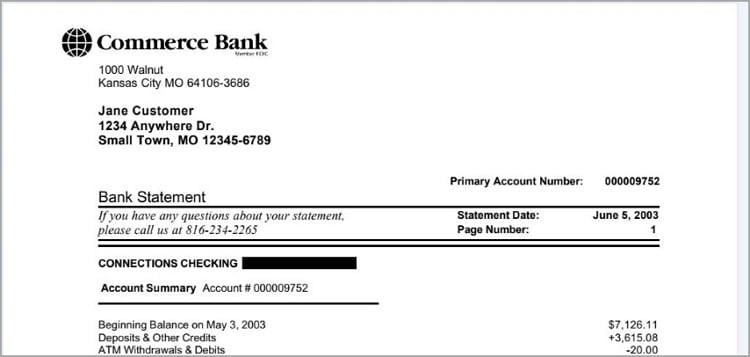

What Does a Redacted Bank Statement Look Like?

Below is an example of a properly redacted bank statement used for proof of address.

- ✔ Name visible

- ✔ Address visible

- ✔ Date visible

- ✖ Account number blacked out

- ✖ Transaction details hidden

Part 2. Redact Bank Statements Using Wondershare PDFelement

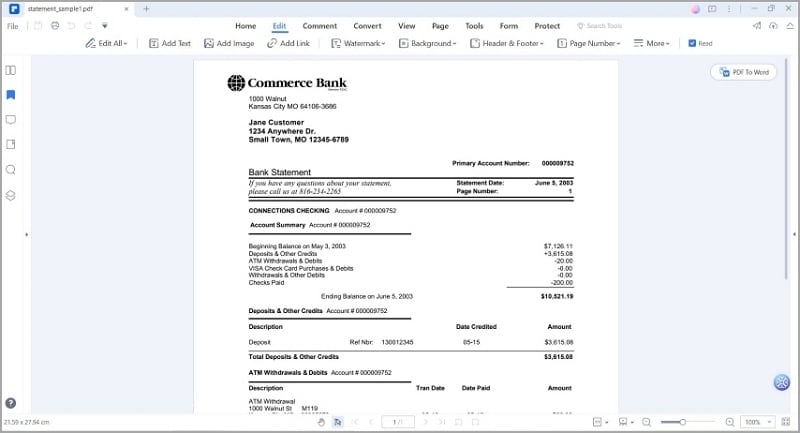

Now you know the reasons why you'd want to redact information from a bank statement. It's time to learn how to do that.

Using tools with a redact feature is an easy answer. And among your best options is Wondershare PDFelement, a globally popular PDF solution. Its wide array of features includes a very reliable redact function. And it is so easy to use. Here is a little guide on how to use this feature:

- Open the bank statement PDF with Wondershare PDFelement.

- Click Protect.

- Click Mark for Redaction.

- Select the information that you wish to redact.

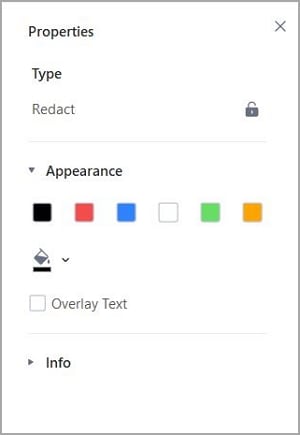

- Right-click the selected text. Click Properties on the right-click pop-up menu.

- The "Properties" panel will appear on the right-hand side of the PDFelement interface.

- Select the color you want to use to block the selected information. You'd typically want to use black.

- Click Apply Redaction > Continue.

- Save the document.

Part 3. Is It Illegal To Redact Bank Statements?

As mentioned above, many situations call for the redaction of information from a bank statement. If you don't do it, you may be exposed to serious privacy risks. So it is okay to create redacted bank statements.

But there is a condition. It is only allowed if you are protecting sensitive information. You should not redact information from a bank statement for deceptive purposes.

Please do not ever modify information from a redacted bank statement. Replacing them with fraudulent information has never been, and never will be, acceptable.

Whether it is legal or illegal is a complex topic. It always depends on the circumstances and the reason for redacting. So let us look at some considerations.

1. Legal Redaction

In certain situations, redacting information from a bank statement can be legal and necessary.

For example, financial institutions may redact sensitive personal information, such as account numbers or social security numbers, because of the Gramm-Leach-Bliley Act. It requires financial institutions to protect their customers' nonpublic personal information. In this case, the reason for redacting information is totally justified.

2. Unauthorized Redaction

You need proper authorization before redacting information from a bank statement. Not getting this may indicate that you are trying to alter or conceal important details to deceive or commit fraud. Obviously, it is illegal. Tampering with financial documents or using redacted statements to mislead others can lead to legal consequences.

3. Consent and Ownership

You should never redact information from a bank statement if you don't have ownership over it. Redacting information could be considered a breach of privacy or unauthorized access to personal data. It's only acceptable if you have gotten permission.

But who owns the document? Bank statements are typically considered the property of the account holder or the financial institution.

4. Specific Jurisdictions

You should note that the redaction of information from bank statements varies depending on local laws and regulations. Therefore, you should consider the laws applicable in your jurisdiction when dealing with sensitive financial documents. We highly recommend that you consult a lawyer if you are unsure about its legality.

Suppose you still have concerns or questions about redacting information from a bank statement or any other financial document. Please seek guidance from a lawyer or a legal or financial professional.

Remember that it's essential to handle sensitive information with care, respecting privacy rights and adhering to ethical and legal standards.

Part 4. Dangers of Skipping Redaction

What happens when you submit bank statements that are not redacted? How serious is the trouble you are putting yourself in?

This section will help you understand the dangers of skipping redaction. Here is a list of the risks.

1. Identity Theft

Identity theft is when someone pretends to be you for their personal gain. Culprits are able to do this when they get your personal information. And speaking of that, a bank statement contains this information. Furthermore, a bank statement also contains your financial information.

Suppose the wrong person gets their hands on your bank statement. They can use the information they find in the document to access your bank account. Also, they can open credit accounts in your name. It would result in financial problems.

2. Getting Hacked

Electronic documents offer so much convenience. When you need to send a document, you can email them with the digitized documents as attachments. You no longer have to physically deliver the document to the recipient. Indeed,this method is much faster and more convenient.

But there's a catch. There is one factor that makes using them quite dangerous. Unfortunately, cybercriminals like hackers exist. If they get access to your bank statement and every piece of information is visible, you're going to have a big problem.

These people can use your personal information for malicious purposes. Also, as mentioned above, they can use the information to access your bank account.

With that said, it is wise to redact information from a bank statement.

3. Privacy Invasion

It is not just your name and address that a bank statement contains. It also has information that you really don't want others to know. That includes your spending habits and financial position.

If you are a business person, you really do not want this information to get leaked. Your competitors may use this information against you.

Part 5. Frequently Asked Questions About Redacted Bank Statements

A redacted bank statement is a version of your statement where sensitive information is permanently removed while keeping required details visible. Here are the most common questions people ask before submitting one.

1. What does a redacted bank statement look like?

A redacted bank statement looks like a normal statement, but specific sensitive details are blacked out. In most cases, the recipient still needs to see your name, the statement date, and (for proof of address) your residential address, while account numbers and other unnecessary details are blocked.

Important: secure redaction permanently removes the hidden information from the PDF. Simply drawing a black box over text is not always safe.

2. What should you redact on a bank statement?

Redact anything sensitive that is not required for the purpose of submission. Common items to redact include:

- Bank account number (especially the full number)

- Routing number (if not required)

- Transaction reference IDs

- Irrelevant transaction details (descriptions, merchants, notes)

- Any online banking identifiers

Keep visible the information the receiving party needs (for example, your name, address, and statement date when it is used for proof of address).

3. Can I redact my bank statement for proof of address?

Yes, in many cases you can redact your bank statement for proof of address. The key is to keep the required fields visible. Most organizations require:

- Your full name

- Your residential address

- The statement date (often within the last 1–3 months)

You can usually redact account numbers, balances, and transaction history — but always check the exact requirements of the organization requesting the document.

4. Is it illegal to redact a bank statement?

Redacting a bank statement is generally legal when you do it to protect sensitive personal or financial information. It becomes illegal if you redact or modify information to mislead someone, conceal material facts, or commit fraud.

Because laws and acceptance rules vary by jurisdiction and use case, consult a legal professional if you are unsure.

5. How do I redact a bank statement properly?

To redact a bank statement properly, you should use a PDF tool that supports real redaction (not just visual covering). Proper redaction means the selected text or area is removed from the file and cannot be recovered.

A common safe workflow is: mark sensitive information for redaction, apply redaction, then save a new copy of the PDF.

6. Can I redact a bank statement online for free?

Some online tools allow free redaction, but you should be careful with sensitive financial documents. Make sure the tool permanently removes the hidden content instead of only placing a black rectangle on top of the text.

If the document contains highly sensitive data, using a reliable desktop PDF editor is often safer.

7. Can I black out transactions on my bank statement?

You can often black out transactions that are not relevant to the purpose of submission. For example, if the recipient only needs to verify your name and address, detailed transaction history may not be required.

However, do not hide any information that the reviewing authority explicitly requests. When in doubt, confirm first.

Can I Redact My Bank Statement for Proof of Address?

Yes — but only partially.

When submitting a bank statement as proof of address, you must keep:

- Your full name

- Your residential address

- The statement date

You may redact:

- Account numbers

- Transaction history

- Balance details

Conclusion

Most of the time, you'd want to send a redacted bank statement rather than a bare one. It protects you from privacy and security-related risks. But of course, you should only do it for legal purposes.

Redacting information from a bank statement is easy to do, too. So there's really no excuse not to do it. Wondershare PDFelement can make this even easier with its processing power and intuitive interface. It's the best tool you can use for redacting information from bank statements.

Home

Home

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure