PDFelement-Powerful and Simple PDF Editor

Get started with the easiest way to manage PDFs with PDFelement!

Many U.S. citizens fill out IRS Form 3911 for lost stimulus checks. However, many people struggle to validly fill out and send the IRS form 3911. If you don't fill out the form correctly, it will be deemed invalid, and you won't receive your stimulus check.

Therefore, you must be aware of how to fill out Form 3911. Fortunately, this article gives you a clear guide on how to fill out form 3911.

In this article

Download IRS Form 3911 (PDF & Printable Versions)

What Is IRS Form 3911 and When To Fill Out Form 3911?

IRS Form 3911, Taxpayer Statement Regarding Refund, is used to request a payment trace. A payment trace allows the IRS to investigate whether a refund or certain other IRS-issued payments were sent, cashed, returned, or misdirected.

Form 3911 is commonly used in the following situations:

- A federal tax refund was issued, but was never received

- A refund check was lost, stolen, or destroyed

- A direct deposit refund was sent to the wrong bank account

- A stimulus check was issued, but not received

- A replacement refund is needed after the original payment was cashed incorrectly

Form 3911 does not itself issue a replacement refund. It triggers the investigation. If the IRS confirms the payment was not received or was improperly cashed, they will then reissue it. If a direct deposit went to the wrong account and was not returned by the bank, the IRS may require additional time or documentation before reissuing funds.

For example, if you didn't receive your stimulus check or you received the stimulus check but accidentally misplaced or lost it, you can fill out IRS Form 3911 for stimulus check replacement. This form allows users to claim a missing or misplaced stimulus check to initiate a refund trace. After you fill out the IRS Form 3911, the IRS can send a replacement check or a claim package, depending on whether the check was cashed out or not.

Form 3911 Instructions: Filling Out the Form

You can follow the instructions here to correctly and effectively fill out IRS Form 3911 for a lost stimulus check or other situations.

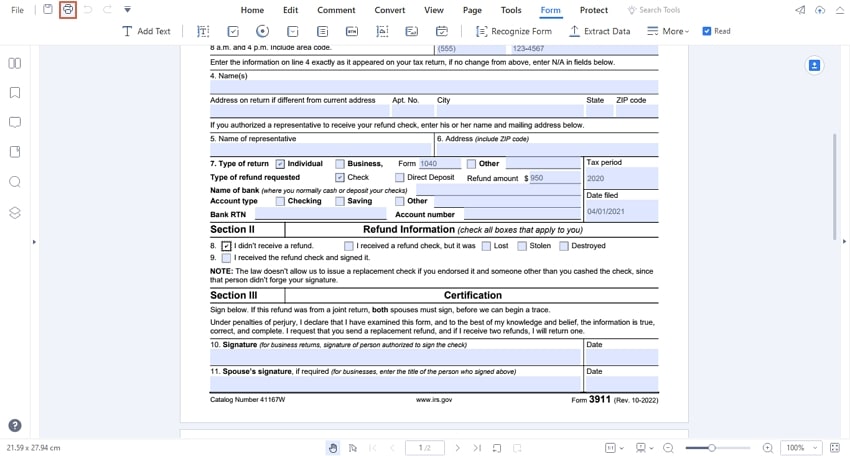

Tip: If you are filling out the Form 3911 electronically, a great PDF editor can make it easy. One of the best PDF editors - Wondershare PDFelement, can help you fill out a blank IRS Form 3911, print PDF documents, sign documents, and more.

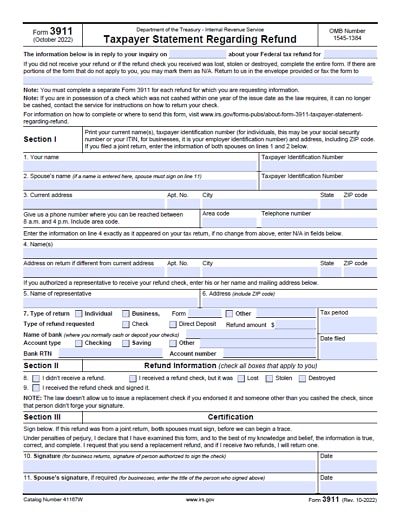

1. Top Section: Should I Need To Fill It Out

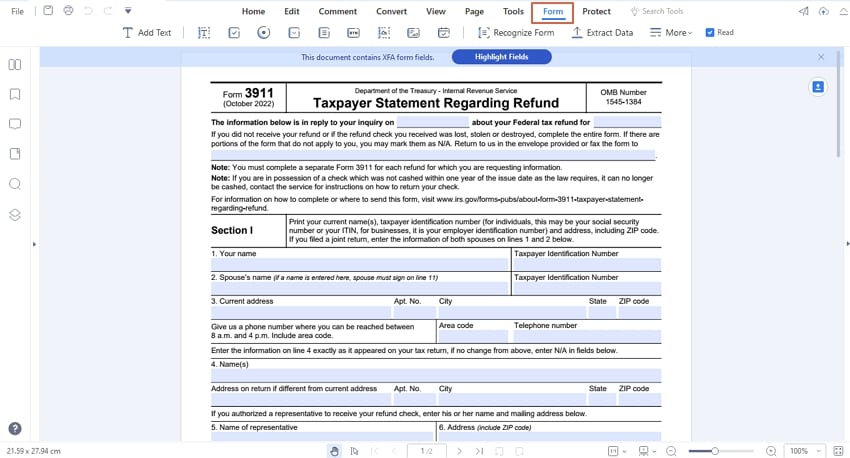

If you downloaded IRS Form 3911, you could see that there is a top part before "Section I" with some checkboxes and other fillable fields. This part is meant for the IRS; you are not supposed to fill it. You can leave it blank and proceed to section 1.

2. Section I

Proceed to the "Section 1" part and fill in the requested information in the respective fields. This is where you enter your identifying and return details. This section is numbered from 1 to 7. If you filed a joint return, you enter both spouses' information on Lines 1 and 2, and the spouse listed must also sign later in Section III.

Line 1: Your name and taxpayer identification number (SSN/ITIN).

Line 2: Spouse's name and taxpayer identification number (if a joint return; spouse must sign in Section III).

Line 3: Your current address and a daytime phone number.

Line 4: Enter the name(s) and address exactly as it appeared on the tax return. If there is no change from what you already entered above, the form directs you to enter N/A in these fields.

Lines 5–6: If you authorized a representative to receive the refund check, enter the representative’s name and mailing address.

Line 7: Provide return/refund details the IRS needs to trace the payment, including:

- Type of return (individual, business, or other/form)

- Type of refund requested (check or direct deposit) and the refund amount

- Bank name, account type, bank routing transit number (RTN), and account number (if direct deposit info applies)

- Tax period and date filed

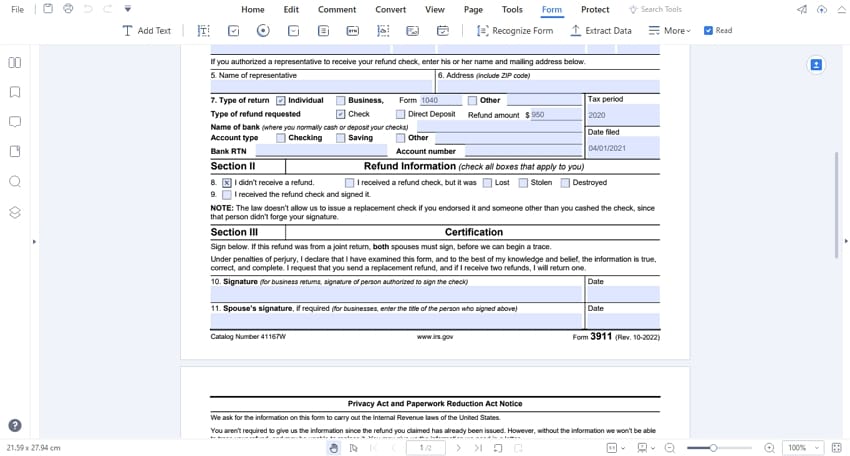

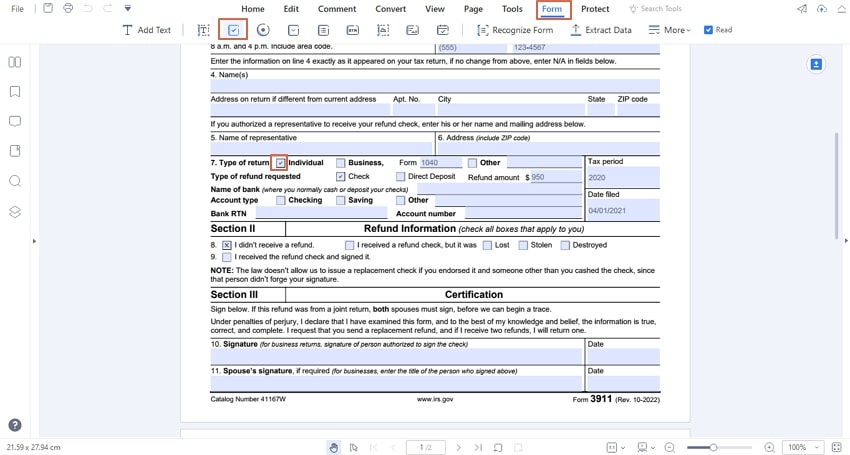

3. Section 2

In Section II, you are required to check the given checkboxes.

Line 8: Check whether you didn’t receive a refund, or you received a refund check but it was lost, stolen, or destroyed.

Line 9: Check if you received the refund check and signed it. The form includes an important note that the IRS generally can’t issue a replacement if you endorsed the check and someone else cashed it (because it wouldn’t be a forged signature).

4. Section 3

You need to sign the IRS form when you have finally filled in the target fields. If you need to mail Form 3911, it requires a wet signature; therefore, you first need to print the document and sign it by hand using a pen or ink (wet signature). Take the printed IRS Form 3911 from the printer and apply your handwritten signature in the respective field using a pen or ink.

5. Mail or Fax IRS Form 3911

When you have finally signed and are satisfied with the IRS Form 3911, it is time to mail or fax it to your respective address. However, knowing that the mailing address or fax number of IRS Form 3911 depends on your state is worth knowing.

Georgia, Maryland, Florida, and Alaska, but a few have different fax or mail addresses. Therefore, you should find the right address for your state. Once you have the right address, only send the signed Form 3911. Don't attach anything else other than this form.

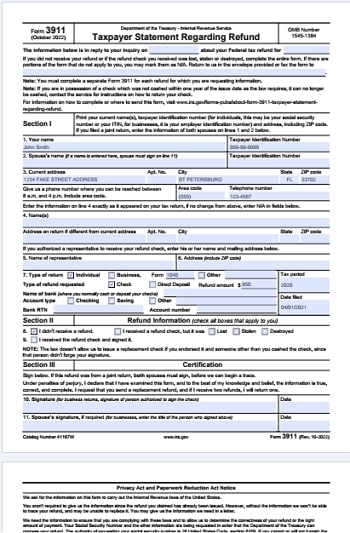

IRS Form 3911 Filled Out Example

While filling out an IRS Form 3911 looks pretty straightforward, many people make mistakes and send incomplete or invalid documents. Such documents can be disqualified, and you might not get the refund stimulus check.

A valid filled IRS Form 3911 should have all the relevant fields filled with the correct information, as illustrated by the following sample.

FAQs about IRS Form 3911

How to Use Form 3911 for Stimulus Checks

Form 3911 can be used to trace missing Economic Impact Payments (EIP), including EIP 1, EIP 2, EIP 3.

If the IRS records show that a stimulus payment was issued but not received, Form 3911 may be required to initiate a payment trace. When completing the form for stimulus checks, write "EIP" and the applicable payment number in the refund amount section.

If the stimulus payment was never issued, Form 3911 is not appropriate. In those cases, the missing amount may need to be claimed as a Recovery Rebate Credit on your tax return instead.

Can You File or Submit Form 3911 Online?

Form 3911 can't be filed/submitted online. If you need to use the form, you typically mail or fax it, following the instructions on the form or any IRS letter you received.

Online tools are for status checks, not form submission. The IRS "Where's My Refund?" tool are commonly used first to confirm whether a refund was issued before initiating a trace.

How Long Does IRS Form 3911 Take to Process?

Processing times vary depending on the type of payment and IRS workload. In general:

- Refund traces may take 6 to 8 weeks

- Stimulus payment traces may take longer, especially during peak periods

Conclusion

Claiming your lost stimulus check is not a rocket science task. This process is easier and can be done by anyone. However, you need a proper PDF editor to fill the respective fields accurately. While finding a PDF editor that ticks all the boxes is not easy, Wondershare PDFelement is proving the real deal. Download this program to fill and print your IRS form 3911 validly.

Home

Home

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure