PDFelement-Powerful and Simple PDF Editor

Get started with the easiest way to manage PDFs with PDFelement!

It is common for U.S. citizens to fill out form 8862 to reclaim disallowed tax credits. However, this form can be complicated for newbies due to several form fields. While you can download the respective instruction file, you need more guidance to effortlessly and effectively fill and file the IRS form 8862.

Fortunately, this article gives you a detailed guide on how to fill out form 8862 flawlessly.

When Do You Need IRS Form 8862?

IRS Form 8862 is a form you file to reclaim specific tax credits previously disallowed by the IRS for any reason other than arithmetic or clerical errors. Such tax credits include child tax credit, earned income credit, American opportunity credit, and additional child tax credit, among others.

If you were denied tax credits due to circumstances that have now been resolved within the IRS, then you can fill out IRS Form 8862 to reclaim the credit. Also, if you now meet all the requirements and are eligible for such credits, you can fill out the form and send it to the IRS.

How To Fill Out IRS Form 8862

IRS Form 8862 should be filled out appropriately. If wrong information is entered in the provided fields accidentally or deliberately, you might have a rough time correcting the mess and reclaiming the tax credit. To avert this mayhem, we give you proper guidelines for filling out IRS form 8862.

1. Download IRS Form 8862 and Install PDFelement

When filling out IRS Form 8862, you must remain cautious. Errors can prove costly and deny you a chance to receive your credit promptly. Obviously, you don't want to go in that direction.

Therefore, you need a tool to help you seamlessly and accurately fill out IRS form 8862. The good news is that you can use a suitable PDF editor and fill out your IRS Form 8862 effectively.

Wondershare PDFelement - PDF Editor is undoubtedly the best PDF editor to fill out IRS form 8862. Thanks to the collection of form editing features, amazing speed, compatibility, and ease of use. It is a powerful form editor and offers virtually everything you would demand from a modern PDF editor.

The following steps illustrate how to download IRS Form 8862 and ready PDFelement to fill out the form.

Step 1 Using a suitable browser on your computer, navigate to the IRS homepage and click the "Form 8862" link. This form comes in PDF format and is automatically downloaded into your computer.

Step 2 Now, you need to download Wondershare PDFelement to help fill out your IRS form 8862. You can download the free trial version or buy the affordable premium version.

Step 3 When PDFelement is downloaded, click the .exe file and run it on your device. Follow the on-screen instructions to install PDFelement on your computer successfully.

Tips

Use the latest version of IRS form 8862- Updated versions of IRS might have new fields or adjustments that must be correctly filled. Otherwise, you might not provide all the needed information, and your claim can be disqualified.

Use the right PDF editing tools to make it easy when filling the respective IRS form 8862 fields. Fortunately, Wondershare PDFelement meets the needs of the user.

2. Add Fillable Fields Into IRS Form 8862 (Optional)

The downloaded IRS form 8862 can either be interactive or non-interactive. You can directly fill out the form without additional editing if the form is interactive. On the other hand, a non-interactive form field cannot be fielded directly.

You need a suitable form filler like PDFelement to make it interactive. If your IRS form 8862 is non-interactive, use PDFelement to convert it into an interactive form, as shown below.

Step 1 Open Wondershare PDFelement on your device and upload the IRS form 8862 you downloaded.

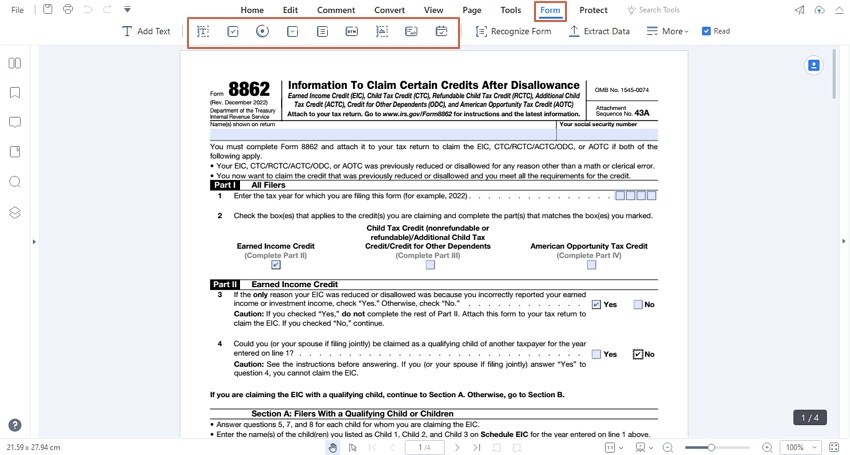

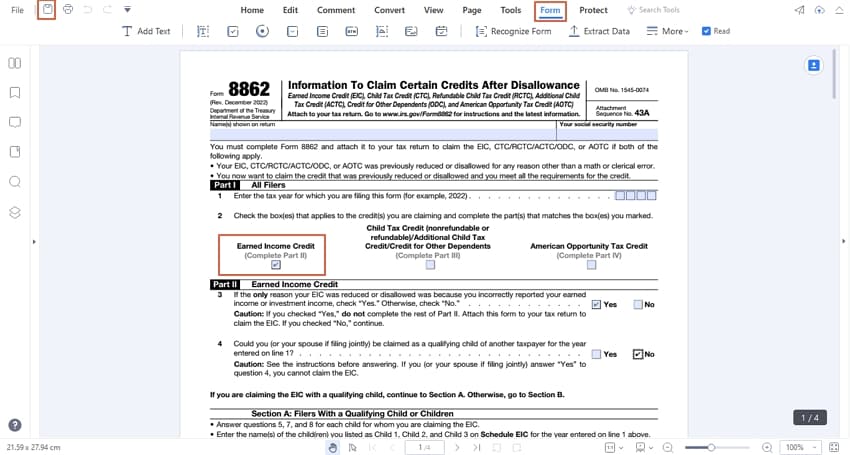

Step 2 When the form is uploaded, click the "Form" tab on the toolbar to access various form field options.

Step 3 Choose desired form fields and place them on the target area of your IRS form 8862. Once satisfied, click the "Save" icon to save the changes.

3. Fill Out IRS Form 8862 with PDFelement

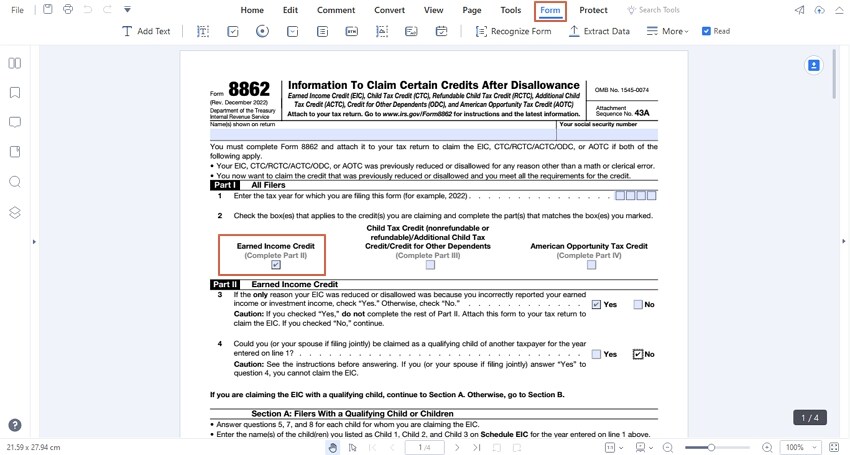

When you open the downloaded IRS form 8862 on PDFelement, you will realize that it has five parts named part I to Part V. The following guideline shows how to fill the respective parts of IRS form 8862.

Part I of IRS Form 8862

In this section, you provide two important details: The target tax year disallowed and the type of credit you are claiming. You tick the respective checkbox for the target option.

Part II of IRS Form 8862

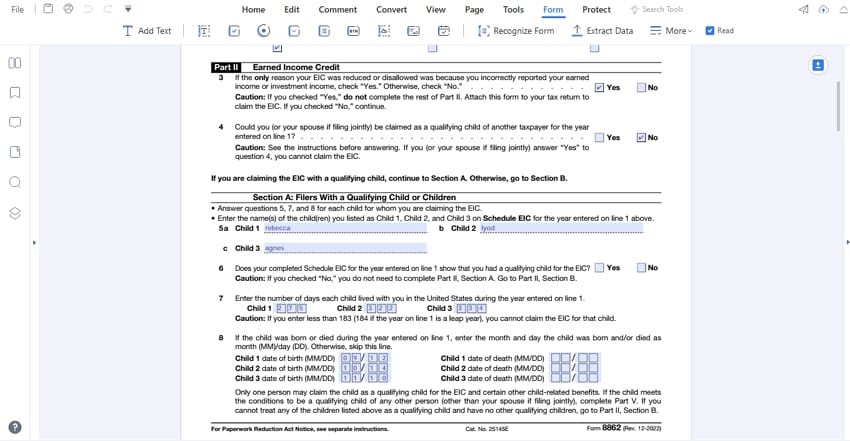

This section is only useful if you are claiming earned income credit. Otherwise, skip to the next part. If you selected the earned income credit option, mark the right checkbox in the two questions asked and provide the correct responses for the rest of the questions if applicable.

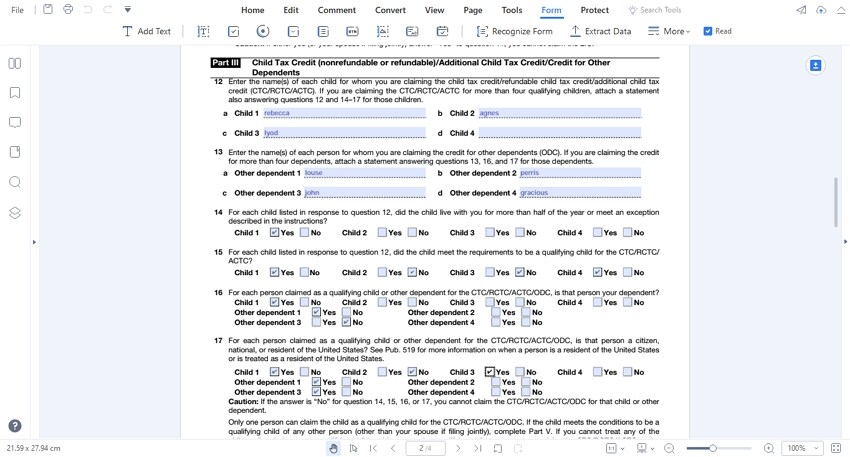

Part III of IRS Form 8862

This section is relevant if you are claiming a child tax credit. Here, you provide the details of the child and dependencies where applicable. Then, enter the details in the respective text fields and mark the right options in the checkboxes provided.

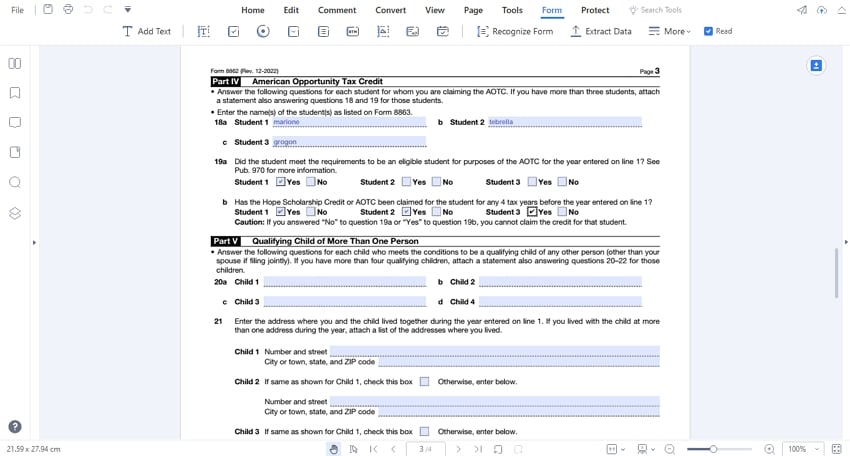

Part IV of IRS Form 8862

This part is only relevant if you claim the American opportunity tax credit. Here, you need to answer the questions for each student that you are claiming. Enter the student(s) name in the respective field and tick the correct checkboxes in the other questions.

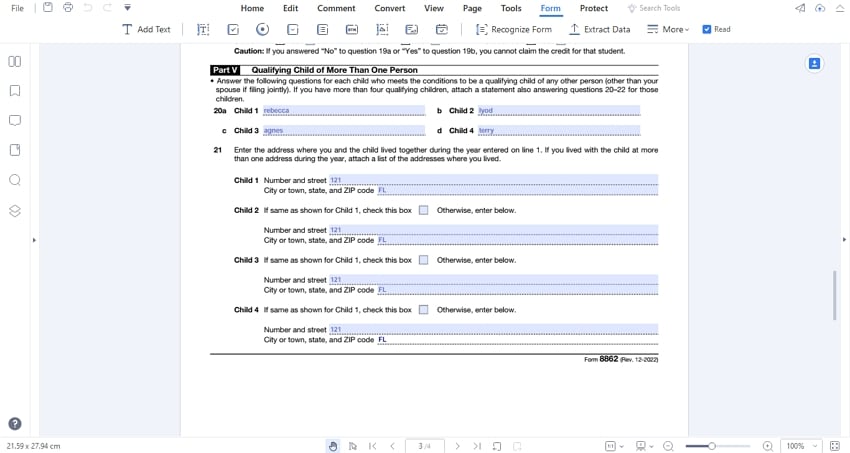

Part V of IRS Form 8862

This is the final part of the IRS form 8862. In this section, you are claiming the child tax credit for a qualifying child of more than one person (other than your spouse). Provide the child's name and the address where you live with the child.

Read the instructions carefully and correctly fill in the details asked in this section.

Tips for Filling out IRS Form 8862

If the form is non-interactive, make it interactive with suitable tools like PDFelement.

Read the instructions carefully before filling out the form. You can download the IRS form 8862 instruction form on the IRS website.

Provide accurate information because wrong information can lead to serious penalties.

How To File IRS Form 8862

Once you have filled out IRS form 8862, you can proceed to file it online or via mail. Nearly all online tax preparation programs offer IRS form 8862. Therefore, you can send this file electronically by attaching it with the rest of the tax return files.

Furthermore, you can send it to the email address indicated in the separate letter you received from the IRS asking you to complete the form. Whether you send it electronically or via mail, you don't need to print and sign IRS form 8862.

People Also Ask

IRS form 8862 has several fields, and you might easily get stuck especially if you are a newbie. Many people flock to the internet with several questions on IRS form 8862. Some of the popular questions and answers include.

1. Why Would the IRS Deny Child Tax Credit?

When you are reclaiming the child tax credit, it is not guaranteed that you will be cleared and qualified for the credit. Sometimes the IRS might deny you a child tax credit if you don't meet the qualification rules. The grounds for disqualification for the child tax credit include the following:

● If the child is not related to you.

● If the child did not live with you in the same house for a period not exceeding half the tax period.

● If the age, student, and disability status will affect the qualification.

● If your child files a joint return with another person.

2. Why Would Someone Be Disallowed Earned Income Credit?

You will definitely qualify if you have a genuine claim for earned income credit. However, there are several instances you can be disallowed earned income credit. They include:

● If you click the first option under earned credit income, it is not the only reason you were reduced/eliminated.

● When you don't answer the questions for all children.

● If you are not a citizen of the U.S. and have not resided in the U.S. for more than one year.

● When you fail to provide accurate information.

3. What Happens if EIC Is Disallowed?

Earned income credit is refundable and available to low and moderate U.S. taxpayers. However, EIC can be disallowed for many reasons. In case it is disallowed for reasons that are not math or clerical errors, then you can file the IRS form 8862 before the IRS gives you the green light to use the service again.

It is worth knowing that you must only file IRS form 8862 once for every credit you are disallowed. If there is attempted fraud in filling out the form, you will be disallowed for ten years.

Conclusion

After going through this article, you won't struggle to fill out IRS form 8862. This form has several fields, and you need a good PDF form filler to make your work easier and more effective.

Fortunately, this article has elaborated on how Wondershare PDFelement solves the problems of filling out I.S. form 8862. You can download PDFelement today and get the best experience when filling out IRS form 8862 and other PDF forms.