Quick Guide to Get Your IRS Tax Refund

Quickly get the important information and main

steps of filing your tax refund to save your time.

Part 1. When to File Tax?

File your taxes by April 18, 2023.

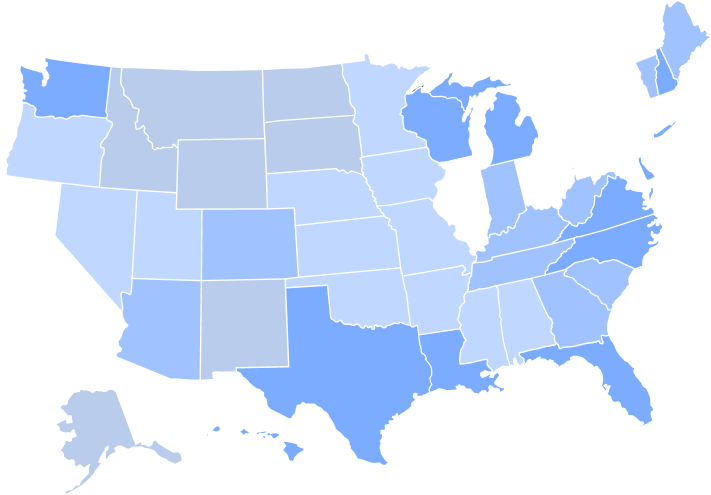

Part 2. Where to File Tax?

Where to File Tax Returns - Addresses Listed

by Return Type

In order to determine where to file your return, identify the form number for which you need the information

Check the filing address by return type >>Where to File Addresses for Tax

Returns by State

Each states has different addresses for filing tax returns.

Check the tax filing address by state >>

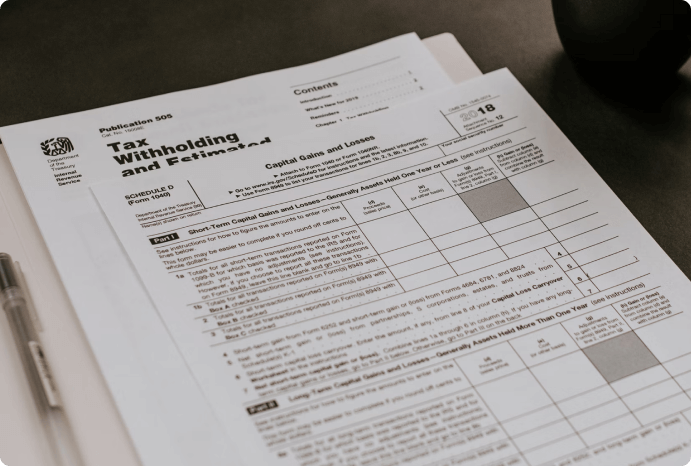

Part 3. How to File Tax?

A little prep work can save your time and money

Gather Paperwork

- Gather all the annual tax documents you've received that record your taxable income and deductible expenses.

- Collect all your receipts and organize them by category if you itemize your deductions.

- Dig out a copy of last year's taxes for reference.

- Get the needed tax forms from your tax pro, tax software, or the IRS.

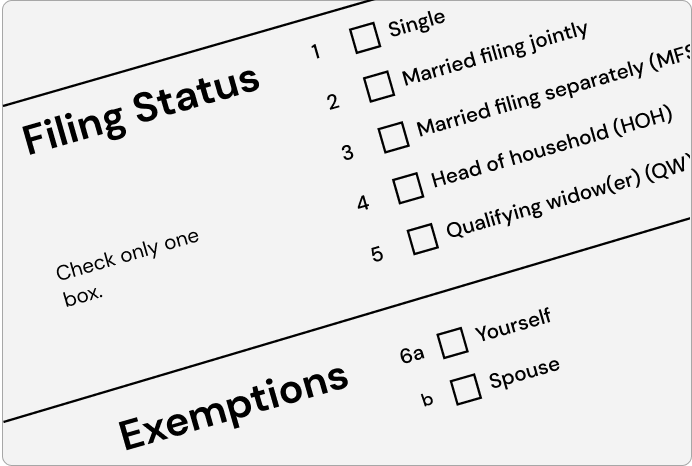

Determine Filing Status

- Marital status and spouse's year of death (if applicable).

- The percentage of the costs that your household members paid toward keeping up a home.

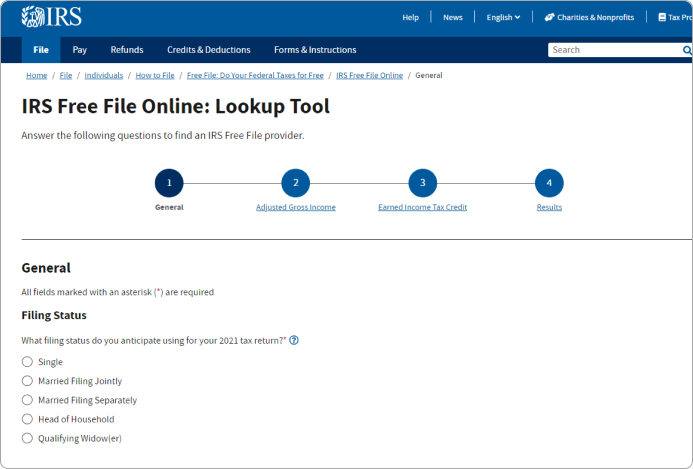

Choose File Options

- Use IRS Free File or Fillable Forms.

- Use a Free Tax Return Preparation Site - Volunteer Income Tax Assistance (VITA) /Tax Counseling for the Elderly (TCE).

- Use Commercial Software.

- Find an Authorized e-file Provider.

Confirm Key Informations

- Please confirm if you choose a correct tax form and see if you are eligible for credits and deductions.

File Your Taxes

- Choose the filing method that best meets your needs: online, by email, or through a tax professional.

- File your taxes by April 18, 2023.

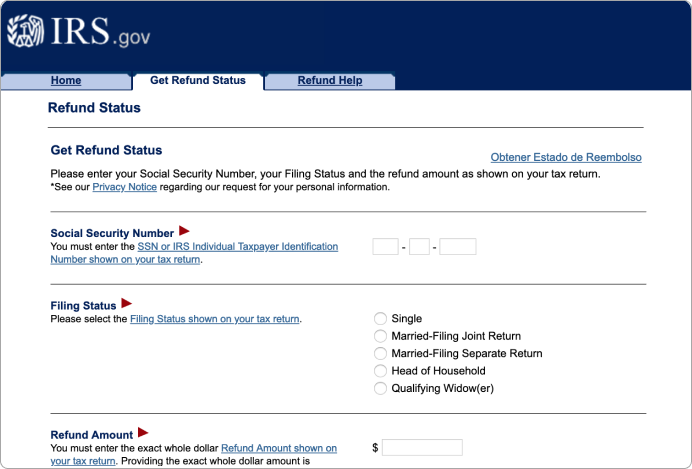

Check Your Tax Refund Status

- Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the quickest and most convenient method of tracking your refund. The systems are updated once every 24 hours.

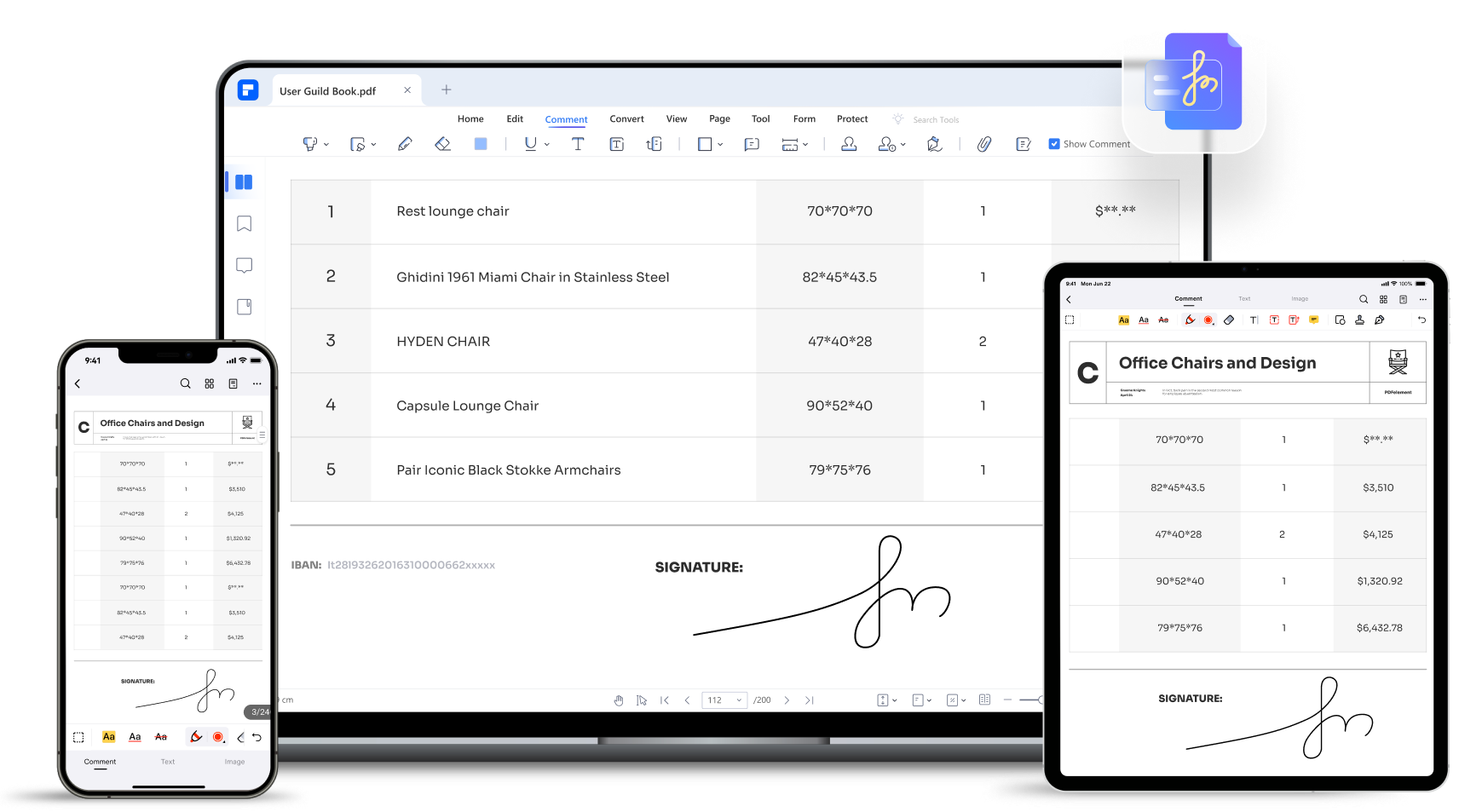

Part 4. Fill Forms with PDFelement - PDF Editor

A Complete PDF

Tax Form Filling Solution

PDFelement as an all-in-one PDF solution can help you fill and sign PDF forms with ease. You can also (batch) print and send the PDF tax forms to others quickly.

Part 5. PDFelement Special Offers

PDFelement Pro is an all-in-one PDF solution with powerful tools to reliably create and manage PDF forms and documents.

PDFelement Pro is an all-in-one PDF solution with powerful tools to reliably create and manage PDF forms and documents.

Part 6. Frequently Asked Questions

- Form 1040: U.S. Individual Income Tax Return

- Form 1040-SR: U.S. Tax Return for Seniors

- Form W-2: Wage and Tax Statement

- Form W-4: Employee's Withholding Certificate

- Form W-4P: Withholding Certificate for Pension or Annuity Payments

- Form 1099-G: Certain Government Payments

- Form 1099-K: Payment Card and Third Party Network Transactions

- Form 1099-DIV: Dividends and Distributions

- Form 1095-A: Health Insurance Marketplace Statement

- You enter the incorrect information, such as your name, Social Security numbers, filing status, and so on.

- Your items are not entered on the correct line.

- You don't check for typos.

- You automatically take the standard deduction.

- You forgot about your state's individual healthcare mandate.

This is the easiest way to find out how much you owe, your payment history, your prior year adjusted gross income (AGI), and other tax records.