Discover the Role of a Customs Invoice in International Business

2025-12-22 15:06:04 • Filed to: Invoice Template • Proven solutions

Thanks to modern telecommunications infrastructure, you can sell goods across borders. These are items that have been bought by a foreign customer. In such a case, you need to utilize a customs invoice. This document indicates the contents of the package in which you have shipped the items. This invoice is required by customs clearance. That's because the goods cannot leave the country or enter a new national jurisdiction without this document.

Free Customs Invoice Template

Free Download and customize it according to the sample text below

Free Download>>> |

Free Download>>> |

Free Download>>> |

What is a Customs Invoice

A customs invoice is essentially a record of the contents of an internationally shipped parcel. This document is required by law because any items leaving a country in a package are regarded as exports. Thus, the Canada customs invoice is provided to the customs agents as well as the customer receiving the shipped goods. A customs invoice is required for any parcels that exceed 2.5kg.

What to Include in a Customs Invoice

A customs invoice is required for any international sale of goods. For it to be valid, the document needs to have a number of important elements. They include:

• The Vendor Details

This is the name, address and phone number of the company that is selling the items. The business registration number can also be included.

• A Full Description of the Items in the Package

The items in the package need to be described in detail. Hence, this section of the customs invoice needs to be filled. The quantity of the items should be indicated as well.

• Invoice Number

This is a unique identifier of the particular Canadian customs invoice. It can be made up purely of digits or contain a combination of digits and letters. It is also referred to as a Shipper's Reference Number.

• The Consignee

This is the individual customer who receives the items that are on the package. Their details need to be indicated in the customs invoice. This includes their name, address and phone number.

• The Date of Issuance

This is the date when the invoice was officially issued.

• VAT Amount

This is the cash value of the VAT tax that is associated with the goods shipped.

• Total Amount Net of VAT

This is the cost of the shipped goods minus the cash value of VAT.

• Full Amount

This is the total amount of money that the customer needs to pay for the shipped items. If the company sending the items is registered for VAT, this amount includes the VAT tax amount.

• Country of Origin

This is a very important element to include in the customs invoice. It provides essential details about the country in which the goods were manufactured. It is important to note that the country of origin is not the nation from which the goods were sent.

• The Export Reason

This is an important factor to include in the ups customs invoice. It describes the reason for shipping. In this case, this reason should be goods purchased in business.

• Port of Entry Information

The customs invoice should have some information about the expected port of entry. Details about the address and phone number of the handlers in the port of entry of the destination country should be indicated in the customs invoice.

• Destination Control Statement

This is a special description that needs to be included in the customs clearance invoice. It gives details about the country which the goods should be shipped to. It is important because it provides guidance in case the package or container arrives at a restricted country.

Creating Customs Invoices Easier with FreshBooks

FreshBooks is a specialized accounting software which you can utilize to run your business. It is secure and is packed full of features that help to increase operational efficiency. By using this digital tool, you can automate your business processes. As a result, you are able to focus more on expansion than accounting.

The FreshBooks software has an interface that is intuitive and very easy to use. As a result, it comes in handy for creating professional customs invoices. This digital tool has a collection of powerful features. They can assist you to create invoices, organize expenses and interact with clients automatically. FreshBooks implements Cloud infrastructure. Therefore, it is accessible from any Internet-capable device.

How to Create a Customs Invoice with FreshBooks

FreshBooks software makes it very easy for you to create a customs invoice. There are two main paths that you can use to accomplish this activity. They include The Dashboard and the New Invoice section.

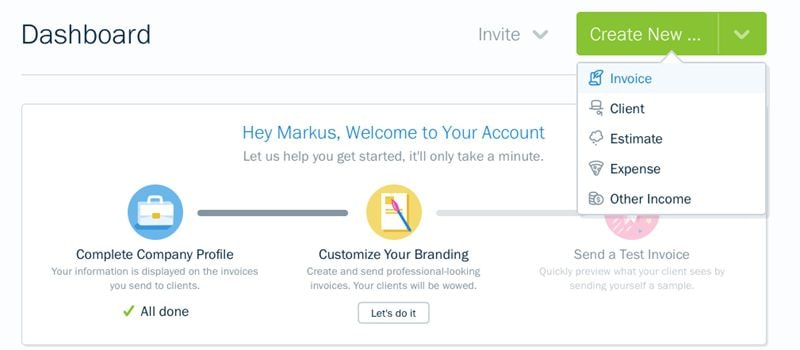

1. Using the FreshBooks Dashboard

You can create a brand new invoice directly from the Dashboard on this software. This platform provides you with a pair of options for this activity.

- You can click upon the button labeled "Create New".

- Tap on "Invoice" and this will deliver you to a "New Invoice" screen.

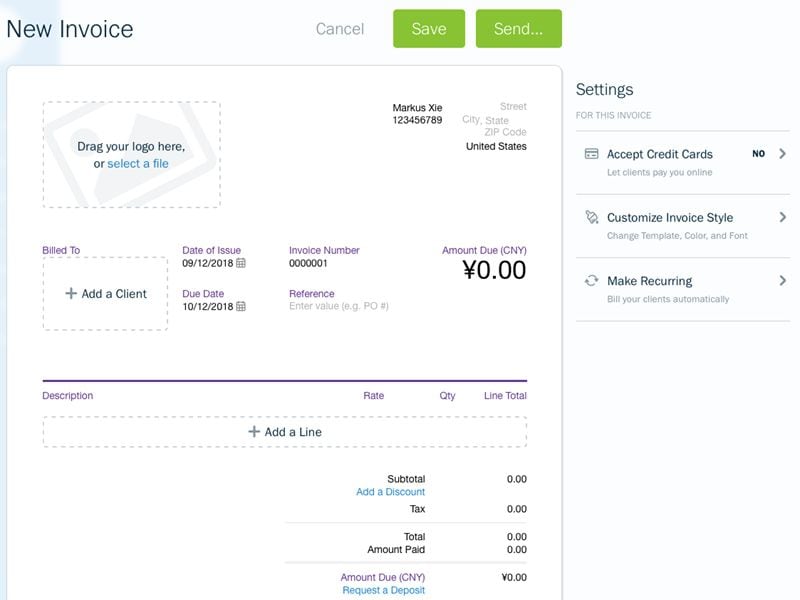

2. Using the "New Invoice" panel

It is also possible to create a new invoice by heading directly to the section labeled Invoices. Once there, you can click on a button that is labeled "New Invoice". It is located at the top right hand corner of the window.

After you click upon it, the software will take you a customs invoice template screen where you can add details about this document. This data is entered in specific sections within the template. The main sections include:

- Accept Credit Cards:

This section allows you to specify if your customs invoice will support credit card payments.

- Customize Invoice Style:

Through this section, you can customize the overall look and appearance of your customs invoice. The section allows you to pick a theme for the rest of the business document. This theme can be Modern or Simple. You can also pick the overall color as well as highlights for the banner and headings. The font is also determined in this section.

- Invoice Transaction Details:

This is the main part of the invoice customization sections. It allows you to enter data about the active transaction that you are handling. This information includes your Vendor company name, the Invoice Number, the Date of Issuance, the Customer's details, the Due Date, Amounts involved in the transaction as well as Terms.

Having completed filling in the invoice template, the FreshBooks software presents you with two main options. These are to Save or Send the invoice. Saving it preserves the document in PDF format, ready for further editing. On the other hand, "Sending" it delivers the invoice to the customer through email.

The FreshBooks software makes it very easy to create a customs invoice. It presents you with a collection of tools that make this possible. It is a prime business assistant today!

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Up to 18% OFF: Choose the right plan for you and your team.

PDFelement for Individuals

Edit, print, convert, eSign, and protect PDFs on Windows PC or Mac.

PDFelement for Team

Give you the flexibility to provision, track and manage licensing across groups and teams.

Elise Williams

chief Editor

Generally rated4.5(105participated)