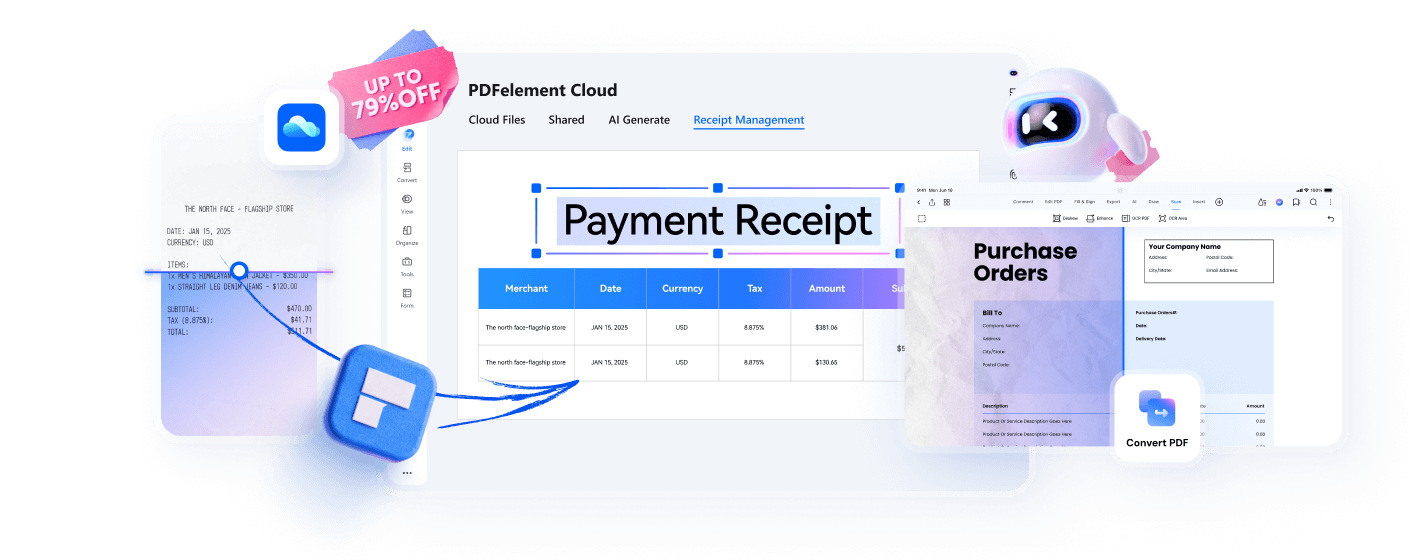

Accurate tax data starts with receipts & invoices

– Making tax filing easier, faster, and more accurate.

Scan receipts and invoices, extract and verify tax data, and export clean, tax-ready results to Excel through a simple mobile-to-desktop workflow.

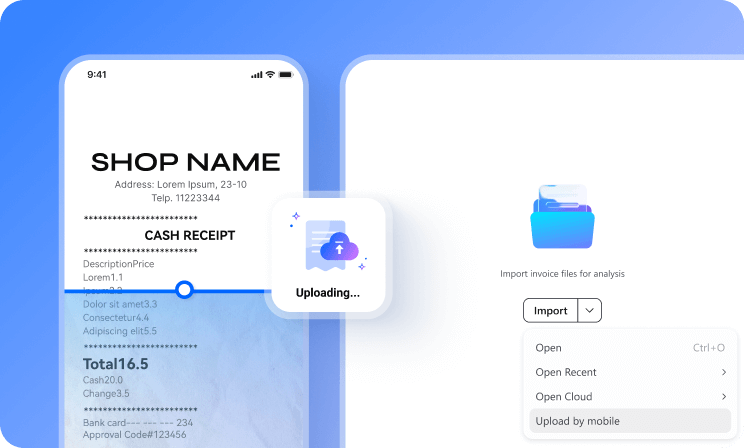

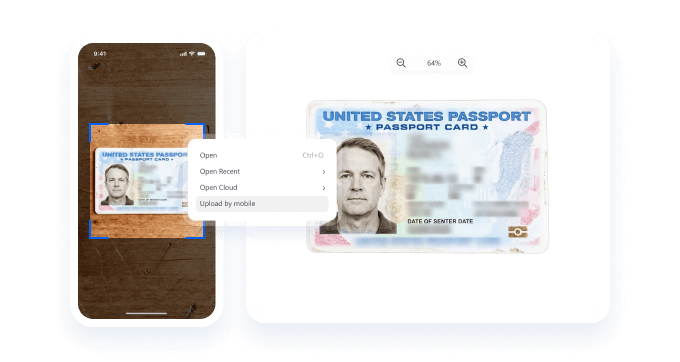

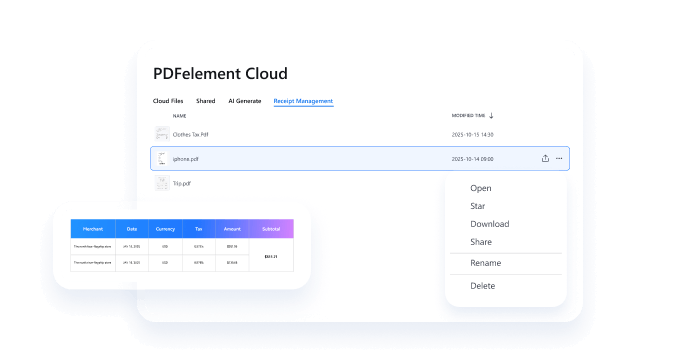

Scan receipts and invoices on mobile or upload files on desktop – both support direct data extraction, with optional cross-device sync.

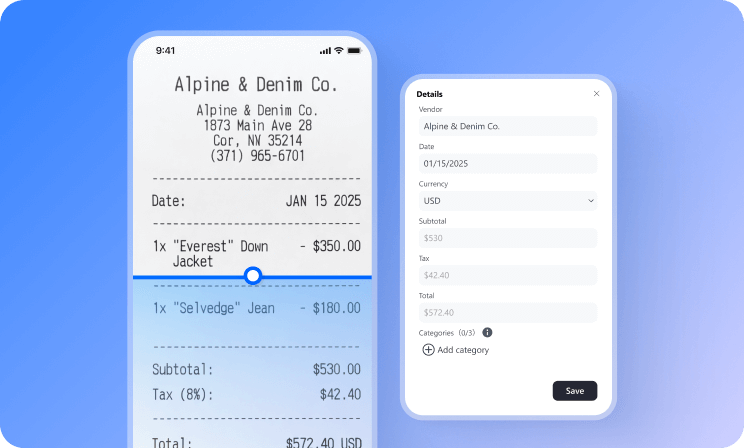

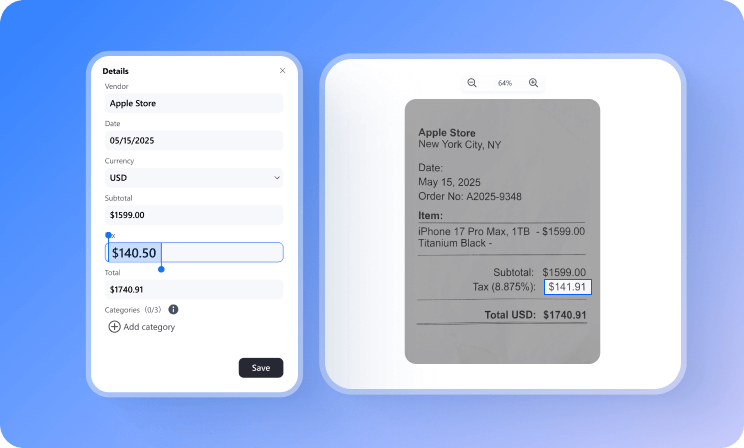

Automatically extract tax data from receipts and invoices, including merchant, date, currency, tax amount, subtotal, and total.

Verify extracted fields with a single click by jumping directly to their locations in the original document, ensuring accuracy for tax filing.

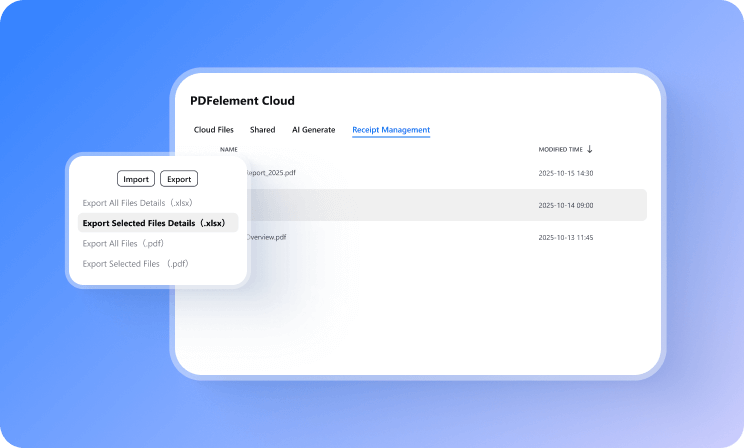

Export verified receipt and invoice data directly to Excel, and securely store the original documents in the cloud by type.

More than receipts & invoices –

complete PDF tools for tax season.

Go beyond receipts and invoices with a full set of PDF tools built for tax season.

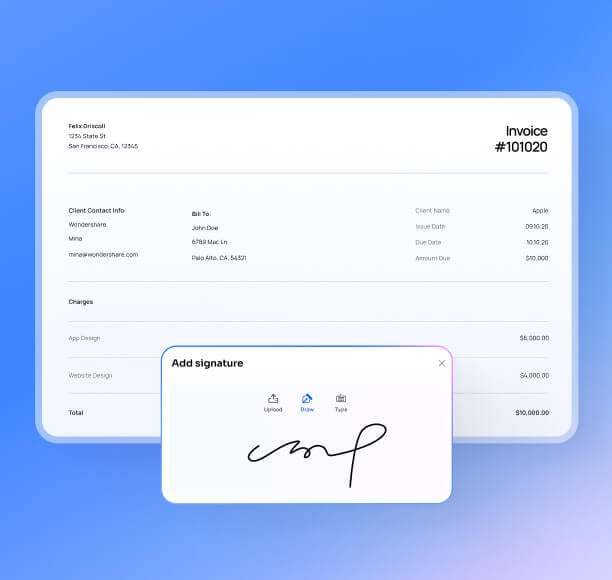

Fill and sign tax forms digitally to complete filings without printing or scanning.

Edit, annotate, and organize receipts, invoices, and tax PDFs for review and collaboration.

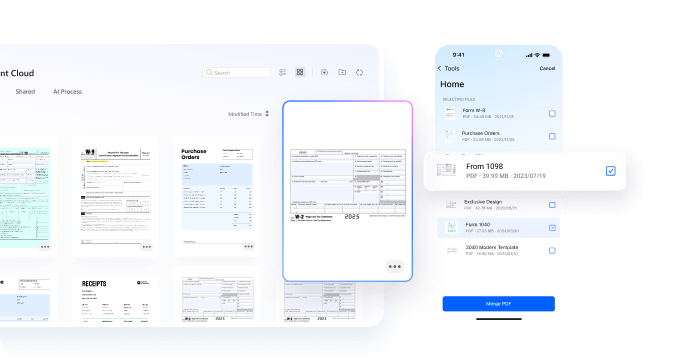

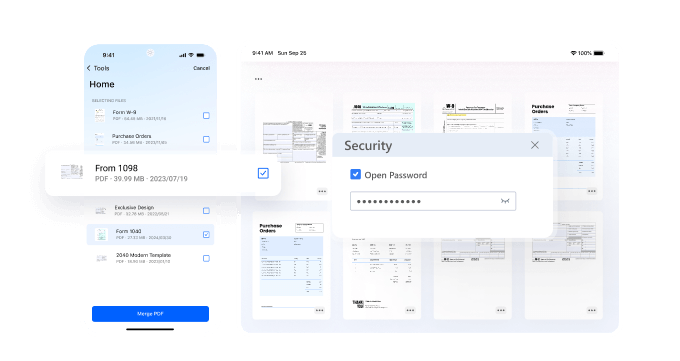

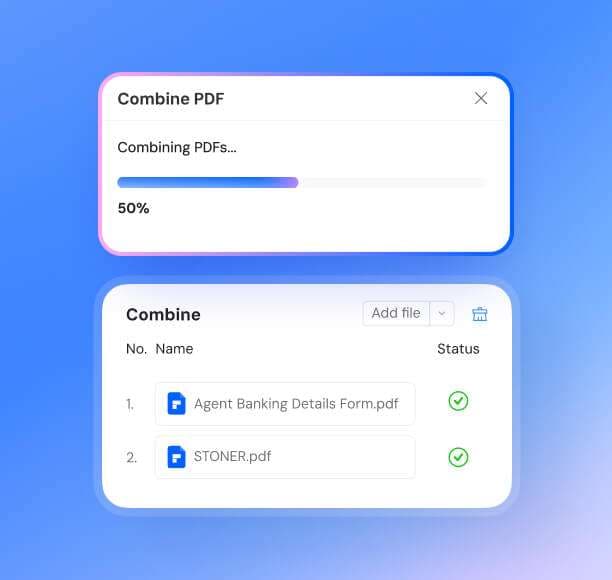

Combine receipts, invoices, and tax forms into organized, secure files by tax year or category.

Convert PDFs to Excel, Word, or image formats, and compress files to meet tax platform requirements.

Tax season special offers:

Save Up to 79% OFF on PDFelement across all platforms.

- Perpetual Plan of PDFelement for Windows and Mac

- 3 Year Plan of PDFelement for iOS, Android, and Web

- 1-Year Plan of PDFelement for Windows and Mac

- 1-Year Plan of PDFelement for iOS, Android, and Web

PDFelement for Windows

Tax Filing Tips

How to organize tax documents.

-

Personal information for everyone included on your tax return.•Full names and Social Security numbers (SSNs), or Tax Identification Numbers (TINs) for all individuals on the return.•Bank routing and account numbers for tax refund payments.•A 6-digit IRS Identity Protection PIN (IP PIN) to help prevent unauthorized use of your SSN.

-

Tax forms that report your income.•Form W-2 – for wages from an employer.•Form 1099-G – for unemployment compensation.•Form 1099 series – for self-employment income or other reportable income.

-

Tax deduction documents.•Form 1098 series, including: 1098 – Mortgage Interest Statement. 1098-C – vehicle donation valued at more than $500. 1098-E – student loan interest payments. 1098-T – Tuition Statement for education expenses.

-

Receipts for deductible expenses.•Childcare and qualified education expenses.•Charitable donation receipts.•Medical and dental expense records.

IRS Forms Templates Free Download.

More detailed tips about filing taxes.

PDFelement Today!