Understanding and Utilizing IRS Form 8936

IRS Form 8936 is a tax form for people who buy electric vehicles (EVs). This form helps them get tax credits. Tax credits are a way to save money on taxes. When you buy an EV, the government rewards you. This reward is like a discount on the taxes you owe.

Understanding IRS Form 8936 is important. It can help you save much money. This article will explain what IRS Form 8936 is. It will also tell you how to use it. We will go through each step. Our goal is to make things clear and simple. This way, you can get the most out of your tax credits. If you own an EV or plan to buy one, this article is for you.

In this article

Part 1. What Is Form 8936?

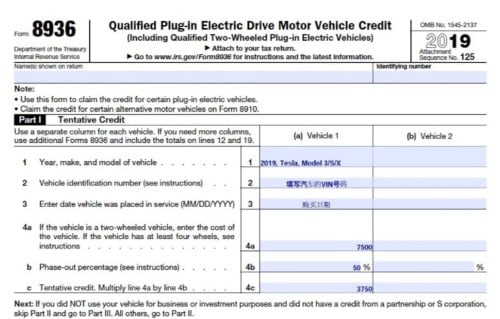

IRS Form 8936 is a special paper you fill out for taxes. It's for people who buy electric vehicles (EVs), like electric cars. This form is how you tell the government you bought an EV. When you do this, you can get money back on your taxes. This money back is called a tax credit.

The form has parts where you write down details about your EV. You tell them what car you bought, when, and how much it cost. The government uses this to decide how much money you get back.

This tax credit is a way to make EVs more popular. EVs are good for the environment. They don't use gas, so they don't pollute the air. The government wants more people to buy EVs. So, they offer this tax credit as a reward.

If you're considering buying an EV or already have one, IRS Form 8936 is important. It can help you save money. In this article, we'll explain how to fill out the form and how to make sure you get your tax credit.

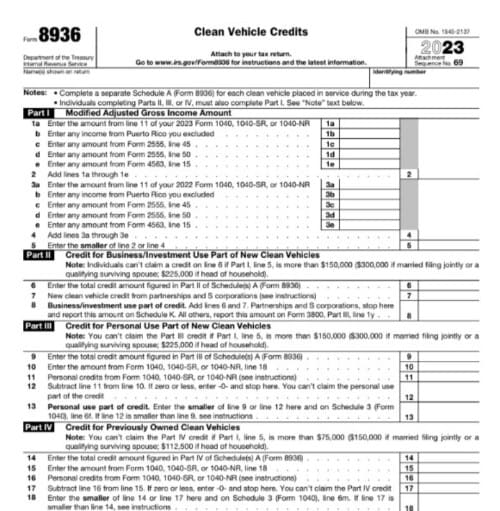

Instructions for Form 8936

Filling out IRS Form 8936 is easy if you know what to do. Here's how to fill it out for the tax year 2022:

- Find the Form: First, get the form. You can download it from the IRS website.

- Part I: This part is about your electric vehicle (EV). Write the make, model, and year of your EV. Also, say when you bought it.

- Part II: This is where you figure out your credit. The form will ask about the cost of your EV and other details. There are boxes to fill in. Each box has instructions. Follow them to see how much money you can get back.

- Part III: Only some people need to fill this out. It's for businesses or if you have more than one EV.

Remember, the amount of money you get back depends on your EV. Not all EVs get the same credit. The form helps you figure out your exact credit.

Lastly, check everything twice. Make sure all your information is correct. Then, attach Form 8936 to your tax return when you file it.

This form can help you save money. Take your time with it. If you need help, ask a tax professional.

Form 8936 Example

Let's say Jane bought an electric car in 2022. Her car is a 2022 Model E from ElectricAuto. She paid $40,000 for it. Now, Jane wants to get her tax credit using Form 8936. Here's how she does it:

- Getting the Form: Jane downloads Form 8936 from the IRS website.

- Filling Out Part I: She writes the make, model, and year of her car: ElectricAuto, Model E, 2022. She also adds the date she bought it.

- Filling Out Part II: Jane follows the instructions. She sees she needs to write $40,000 as the cost of her car. The form helps her calculate her credit. Let's say the instructions lead her to a $7,500 credit.

- Checking Part III: Jane is not a business and only bought one EV, so she skips this part.

Jane now understands she can get $7,500 back from her taxes because she bought an electric car.

Here are some common scenarios for Form 8936:

- Buying a New EV: Like Jane, you use Form 8936 to claim credit if you buy a new electric car.

- Leasing an EV: If you lease an EV, the leasing company might claim the credit, not you.

- Second-hand EVs: Buying a used electric car usually doesn't qualify for the credit. It's for the first owner only.

- Business Use: If you buy an EV for your business, you can still use Form 8936. There might be extra steps in Part III.

Remember, the credit can make EVs more affordable. If you bought an electric car, don't forget to use Form 8936. It's worth the effort to get your tax credit.

Part 2. How To Fill Form 8936

Filling out IRS Form 8936 is straightforward. Follow these steps to complete it correctly:

Step1

First, download Form 8936 from the IRS website. Make sure it's for the right tax year.

Step2

Before you start, read the form's instructions. They will guide you on how to fill it out.

Step3

Write down the make, model, and year of your electric vehicle (EV). Include the date you bought it.

Step4

Follow the form's steps to calculate your tax credit. This part might need some math. You'll enter the cost of your EV and other details to determine your credit amount.

Step5

If you're claiming the credit for a business or have more than one EV, fill out this section. If not, you can skip it.

Filing Form 8936 with TurboTax

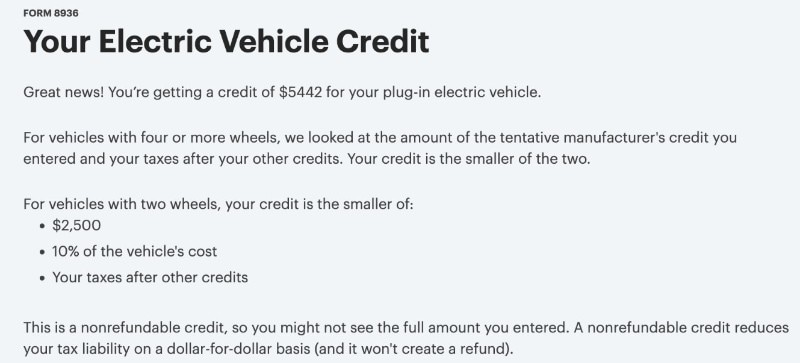

Filing Form 8936 with TurboTax is a smart choice for many. TurboTax is a tax software that guides you through your tax return. It makes filing taxes easier. Here's how it helps with Form 8936:

Step1

Open TurboTax and start your tax return.

Step2

TurboTax asks about your life and taxes. Answer the questions. It helps TurboTax understand what forms you need, including Form 8936.

Step3

When you get to the car section, tell TurboTax about your EV. TurboTax will then say you can use Form 8936.

Step4

TurboTax shows you Form 8936. It asks for details about your EV. Fill in the make, model, purchase date, and cost.

Step5

The software calculates your tax credit based on the information you give. It tells you how much credit you can get.

Step6

Review your tax return in TurboTax. Make sure all information is correct. Then, file your taxes with TurboTax. It sends your return to the IRS.

In short, TurboTax is a helpful tool for filing Form 8936. It simplifies the process. Plus, you get the benefit of expert advice and easy-to-follow steps. This makes claiming your EV tax credit easier and more accurate.

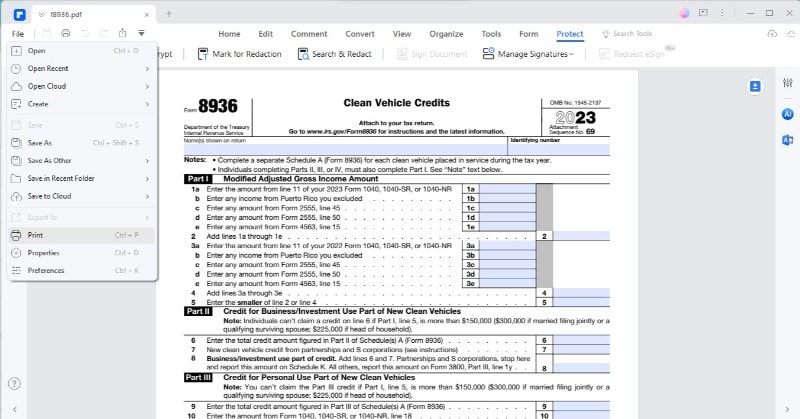

Part 3. PDFelement: A Tool for Managing Form 8936

PDFelement is a program that lets you work with PDF files. It's great for handling Form 8936. This form is what you use to get a tax credit for buying an electric vehicle (EV). With PDFelement, you can easily view and print this form.

- Easy to Use: PDFelement is simple. It lets you open Form 8936 without trouble. You can look at the form on your computer and understand it better.

- Fill Out Forms: You can type directly on Form 8936 in PDFelement. This means you can fill out the form on your computer. No need to print it and write by hand.

- Print Easily: When you're ready, printing is easy. Just a click, your form is ready to be mailed or saved.

- Save Your Work: PDFelement lets you save your filled-out Form 8936. This is good for keeping records. You can look back at what you filed last year.

Using PDFelement for Form 8936 makes things simpler. It's good for viewing, filling out, and printing tax forms. This can save you time and make tax season less stressful.

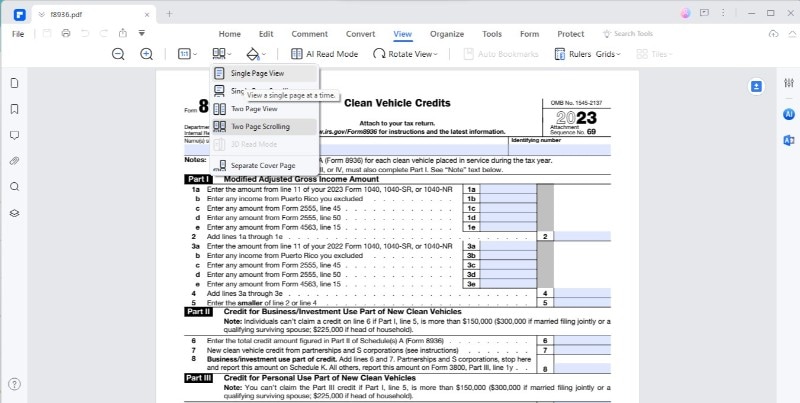

Using PDFelement to View Form 8936

PDFelement is a tool that helps you look at documents like Form 8936. This form is important for getting a tax credit if you buy an electric car. PDFelement makes it easy to see and read your form. Here's how it helps:

Step1

First, open Form 8936 in PDFelement. Just find the file on your computer and open it in the program.

Step2

Next, find the 'View' option in PDFelement. This lets you change how you see the form.

Step3

You can pick how you want to see the pages. Maybe you like seeing one page at a time. Or, you might prefer two pages side by side. You can also scroll through the pages without stopping. Pick what works best for you.

Here's why it's good:

- Easier to Read: You can make the text bigger or smaller. This is great if the text is too small to read well.

- Simple to Find Pages: If you need to find a specific part, you can jump right to it. This saves time.

- View It Your Way: Everyone has their way of reading. PDFelement lets you set up the document how you like it.

Using PDFelement to view Form 8936 makes everything simpler. You can easily change how you see the document. This makes working on your taxes easier.

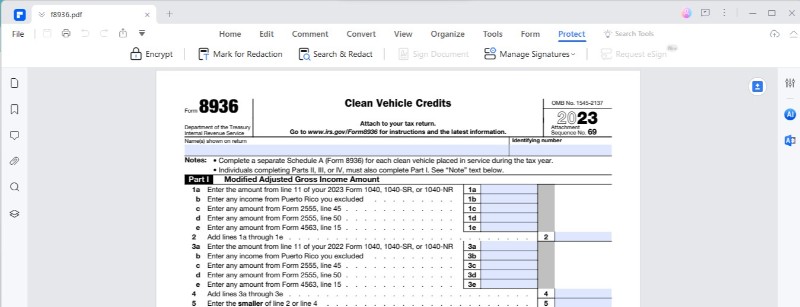

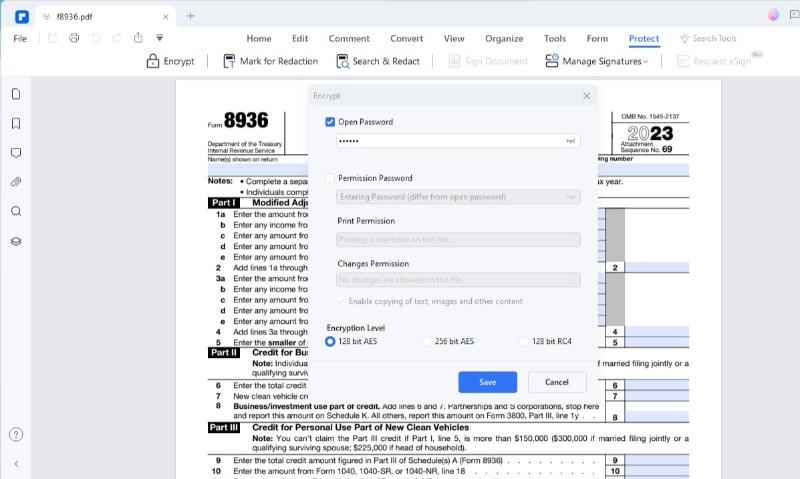

Enhancing Security with PDFelement's Password Feature

Here's how to set passwords for all your tax forms using PDFelement:

Step1

First, start PDFelement. Open your Form 8936 in it.

Step2

Find the "Protect" tab at the top. Click on "Set Password".

Step3

You can make two kinds of passwords. One is an "Open Password". It stops people from opening the form without the password. The other is a "Permission Password". It stops people from changing or printing your form.

Securing your Form 8936 with a password in PDFelement is smart. This form has private info, like your tax details

- Keep Your Info Safe: Your tax info is important. A password stops others from seeing or changing it.

- Stops Unwanted Printing or Changes: With a password, no one can print or edit your form without permission.

Using a password in PDFelement is a good way to protect your Form 8936. It's easy to do and keeps your sensitive info safe.

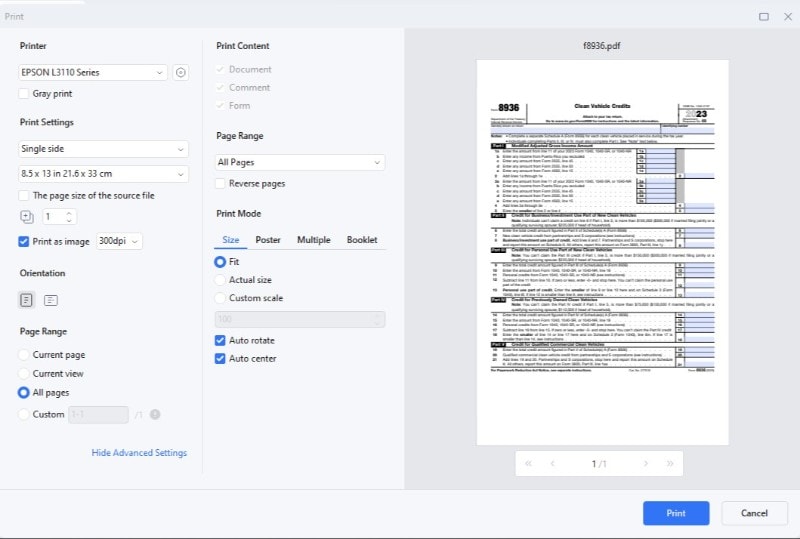

Printing Forms Efficiently With PDFelement

PDFelement's printing features are great for handling documents like tax forms. Here's how to use it to print efficiently:

Step1

Start by opening the forms you need in PDFelement. You can open more than one form at a time.

Step2

Click on 'File', then choose 'Print'. This gets you ready to print.

Step3

Make sure you select the correct printer. Check the settings to match what you need.

Collate Print Mode is super helpful. It keeps your printed documents in order. Say you're printing three copies of a form. Collate makes sure each set is complete before starting the next set. This way, all your copies are sorted right away.

- Saves Time: No need to sort pages by hand. They print in the right order.

- Efficient: Great for when you need several copies for taxes, sharing, or keeping records.

Printing with PDFelement, especially using Collate Print Mode, simplifies managing your paperwork. It's a straightforward way to get your documents printed correctly and quickly.

Conclusion

Using PDFelement for your tax forms, like Form 8936, is a smart move. It makes viewing, securing, and printing your forms simple and efficient. With features like password protection and Collate Print Mode, managing your documents becomes easier and safer. Whether you're filing taxes or handling sensitive paperwork, PDFelement is a great tool to help you stay organized and protect your information.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure