All the Basics About the IRS 1099 K Tax Forms

What is Form 1099 K? It is a tax form used to report income received from payment card transactions and third-party network transactions. That includes things like PayPal, Venmo, and credit card companies. It is not among the most common 1099 Forms. So, if it's the first time you got this, you may not know what to do. Worry not. This article will give you all the information about Form 1099 K that you need to know.

Additionally, we will introduce you to a tool you can use to view and print Form 1099 K files: Wondershare PDFelement.

On this page

- 01 Exploring 1099 K Tax Forms: What Are They Used For?

- 02 Recent Modifications to the IRS 1099-K Threshold

- 03 Review and Print 1099 K Forms Using Wondershare PDFelement

Part 1. Exploring 1099 K Tax Forms: What Are They Used For?

Form 1099 K is another type of Form 1099, a tax form certain groups of people need to submit to the IRS. It is for enforcing tax laws and regulations. But how does it differ from other 1099 Forms?

The entities that need to issue Form 1099 K are fewer than those that need to issue Form 1099 NEC or Form 1099 MISC. It's a responsibility given to payment settlement entities like credit card companies and online payment processors like PayPal.

When do they need to send a Form 1099 K? And who should receive them? Let's find out.

Types of Transactions Reported in 1099 K Form

Form 1099-K reports payment card transactions, such as credit card and debit card payments and third-party network transactions. Third-party network transactions include payments made through online platforms, digital wallets, or other third-party payment processors.

Who Receives a Tax Form 1099 K?

Any company or individual that received income from payment card transactions and third-party network transactions may receive a Form 1099 K. But that applies only if their income from these transactions has met the set threshold.

These groups include (but are not limited to) merchants, online sellers, freelancers, delivery drivers, and NGOs. That said, users of Etsy, eBay, Stripe, and Venmo are some examples.

Recipient Information Included in a 1099 K Form

A Form 1099K's purpose is to help the IRS match the income reported with the recipient's tax return. That said, it includes all the necessary information to meet this goal. That includes name, address, and taxpayer identification number (TIN).

Part 2. Recent Modifications to the IRS 1099-K Threshold

The threshold for Form 1099 K used to be $20,000, and the recipient must have had at least 200 transactions. New laws would bring that down to only $600. To not make the changes too sudden, they delayed the changes. In 2023, they used the old threshold. But this year, 2024, the new threshold is $5000. They will eventually bring this down even more to $600.

Should all transactions be reported? No. It is stated on the IRS website that there's no need to report personal transactions. Birthday or holiday gifts, paying someone for household bills, and sharing the cost of meals are the listed examples.

Part 3. Review and Print 1099 K Forms Using Wondershare PDFelement

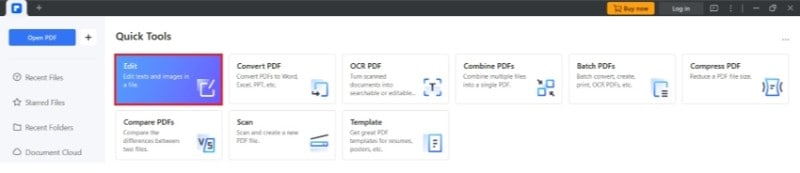

Suppose you have received a Form 1099 K. You have to check its contents to ensure the information line up with your tax returns. For this, you can use Wondershare PDFelement. The tax form 1099 K will be sent to you as a PDF, and Wondershare PDFelement is an affordable but powerful PDF tool. Furthermore, it is available not only on Windows but also on Mac, iOS, and Android.

Part 3.1. View IRS Form 1099 K Using Wondershare PDFelement

Wondershare PDFelement is a fantastic PDF reader. It offers different layouts on its View tab. Suppose you want to see the whole page, Wondershare PDFelement has an option for you. But what if you have eyesight problems and so you want to see the document closer to you? Wondershare PDFelement also has a layout for you.

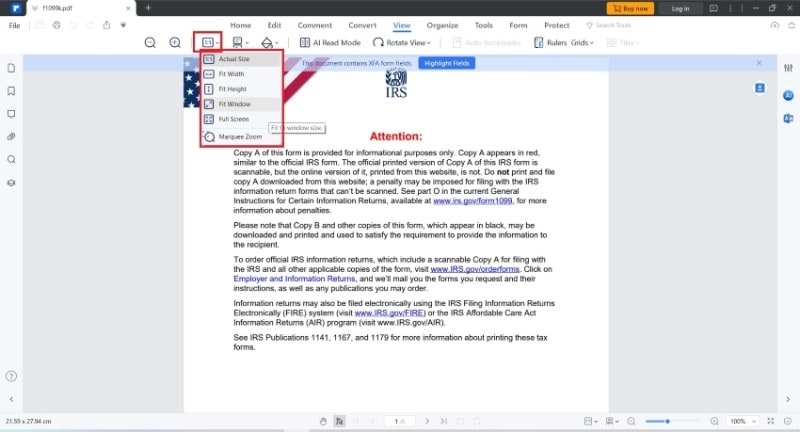

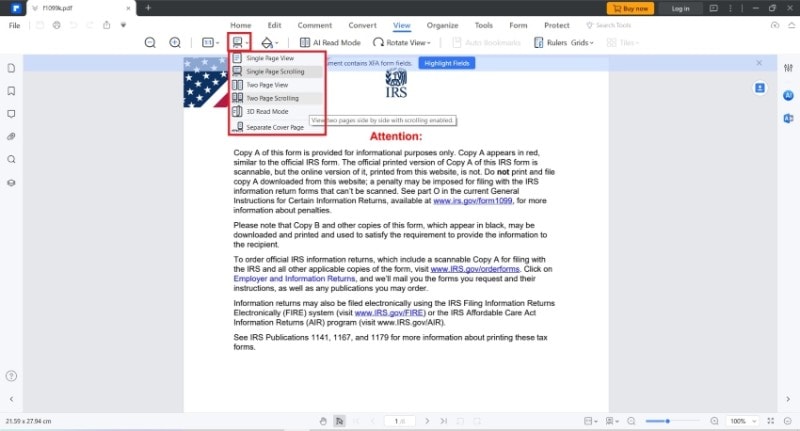

Here's how to change the layout on Wondershare PDFelement.

- Open the Tax Form 1099 K using Wondershare PDFelement.

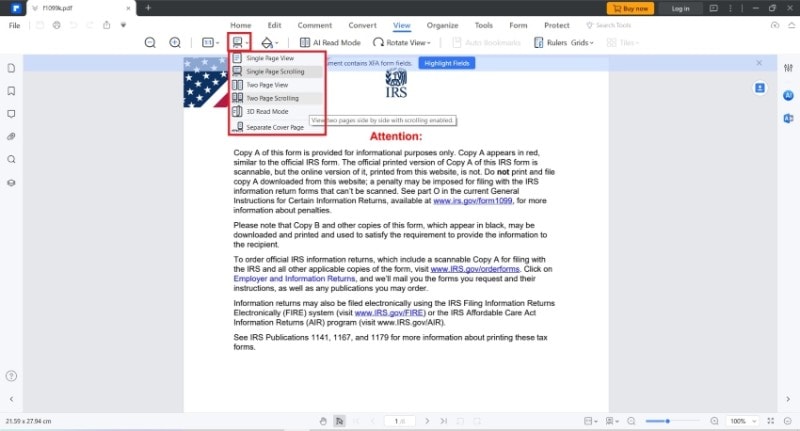

- Click View.

- Click the first icon after the Zoom In icon. This will let you choose a page size. Select Full Width if you want bigger letters or Fit Window to see the whole page on your screen.

- You can also click the Page View button to select a Page View. This will allow you to view a single page or two pages at once.

Part 3.2. Print 1099 K Using Wondershare PDFelement

What if you want printed copies of your Form 1099 K? Maybe that is how you prefer to store it. Or maybe you need a hard copy for some process. Wondershare PDFelement allows you to print it.

What is so great about using Wondershare PDFelement for printing is it offers collated printing. This makes printing multiple copies easier. Let's say you want to print 5 copies, and the document has 4 pages. In the past, the printer would print page 1 5 times before printing page 2. So, after printing all the copies, you need to separate the pages from their stacks and rearrange them.

Here's a quick guide on how to do collated printing on Wondershare PDFelement.

- Open the Form 1099 K using Wondershare PDFelement.

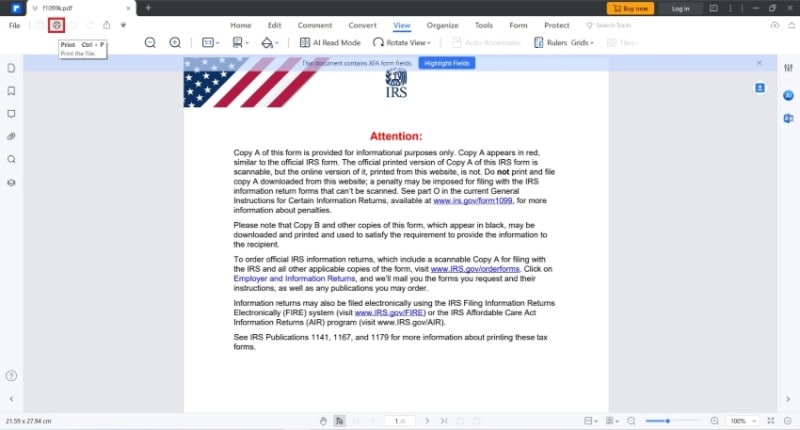

- Click Print on the top toolbar.

- Indicate how many copies you want to print.

- The Collate checkbox will appear. Check it.

- Click the Print button.

Conclusion

Due to the new Form 1099 K threshold, more people will be receiving a Form 1099 K starting this year. To recap, it is a tax form payment settlement entities issue to people and entities that have earned $5000. That amount must be earned from payment card transactions and third-party network transactions. So, if you are a merchant who earns that much from this type of transaction, you can expect one this year.

We recommend using Wondershare PDFelement. It offers a great viewing experience with its many layout options. Not just that. But Wondershare PDFelement also offers Collated Printing, which is the best way to print multiple copies of a document. The best part is that you do not need a subscription to use these tools. They are among Wondershare PDFelemen's free tools!

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure